Outlook for the Next Few Months

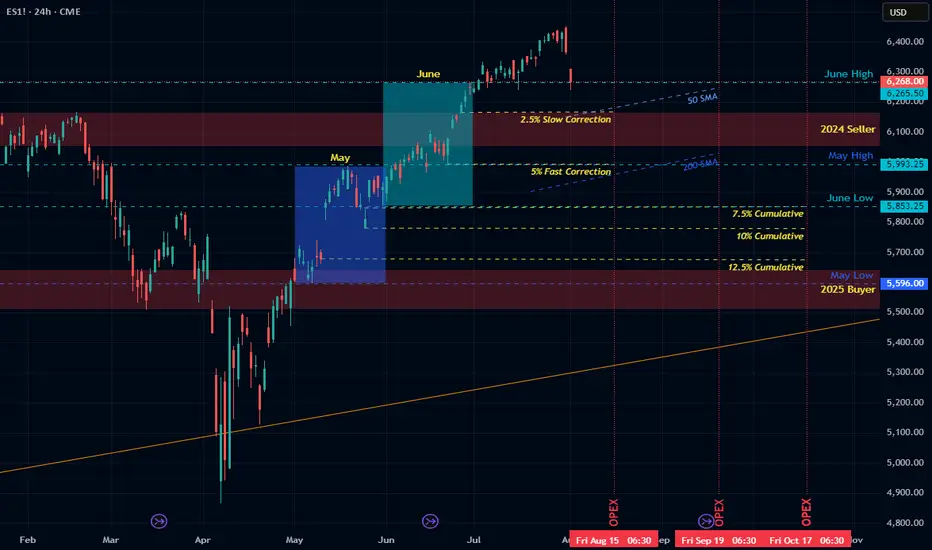

• Now–August OpEx: -2.5% to -5% slow correction

• August–September OpEx: potential 5–7.5% additional decline

• By late Q3: cumulative 10–12.5% drawdown (target S&P ~5700).

• October: possible bounce — or acceleration if data worsens

• End of Year: risk of deep drop à la Oct–Dec 2018 if trends continue

Macro Backdrop

• Watch for margin compression, CPI surprise, and unemployment uptick

• Private data shows more fragility than government numbers

• QRA-driven liquidity tightening may amplify downside risk

Political Timing and Fed Policy

• Administration may welcome controlled decline to enable early 2026 rate cuts

• If market doesn’t decline soon, blow-off top/melt-up into midterms possible

• Now–August OpEx: -2.5% to -5% slow correction

• August–September OpEx: potential 5–7.5% additional decline

• By late Q3: cumulative 10–12.5% drawdown (target S&P ~5700).

• October: possible bounce — or acceleration if data worsens

• End of Year: risk of deep drop à la Oct–Dec 2018 if trends continue

Macro Backdrop

• Watch for margin compression, CPI surprise, and unemployment uptick

• Private data shows more fragility than government numbers

• QRA-driven liquidity tightening may amplify downside risk

Political Timing and Fed Policy

• Administration may welcome controlled decline to enable early 2026 rate cuts

• If market doesn’t decline soon, blow-off top/melt-up into midterms possible

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.