[1] Understanding the Current Setup

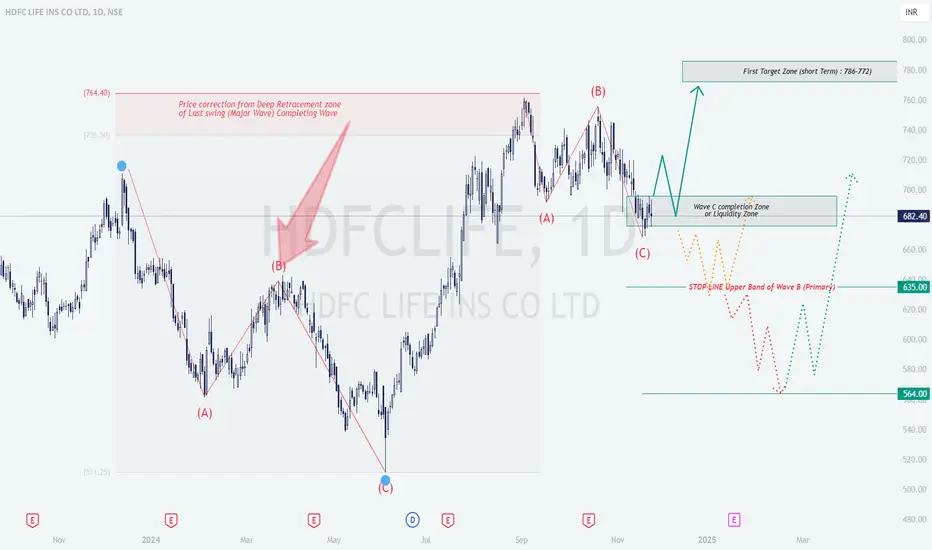

The chart reflects a corrective Elliott Wave structure (ABC pattern):

Wave A: Initial decline from the peak of ₹764.40.

Wave B: Pullback to a resistance zone after Wave A.

Wave C: Continuation of the downtrend, nearing a potential completion zone or liquidity zone around ₹670-680.

The stock is currently consolidating near this Wave C completion zone, signaling a possible reversal to the upside.

[2] Trade Setup Explanation

[3] Technical Analysis Insights

Fibonacci Levels: Wave B retraced deeply (likely 61.8%-78.6% of Wave A). Wave C aligns with extensions (1x or 1.618x of Wave A).

Liquidity Zone: The ₹670-682 zone is a demand area where institutional buying might occur. Look for bullish candlestick patterns for confirmation.

Target Zone: ₹772-786 is a key resistance area, ideal for profit-taking in a bullish scenario.

Stop-Loss Placement: Logical stops are set below the invalidation levels (~₹635 for bulls, ~₹680 for bears).

[4] Prediction and Plan

[5] Educational Takeaway

Elliott Wave Application: Highlights an ABC correction and potential reversal.

Risk Management: Use stop losses at key invalidation levels to minimize risks.

Confirmation Tools: Enhance reliability using indicators like RSI divergence, MACD crossovers, or volume spikes.

Patience: Wait for price action confirmation before entering trades.

This structured plan ensures adaptability to both bullish and bearish scenarios while maintaining disciplined risk management.

The chart reflects a corrective Elliott Wave structure (ABC pattern):

Wave A: Initial decline from the peak of ₹764.40.

Wave B: Pullback to a resistance zone after Wave A.

Wave C: Continuation of the downtrend, nearing a potential completion zone or liquidity zone around ₹670-680.

The stock is currently consolidating near this Wave C completion zone, signaling a possible reversal to the upside.

[2] Trade Setup Explanation

- Bullish Setup:Logic: If Wave C concludes within the Liquidity Zone (~₹670-682), an upward reversal is anticipated toward the first target zone at ₹772-786.

Entry Point: Enter after a clear breakout or reversal signal (e.g., bullish candlestick, trendline breakout, or volume spike).

Targets:

- Target 1: ₹772-786.

- Target 2: Further upside based on price action.

Stop Loss: Below the Wave C lower boundary (~₹635). - Bearish Setup (Alternate Scenario):Logic: A breakdown below ₹635 suggests further downside.

Entry Point: Short on confirmation of a breach below ₹635.

Target: Next support zone at ₹564.

Stop Loss: Above the Liquidity Zone (~₹680).

[3] Technical Analysis Insights

Fibonacci Levels: Wave B retraced deeply (likely 61.8%-78.6% of Wave A). Wave C aligns with extensions (1x or 1.618x of Wave A).

Liquidity Zone: The ₹670-682 zone is a demand area where institutional buying might occur. Look for bullish candlestick patterns for confirmation.

Target Zone: ₹772-786 is a key resistance area, ideal for profit-taking in a bullish scenario.

Stop-Loss Placement: Logical stops are set below the invalidation levels (~₹635 for bulls, ~₹680 for bears).

[4] Prediction and Plan

- []Primary Scenario (Bullish): Wave C completes in the Liquidity Zone, leading to a reversal targeting ₹772-786.

[]Alternate Scenario (Bearish): Breakdown below ₹635 invalidates the bullish outlook, with potential downside to ₹564.

[5] Educational Takeaway

Elliott Wave Application: Highlights an ABC correction and potential reversal.

Risk Management: Use stop losses at key invalidation levels to minimize risks.

Confirmation Tools: Enhance reliability using indicators like RSI divergence, MACD crossovers, or volume spikes.

Patience: Wait for price action confirmation before entering trades.

This structured plan ensures adaptability to both bullish and bearish scenarios while maintaining disciplined risk management.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.