OPEN-SOURCE SCRIPT

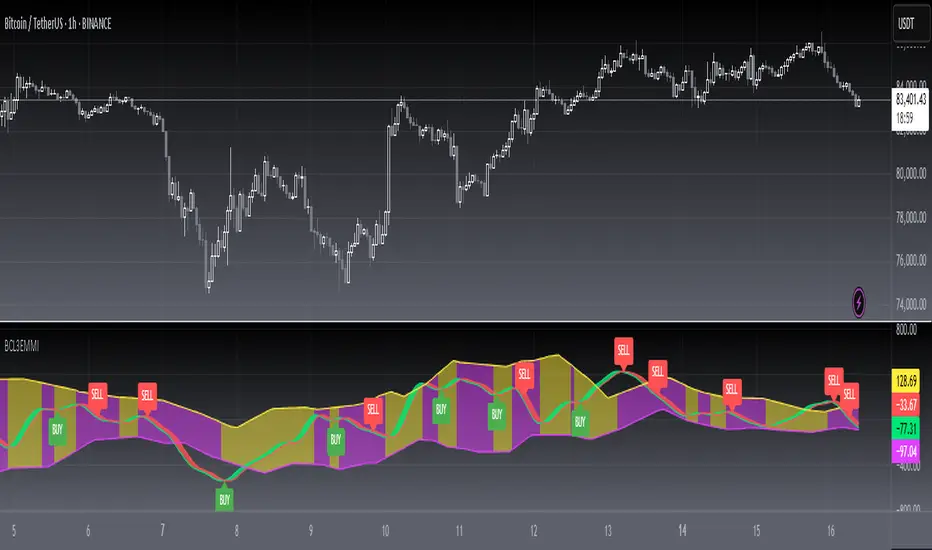

Atualizado [blackcat] L3 Ehlers Market Mode Indicator

Level: 3

Background

John F. Ehlers introuced Market Mode Indicator on April, 2012.

Function

This indicator is used to determine whether the market is in a trending or a cyclical mode. This is accomplished by comparing the average value of price, after being filtered to the peaks and valleys of that filtered price. The filter used in this indicator is a second order butterworth filter. For more information on this calculation see "Introducing SwamiCharts" (March 2012) and "Empirical Mode Decomposition" (March 2010) from Technical Analysis of Stocks and Commodities by Dr. Ehlers.

Key Signal

MeanCalc --> short term fast line

MeanCalc(2) --> short term slow line

long ---> long entry signal

short ---> short entry signal

Pros and Cons

NOT 100% John F. Ehlers definition translation, even variable names are the same. This help readers who would like to use pine to read his book.

Remarks

The 80th script for Blackcat1402 John F. Ehlers Week publication.

I kept the core of Ehlers market mode indicator, but add conditons for long and short entries which i think they are reasonable.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Background

John F. Ehlers introuced Market Mode Indicator on April, 2012.

Function

This indicator is used to determine whether the market is in a trending or a cyclical mode. This is accomplished by comparing the average value of price, after being filtered to the peaks and valleys of that filtered price. The filter used in this indicator is a second order butterworth filter. For more information on this calculation see "Introducing SwamiCharts" (March 2012) and "Empirical Mode Decomposition" (March 2010) from Technical Analysis of Stocks and Commodities by Dr. Ehlers.

Key Signal

MeanCalc --> short term fast line

MeanCalc(2) --> short term slow line

long ---> long entry signal

short ---> short entry signal

Pros and Cons

NOT 100% John F. Ehlers definition translation, even variable names are the same. This help readers who would like to use pine to read his book.

Remarks

The 80th script for Blackcat1402 John F. Ehlers Week publication.

I kept the core of Ehlers market mode indicator, but add conditons for long and short entries which i think they are reasonable.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Notas de Lançamento

OVERVIEWThe L3 Ehlers Market Mode Indicator is a technical analysis tool that identifies market trends and generates buy/sell signals using John Ehlers' proprietary formulas. The indicator calculates momentum and volatility indicators to determine optimal entry and exit points in the market.

FEATURES

• Real-time market mode detection

• Customizable input parameters:

Price calculation method (default: hl2)

Period length (default: 20)

BPDelta value (default: 0.5)

Fraction ratio (default: 0.5) • Visual representation of:

Mean calculation line

Peak and valley levels

Signal crossover points • Automatic BUY/SELL signal labels on chart

HOW TO USE

Add the indicator to your chart

Adjust the input parameters as needed:

Select price source (hl2, close, etc.)

Set desired period length

Modify BPDelta value

Adjust fraction ratio

Monitor the indicator for:

Crossovers between mean lines

Breakthroughs of peak/valley levels

Automatic signal labels

LIMITATIONS

• Works best on liquid, trending markets

• Requires proper parameter tuning for specific assets

• May generate false signals during choppy market conditions

NOTES

• Backtesting recommended before live trading

• Consider combining with other indicators for confirmation

• Default parameters optimized for general use

Notas de Lançamento

This modified version adds alert conditions for both buy and sell signals as requested. The alertcondition() function is used to create alert triggers when the longSignal or shortSignal becomes true. You can now set up alerts in TradingView based on these conditions.Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.