Viés de alta

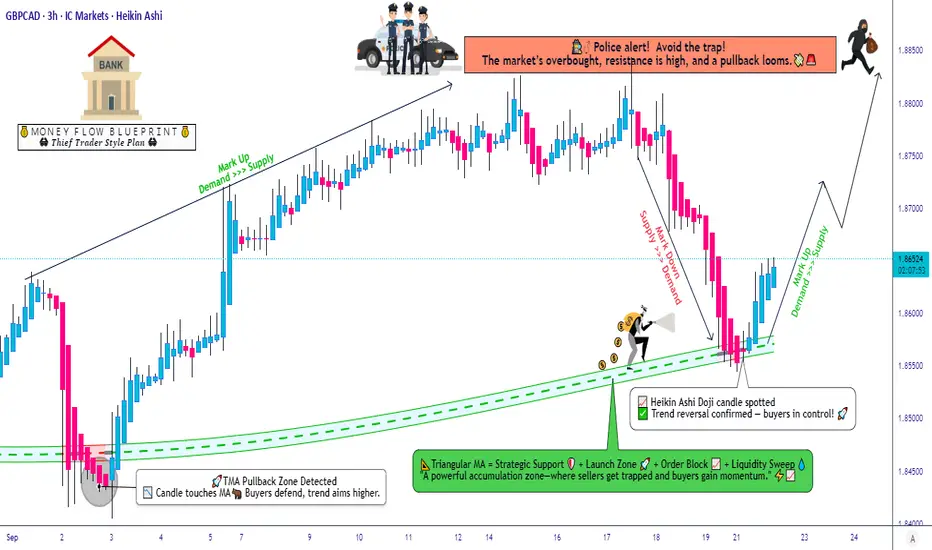

GBP/CAD Technical Outlook: Layered Entry Strategy Explained

🤑 GBP/CAD: "Pound vs. Loonie Heist" — Swing/Day Trade Wealth Map 🚀

🎉 Ladies & Gentlemen, welcome to the Thief’s Lair! Buckle up for a slick, professional, and slightly cheeky GBP/CAD trading plan that’s ready to snatch profits from the Forex market! This Pound vs. Loonie Dollar setup is primed for action with a bullish vibe, confirmed by technicals that scream “Let’s ride!” 😎 Let’s break it down with style and precision to make those pips rain! 💸

📈 The Setup: Bullish Bandits on the Move! 🦸♂️

🔍 Market Mood: Bullish momentum confirmed! 📈 The Triangular Moving Average (TMA) shows a solid 38.2% Fibonacci pullback, signaling a textbook retracement.

🕯️ Heikin Ashi Power: Doji candles are flashing bullish strength 💪, with institutional riders joining the party. The trend is our friend, and it’s time to hop on!

🌍 Why GBP/CAD?: The Pound is flexing against the Loonie, backed by macroeconomic vibes like UK economic resilience and CAD’s sensitivity to oil price swings. Keep an eye on crude oil moves for extra context! 🛢️

🕵️♂️ The Thief’s Strategy: Layered Limit Order Heist 🏦

🎯 Entry Plan: We’re setting up a sneaky layered limit order strategy to maximize our entries. Stack those buy limits like a pro thief stacking cash! 💰

📊 Buy Limit Layers:

1.85800 🟢

1.86000 🟢

1.86200 🟢

1.86500 🟢

💡 Pro Tip: Feel free to add more layers based on your risk appetite! Customize your heist to fit your style. 😎

❓ Why Layering?: This approach lets us scale into the trade, catching the best entries as the market dances around our levels. It’s like setting multiple traps for the pips! 🕸️

🛑 Stop Loss: Protect Your Loot! 🔒

🚨 Thief’s SL: Set at 1.85400 to keep our risk tight. This level sits below key support, giving us room to breathe while dodging market traps.

📝 Note: Dear Thief OG’s, this SL is my suggestion, but you’re the boss of your bucks! Adjust based on your risk tolerance and account size. 💼

🎯 Take Profit: Cash Out Before the Cops Close In! 👮♂️

🏆 Target: Aim for 1.88500, where strong resistance meets an overbought RSI zone. The market’s screaming “trap ahead!” so let’s grab profits and ghost! 👻

📝 Note: Thief OG’s, this TP is my call, but you decide when to pocket the cash. Take profits at your own risk and vibe! 💸

🔗 Related Pairs to Watch

Because GBP/CAD doesn’t move alone, here are correlations worth tracking:

💷 GBP/USD (

GBPUSD) → Often mirrors GBP momentum against the dollar.

GBPUSD) → Often mirrors GBP momentum against the dollar.

USD/CAD (

USDCAD) → Strong CAD moves can spill over to GBP/CAD.

USDCAD) → Strong CAD moves can spill over to GBP/CAD.

EUR/CAD (

EURCAD) → CAD correlation check.

EURCAD) → CAD correlation check.

Gold ( XAUUSD) → Sometimes inverse to CAD (commodity-driven).

XAUUSD) → Sometimes inverse to CAD (commodity-driven).

Keep these on your radar to confirm strength or weakness in CAD/GBP.

🧠 Key Points to Nail This Trade 🧠

✅ Technical Confirmation: TMA + Fibonacci 38.2% pullback + Heikin Ashi Doji = a high-probability setup.

⚖️ Risk Management: Use the layered entry to spread risk and keep your SL tight to avoid getting caught!

📅 Market Context: Monitor UK economic data (e.g., PMI, BOE updates) and CAD’s oil-driven moves for better timing.

🏃♂️ Escape Plan: Watch for RSI overbought signals near 1.88500 to secure profits before a potential reversal.

⚠️ Disclaimer ⚠️

This is a Thief-Style Trading Strategy crafted for fun and educational purposes. Trading involves risks, and I’m not a financial advisor. Make your moves at your own risk, and always do your own research! 😎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#GBPCAD #Forex #SwingTrading #DayTrading #ThiefStrategy #ForexCommunity #MarketOutlook #TechnicalAnalysis

🎉 Ladies & Gentlemen, welcome to the Thief’s Lair! Buckle up for a slick, professional, and slightly cheeky GBP/CAD trading plan that’s ready to snatch profits from the Forex market! This Pound vs. Loonie Dollar setup is primed for action with a bullish vibe, confirmed by technicals that scream “Let’s ride!” 😎 Let’s break it down with style and precision to make those pips rain! 💸

📈 The Setup: Bullish Bandits on the Move! 🦸♂️

🔍 Market Mood: Bullish momentum confirmed! 📈 The Triangular Moving Average (TMA) shows a solid 38.2% Fibonacci pullback, signaling a textbook retracement.

🕯️ Heikin Ashi Power: Doji candles are flashing bullish strength 💪, with institutional riders joining the party. The trend is our friend, and it’s time to hop on!

🌍 Why GBP/CAD?: The Pound is flexing against the Loonie, backed by macroeconomic vibes like UK economic resilience and CAD’s sensitivity to oil price swings. Keep an eye on crude oil moves for extra context! 🛢️

🕵️♂️ The Thief’s Strategy: Layered Limit Order Heist 🏦

🎯 Entry Plan: We’re setting up a sneaky layered limit order strategy to maximize our entries. Stack those buy limits like a pro thief stacking cash! 💰

📊 Buy Limit Layers:

1.85800 🟢

1.86000 🟢

1.86200 🟢

1.86500 🟢

💡 Pro Tip: Feel free to add more layers based on your risk appetite! Customize your heist to fit your style. 😎

❓ Why Layering?: This approach lets us scale into the trade, catching the best entries as the market dances around our levels. It’s like setting multiple traps for the pips! 🕸️

🛑 Stop Loss: Protect Your Loot! 🔒

🚨 Thief’s SL: Set at 1.85400 to keep our risk tight. This level sits below key support, giving us room to breathe while dodging market traps.

📝 Note: Dear Thief OG’s, this SL is my suggestion, but you’re the boss of your bucks! Adjust based on your risk tolerance and account size. 💼

🎯 Take Profit: Cash Out Before the Cops Close In! 👮♂️

🏆 Target: Aim for 1.88500, where strong resistance meets an overbought RSI zone. The market’s screaming “trap ahead!” so let’s grab profits and ghost! 👻

📝 Note: Thief OG’s, this TP is my call, but you decide when to pocket the cash. Take profits at your own risk and vibe! 💸

🔗 Related Pairs to Watch

Because GBP/CAD doesn’t move alone, here are correlations worth tracking:

💷 GBP/USD (

USD/CAD (

EUR/CAD (

Gold (

Keep these on your radar to confirm strength or weakness in CAD/GBP.

🧠 Key Points to Nail This Trade 🧠

✅ Technical Confirmation: TMA + Fibonacci 38.2% pullback + Heikin Ashi Doji = a high-probability setup.

⚖️ Risk Management: Use the layered entry to spread risk and keep your SL tight to avoid getting caught!

📅 Market Context: Monitor UK economic data (e.g., PMI, BOE updates) and CAD’s oil-driven moves for better timing.

🏃♂️ Escape Plan: Watch for RSI overbought signals near 1.88500 to secure profits before a potential reversal.

⚠️ Disclaimer ⚠️

This is a Thief-Style Trading Strategy crafted for fun and educational purposes. Trading involves risks, and I’m not a financial advisor. Make your moves at your own risk, and always do your own research! 😎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#GBPCAD #Forex #SwingTrading #DayTrading #ThiefStrategy #ForexCommunity #MarketOutlook #TechnicalAnalysis

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Publicações relacionadas

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Publicações relacionadas

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.