PAT Screener | Flux Charts

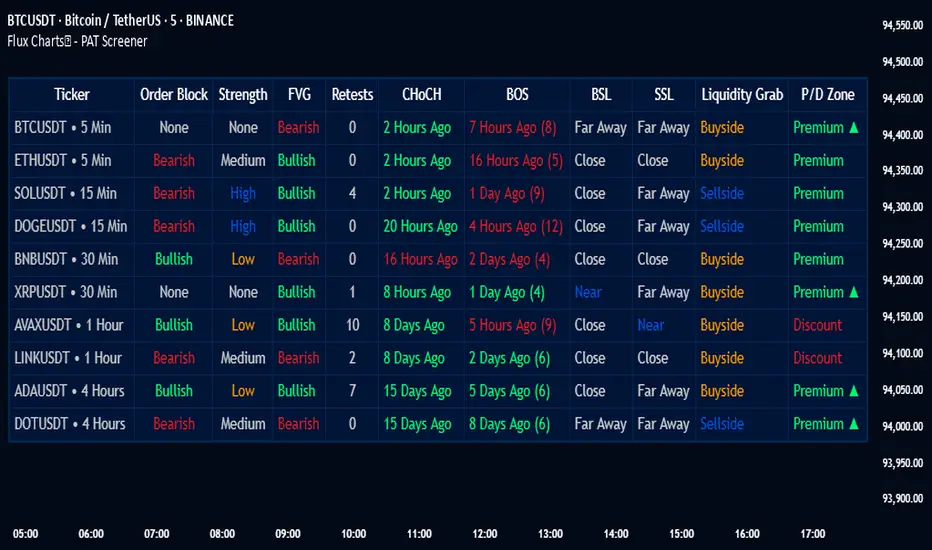

Introducing our new Price Action Toolkit (PAT) Screener! This screener can spot trading opportunities that Price Action Toolkit offers across 8 different tickers! We believe that this screener will help you take a glimpse of the current state of the market much easier.

Features of the new Price Action Toolkit (PAT) Screener :

- Finds Latest Across 8 Tickers:

- Order Blocks

- Breaker Blocks

- Fair Value Gaps (FVG)

- Inversion FVGs

- Market Structures (BOS, CHoCH, CHoCH+)

- Liquidity Zones

- Liquidity Grabs

- Premium / Discount Zones

Shows Additional Information Like :

- Strength

- Retests

- (Bullish & Bearish) Volume

- Consumption

Also :

- All Features Support Tuning

- Customizable Theme

📌 HOW DOES IT WORK ?

1. Order Blocks

Order blocks occur when there is a high amount of market orders exist on a price range. It is possible to find order blocks using specific formations on the chart.

The high & low volume of order blocks should be taken into consideration while determining their strengths. The determination of the high & low volume of order blocks are similar to FVGs, in a bullish order block, the high volume is the last 2 bars' total volume, while the low volume is the oldest bar's volume. In a bearish order block scenario, the low volume becomes the last 2 bars' total volume.

2. Breaker Blocks

Breaker blocks form when an order block fails, or "breaks". It is often associated with market going in the opposite direction of the broken order block, and they can be spotted by following order blocks and finding the point they get broken, i.e. price goes below a bullish order block.

The volume of a breaker block is simply the total volume of the bar that the original order block is broken. Often the higher the breaking bar's volume, the stronger the breaker block is.

The strength of Order & Breaker Blocks are calculated by the size of the block to the Average True Range (ATR) of the chart.

3. Fair Value Gaps

Fair value gaps often occur when there is an imbalance in the market, and can be spotted with a specific formation on the chart.

The volume when the FVG occurs plays an important role when determining the strength of it, so we've placed two bars on the FVG zone, indicating the high & low volumes of the FVG. The high volume is the total volume of the last two bars on a bullish FVG, while the low volume is [total volume] - [high volume] of the FVG. For a bearish FVG, the total volume of the last two bars is the low volume. The indicator can also detect FVGs that exist in other timeframes than the current chart.

4. Inversion Fair Value Gaps

A Fair Value Gap generally occur when there is an imbalance in the market. They can be detected by specific formations within the chart. An Inverse Fair Value Gap is when a FVG becomes invalidated, thus reversing the direction of the FVG.

IFVGs get consumed when a Close / Wick enters the IFVG zone. Check this example:

5. Market Structures

Sometimes specific market structures form and break as the market fills buy & sell orders. Formed Change of Character (CHoCH) and Break of Structure (BOS) often mean that market will change direction, and they can be spotted by inspecting low & high pivot points of the chart.

The number of times the chart recently had a BOS is displayed between brackets, Ex : (3)

6. Liquidity Zones

Buyside & Sellside Liquidity zones are where most traders place their take-profits and stop-losses in their long / short positions. They are spotted by using high & low pivot points on the chart.

7. Liquidity Grabs

Liquidity grabs occur when one of the latest pivots has a false breakout. Then, if the wick to body ratio of the bar is higher than 0.5 (can be changed from the settings) a liquidity grab has occurred.

8. Premium & Discount Zones

The premium zone is a zone that is over the fair value of the asset's price, and the discount zone is the opposite. They are formed by the latest high & low pivot points.

If the latest close price is outside the Premium or Discount zone, you will see "Premium ⬆️" or "Discount ⬇️". These mean that the price is currently higher than the premium zone or lower than the discount zone.

🚩UNIQUENESS

This screener offers a comprehensive dashboard for traders, combining multiple analytical elements with customizable settings to aid in decision-making across different tickers and timeframes. We believe that this will help traders spot trading opportunities much easier by providing crucial information in a single dashboard. Our new screener contains of common elements like Order & Breaker Blocks, Fair Value Gaps & IFVGs as well as rather unique elements like Liquidity Grabs. With the use of up to 8 tickers & timeframes, you can easily take a look at the bigger picture of the market. We recommend reading the "How Does It Work" section of the description to get a better understanding about how this indicator is unique to others.

⚙️SETTINGS

1. Tickers

You can set up to 8 tickers for the screener to scan here. You can also enable / disable them and set their individual timeframes.

You can enable / disable Retests, Strength, Consumption and (Bullish & Bearish) Volume for :

Order Blocks (Retests, Strength, Bullish & Bearish Volume)

Breaker Blocks (Retests, Strength, Volume)

Fair Value Gaps (Retests, Consumption, Strength, Bullish & Bearish Volume)

Inversion Fair Value Gaps (Retests, Consumption, Strength, Volume)

2. Order Blocks

Enabled -> Enables / Disables Order Blocks

Zone Invalidation -> Select between Wick & Close price for Order Block Invalidation.

Swing Length -> Swing length is used when finding order block formations. Smaller values will result in finding smaller order blocks.

3. Breaker Blocks

Enabled -> Enables / Disables Breaker Blocks

Zone Invalidation -> Select between Wick & Close price for Breaker Block Invalidation.

4. Fair Value Gaps

Enabled -> Enables / Disables Fair Value Gaps

Zone Invalidation -> Select between Wick & Close price for FVG Zone Invalidation.

Zone Filtering -> With "Average Range" selected, algorithm will find FVG zones in comparison with average range of last bars in the chart. With the "Volume Threshold" option, you may select a Volume Threshold % to spot FVGs with a larger total volume than average.

FVG Detection -> With the "Same Type" option, all 3 bars that formed the FVG should be the same type. (Bullish / Bearish). If the "All" option is selected, bar types may vary between Bullish / Bearish.

Detection Sensitivity -> You may select between Low, Normal or High FVG detection sensitivity. This will essentially determine the size of the spotted FVGs, with lower sensitivities resulting in spotting bigger FVGs, and higher sensitivities resulting in spotting all sizes of FVGs.

5. Inversion Fair Value Gaps

Zone Invalidation -> Select between Wick & Close price for IFVG Zone Invalidation. This setting also switches the type for IFVG consumption.

6. Market Structures

Break Of Structure (BOS) -> If the current structure of the market is broken in a bullish or bearish direction, it will be displayed.

Change Of Character (CHoCH) -> If the market shifts into another direction, it will be displayed.

Change Of Character+ (CHoCH+) -> This will display Change Of Characters detected with higher sensitivity if enabled.

7. Liquidity Zones

Buyside Liquidity -> Enables / Disables Buyside Liquidity

Sellside Liquidity -> Enables / Disables Sellside Liquidity

8. Liquidity Grabs

Pivot Length -> This setting determines the range of the pivots. This means a candle has to have the highest / lowest wick of the previous X bars and the next X bars to become a high / low pivot.

Wick-Body Ratio -> After a pivot has a false breakout, the wick-body ratio of the latest candle is tested. The resulting ratio must be higher than this setting for it to be considered as a liquidity grab.

9. Premium & Discount Zones

Enabled -> Enables / Disables Premium & Discount Zones.

10. Style

You can customize the visual looks of the screener here.

- Converted Script to PineScript v6

- Various Optimizations & Fixes

- Fixed an issue where some market structures could be missing on the screener.

- Solved a visual issue that resulted in market structures color being stuck on bearish colors even if they were bullish.

- Added EQH & EQL settings.

- Organized some settings.

Fair Value Gaps:

- Fair Value Gap detection method was improved for efficiency

- REMOVED: Zone Filtering setting

- REMOVED: Volume Threshold % setting

- NEW: "All" Detection Method. This detects both same & mixed FVGs. A "same" FVG is one made up of 3 similar candles (bullish or bearish) and a "mixed" FVG is made up of bullish and bearish candles.

- UPDATED: Sensitivity setting is now an integer value between 0-25, 0 Detects all FVGs while higher values filter out smaller gaps.

Order Blocks:

- Order Block detection was changed for efficiency and faster detections.

- UPDATED: Swing Length setting is now "Sensitivity". Lower sensitivity will detect more order blocks.

- The screener now supports up to 15 tickers!

- Reworked UI for visual clarity. Customization of the dashboard is also improved with new secondary colors being added.

- The default screener position is now top right of the chart.

- Renamed Buyside Liquidity to "BSL" and Sellside Liquidity to "SSL"

- Bullish & Bearish Order Blocks can no longer overlap with each other.

- Order Blocks will not be detected if they are too close to each other.

- Fixed an issue where "Same" & "Mixed" settings did not work properly for FVG detection.

- IFVG & Breaker Block detection is improved.

- Fixed an issue where Bullish BOS could be lower than the previous Bullish BOS & Bearish BOS could be higher than the previous Bearish BOS.

- Fixed an issue with the new Order Block detection logic that could cause excess removal of some Order Blocks.

- New "Trendlines" Feature! Effortlessly identify the prevailing direction of price action with the new Trendlines feature. Watch for price interactions with these lines; breakouts or bounces can provide potential trading signals. With the new version of the screener, enable the feature to see the latest detected valid trendline type (Bullish / Bearish) and the current distance from price to the trendline, ie. Bullish (0.15%).

Script sob convite

Somente usuários aprovados pelo autor podem acessar este script. Você precisará solicitar e obter permissão para usá-lo. Normalmente, essa permissão é concedida após o pagamento. Para obter mais detalhes, siga as instruções do autor abaixo ou entre em contato diretamente com fluxchart.

A TradingView NÃO recomenda pagar ou usar um script, a menos que você confie totalmente em seu autor e entenda como ele funciona. Você também pode encontrar alternativas gratuitas e de código aberto em nossos scripts da comunidade.

Instruções do autor

Join our Discord community: discord.gg/FluxCharts

Aviso legal

Script sob convite

Somente usuários aprovados pelo autor podem acessar este script. Você precisará solicitar e obter permissão para usá-lo. Normalmente, essa permissão é concedida após o pagamento. Para obter mais detalhes, siga as instruções do autor abaixo ou entre em contato diretamente com fluxchart.

A TradingView NÃO recomenda pagar ou usar um script, a menos que você confie totalmente em seu autor e entenda como ele funciona. Você também pode encontrar alternativas gratuitas e de código aberto em nossos scripts da comunidade.

Instruções do autor

Join our Discord community: discord.gg/FluxCharts