Moving Average Slope Strategy - Level 1

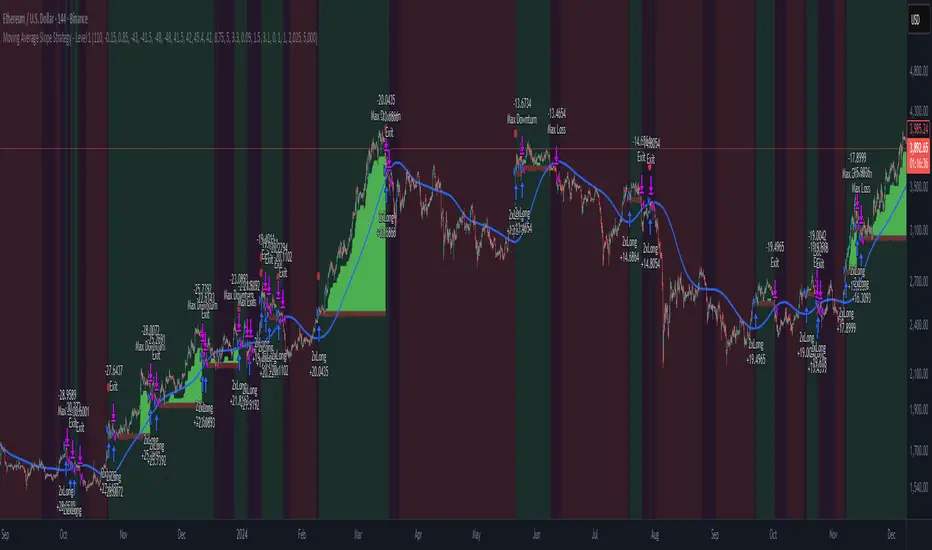

The script classifies the market into three possible regimes:

- Bull (long bias): when the slope of the Laguerre filter is positive. In this state, the strategy favors long entries.

- Bear (short bias): when the slope is negative. In this case, the strategy favors short entries.

- Range (neutral / no trade): when the slope is relatively flat, suggesting sideways market conditions where the strategy avoids opening trades.

To determine the transition between these regimes, two threshold parameters are used: one for the bull–range transition and another for the bear–range transition. These effectively control how much bull, bear, and range activity the strategy detects.

The user can configure the strategy to run long-only, short-only, or both directions, depending on the market or preference.

In addition to the core regime logic, the strategy includes several risk and trade management controls that are featured in all my strategies. These include:

- A minimum loss threshold for all trades

- A minimum profit threshold

- A maximum loss limit

- A maximum drawdown limit (from peak profits)

- A minimum drawdown limit (from peak profits)

Four oscillators are also integrated into the logic to detect short-term overbought and oversold conditions. These help the strategy avoid entering or exiting a trade when price has already extended too far in one direction, improving timing and potentially reducing false entries and exits.

The script is designed to be flexible across different assets and timeframes. However, to achieve consistent results, it is important to optimize parameters carefully. A recommended workflow is as follows:

- Disable the walk-forward option during the optimization phase.

- Optimize the first main parameter while keeping others fixed.

- Once a satisfactory value is found, move to the second parameter.

- Continue the process for subsequent parameters.

- Optionally, repeat the full sequence once more to refine the results.

- Finally, activate walk-forward analysis and check the out-of-sample results.

This strategy is published as invite-only with hidden source code. It is part of a broader collection of technical analysis strategies I have developed, which focus on regime detection and adaptive trading systems.

There are five levels of strategy complexity and performance in my collection. This script represents a Level 1 strategy, designed as a solid foundation and introduction to the framework. More advanced levels progressively add greater complexity, adaptability, and robustness.

Finally, when multiple strategies are combined under this same framework, the results become more robust and stable. In particular, combining my suite of technical analysis strategies with my macro strategies and on-chain strategies for cryptocurrencies creates a multi-layered system that adapts across regimes, timeframes, and market conditions.

This strategy requires a subscription.

Script sob convite

Somente usuários aprovados pelo autor podem acessar este script. Você precisará solicitar e obter permissão para usá-lo. Normalmente, essa permissão é concedida após o pagamento. Para obter mais detalhes, siga as instruções do autor abaixo ou entre em contato diretamente com mks17.

O TradingView NÃO recomenda pagar ou usar um script ao não ser que você confie totalmente no seu autor e compreende como isso funciona. Você pode também encontrar alternativas gratuitas e de código aberto em nossa comunidade de scripts.

Instruções do autor

Aviso legal

Script sob convite

Somente usuários aprovados pelo autor podem acessar este script. Você precisará solicitar e obter permissão para usá-lo. Normalmente, essa permissão é concedida após o pagamento. Para obter mais detalhes, siga as instruções do autor abaixo ou entre em contato diretamente com mks17.

O TradingView NÃO recomenda pagar ou usar um script ao não ser que você confie totalmente no seu autor e compreende como isso funciona. Você pode também encontrar alternativas gratuitas e de código aberto em nossa comunidade de scripts.