PROTECTED SOURCE SCRIPT

CPR with EMA & VWAP Confirmation

IF this Indicator not properly alignment in chart.. just click indicator three dot more option and choose pine to scale (Pinned to A or right )

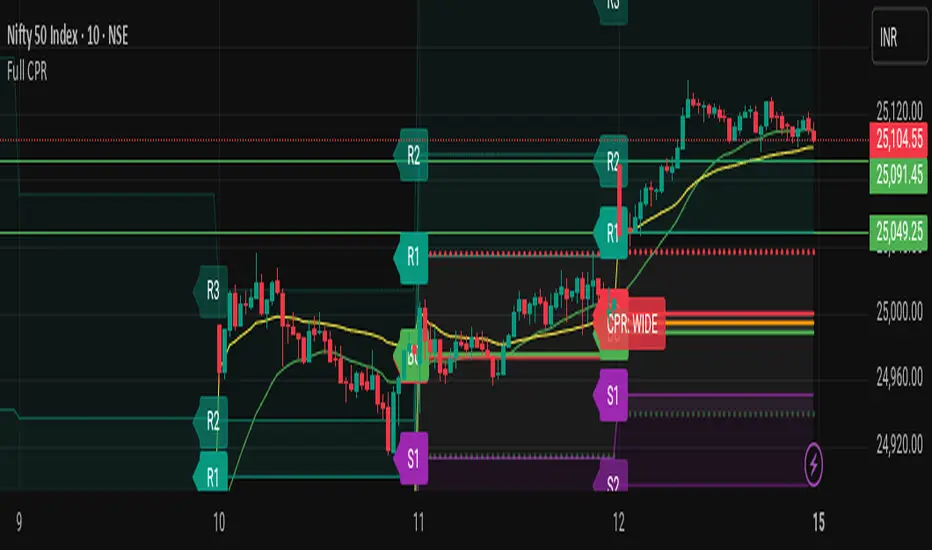

The Full CPR indicator is a complete intraday trading framework that combines Central Pivot Range (CPR) levels, Pivot Targets (R1/R2/R3, S1/S2/S3), and trend confirmations using EMA & VWAP. It is designed for traders who rely on CPR-based setups for intraday trend, breakout, and reversal opportunities.

Key Features

CPR Levels (Pivot, BC, TC): Auto-calculated daily from the previous day’s High, Low, and Close.

Target Zones: Standard targets (R1, R2, S1, S2) plus optional extensions (R3, S3).

EMA & VWAP Filters: Flexible entry confirmations with selectable buffer % and modes:

EMA only

VWAP only

Both

Any

Narrow/Wide CPR Detection: Identifies Narrow CPR (possible trending days) and Wide CPR (possible sideways/range days).

Previous Day High/Low (PDH/PDL): Plotted with shaded zones for support/resistance.

Auto Labels & Tags: Session labels for Pivot, BC, TC, targets, plus CPR Type (NARROW / WIDE / NORMAL).

Shaded Zones: CPR, bullish (R1–R2), bearish (S1–S2), and extension zones filled with transparency controls.

Entry Triggers:

Long entry when price closes above upper CPR band (or BC, depending on mode).

Short entry when price closes below lower CPR band (or TC, depending on mode).

Stoploss (SL): Opposite CPR band is marked as SL.

Target Tracking: Auto-marks T1/T2/T3 hits for both long and short trades.

Alerts: Built-in alerts for Long/Short entry, Target hits, and Stoploss triggers.

How to Use

Trend Days (Narrow CPR): Look for strong breakouts beyond CPR with EMA/VWAP confirmation.

Range Days (Wide CPR): Expect sideways movement; use CPR and PDH/PDL for quick scalps.

Entry & SL:

Go long when price breaks above CPR upper band (SL = lower band).

Go short when price breaks below CPR lower band (SL = upper band).

Targets: Use R1/R2/R3 (bullish) or S1/S2/S3 (bearish) as progressive booking levels.

Disclaimer

This script is for educational purposes only. It does not guarantee profits and should not be considered financial advice. Always backtest thoroughly and use proper risk management before live trading.

The Full CPR indicator is a complete intraday trading framework that combines Central Pivot Range (CPR) levels, Pivot Targets (R1/R2/R3, S1/S2/S3), and trend confirmations using EMA & VWAP. It is designed for traders who rely on CPR-based setups for intraday trend, breakout, and reversal opportunities.

Key Features

CPR Levels (Pivot, BC, TC): Auto-calculated daily from the previous day’s High, Low, and Close.

Target Zones: Standard targets (R1, R2, S1, S2) plus optional extensions (R3, S3).

EMA & VWAP Filters: Flexible entry confirmations with selectable buffer % and modes:

EMA only

VWAP only

Both

Any

Narrow/Wide CPR Detection: Identifies Narrow CPR (possible trending days) and Wide CPR (possible sideways/range days).

Previous Day High/Low (PDH/PDL): Plotted with shaded zones for support/resistance.

Auto Labels & Tags: Session labels for Pivot, BC, TC, targets, plus CPR Type (NARROW / WIDE / NORMAL).

Shaded Zones: CPR, bullish (R1–R2), bearish (S1–S2), and extension zones filled with transparency controls.

Entry Triggers:

Long entry when price closes above upper CPR band (or BC, depending on mode).

Short entry when price closes below lower CPR band (or TC, depending on mode).

Stoploss (SL): Opposite CPR band is marked as SL.

Target Tracking: Auto-marks T1/T2/T3 hits for both long and short trades.

Alerts: Built-in alerts for Long/Short entry, Target hits, and Stoploss triggers.

How to Use

Trend Days (Narrow CPR): Look for strong breakouts beyond CPR with EMA/VWAP confirmation.

Range Days (Wide CPR): Expect sideways movement; use CPR and PDH/PDL for quick scalps.

Entry & SL:

Go long when price breaks above CPR upper band (SL = lower band).

Go short when price breaks below CPR lower band (SL = upper band).

Targets: Use R1/R2/R3 (bullish) or S1/S2/S3 (bearish) as progressive booking levels.

Disclaimer

This script is for educational purposes only. It does not guarantee profits and should not be considered financial advice. Always backtest thoroughly and use proper risk management before live trading.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.