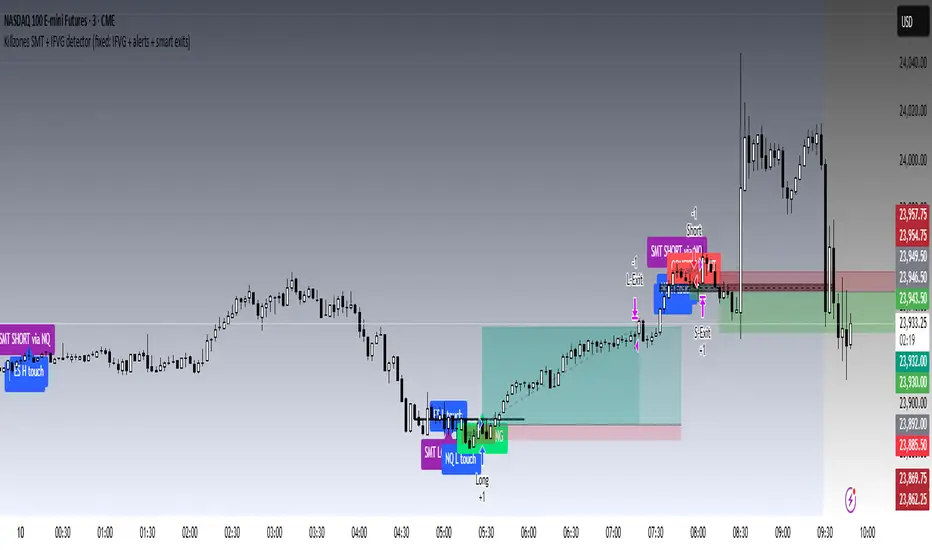

Killzones SMT + IFVG detector

Killzones SMT + IFVG detector is a rules-based tool for intraday setups inside defined “killzone” windows. It combines SMT (cross-market divergence between NQ and ES) with strict ICT-style IFVG confirmation (3-bar imbalance), plus safety gates and optional stop/target management.

Design rationale — how the pieces work together

- []Context first: time-boxed killzones + recorded session extremes (H/L) focus the search on likely liquidity areas.

[]Selective divergence: signals require exclusive SMT sweeps (one index takes the level while the other does not), which filters noise.

[]Strict confirmation: only confirms when price closes beyond the IFVG boundary in the candle’s direction (bull close above upper gap for longs; bear close below lower gap for shorts).

[]Safety gating: same-bar H&L sweep on the same symbol pauses until the next killzone; weekend lockout; cooldown; and a max initial-stop gate that skips oversized setups.

How it works (high level)

- []Session extremes inside killzones: during each window, the script stores NQ/ES highs/lows and keeps a limited number of untouched levels.

[]SMT (exclusive sweep): a candidate forms when, on the same bar, only one index sweeps its stored H/L while the other does not.

• Bullish SMT: one index sweeps the low while the other remains above its session low.

• Bearish SMT: one index sweeps the high while the other remains below its session high.

Detection supports Sweep (Cross) with minimum-tick penetration or Exact Tick equality.

[]IFVG lock & confirmation: after an SMT candidate, the script locks a qualifying 3-bar IFVG on the chosen confirmation symbol (NQ or ES). Confirmation requires a close through the gap boundary in the candle’s direction. Optional “re-lock” keeps tracking the newest valid IFVG until confirmation/expiry.

[](Strategy option) Exits: initial stop from last opposite-candle wick (+ buffer), fixed TP in points, and step-ups to BE → 50% → 80% of target as progress thresholds are reached.

Killzones (what they are + default times)

Times are interpreted in the chart’s timezone. The logic stores extremes made inside these windows and monitors them forward.

- []19:00–23:00 — Early overnight liquidity formation.

[]01:00–04:00 — London/European activity window.

[]08:30–10:00 — U.S. morning discovery (major data at :30).

[]11:00–12:00 — Midday probe/pause; thinner liquidity. - 12:30–15:00 — U.S. afternoon continuation/unwind into close.

How to use

- []Apply on a chart with NQ and ES data (e.g., continuous futures). Choose killzone windows and detection mode (Cross vs Exact Tick).

[]Select the confirmation symbol (NQ or ES) and optionally enable IFVG re-lock until confirmation/expiry. - set realistic Properties and run on “Once per bar close.”

*

Alerts: enable SMT Bullish/Bearish and/or Confirm LONG/SHORT; “Once per bar close” is generally recommended.

What the alerts mean

- []SMT Bullish/Bearish: an exclusive sweep + divergence printed this bar.

[]Confirm LONG/SHORT: the close crossed the IFVG boundary in the candle’s direction per the rules.

Limitations

Signals depend on data quality, feeds, and timeframe. Divergence and confirmations can fail. Designed primarily for the NQ/ES pair. Past performance is not indicative of future results; use prudent risk controls.

Disclaimer

Educational tool only; not financial advice. Trade at your own risk.

Script sob convite

Somente usuários aprovados pelo autor podem acessar este script. Você precisará solicitar e obter permissão para usá-lo. Normalmente, essa permissão é concedida após o pagamento. Para obter mais detalhes, siga as instruções do autor abaixo ou entre em contato diretamente com eliran5060.

O TradingView NÃO recomenda pagar ou usar um script ao não ser que você confie totalmente no seu autor e compreende como isso funciona. Você pode também encontrar alternativas gratuitas e de código aberto em nossa comunidade de scripts.

Instruções do autor

Aviso: leia nosso guia para scritps somente sob convite antes de solicitar acesso.

Feel free to contact me via: eliran5060@gmail.com

Aviso legal

Script sob convite

Somente usuários aprovados pelo autor podem acessar este script. Você precisará solicitar e obter permissão para usá-lo. Normalmente, essa permissão é concedida após o pagamento. Para obter mais detalhes, siga as instruções do autor abaixo ou entre em contato diretamente com eliran5060.

O TradingView NÃO recomenda pagar ou usar um script ao não ser que você confie totalmente no seu autor e compreende como isso funciona. Você pode também encontrar alternativas gratuitas e de código aberto em nossa comunidade de scripts.

Instruções do autor

Aviso: leia nosso guia para scritps somente sob convite antes de solicitar acesso.

Feel free to contact me via: eliran5060@gmail.com