Cyatophilum Bands Definitive Edition

A Swing Trade indicator providing backtest and alerts which can be used as a long, short or reversal strategy.

Its main goal is to catch breakouts and huge moves, and to try and beat the Buy & Hold Return.

█ CONCEPTS

The strategy consists of a unique custom indicator that works like this:

A Smoothed Donchian Channel combined with a consolidation check will trigger an entry.

The entry is then guided by a faster channel used as a trailing stop.

█ HOW TO USE

The most effective way to use this indicator is on high timeframes, from 2H to 1D.

The recommended pairs are trending pairs with consolidation areas. Yes, I'm especially looking at crypto.

The first appproach would be to catch long and short breakouts, and ride the trend using the trailing stop.

Adjust the Bands wisely to trigger entries at the right time.

The second approach is to go longs only, and try to beat the Buy & Hold return.

For this, click "Go long" and use an order size of 100% equity. Then adjust the Bands, trailing stop and chart timeframe.

The Buy & Hold comparator will come handy when backtesting.

█ INDICATOR SETTINGS

Strategy Direction

Choose wether to go long only, short only or both directions.

Bands Configuration

The bands lookback, smoothing and consolidation % are used to change the behavior of the bands. More info in the settings tooltips.

Trailing Stop

The "speed" of the trailing stop can be configured, allowing more or less room for the price to move before exiting.

Volume Condition

In addition to the consolidation condition, you can add a volume check to your entry. Is the volume rising or not? Useful in most scenarios.

Exit Alert Type

If you want to receive alerts during bars or prefer to ignore wicks.

Backtest Settings

This is where you choose the backtest period which is also used to calculate the B&H return.

Graphics

The configuration panel with all the indicator settings backtest info.

The buy & Hold Comparator is an additional panel that turns green when the strategy's return is greater than the Buy & Hold return.

Note: The Strategy Return is the strategy netprofit + the strategy openprofit.

█ ALERTS

Configure your alert messages for all events in the indicator settings.

Then click "Add Alert". In the popup window, select the option "alert() function calls only", give the alert a name and you are good to go!

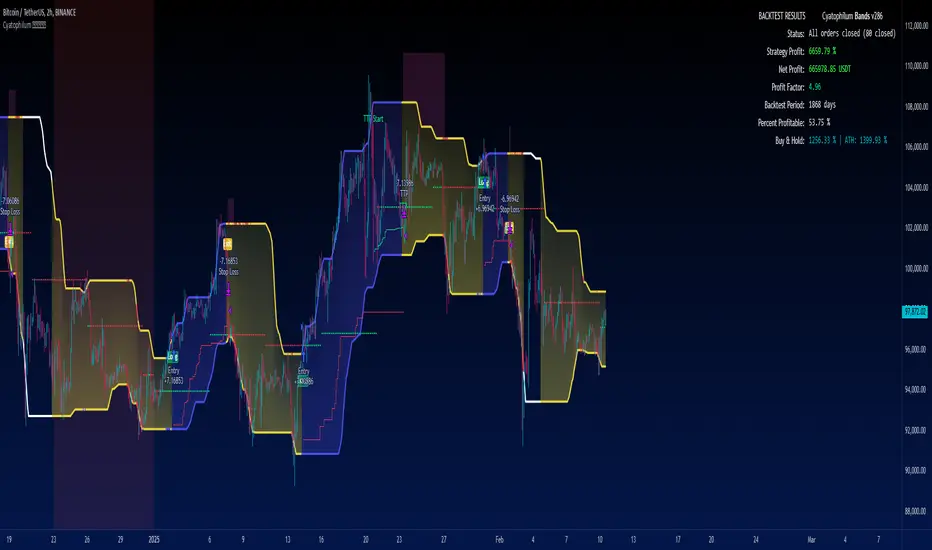

█ BACKTEST RESULTS

The backtest settings used in this snapshot are the following:

- Initial Capital: 10 000$

- Order size: 100% equity (It indeed compounds and this is intended since the main goal of the strategy is to compare to Buy & Hold return)

- Commission: 0.1%

- Slippage : 10 ticks

The Indicator settings used for this are shown in the main chart above.

You can disable it by going in the style tab -> tables, or by clicking the indicator setting "Backtest Results Table".

You can also change its size if you want to make it bigger or smaller.

It replaces the Buy & Hold Comparator

Added Bands settings: Multiplicator and Offset

Removed multiplicator for DC channel

Fix some visual bug with Take Profit line continuing when SL was hit

Added custom order size setting

All alerts:

{price} will return the close price

{ticker} symbol name without exchange prefix

{tickerid} symbol name with exchange prefix

Buy & Sell alert:

{TP}, {TP2}, {SL} will return the TP & SL prices

- Inputs (quality of life)

- New ATR trailing stop option

- Backtest Table new design and options (colors, position)

- Added Alerts placeholders

- Plots (gradients, yay!)

- Added a take profit option to NOT take profit when the global trend is in our direction

- The strategy will no longer enter a trade immediately after take profit is hit

- Bands Timeframe: Make the Bands higher timeframe and go trade on lower timeframes without changing bands settings!

- Bands Source: Choose between 'Donchian', 'SMA' or 'EMA' to create your bands. Note that SMA and EMA are meant to be used with the new ATR and STDEV inputs but can work on their own!

- Add Standard Deviation to the Bands: This input replaces the previous 'Bollinger Bands' input, and allows more customisation.

- Add Average True Range to the Bands: This input replaces the previous 'Keltner Channels' input, and allows more customisation. Can be combined with the previous inputs!

Bug fixes:

Only graphical fixes within the backtest panel: open profit % is now correct!

New plot: Take Profit EMA used for Trend condition (option released in a previous update)

Strategy Direction

- reverse order option

Bands Settings

- Range Filter

Prevents fakeouts from previously touched support/resistance (recommended)

- Trend Filter

Creates a MTF pivot to filter trades (recommended)

Stop Loss

- Mode 'Auto', '%', 'pips', 'ATR'.

- Trailing Stop Loss Mode 'Classic', 'ATR', MTF.

Take Profit

- Mode '%', 'pips', 'Auto'.

Alerts

- Take Profit, Exit and Stop loss alerts are all grouped into a single 'EXIT' alert for easier setup.

Added ATR settings for the trailing stop.

Added ATR settings for stop loss start price

- "long/short sl alert type" input

- "exit alert (faster band)" replaces "exit all" alert

'EXTERNAL', 'Tilson T3', 'Adaptive Tilson T3', 'EMA', 'SMA', 'WMA', 'HULL MA', 'Adaptive HULL MA', 'KAMA', 'ALMA', 'RMA', 'SWMA', 'VWMA','SMMA','VIDYA','FRAMA','DEMA'.

Added NASDAQ/BTC.D Filters.

- Add a filter for long: do not enter when NASDAQ/BTC.D are falling.

- Add a filter for long: only enter when NASDAQ/BTC.D are rising.

- Pick a higher timeframe (for ex 5 days)

- select which supports to enable (ex S2 to S5)

In contrary to the breakouts, the rebound entry can only happen when price is not consolidated.

The rebound entries are affected by the Nasdaq/BTC.D filter.

These rebounds do not happen often but give great buy opportunity.

Long only (for now)

- Fixed a repainting issue with the nasdaq/BTC.D filter

- Code optimisation

- Added a "Fast & Simple" Graphics mode to further reduce loading time and chart graphics

- Added Alert tutorial label

- Increased readability

- Added tooltips

- Pivot rebounds will now trigger a short exit event when shorts enabled

- Inputs clarification

- Updated to pine version 6

- Added Trailing Take Profit feature

- Added Correlation Filter (replaces Nasdaq Filter)

The TTP can be anchored to the Take Profit, and/or triggered by custom conditions (see screenshot).

The Correlation Filter is now more customisable (not limited to Nasdaq) and can use 2 symbols.

Combine the Weighted Moving Average with 2+ Average True Range multiplier to get nice results.

Script sob convite

Somente usuários aprovados pelo autor podem acessar este script. Você precisará solicitar e obter permissão para usá-lo. Normalmente, essa permissão é concedida após o pagamento. Para obter mais detalhes, siga as instruções do autor abaixo ou entre em contato diretamente com cyatophilum.

A TradingView NÃO recomenda pagar ou usar um script, a menos que você confie totalmente em seu autor e entenda como ele funciona. Você também pode encontrar alternativas gratuitas e de código aberto em nossos scripts da comunidade.

Instruções do autor

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Aviso legal

Script sob convite

Somente usuários aprovados pelo autor podem acessar este script. Você precisará solicitar e obter permissão para usá-lo. Normalmente, essa permissão é concedida após o pagamento. Para obter mais detalhes, siga as instruções do autor abaixo ou entre em contato diretamente com cyatophilum.

A TradingView NÃO recomenda pagar ou usar um script, a menos que você confie totalmente em seu autor e entenda como ele funciona. Você também pode encontrar alternativas gratuitas e de código aberto em nossos scripts da comunidade.

Instruções do autor

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/