OPEN-SOURCE SCRIPT

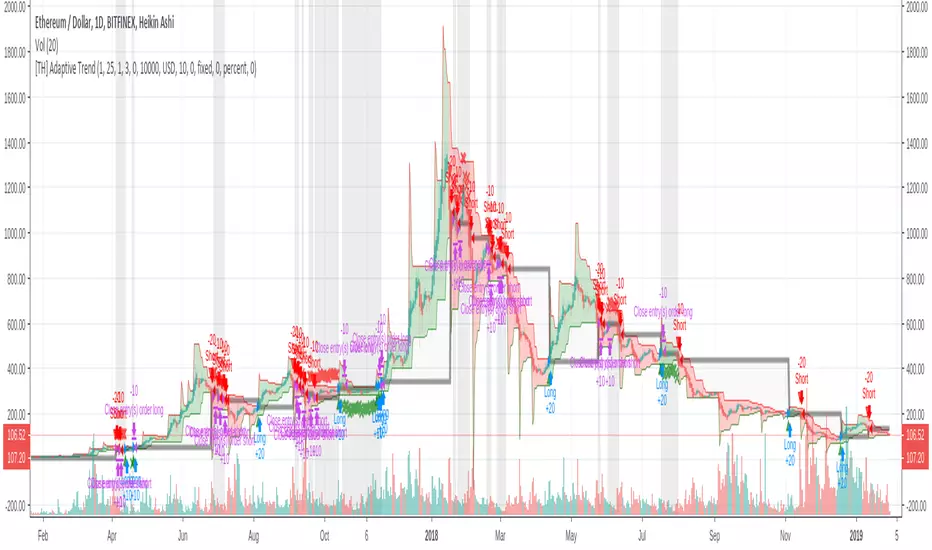

[TH] Adaptive Trend : Strategy

Adaptive Trend : Strategy

*** It should be used with 'heikin ashi' chart ***

*** It should be used with 'heikin ashi' chart ***

- Super Trend

Basically, it is super trend strategy ( Rajandran R Supertrend )

- My idea is,

1. (scale) Factor of super trend is related with sensitivity of Up/Down trend change

2. Constant Factor cause failure of super trend strategy when market prices variance is low ( ie. high Factor ==> miss short trend )

3. By using variance measure ( like BollingerBand ) as a varying Factor, maybe we can catch short trend and long trend together - Loss Cut

The silver thick line is loss cut line & silver background means exit position status

I found that silver background is appear usually when price moves horizontally

1. It is set to open price of actual position entry ( heikin ashi chart's open price = loss cut line = (open + close)/2 )

2. If position is long

==> loss cut is executed when low price is lower than loss cut line

==> re-entry when low price is higher than loss cut line

3. If Position is short

==> loss cut is executed when high price is higher than loss cut line

==> re-entry when high price is lower than loss cut lin

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.