OPEN-SOURCE SCRIPT

Atualizado CVD with Moving Average (Trend Colors) [SYNC & TRADE]

Yesterday I wrote a simple and easy code for the indicator "Cumulative Delta Volume with a moving average" using AI.

Introduction:

Delta is the difference between buys and sells. If there are more purchases, the delta is positive, if there are more sales, the delta is negative. We look at each candle separately on a particular time frame, which does not give us an overall picture over time.

Cumulative volume delta is in many ways an extension of volume delta, but it covers longer periods of time and provides different trading signals. Like the volume delta indicator, the Cumulative Volume Delta (CVD) indicator measures the relationship between buying and selling pressure, but does not focus on one specific candle (or other chart element), but rather gives a picture over time.

What did you want to get?

I have often seen that they tried to attach RSI and the Ichimoku cloud to the cumulative delta of volume, but I have never seen a cumulative delta of volume with a moving average. A moving average that takes data from the cumulative volume delta will be different from the moving average of the underlying asset. It has been noted that often at the intersection of the cumulative volume delta and the moving average, this is a more accurate signal to buy or sell than the same intersections for the underlying asset.

Initially, 5 moving averages were made with values of 21, 55, 89, 144 and 233, but I realized that this overloads the chart. It is easier to change the length of the moving average depending on the time frame you are using than to overload the chart. The final version with one moving SMA, EMA, RMA, WMA, HMA.

The logic for applying a moving average to a cumulative volume delta:

You choose a moving average, just like you would on your underlying asset. Use the moving average you like and the period you are used to working with. Each TF has its own settings.

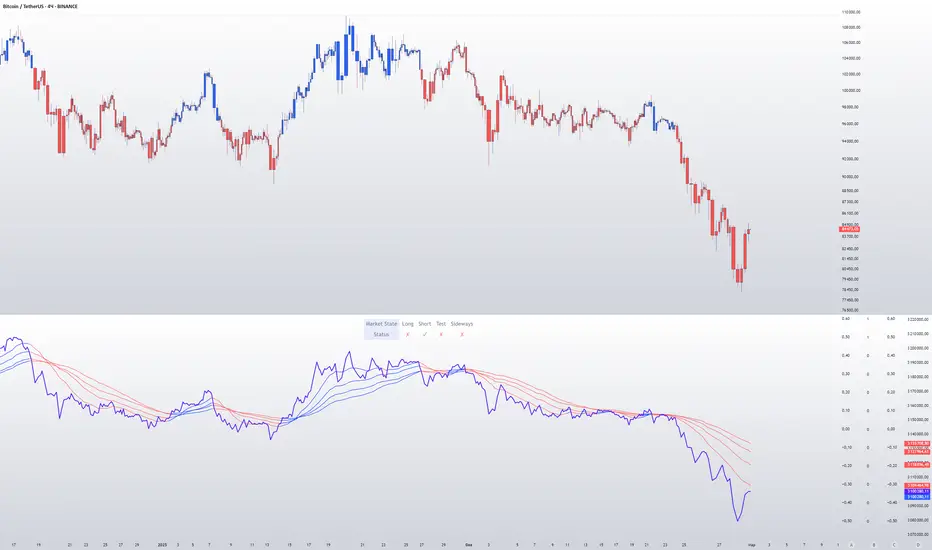

What we see on the graph:

This is not an oscillator, but an adapted version for a candlestick chart (line only). Using it, you can clearly see where the market is moving based on the cumulative volume delta. The cool thing is that you can include your moving average applied to the cumulative volume delta. Thanks to this, you can see a trend movement, a return to the moving average to continue the trend.

Opportunities not lost:

The most interesting thing is that it remains possible to observe the divergence of the asset and the cumulative delta of the volume. This gives a great advantage. Those who have not worked with divergence do not rush into it right away. There may be 3 peaks in divergence (as with oversold/overbought), but it works many times more clearly than RSI and MACD.

Here's a good example on the daily chart. The moment we were all waiting for 75,000. The cumulative Delta Volume fell with each peak, while the price chart (tops) were approximately level.

Usually they throw (allow to buy) without volume for sales (delta down, price up) in order to merge at a more interesting price. And they also drain without the volume of purchases for a squeeze (price down / delta up) and again I buy back at a more interesting price. There are more complex estimation options; you can read about the divergence of the cumulative delta of the CVD volume. I just recommend doing a backtest.

Recommendations:

One more moment. Use the indicator on the stock exchange, where there is the most money, by turnover and by asset. Choose Binance, not Bybit. Those. choose the BTC asset, for example, but on the Binance exchange. Not futures, but spot.

The greater the turnover on the exchange for an asset, and the fewer opportunities to enter with leverage, the less volatile the price and the more beautiful and accurate the chart.

Works on all assets. There is a subscription limit (the number of calculated bars) that has little effect on anything. Can be applied to any asset where there is volume (not SPX, but ES1, not MOEX, but MX1!).

Перевод на русский.

Вчера написал с помощью AI простой и легкий код индикатора "Кумулятивная Дельта Объема со скользящей средней".

Введение:

Дельта (Delta) — это разница между покупками и продажами. Если покупок больше — дельта положительная, если больше продаж — дельта отрицательная. Мы смотрим на каждую свечу отдельно на том или ином таймфрейме, что не дает нам общей картины во времени.

Кумулятивная дельта объема — во многом продолжение дельты объёмов, но она включает более длительные периоды времени и дает другие торговые сигналы. Как и индикатор дельты объёма, индикатор кумулятивной дельты объема (Cumulative Volume Delta, CVD) измеряет связь между давлением покупателей и продавцов, но при этом не фокусируется на одной конкретной свече (или другом элементе графика), а дает картину во времени.

Что хотел получить?

Часто видел, что к кумулятивной детьте объема пытались прикрепить RSI и облако ишимоку, но никогда не видел кумулятивную дельту объема со скользящей средней. Скользящая средняя которая берет данные от кумулятивной дельты объема будет отличатся от скользящей средней основного актива. Было замечено, что часто в местах пересечения кумулятивной дельты объема и скользящей средней - это более точный сигнал к покупке или продаже, чем такие же пересечения по основному активу.

Изначально было сделанно 5 скользящих со значениями 21, 55, 89, 144 и 233, но я понял, что это перегружает график. Проще менять длину скользящей средней от используемого таймфрейма, чем перегружать график. Финальный вариант с одной скользящей SMA, EMA, RMA, WMA, HMA.

Логика применения скользящей средней к кумулятивной дельте объема:

Вы выбираете скользящую среднюю, так же как и на основном активе. Применяйте ту скользящую среднюю, которая вам нравится и период, с которым привыкли работать. На каждом TF свои настройки.

Что мы видим на графике:

Это не осциллятор, а адаптированная версия к свечному графику (только линия). С помощью него вы можете наглядно посмотреть куда движется рынок по кумулятивной дельте объема. Самое интересное, что вы можете включить свою скользящую среднюю, применимую к кумулятивной дельте объема. Благодаря этому вы можете видеть трендовое движение, возврат к средней скользящей для продолжения тренда.

Не потерянные возможности:

Самое интересное, что осталась возможность наблюдать за дивергенцией актива и кумулятивной дельтой объема. Это дает большое преимущество. Те кто не работал с дивергенцией не бросайтесь на нее сразу. Может быть и 3 пика в дивергенции (как с перепроданностью / перекупленностью), но работает в разы четче чем RSI и MACD.

Вот хороший пример на дневном графике. Момент когда мы все ждали 75000. Кумулятивная Дельта Объема падала с каждым пиком, в то время как ценовой график (вершины) были примерно на уровне.

Обычно закидывают (разрешают покупать) без объема на продажи (дельта вниз цена вверх), чтобы слить по более интересной цене. И также сливают без объема покупок для сквиза (цена вниз / дельта вверх) и опять откупаю по более интересной цене. Существуют более сложные варианты оценки, можете почитать про дивергенцию кумулятивной дельты объема CVD. Только рекомендую сделать бэктест.

Рекомендации:

Еще момент. Используйте индикатор, на бирже, там где больше всего денег, по обороту и по активу. Выбирайте не Bybit, а Binance. Т.е. выбираете актив BTC, к примеру, но на бирже Binance. Не фьючерс, а спот.

Чем более большие обороты на бирже, по активу, и меньше возможностей заходить с плечами, тем менее волатильная цена и более красивый и точный график.

Работает на всех активах. Есть ограничение по подписке (количество рассчитываемых баров) мало влияет на что. Можно применить к любому активу где есть объем (не SPX, а ES1, не MOEX, а MX1!).

Introduction:

Delta is the difference between buys and sells. If there are more purchases, the delta is positive, if there are more sales, the delta is negative. We look at each candle separately on a particular time frame, which does not give us an overall picture over time.

Cumulative volume delta is in many ways an extension of volume delta, but it covers longer periods of time and provides different trading signals. Like the volume delta indicator, the Cumulative Volume Delta (CVD) indicator measures the relationship between buying and selling pressure, but does not focus on one specific candle (or other chart element), but rather gives a picture over time.

What did you want to get?

I have often seen that they tried to attach RSI and the Ichimoku cloud to the cumulative delta of volume, but I have never seen a cumulative delta of volume with a moving average. A moving average that takes data from the cumulative volume delta will be different from the moving average of the underlying asset. It has been noted that often at the intersection of the cumulative volume delta and the moving average, this is a more accurate signal to buy or sell than the same intersections for the underlying asset.

Initially, 5 moving averages were made with values of 21, 55, 89, 144 and 233, but I realized that this overloads the chart. It is easier to change the length of the moving average depending on the time frame you are using than to overload the chart. The final version with one moving SMA, EMA, RMA, WMA, HMA.

The logic for applying a moving average to a cumulative volume delta:

You choose a moving average, just like you would on your underlying asset. Use the moving average you like and the period you are used to working with. Each TF has its own settings.

What we see on the graph:

This is not an oscillator, but an adapted version for a candlestick chart (line only). Using it, you can clearly see where the market is moving based on the cumulative volume delta. The cool thing is that you can include your moving average applied to the cumulative volume delta. Thanks to this, you can see a trend movement, a return to the moving average to continue the trend.

Opportunities not lost:

The most interesting thing is that it remains possible to observe the divergence of the asset and the cumulative delta of the volume. This gives a great advantage. Those who have not worked with divergence do not rush into it right away. There may be 3 peaks in divergence (as with oversold/overbought), but it works many times more clearly than RSI and MACD.

Here's a good example on the daily chart. The moment we were all waiting for 75,000. The cumulative Delta Volume fell with each peak, while the price chart (tops) were approximately level.

Usually they throw (allow to buy) without volume for sales (delta down, price up) in order to merge at a more interesting price. And they also drain without the volume of purchases for a squeeze (price down / delta up) and again I buy back at a more interesting price. There are more complex estimation options; you can read about the divergence of the cumulative delta of the CVD volume. I just recommend doing a backtest.

Recommendations:

One more moment. Use the indicator on the stock exchange, where there is the most money, by turnover and by asset. Choose Binance, not Bybit. Those. choose the BTC asset, for example, but on the Binance exchange. Not futures, but spot.

The greater the turnover on the exchange for an asset, and the fewer opportunities to enter with leverage, the less volatile the price and the more beautiful and accurate the chart.

Works on all assets. There is a subscription limit (the number of calculated bars) that has little effect on anything. Can be applied to any asset where there is volume (not SPX, but ES1, not MOEX, but MX1!).

Перевод на русский.

Вчера написал с помощью AI простой и легкий код индикатора "Кумулятивная Дельта Объема со скользящей средней".

Введение:

Дельта (Delta) — это разница между покупками и продажами. Если покупок больше — дельта положительная, если больше продаж — дельта отрицательная. Мы смотрим на каждую свечу отдельно на том или ином таймфрейме, что не дает нам общей картины во времени.

Кумулятивная дельта объема — во многом продолжение дельты объёмов, но она включает более длительные периоды времени и дает другие торговые сигналы. Как и индикатор дельты объёма, индикатор кумулятивной дельты объема (Cumulative Volume Delta, CVD) измеряет связь между давлением покупателей и продавцов, но при этом не фокусируется на одной конкретной свече (или другом элементе графика), а дает картину во времени.

Что хотел получить?

Часто видел, что к кумулятивной детьте объема пытались прикрепить RSI и облако ишимоку, но никогда не видел кумулятивную дельту объема со скользящей средней. Скользящая средняя которая берет данные от кумулятивной дельты объема будет отличатся от скользящей средней основного актива. Было замечено, что часто в местах пересечения кумулятивной дельты объема и скользящей средней - это более точный сигнал к покупке или продаже, чем такие же пересечения по основному активу.

Изначально было сделанно 5 скользящих со значениями 21, 55, 89, 144 и 233, но я понял, что это перегружает график. Проще менять длину скользящей средней от используемого таймфрейма, чем перегружать график. Финальный вариант с одной скользящей SMA, EMA, RMA, WMA, HMA.

Логика применения скользящей средней к кумулятивной дельте объема:

Вы выбираете скользящую среднюю, так же как и на основном активе. Применяйте ту скользящую среднюю, которая вам нравится и период, с которым привыкли работать. На каждом TF свои настройки.

Что мы видим на графике:

Это не осциллятор, а адаптированная версия к свечному графику (только линия). С помощью него вы можете наглядно посмотреть куда движется рынок по кумулятивной дельте объема. Самое интересное, что вы можете включить свою скользящую среднюю, применимую к кумулятивной дельте объема. Благодаря этому вы можете видеть трендовое движение, возврат к средней скользящей для продолжения тренда.

Не потерянные возможности:

Самое интересное, что осталась возможность наблюдать за дивергенцией актива и кумулятивной дельтой объема. Это дает большое преимущество. Те кто не работал с дивергенцией не бросайтесь на нее сразу. Может быть и 3 пика в дивергенции (как с перепроданностью / перекупленностью), но работает в разы четче чем RSI и MACD.

Вот хороший пример на дневном графике. Момент когда мы все ждали 75000. Кумулятивная Дельта Объема падала с каждым пиком, в то время как ценовой график (вершины) были примерно на уровне.

Обычно закидывают (разрешают покупать) без объема на продажи (дельта вниз цена вверх), чтобы слить по более интересной цене. И также сливают без объема покупок для сквиза (цена вниз / дельта вверх) и опять откупаю по более интересной цене. Существуют более сложные варианты оценки, можете почитать про дивергенцию кумулятивной дельты объема CVD. Только рекомендую сделать бэктест.

Рекомендации:

Еще момент. Используйте индикатор, на бирже, там где больше всего денег, по обороту и по активу. Выбирайте не Bybit, а Binance. Т.е. выбираете актив BTC, к примеру, но на бирже Binance. Не фьючерс, а спот.

Чем более большие обороты на бирже, по активу, и меньше возможностей заходить с плечами, тем менее волатильная цена и более красивый и точный график.

Работает на всех активах. Есть ограничение по подписке (количество рассчитываемых баров) мало влияет на что. Можно применить к любому активу где есть объем (не SPX, а ES1, не MOEX, а MX1!).

Notas de Lançamento

Friends. Yesterday I wrote a simple and easy code for the indicator "Cumulative Delta Volume with a moving average" using AI.Introduction:

Delta is the difference between buys and sells. If there are more purchases, the delta is positive, if there are more sales, the delta is negative. We look at each candle separately on a particular time frame, which does not give us an overall picture over time.

Cumulative volume delta is in many ways an extension of volume delta, but it covers longer periods of time and provides different trading signals. Like the volume delta indicator, the Cumulative Volume Delta (CVD) indicator measures the relationship between buying and selling pressure, but does not focus on one specific candle (or other chart element), but rather provides a map over time.

What did you want to get?

I have often seen that they tried to attach "RSI" and an "Ichimoku cloud" to the cumulative volume delta, but I have never seen a cumulative volume delta with a moving average. A moving average that takes data from the cumulative volume delta will be different from the moving average of the underlying asset. It was noticed that often at the intersection of the cumulative volume delta and the moving average, this is a more accurate signal to buy or sell than the same intersections for the underlying asset.

Initially, 5 moving averages were made with values of 21, 55, 89, 144 and 233, but I realized that this overloads the chart. It is easier to change the length of the moving average depending on the time frame you are using than to overload the chart. The final version with one moving SMA, EMA, RMA, WMA, HMA.

The logic for applying a moving average to a cumulative volume delta:

You choose a moving average, just like you would on your underlying asset. Use the moving average you like and the period you are used to working with. Each TF has its own settings.

What we see on the graph:

This is not an oscillator, but an adapted version for a candlestick chart (line only). Using it, you can clearly see where the market is moving based on the cumulative volume delta. The cool thing is that you can include your moving average applied to the cumulative volume delta. Thanks to this, you can see a trend movement, a return to the average moving average to continue the trend.

Opportunities not lost:

The most interesting thing is that it remains possible to observe the divergence of the asset and the cumulative delta of the volume. This gives a great advantage. Those who have not worked with divergence do not rush into it right away. There may be 3 peaks in divergence (as with oversold/overbought), but it works many times more clearly than RSI and MACD.

Here's a good example on the daily chart. The moment we were all waiting for 75,000. The cumulative Delta Volume fell with each peak, while the price chart (tops) were approximately level.

Usually they throw (allow to buy) without volume for sales (delta down, price up) in order to merge at a more interesting price. And they also drain without the volume of purchases for a squeeze (price down / delta up) and again I buy back at a more interesting price. There are more complex estimation options; you can read about the divergence of the cumulative delta of the CVD volume. I just recommend doing a backtest.

Recommendations:

One more moment. Use the indicator on the stock exchange, where there is the most money, by turnover and by asset. Choose Binance, not Bybit. Those. choose the BTC asset, for example, but on the Binance exchange. Not futures, but spot.

The greater the turnover on the exchange for an asset, and the fewer opportunities to enter with leverage, the less volatile the price and the more beautiful and accurate the chart.

Works on all assets. There is a subscription limit (the number of calculated bars) that has little effect on anything. Can be applied to any asset where there is volume (not SPX, but ES1, not MOEX, but MX1!).

Notas de Lançamento

Fixed:Installation occurs in a new window.

Fixed a bug with the sliding average of the HMA.

Notas de Lançamento

CVD PRO [SYNC & TRADE] Indicator GuideGeneral Description

CVD PRO [SYNC & TRADE] is an advanced market analysis indicator based on Cumulative Volume Delta (CVD). It helps identify trends, entry and exit points, and provides statistics on signal performance.

Main features of the indicator

1. Setting up optimization parameters

For long positions (Long):

Moving average length (default 89)

Multiplier for calculations (default 1.62)

ATR period length (default 46)

For short positions (Short):

Similar parameters with the ability to independently configure

2. Flexible strategy settings

Ability to enable/disable signals for long positions

Ability to enable/disable signals for short positions

Work with different timeframes (daily, weekly, monthly)

Integration of volume analysis

3. Visual elements

Main display elements:

Trend line with dynamic color change (blue - ascending, red - descending)

Cloud around the main line to determine uncertainty zones

Three levels of parallel lines above and below the main line

Information panels:

Market status table

Signal efficiency statistics

Customizable size font

4. Market condition analysis

The indicator detects the following conditions:

Strong uptrend

Strong downtrend

Level testing

Sideways movement

5. Alert system

Customizable alerts for:

Trend change to uptrend

Trend change to downtrend

Reaching key levels

Pattern formation

How to use the indicator

Basic setup

Initial setup:

Start with default parameters

Select your preferred trading type (long or short)

Configure the display of information tables

Display setup:

Select a convenient font size

Configure the visibility of various elements

Determine whether to display statistics

Advanced use

Parameter optimization:

Select the optimal length of the average

Configure the multiplier for the volatility of the instrument

Set the appropriate ATR length

Working with volume:

Enable volume integration for accurate signals

Analyze the difference between regular and volume CVD

Use volume confirmation for signals

Multi-timeframe analysis:

Use higher timeframe data

Compare signals on different time periods

Consider long-term trends

Interpretation of signals

Strong trend

CVD is above/below the middle line

Clear direction of movement

High percentage of successful signals

Testing levels

CVD in the cloud area

Possible formation of a reversal

Additional confirmation is needed

Sideways movement

CVD between the first parallel lines

Low volatility

Caution in trading is recommended

Statistics and analysis of efficiency

Tracked parameters

Total number of signals

Percentage of successful signals

Separate statistics for long and short positions

Using statistics

Analysis of strategy efficiency

Optimization of parameters

Determining the best conditions for entry

Trading recommendations

Opening positions:

Wait for a clear signal

Check confirmation by volume

Consider the general state of the market

Risk management:

Use parallel lines to stop-loss

Consider the volatility of the instrument

Monitor the success statistics

Closing positions:

Monitor signs of a reversal

Use the cloud for partial fixation

Consider signals of the opposite direction

Руководство по индикатору CVD PRO [SYNC & TRADE]

Общее описание

CVD PRO [SYNC & TRADE] - это продвинутый индикатор для анализа рынка, который основан на кумулятивном дельта объеме (CVD). Он помогает определять тренды, точки входа и выхода из рынка, а также предоставляет статистику по эффективности сигналов.

Основные возможности индикатора

1. Настройка параметров оптимизации

Для длинных позиций (Long):

Длина скользящей средней (по умолчанию 89)

Множитель для расчетов (по умолчанию 1.62)

Длина периода ATR (по умолчанию 46)

Для коротких позиций (Short):

Аналогичные параметры с возможностью независимой настройки

2. Гибкие настройки стратегии

Возможность включения/отключения сигналов для длинных позиций

Возможность включения/отключения сигналов для коротких позиций

Работа с разными таймфреймами (дневной, недельный, месячный)

Интеграция объемного анализа

3. Визуальные элементы

Основные элементы отображения:

Линия тренда с динамическим изменением цвета (синий - восходящий, красный - нисходящий)

Облако вокруг основной линии для определения зон неопределенности

Три уровня параллельных линий выше и ниже основной линии

Информационные панели:

Таблица состояния рынка

Статистика эффективности сигналов

Настраиваемый размер шрифта

4. Анализ состояния рынка

Индикатор определяет следующие состояния:

Сильный восходящий тренд

Сильный нисходящий тренд

Тестирование уровней

Боковое движение

5. Система оповещений

Настраиваемые алерты на:

Смену тренда на восходящий

Смену тренда на нисходящий

Достижение ключевых уровней

Формирование паттернов

Как использовать индикатор

Базовая настройка

Первичная установка:

Начните с параметров по умолчанию

Выберите предпочтительный тип торговли (long или short)

Настройте отображение информационных таблиц

Настройка отображения:

Выберите удобный размер шрифта

Настройте видимость различных элементов

Определите необходимость показа статистики

Продвинутое использование

Оптимизация параметров:

Подберите оптимальную длину средней

Настройте множитель под волатильность инструмента

Установите подходящую длину ATR

Работа с объемом:

Включите интеграцию объема для точных сигналов

Анализируйте разницу между обычным и объемным CVD

Используйте объемные подтверждения для сигналов

Многотаймфреймный анализ:

Используйте данные старшего таймфрейма

Сверяйте сигналы по разным временным периодам

Учитывайте долгосрочные тренды

Интерпретация сигналов

Сильный тренд

CVD находится выше/ниже средней линии

Четкое направление движения

Высокий процент успешных сигналов

Тестирование уровней

CVD в зоне облака

Возможное формирование разворота

Необходимо дополнительное подтверждение

Боковое движение

CVD между первыми параллельными линиями

Низкая волатильность

Рекомендуется осторожность в торговле

Статистика и анализ эффективности

Отслеживаемые параметры

Общее количество сигналов

Процент успешных сигналов

Отдельная статистика для long и short позиций

Использование статистики

Анализ эффективности стратегии

Оптимизация параметров

Определение лучших условий для входа

Рекомендации по торговле

Открытие позиций:

Дождитесь четкого сигнала

Проверьте подтверждение объемом

Учитывайте общее состояние рынка

Управление рисками:

Используйте параллельные линии для стоп-лоссов

Учитывайте волатильность инструмента

Следите за статистикой успешности

Закрытие позиций:

Отслеживайте признаки разворота

Используйте облако для частичной фиксации

Учитывайте сигналы противоположного направления

Notas de Lançamento

For convenience, an option to disable display of base parallel distance on the graph has been added.Для удобства добавлена опция отключения отображения base parallel distance на графике.

Notas de Lançamento

CVD PRO [SYNC & TRADE] Indicator for TradingViewThis indicator is an advanced version of Cumulative Volume Delta (CVD), allowing you to analyze volume flows in the market with different settings for long and short positions.

Operating principle

The indicator calculates the cumulative volume delta indicator, taking into account the ratio of volume to price change, and displays it as a line or candles. Moving averages with flexible settings and cloud areas are used for trend analysis.

Main components

Strategy settings

Long/Short Settings: Ability to enable/disable and independently configure parameters for long and short positions

MA Length and MA Type: Parameters for two moving averages for each type of position (length and type: SMA, EMA, WMA, RMA, HMA)\n- Multiplier and Length: Multipliers and periods for calculating indicator zones

CVD calculation

The indicator offers two methods for calculating CVD:

With volume integration: volume * (close - open)\n2. With range normalization: volume * (close - open) / (high - low)

Cloud zones and parallel lines

Dynamic cloud: Zones around moving averages calculated taking into account market volatility

Parallel lines: Additional levels at a specified distance from the moving average (optional)

Analysis on higher timeframes

The ability to use data from higher timeframes (D, W, M) to calculate the indicator, which allows you to take into account long-term trends.

Visualization

CVD display type: Line or candlesticks

Bar coloring: Depending on the indicator value and its position relative to the levels

Market status table: Displays the current state (Long, Short, Test, Sideways)

Market status definition

The indicator classifies the current market state:

Long: CVD is above both moving averages (Long and Short)

Short: CVD is below both moving averages

Test: CVD is testing the cloud boundaries (located between the moving average and the upper/lower cloud boundary)

Sideways: CVD is in a sideways range (between parallel lines)

Adaptation to volatility

The indicator automatically adapts to changes in market volatility:

Dynamic cloud distance changing depending on the ratio of current volatility to average

Dynamic multipliers for calculating boundaries adapting to ATR changes

Alerts

Built-in conditions for alerts:

Long trend transition to an upward direction

Long trend transition to a downward direction

Short trend transition to an upward direction

Short trend transition to a downward direction

Application

The indicator can be used to:

Determine the strength of a trend based on volume flows

Identify potential reversal zones when testing cloud boundaries

Build trading strategies taking into account a trend change

Analyze sideways market movements and their boundaries

The main advantage of the indicator is its comprehensive analysis of volume flows taking into account volatility and the ability to adapt to various market conditions.

The CVD PRO Premium indicator is a powerful tool for analyzing volume flows in the market using Cumulative Volume Delta (CVD). It calculates the cumulative ratio of volume to price change, which allows you to identify imbalances in supply and demand.

Key features of the indicator:

Separate settings for Long and Short positions with the ability to use different types and periods of moving averages

Dynamic cloud zones that adapt to market volatility

Ability to analyze on higher timeframes (D, W, M)

Visual table of market conditions with classification of the current situation

The indicator determines four market conditions: Long, Short, Test and Sideways, which helps to make more informed trading decisions taking into account current volume flows.

Notas de Lançamento

CVD PRO [SYNC & TRADE] Indicator for TradingViewThis indicator is an advanced version of Cumulative Volume Delta (CVD), allowing you to analyze volume flows in the market with different settings for long and short positions.

Operating principle

The indicator calculates the cumulative volume delta indicator, taking into account the ratio of volume to price change, and displays it as a line or candles. Moving averages with flexible settings and cloud areas are used for trend analysis.

Main components

Strategy settings

Long/Short Settings: Ability to enable/disable and independently configure parameters for long and short positions

MA Length and MA Type: Parameters for two moving averages for each type of position (length and type: SMA, EMA, WMA, RMA, HMA)\n- Multiplier and Length: Multipliers and periods for calculating indicator zones

CVD calculation

The indicator offers two methods for calculating CVD:

With volume integration: volume * (close - open)\n2. With range normalization: volume * (close - open) / (high - low)

Cloud zones and parallel lines

Dynamic cloud: Zones around moving averages calculated taking into account market volatility

Parallel lines: Additional levels at a specified distance from the moving average (optional)

Analysis on higher timeframes

The ability to use data from higher timeframes (D, W, M) to calculate the indicator, which allows you to take into account long-term trends.

Visualization

CVD display type: Line or candlesticks

Bar coloring: Depending on the indicator value and its position relative to the levels

Market status table: Displays the current state (Long, Short, Test, Sideways)

Market status definition

The indicator classifies the current market state:

Long: CVD is above both moving averages (Long and Short)

Short: CVD is below both moving averages

Test: CVD is testing the cloud boundaries (located between the moving average and the upper/lower cloud boundary)

Sideways: CVD is in a sideways range (between parallel lines)

Adaptation to volatility

The indicator automatically adapts to changes in market volatility:

Dynamic cloud distance changing depending on the ratio of current volatility to average

Dynamic multipliers for calculating boundaries adapting to ATR changes

Alerts

Built-in conditions for alerts:

Long trend transition to an upward direction

Long trend transition to a downward direction

Short trend transition to an upward direction

Short trend transition to a downward direction

Application

The indicator can be used to:

Determine the strength of a trend based on volume flows

Identify potential reversal zones when testing cloud boundaries

Build trading strategies taking into account a trend change

Analyze sideways market movements and their boundaries

The main advantage of the indicator is its comprehensive analysis of volume flows taking into account volatility and the ability to adapt to various market conditions.

The CVD PRO Premium indicator is a powerful tool for analyzing volume flows in the market using Cumulative Volume Delta (CVD). It calculates the cumulative ratio of volume to price change, which allows you to identify imbalances in supply and demand.

Key features of the indicator:

Separate settings for Long and Short positions with the ability to use different types and periods of moving averages

Dynamic cloud zones that adapt to market volatility

Ability to analyze on higher timeframes (D, W, M)

Visual table of market conditions with classification of the current situation

The indicator determines four market conditions: Long, Short, Test and Sideways, which helps to make more informed trading decisions taking into account current volume flows.

Notas de Lançamento

Alerts to enter states:Enter Long State: triggered when CVD is above both long moving averages.

Enter Short State: triggered when CVD is below both short moving averages.

Enter Test Long State: triggered when CVD starts testing the Long cloud.

Enter Test Short State: triggered when CVD starts testing the Short cloud.

Enter Sideways Long State: triggered when CVD enters a sideways Long range.

Enter Sideways Short State: triggered when CVD enters a sideways Short range.

Alerts to exit states:

Exit Long State: triggered when CVD exits the Long state.

Exit Short State: triggered when CVD exits the Short state.

Exit Test Long State: triggered when CVD exits the Long cloud test.

Exit Test Short State: triggered when CVD exits the Short cloud test.

Exit Sideways Long State: Triggered when CVD exits the sideways Long range.

Exit Sideways Short State: Triggered when CVD exits the sideways Short range.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

🎓 Эксклюзив: авторская вероятностная методика.

⚖️ Не угадываем, а рассчитываем.

📊 Новый стандарт анализа.

💬 Мои сделки и анализ: t.me/SyncAndTrade

🛠 Все индикаторы и их разбор: t.me/SyncAndTradeExperience

🌀 Метод, меняющий взгляд на рынок.

⚖️ Не угадываем, а рассчитываем.

📊 Новый стандарт анализа.

💬 Мои сделки и анализ: t.me/SyncAndTrade

🛠 Все индикаторы и их разбор: t.me/SyncAndTradeExperience

🌀 Метод, меняющий взгляд на рынок.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

🎓 Эксклюзив: авторская вероятностная методика.

⚖️ Не угадываем, а рассчитываем.

📊 Новый стандарт анализа.

💬 Мои сделки и анализ: t.me/SyncAndTrade

🛠 Все индикаторы и их разбор: t.me/SyncAndTradeExperience

🌀 Метод, меняющий взгляд на рынок.

⚖️ Не угадываем, а рассчитываем.

📊 Новый стандарт анализа.

💬 Мои сделки и анализ: t.me/SyncAndTrade

🛠 Все индикаторы и их разбор: t.me/SyncAndTradeExperience

🌀 Метод, меняющий взгляд на рынок.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.