OPEN-SOURCE SCRIPT

Atualizado Technical checklist

No one indicator is perfect. People always have their favorite indicators and maintain a bias on weighing them purely on psychological reasons other than mathematical. This technical checklist indicator collected 20 common indicators and custom ones to address the issue of a bias weighted decision.

Here, I apply machine learning using a simple sigmoid neuron network with one hidden layer and a single node to avoid artifacts. For the ease of data collection, the indicator matrix is first shown as a heatmap. Once an uptrend signal window is selected manually, an indicator matrix can be recorded in a binary format (i.e., 1 0 0 1 1 0, etc.).

For example, the following indicator matrix was retrieved from the MRNA chart (deciscion: first 5 rows, buying; last 5 rows, no buying):

<mrna_input.txt>

1 1 0 0 0 1 1 1 1 1 0 1 0 0 1 1 0 1 1 1

1 1 0 0 1 1 1 0 0 0 1 0 1 1 0 1 0 1 1 1

0 0 1 1 0 1 0 0 0 1 1 1 0 0 1 0 0 1 0 0

1 1 0 0 0 1 1 1 1 1 1 0 1 0 0 1 0 1 0 0

0 0 1 1 0 1 1 1 0 1 1 1 0 1 1 1 0 1 0 0

1 1 0 0 1 0 1 0 0 0 0 1 0 0 0 1 0 0 1 1

1 1 0 0 0 0 1 0 0 0 0 1 0 0 1 1 0 1 1 1

0 0 0 0 1 0 1 0 0 1 1 0 0 0 0 0 0 1 0 0

0 0 0 0 0 0 1 0 0 0 1 0 0 1 0 0 0 1 1 1

0 0 0 0 1 0 1 0 0 0 1 0 1 0 0 0 0 1 1 1

This matrix is then used as an input to train the machine learning network. With a correlated buying decision matrix as an output:

<output.txt>

1

1

1

1

1

0

0

0

0

0

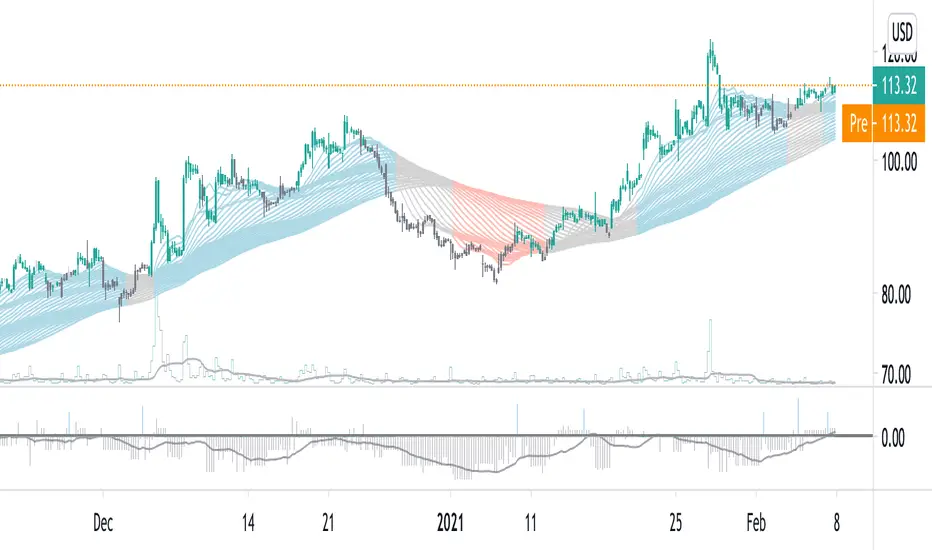

After training, the corrected weight matrix can be applied back to the indicator. And the display mode can be changed from a heatmap into a histogram to reveal buying signals visually.

Usage:

python stock_ml.py mrna_input.txt output.txt

Weight matrix output:

1.37639407

1.67969656

1.0162141

1.3184323

-1.88888442

8.32928588

-5.35777295

3.08739916

3.06464844

0.82986227

-0.53092333

-1.95045383

4.14441698

2.99179435

-0.08379438

1.70379704

0.4173048

-1.51870972

-2.14284707

-2.08513252

Corresponding indicators to the weight matrix:

1. Breakout

2. Reversal

3. Crossover of ema20 and ema60

4. Crossover of ema20 and ema120

5. MACD golden cross

6. Long cycle (MACD crossover 0)

7. RSI not overbought

8. KD not overbought and crossover

9. OBV uptrend

10. Bullish gap

11. High volume

12. Breakout up fractal

13. Rebounce of down fractal

14. Convergence

15. Turbulence reversal

16. Low resistance

17. Bullish trend (blue zone)

18. Bearish trend (red zone)

19. VIX close above ema20

20. SPY close below ema20

PS. It is recommended not to use default settings but to train your weight matrix based on underlying and timeframe.

Here, I apply machine learning using a simple sigmoid neuron network with one hidden layer and a single node to avoid artifacts. For the ease of data collection, the indicator matrix is first shown as a heatmap. Once an uptrend signal window is selected manually, an indicator matrix can be recorded in a binary format (i.e., 1 0 0 1 1 0, etc.).

For example, the following indicator matrix was retrieved from the MRNA chart (deciscion: first 5 rows, buying; last 5 rows, no buying):

<mrna_input.txt>

1 1 0 0 0 1 1 1 1 1 0 1 0 0 1 1 0 1 1 1

1 1 0 0 1 1 1 0 0 0 1 0 1 1 0 1 0 1 1 1

0 0 1 1 0 1 0 0 0 1 1 1 0 0 1 0 0 1 0 0

1 1 0 0 0 1 1 1 1 1 1 0 1 0 0 1 0 1 0 0

0 0 1 1 0 1 1 1 0 1 1 1 0 1 1 1 0 1 0 0

1 1 0 0 1 0 1 0 0 0 0 1 0 0 0 1 0 0 1 1

1 1 0 0 0 0 1 0 0 0 0 1 0 0 1 1 0 1 1 1

0 0 0 0 1 0 1 0 0 1 1 0 0 0 0 0 0 1 0 0

0 0 0 0 0 0 1 0 0 0 1 0 0 1 0 0 0 1 1 1

0 0 0 0 1 0 1 0 0 0 1 0 1 0 0 0 0 1 1 1

This matrix is then used as an input to train the machine learning network. With a correlated buying decision matrix as an output:

<output.txt>

1

1

1

1

1

0

0

0

0

0

After training, the corrected weight matrix can be applied back to the indicator. And the display mode can be changed from a heatmap into a histogram to reveal buying signals visually.

Usage:

python stock_ml.py mrna_input.txt output.txt

Weight matrix output:

1.37639407

1.67969656

1.0162141

1.3184323

-1.88888442

8.32928588

-5.35777295

3.08739916

3.06464844

0.82986227

-0.53092333

-1.95045383

4.14441698

2.99179435

-0.08379438

1.70379704

0.4173048

-1.51870972

-2.14284707

-2.08513252

Corresponding indicators to the weight matrix:

1. Breakout

2. Reversal

3. Crossover of ema20 and ema60

4. Crossover of ema20 and ema120

5. MACD golden cross

6. Long cycle (MACD crossover 0)

7. RSI not overbought

8. KD not overbought and crossover

9. OBV uptrend

10. Bullish gap

11. High volume

12. Breakout up fractal

13. Rebounce of down fractal

14. Convergence

15. Turbulence reversal

16. Low resistance

17. Bullish trend (blue zone)

18. Bearish trend (red zone)

19. VIX close above ema20

20. SPY close below ema20

PS. It is recommended not to use default settings but to train your weight matrix based on underlying and timeframe.

Notas de Lançamento

Change the value of %K from 140 to 90.Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.