## ideaForge Technology Ltd (IDEAFORGE) Price Analysis

**Current Price and Recent Performance**

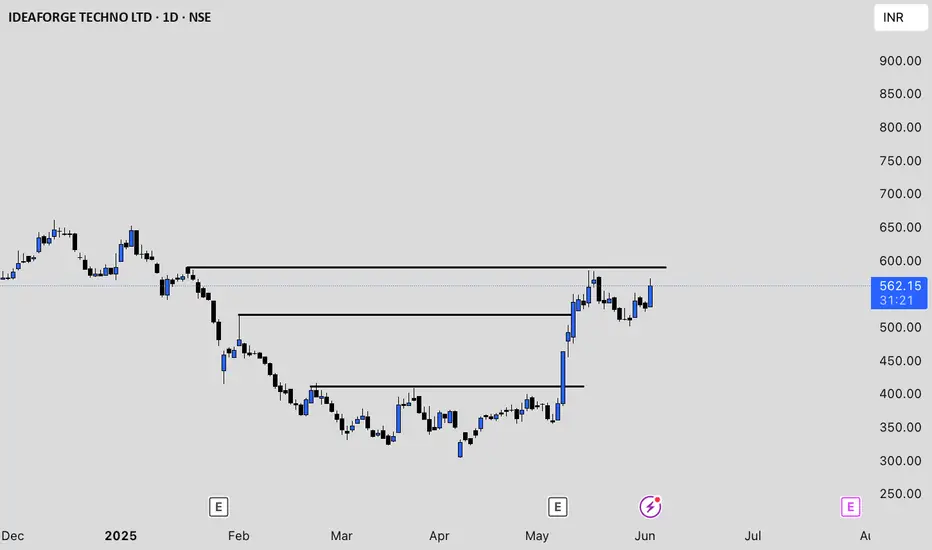

As of June 3, 2025, ideaForge Technology Ltd (IDEAFORGE) is trading at approximately ₹529 on the NSE[7]. The stock has experienced significant volatility in recent months, with a 52-week high of ₹864 and a low of ₹301[2]. Over the past few weeks, the price has rebounded sharply from the ₹360–₹400 range in early May to above ₹520 by the end of May, indicating strong recent momentum[4].

**Valuation and Financials**

- Market capitalization stands at about ₹2,413 crore[2].

- The stock is trading at roughly 3.9 times its book value, which is considered high for its sector[2].

- Return on capital employed (ROCE) is negative at -9.36%, and return on equity (ROE) is also negative at -9.81% for the latest period, reflecting operational challenges or recent losses[2].

- The company is almost debt-free, which is a positive factor for financial stability[2].

- No dividends have been declared, and the company’s interest coverage ratio is low, suggesting limited ability to cover interest expenses from profits[2].

**Operational Highlights and Risks**

- ideaForge operates in the unmanned aircraft systems (UAS) segment, a high-growth and innovative sector[2].

- Promoter holding is relatively low at 29.2%, which may affect investor confidence[2].

- The company’s debtor days and working capital days have increased significantly, indicating potential challenges in cash flow management[2].

- Over the last three years, ROE has averaged just 0.86%, highlighting weak profitability[2].

**Recent Price Action**

- After a sharp rally from ₹360 in early May to over ₹530 by the end of the month, the stock has stabilized in the ₹528–₹559 range in early June[4].

- Trading volumes have been high during this period, suggesting increased investor interest and possible speculative activity[4].

**Summary**

ideaForge Technology Ltd has shown strong recent price momentum but faces fundamental challenges, including negative returns, high valuation relative to book value, and growing working capital requirements. The company’s debt-free status and position in a high-potential industry are positives, but weak profitability and low promoter holding are key risks. Investors should monitor operational improvements and cash flow management before considering long-term positions[2][4][7].

**Current Price and Recent Performance**

As of June 3, 2025, ideaForge Technology Ltd (IDEAFORGE) is trading at approximately ₹529 on the NSE[7]. The stock has experienced significant volatility in recent months, with a 52-week high of ₹864 and a low of ₹301[2]. Over the past few weeks, the price has rebounded sharply from the ₹360–₹400 range in early May to above ₹520 by the end of May, indicating strong recent momentum[4].

**Valuation and Financials**

- Market capitalization stands at about ₹2,413 crore[2].

- The stock is trading at roughly 3.9 times its book value, which is considered high for its sector[2].

- Return on capital employed (ROCE) is negative at -9.36%, and return on equity (ROE) is also negative at -9.81% for the latest period, reflecting operational challenges or recent losses[2].

- The company is almost debt-free, which is a positive factor for financial stability[2].

- No dividends have been declared, and the company’s interest coverage ratio is low, suggesting limited ability to cover interest expenses from profits[2].

**Operational Highlights and Risks**

- ideaForge operates in the unmanned aircraft systems (UAS) segment, a high-growth and innovative sector[2].

- Promoter holding is relatively low at 29.2%, which may affect investor confidence[2].

- The company’s debtor days and working capital days have increased significantly, indicating potential challenges in cash flow management[2].

- Over the last three years, ROE has averaged just 0.86%, highlighting weak profitability[2].

**Recent Price Action**

- After a sharp rally from ₹360 in early May to over ₹530 by the end of the month, the stock has stabilized in the ₹528–₹559 range in early June[4].

- Trading volumes have been high during this period, suggesting increased investor interest and possible speculative activity[4].

**Summary**

ideaForge Technology Ltd has shown strong recent price momentum but faces fundamental challenges, including negative returns, high valuation relative to book value, and growing working capital requirements. The company’s debt-free status and position in a high-potential industry are positives, but weak profitability and low promoter holding are key risks. Investors should monitor operational improvements and cash flow management before considering long-term positions[2][4][7].

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.