OPEN-SOURCE SCRIPT

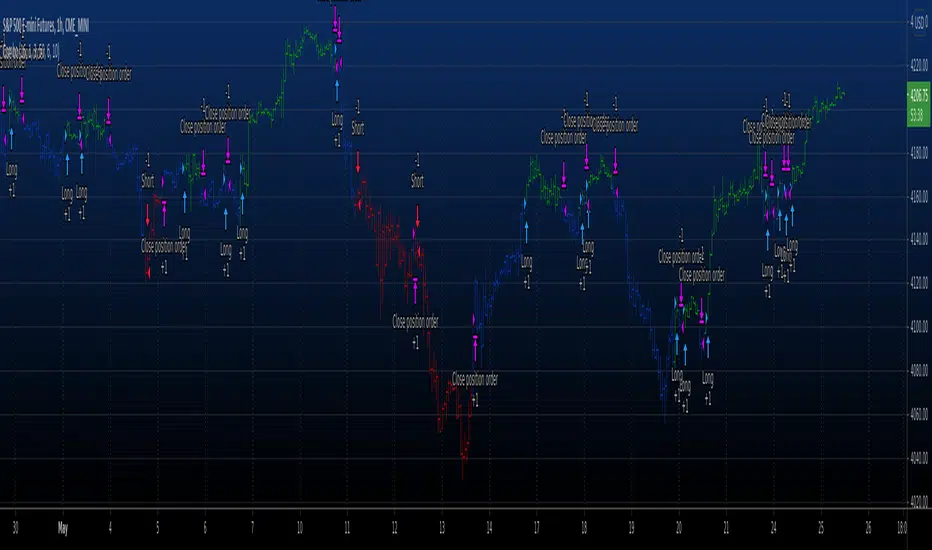

Combo Backtest 123 Reversal & Rainbow Oscillator

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

Ever since the people concluded that stock market price movements are not

random or chaotic, but follow specific trends that can be forecasted, they

tried to develop different tools or procedures that could help them identify

those trends. And one of those financial indicators is the Rainbow Oscillator

Indicator. The Rainbow Oscillator Indicator is relatively new, originally

introduced in 1997, and it is used to forecast the changes of trend direction.

As market prices go up and down, the oscillator appears as a direction of the

trend, but also as the safety of the market and the depth of that trend. As

the rainbow grows in width, the current trend gives signs of continuity, and

if the value of the oscillator goes beyond 80, the market becomes more and more

unstable, being prone to a sudden reversal. When prices move towards the rainbow

and the oscillator becomes more and more flat, the market tends to remain more

stable and the bandwidth decreases. Still, if the oscillator value goes below 20,

the market is again, prone to sudden reversals. The safest bandwidth value where

the market is stable is between 20 and 80, in the Rainbow Oscillator indicator value.

The depth a certain price has on a chart and into the rainbow can be used to judge

the strength of the move.

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

Ever since the people concluded that stock market price movements are not

random or chaotic, but follow specific trends that can be forecasted, they

tried to develop different tools or procedures that could help them identify

those trends. And one of those financial indicators is the Rainbow Oscillator

Indicator. The Rainbow Oscillator Indicator is relatively new, originally

introduced in 1997, and it is used to forecast the changes of trend direction.

As market prices go up and down, the oscillator appears as a direction of the

trend, but also as the safety of the market and the depth of that trend. As

the rainbow grows in width, the current trend gives signs of continuity, and

if the value of the oscillator goes beyond 80, the market becomes more and more

unstable, being prone to a sudden reversal. When prices move towards the rainbow

and the oscillator becomes more and more flat, the market tends to remain more

stable and the bandwidth decreases. Still, if the oscillator value goes below 20,

the market is again, prone to sudden reversals. The safest bandwidth value where

the market is stable is between 20 and 80, in the Rainbow Oscillator indicator value.

The depth a certain price has on a chart and into the rainbow can be used to judge

the strength of the move.

WARNING:

- For purpose educate only

- This script to change bars colors.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.