INVITE-ONLY SCRIPT

BigBeluga - Smart Money Concepts

Atualizado

Smart Money Concepts (SMC) is a comprehensive toolkit built around the around the principles of "smart money" behavior, which refers to the actions and strategies of institutional investors.

SMC transcends traditional technical analysis by delving deeper into this framework. This approach allows users to decipher the actions of these influential players, anticipate their potential impact on market dynamics, and gain insights beyond just price movements.

This all-in-one toolkit provide the user with a unique experience by automating most of the basic and advanced concepts on the chart, saving them time and improving their trading ideas.

🔹Real-time market structure analysis simplifies complex trends by pinpointing key support, resistance, and breakout levels.

🔹Advanced order block analysis leverages detailed volume data to pinpoint high-demand zones, revealing internal market sentiment and predicting potential reversals. This analysis utilizes bid/ask zones to provide supply/demand insights, empowering informed trading decisions.

🔹Imbalance Concepts (FVG and Breakers) allows traders to identify potential market weaknesses and areas where price might be attracted to fill the gap, creating opportunities for entry and exit

🔹Swing failure patterns help traders identify potential entry points and rejection zones based on price swings

🔹Liquidity Concepts, our advanced liquidity algorithm, pinpoints high-impact events, allowing you to predict market shifts, strong price reactions, and potential stop-loss hunting zones. This gives traders an edger to make informed trading decisions based on multi-timeframe liquidity dynamics

🔶 FEATURES

The indicator has quite a lot of features that are provided below:

🔶 BASIC DEMONSTRATION

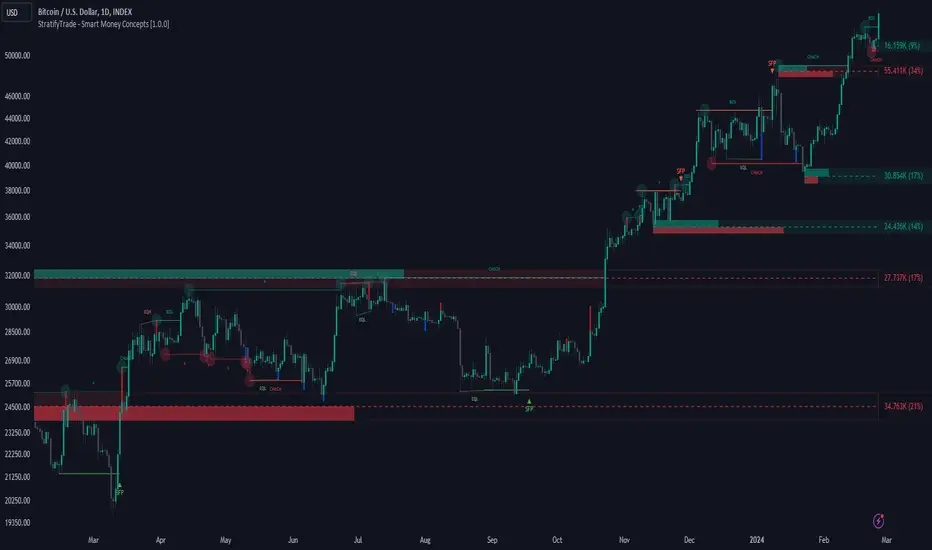

The preceding image illustrates the market structure functionality within the Smart Money Concepts indicator.

Solid lines: These represent the core indicator's internal structure, forming the foundation for most other components. They visually depict the overall market direction and identify major reversal points marked by significant price movements (denoted as 'x').

Dotted lines: These represent an alternative internal structure with the potential to drive more rapid market shifts. This is particularly relevant when a significant gap exists in the established swing structure, specifically between the Break of Structure (BOS) and the most recent Change of High/Low (CHoCH). Identifying these formations can offer opportunities for quicker entries and potential short-term reversals.

Sweeps (x): These signify potential turning points in the market where liquidity is removed from the structure. This suggests a possible trend reversal and presents crucial entry opportunities. Sweeps are identified within both swing and internal structures, providing valuable insights for informed trading decisions.

🔶 USAGE & EXAMPLES

The image above showcases a detailed example of several features from our toolkit that can be used in conjunction for a comprehensive analysis.

Price rejecting from the bullish order block (POC), while printing inside a bullish SFP and internal structure turning bullish (Internal CHoCH).

The image further demonstrates how two bearish order blocks could potentially act as resistance zones when prices approach those levels. These areas might also offer attractive locations to place take-profit orders.

The price has reached our first take-profit level, but is exhibiting some signs of weakness, suggesting a potential pullback which could put the trade at higher risk.

On the other hand, the price action currently exhibits strong bullish sentiment, suggesting favorable entry points and a potential upward trend.

The price has now fully reached our take-profit zone and is also exhibiting bearish confluence, indicating a potential price reversal or trend shift.

🔶 USING CONFLUENCE

The core principle behind the success of this toolkit lies in identifying "confluence." This refers to the convergence of multiple trading indicators all signaling the same information at a specific point or area. By seeking such alignment, traders can significantly enhance the likelihood of successful trades.

In the image above we can see a few examples of the indicator used in confluence with other metrics included in the toolkit.

These are just a few examples of what applying confluence can look like.

🔶 SETTINGS

SMC transcends traditional technical analysis by delving deeper into this framework. This approach allows users to decipher the actions of these influential players, anticipate their potential impact on market dynamics, and gain insights beyond just price movements.

This all-in-one toolkit provide the user with a unique experience by automating most of the basic and advanced concepts on the chart, saving them time and improving their trading ideas.

🔹Real-time market structure analysis simplifies complex trends by pinpointing key support, resistance, and breakout levels.

🔹Advanced order block analysis leverages detailed volume data to pinpoint high-demand zones, revealing internal market sentiment and predicting potential reversals. This analysis utilizes bid/ask zones to provide supply/demand insights, empowering informed trading decisions.

🔹Imbalance Concepts (FVG and Breakers) allows traders to identify potential market weaknesses and areas where price might be attracted to fill the gap, creating opportunities for entry and exit

🔹Swing failure patterns help traders identify potential entry points and rejection zones based on price swings

🔹Liquidity Concepts, our advanced liquidity algorithm, pinpoints high-impact events, allowing you to predict market shifts, strong price reactions, and potential stop-loss hunting zones. This gives traders an edger to make informed trading decisions based on multi-timeframe liquidity dynamics

🔶 FEATURES

The indicator has quite a lot of features that are provided below:

- Swing market structure

- Internal market structure

- Mapping structure

- Discount/Premium zone

- Adjustable market structure

- Strong/Weak H&L

- Sweep

- Volumetric Order block / Breakers

- Fair Value Gaps / Breakers (multi-timeframe)

- Swing Failure Patterns (multi-timeframe)

- Deviation area

- Equal H&L

- Liquidity Prints

- Buyside & Sellside

- Sweep Area

- Highs and Lows (multi-timeframe)

🔶 BASIC DEMONSTRATION

The preceding image illustrates the market structure functionality within the Smart Money Concepts indicator.

Solid lines: These represent the core indicator's internal structure, forming the foundation for most other components. They visually depict the overall market direction and identify major reversal points marked by significant price movements (denoted as 'x').

Dotted lines: These represent an alternative internal structure with the potential to drive more rapid market shifts. This is particularly relevant when a significant gap exists in the established swing structure, specifically between the Break of Structure (BOS) and the most recent Change of High/Low (CHoCH). Identifying these formations can offer opportunities for quicker entries and potential short-term reversals.

Sweeps (x): These signify potential turning points in the market where liquidity is removed from the structure. This suggests a possible trend reversal and presents crucial entry opportunities. Sweeps are identified within both swing and internal structures, providing valuable insights for informed trading decisions.

🔶 USAGE & EXAMPLES

The image above showcases a detailed example of several features from our toolkit that can be used in conjunction for a comprehensive analysis.

Price rejecting from the bullish order block (POC), while printing inside a bullish SFP and internal structure turning bullish (Internal CHoCH).

The image further demonstrates how two bearish order blocks could potentially act as resistance zones when prices approach those levels. These areas might also offer attractive locations to place take-profit orders.

The price has reached our first take-profit level, but is exhibiting some signs of weakness, suggesting a potential pullback which could put the trade at higher risk.

On the other hand, the price action currently exhibits strong bullish sentiment, suggesting favorable entry points and a potential upward trend.

The price has now fully reached our take-profit zone and is also exhibiting bearish confluence, indicating a potential price reversal or trend shift.

🔶 USING CONFLUENCE

The core principle behind the success of this toolkit lies in identifying "confluence." This refers to the convergence of multiple trading indicators all signaling the same information at a specific point or area. By seeking such alignment, traders can significantly enhance the likelihood of successful trades.

In the image above we can see a few examples of the indicator used in confluence with other metrics included in the toolkit.

- Liquidity Prints within order blocks

- SFP close to the POC

- Sweep in liquidity close to a fair value gaps

These are just a few examples of what applying confluence can look like.

🔶 SETTINGS

- Window: limit calculation period

- Swing: limit drawing function

- Internal: a period of the beginning of the internal structure

- Mapping structure: show structural points

- Algorithmic Logic: (Extreme-Adjusted) Use max high/low or pivot point calculation

- Algorithmic loopback: pivot point look back

- Premium / Discount: Lookback period of the pivot point calculation

- Show Last: Amount of Order block to display

- Hide Overlap: hide overlapping order blocks

- Construction: Size of the order blocks

- Fair value gaps: Choose between normal FVG or Breaker FVG

- Mitigation: (close - wick- avg) point to mitigate the order block/imbalance

- SFP lookback: find a higher / lower point to improve accuracy

- Threshold: remove less relevant SFP

- Equal h&L: (short-mid-long term) display longer term

- Any Alert(): Trigger alerts based on the selected inputs

Notas de Lançamento

-Script sob convite

O acesso a este script é restrito aos usuários autorizados pelo autor e pode requerir pagamento. Você pode adicioná-lo a seus favoritos, mas só poderá utilizá-lo após solicitar permissão e obtê-la do autor. Contate BigBeluga para mais informações, ou siga as instruções do autor abaixo.

O TradingView não sugere pagar por um script e usá-lo, a menos que você confie 100% no seu autor e entenda como o script funciona. Em muitos casos, você pode encontrar uma boa alternativa de código aberto gratuita nos nossos Scripts da Comunidade.

Instruções do autor

″Get instant access here: https://bigbeluga.com/

Quer usar esse script no gráfico?

Aviso: por favor leia antes de solicitar acesso.

🔵Gain access to our powerful tools : bigbeluga.com

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.