OPEN-SOURCE SCRIPT

Atualizado SMC Timing

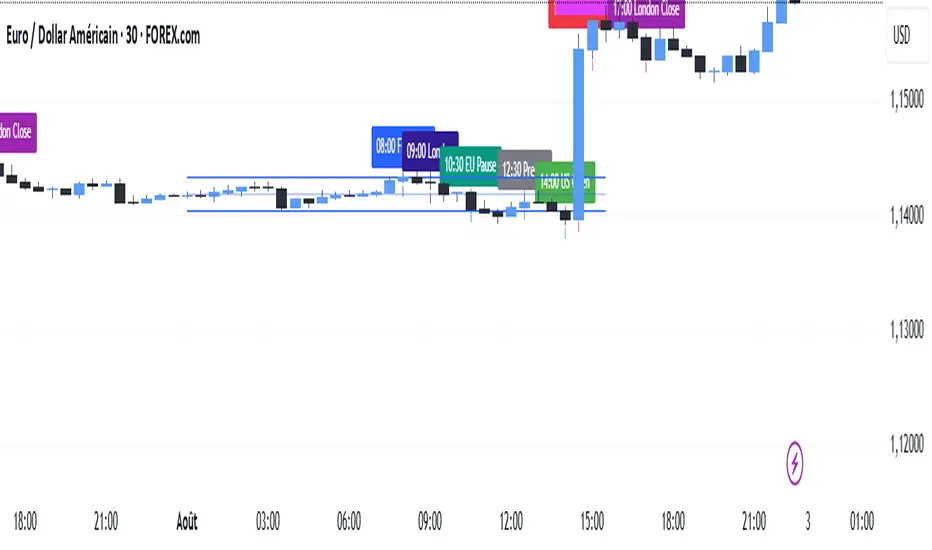

This indicator (“SMC Timing”) visually marks the exact moments when the market typically experiences large liquidity injections—moments that often trigger strong directional moves. By plotting dashed vertical lines and labels at key session boundaries and news events (Frankfurt open, London open, EU mid-session pause, Pre-US, US open, 14:30 U.S. news releases, 15:00 breakout window, and the London close), it draws your attention to the times when stop-runs and institutional orders tend to pile into the market.

Traders can use these timing zones to:

Anticipate liquidity sweeps where smart-money often liquidates weak positions or hunts stops.

Plan higher-probability entries just before or directly after these injections, reducing slippage and improving execution.

Improve win-rate consistency by aligning your trades with the natural ebb and flow of institutional flow rather than fading it.

With customizable session toggles, a “today-only” filter, and a small vertical offset to keep markers clear of price bars, this tool seamlessly integrates into any chart. Positioning yourself around these highlighted times helps you capture the bulk of intraday moves and avoids getting caught in low-liquidity chop.

Traders can use these timing zones to:

Anticipate liquidity sweeps where smart-money often liquidates weak positions or hunts stops.

Plan higher-probability entries just before or directly after these injections, reducing slippage and improving execution.

Improve win-rate consistency by aligning your trades with the natural ebb and flow of institutional flow rather than fading it.

With customizable session toggles, a “today-only” filter, and a small vertical offset to keep markers clear of price bars, this tool seamlessly integrates into any chart. Positioning yourself around these highlighted times helps you capture the bulk of intraday moves and avoids getting caught in low-liquidity chop.

Notas de Lançamento

This indicator (“SMC Timing”) visually marks the exact moments when the market typically experiences large liquidity injections—moments that often trigger strong directional moves. By plotting dashed vertical lines and labels at key session boundaries and news events (Frankfurt open, London open, EU mid-session pause, Pre-US, US open, 14:30 U.S. news releases, 15:00 breakout window, and the London close), it draws your attention to the times when stop-runs and institutional orders tend to pile into the market.Traders can use these timing zones to:

Anticipate liquidity sweeps where smart-money often liquidates weak positions or hunts stops.

Plan higher-probability entries just before or directly after these injections, reducing slippage and improving execution.

Improve win-rate consistency by aligning your trades with the natural ebb and flow of institutional flow rather than fading it.

With customizable session toggles, a “today-only” filter, and a small vertical offset to keep markers clear of price bars, this tool seamlessly integrates into any chart. Positioning yourself around these highlighted times helps you capture the bulk of intraday moves and avoids getting caught in low-liquidity chop.

Notas de Lançamento

V6Notas de Lançamento

This indicator (“SMC Timing”) visually marks the exact moments when the market typically experiences large liquidity injections—moments that often trigger strong directional moves. By plotting dashed vertical lines and labels at key session boundaries and news events (Frankfurt open, London open, EU mid-session pause, Pre-US, US open, 14:30 U.S. news releases, 15:00 breakout window, and the London close), it draws your attention to the times when stop-runs and institutional orders tend to pile into the market.Traders can use these timing zones to:

Anticipate liquidity sweeps where smart-money often liquidates weak positions or hunts stops.

Plan higher-probability entries just before or directly after these injections, reducing slippage and improving execution.

Improve win-rate consistency by aligning your trades with the natural ebb and flow of institutional flow rather than fading it.

With customizable session toggles, a “today-only” filter, and a small vertical offset to keep markers clear of price bars, this tool seamlessly integrates into any chart. Positioning yourself around these highlighted times helps you capture the bulk of intraday moves and avoids getting caught in low-liquidity chop.

hier

Notes de version

This indicator (“SMC Timing”) visually marks the exact moments when the market typically experiences large liquidity injections—moments that often trigger strong directional moves. By plotting dashed vertical lines and labels at key session boundaries and news events (Frankfurt open, London open, EU mid-session pause, Pre-US, US open, 14:30 U.S. news releases, 15:00 breakout window, and the London close), it draws your attention to the times when stop-runs and institutional orders tend to pile into the market.

Traders can use these timing zones to:

Anticipate liquidity sweeps where smart-money often liquidates weak positions or hunts stops.

Plan higher-probability entries just before or directly after these injections, reducing slippage and improving execution.

Improve win-rate consistency by aligning your trades with the natural ebb and flow of institutional flow rather than fading it.

With customizable session toggles, a “today-only” filter, and a small vertical offset to keep markers clear of price bars, this tool seamlessly integrates into any chart. Positioning yourself around these highlighted times helps you capture the bulk of intraday moves and avoids getting caught in low-liquidity chop.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.