OPEN-SOURCE SCRIPT

Atualizado DIN: Dynamic Trend Navigator

DIN: Dynamic Trend Navigator

Overview

The Dynamic Trend Navigator script is designed to help traders identify and capitalize on market trends using a combination of Weighted Moving Averages (WMA), Volume Weighted Average Price (VWAP), and Anchored VWAP (AVWAP). The script provides customizable settings and flexible alerts for various crossover conditions, enhancing its utility for different trading strategies.

Key Features

- **1st and 2nd WMA**: Allows users to set and visualize two Weighted Moving Averages. These can be customized to any period, providing flexibility in trend identification.

- **VWAP and AVWAP**: Incorporates both VWAP and AVWAP, offering insights into price levels adjusted by volume.

- **ATR and ADX Indicators**: Includes the Average True Range (ATR) and Average Directional Index (ADX) to help assess market volatility and trend strength.

- **Flexible Alerts**: Configurable buy and sell alerts for any crossover condition, making it versatile for various trading strategies.

How to Use the Script

1. **Set the WMA Periods**: Customize the periods for the 1st and 2nd WMAs to suit your trading strategy.

2. **Enable VWAP and AVWAP**: Choose whether to include VWAP and AVWAP in your analysis by enabling the respective settings.

3. **Configure Alerts**: Set up alerts for the desired crossover conditions (WMA, VWAP, AVWAP) to receive notifications for potential trading opportunities.

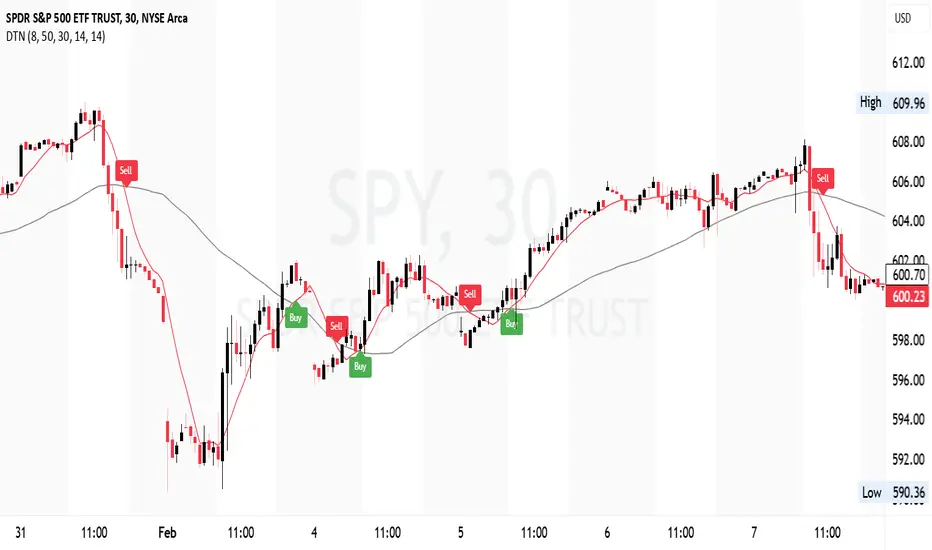

4. **Monitor Signals**: Watch for buy and sell signals indicated by triangle shapes on the chart, which appear at the selected crossover points.

When to Use

- **Best Time to Use**: The script is most effective in trending markets where price movements are well-defined. It helps traders stay on the right side of the trend and avoid false signals during periods of low volatility.

- **When Not to Use**: Avoid using the script in choppy or sideways markets where price action lacks direction. The script may generate false signals in such conditions, leading to potential losses.

Benefits of VWAP and AVWAP

- **VWAP**: The Volume Weighted Average Price provides a price benchmark that adjusts for volume, helping traders identify fair value levels. It is particularly useful for intraday trading and gauging market sentiment.

- **AVWAP**: The Anchored VWAP allows traders to set a starting point for VWAP calculations, providing flexibility in analyzing price levels over specific periods or events. This helps in identifying key support and resistance levels based on volume.

Unique Aspects

- **Customizability**: The script offers extensive customization options for WMA periods, VWAP, AVWAP, and alert conditions, making it adaptable to various trading strategies.

- **Combining Indicators**: By integrating WMAs, VWAP, AVWAP, ATR, and ADX, the script provides a comprehensive view of market conditions, enhancing decision-making.

- **Real-Time Alerts**: The flexible alert system ensures traders receive timely notifications for potential trade setups, improving responsiveness to market changes.

Examples

- **Example 1**: A trader sets the 1st WMA to 8 and the 2nd WMA to 100, enabling the VWAP. When the 1st WMA crosses above the 2nd WMA or VWAP, a buy signal is triggered, indicating a potential long entry.

- **Example 2**: A trader sets the AVWAP to start 30 bars ago and monitors for crossovers with the 1st WMA. When the 1st WMA crosses below the AVWAP, a sell signal is triggered, suggesting a potential short entry.

Final Notes

The Dynamic Trend Navigator script is a powerful tool for traders looking to enhance their market analysis and trading decisions. Its unique combination of customizable indicators and flexible alert system sets it apart from other scripts, making it a valuable addition to any trader's toolkit.

Disclaimer: Never any financial advice. Just ThisGirl loving experimenting with indicators to help myself, as well as others.

Overview

The Dynamic Trend Navigator script is designed to help traders identify and capitalize on market trends using a combination of Weighted Moving Averages (WMA), Volume Weighted Average Price (VWAP), and Anchored VWAP (AVWAP). The script provides customizable settings and flexible alerts for various crossover conditions, enhancing its utility for different trading strategies.

Key Features

- **1st and 2nd WMA**: Allows users to set and visualize two Weighted Moving Averages. These can be customized to any period, providing flexibility in trend identification.

- **VWAP and AVWAP**: Incorporates both VWAP and AVWAP, offering insights into price levels adjusted by volume.

- **ATR and ADX Indicators**: Includes the Average True Range (ATR) and Average Directional Index (ADX) to help assess market volatility and trend strength.

- **Flexible Alerts**: Configurable buy and sell alerts for any crossover condition, making it versatile for various trading strategies.

How to Use the Script

1. **Set the WMA Periods**: Customize the periods for the 1st and 2nd WMAs to suit your trading strategy.

2. **Enable VWAP and AVWAP**: Choose whether to include VWAP and AVWAP in your analysis by enabling the respective settings.

3. **Configure Alerts**: Set up alerts for the desired crossover conditions (WMA, VWAP, AVWAP) to receive notifications for potential trading opportunities.

4. **Monitor Signals**: Watch for buy and sell signals indicated by triangle shapes on the chart, which appear at the selected crossover points.

When to Use

- **Best Time to Use**: The script is most effective in trending markets where price movements are well-defined. It helps traders stay on the right side of the trend and avoid false signals during periods of low volatility.

- **When Not to Use**: Avoid using the script in choppy or sideways markets where price action lacks direction. The script may generate false signals in such conditions, leading to potential losses.

Benefits of VWAP and AVWAP

- **VWAP**: The Volume Weighted Average Price provides a price benchmark that adjusts for volume, helping traders identify fair value levels. It is particularly useful for intraday trading and gauging market sentiment.

- **AVWAP**: The Anchored VWAP allows traders to set a starting point for VWAP calculations, providing flexibility in analyzing price levels over specific periods or events. This helps in identifying key support and resistance levels based on volume.

Unique Aspects

- **Customizability**: The script offers extensive customization options for WMA periods, VWAP, AVWAP, and alert conditions, making it adaptable to various trading strategies.

- **Combining Indicators**: By integrating WMAs, VWAP, AVWAP, ATR, and ADX, the script provides a comprehensive view of market conditions, enhancing decision-making.

- **Real-Time Alerts**: The flexible alert system ensures traders receive timely notifications for potential trade setups, improving responsiveness to market changes.

Examples

- **Example 1**: A trader sets the 1st WMA to 8 and the 2nd WMA to 100, enabling the VWAP. When the 1st WMA crosses above the 2nd WMA or VWAP, a buy signal is triggered, indicating a potential long entry.

- **Example 2**: A trader sets the AVWAP to start 30 bars ago and monitors for crossovers with the 1st WMA. When the 1st WMA crosses below the AVWAP, a sell signal is triggered, suggesting a potential short entry.

Final Notes

The Dynamic Trend Navigator script is a powerful tool for traders looking to enhance their market analysis and trading decisions. Its unique combination of customizable indicators and flexible alert system sets it apart from other scripts, making it a valuable addition to any trader's toolkit.

Disclaimer: Never any financial advice. Just ThisGirl loving experimenting with indicators to help myself, as well as others.

Notas de Lançamento

Dynamic Trend Navigator Script Updates1. Default Indicators:

SMA Periods: The script is set to use SMA (Simple Moving Average) periods of 8 and 50 by default. This provides users with a standard and widely used trend-following method.

2. Exact Placement of Alerts Improved:

Labels for Buy and Sell Signals: To ensure the alerts stay exactly on the crossover points, label.new is used with precise y-values. The Buy signal is placed below the crossover point, pointing up, while the Sell signal is placed above the crossover point, pointing down.

3. Signal Conditions:

Crossovers: The script detects crossovers between SMA1 and SMA2, and optionally with VWAP and AVWAP if enabled by the user. This allows users to customize their strategy based on different indicators.

4. Alerts for Users:

Alert Conditions: Alerts are set up for all selected crossovers, providing users with notifications for buy and sell opportunities based on their chosen indicators.

5. Additional Indicators:

ATR and ADX Calculations: ATR (Average True Range) and ADX (Average Directional Index) calculations are included to provide additional insights into market volatility and trend strength.

Recommendation: Start with a period of 14 for both ATR and ADX. This is the default setting used by many traders and is widely accepted in technical analysis.

ATR: Provides a measure of volatility. A period of 14 balances responsiveness and reliability. It helps traders understand how much an asset typically moves within a specific timeframe, aiding in setting stop-losses and take-profits.

Example

If a user enables the VWAP indicator, the script will monitor crossovers between SMA1 and VWAP and provide alerts accordingly. The labels will stay fixed at the crossover points, ensuring clarity and accuracy regardless of screen resizing.

By making these updates, the script now offers a flexible and precise tool for trend navigation, catering to different user preferences while maintaining robust and consistent signals. By following these recommendations and settings, users can better navigate market trends and volatility.

Notas de Lançamento

Summary of Changes:Added VWAP and AVWAP Selections:

Included options for users to select VWAP and AVWAP for crossovers under the second SMA selection.

Ensured VWAP and AVWAP Lines are Always Plotted:

Made sure VWAP and AVWAP lines are plotted regardless of the additional lines settings.

Added Additional Lines Group:

- Created a new group for additional lines, which includes options for various SMAs, VWAP, and AVWAP.

- Updated Signal Conditions and Alerts:

- Adjusted the signal conditions to check for crossovers and crossunders involving VWAP and AVWAP.

These changes enhance the script's functionality by providing users with more options for crossovers and ensuring the necessary lines are always visible. I hope you enjoy!

Notas de Lançamento

Updated script a little more:Inputs and Variables:

- Removed the AVWAP selection and calculation.

- Added input options for SMA Periods, VWAP, and additional SMAs.

Calculations:

- Calculated SMA 1 and SMA 2 based on user input.

- Calculated VWAP based on user input.

Signal Conditions:

- Defined signal conditions for crossovers involving SMA 1, SMA 2, and VWAP.

- Removed all AVWAP-related conditions.

Plots:

- Plotted SMA 1 (blue) and SMA 2 (purple) by default.

- Plotted VWAP (orange) only if selected by the user.

- Plotted additional SMAs (50, 100, 200, 325) only if selected by the user.

User-Friendly Signals and Alerts:

- Added buy and sell signals based on crossover conditions.

- Added alert conditions for all selected crossovers to notify users.

This ensures that only the selected lines (VWAP and additional SMAs) are plotted when chosen by the user and removes any unintended effects on the default lines.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.