Vib ORB Range (Free)Vib ORB Range (Free) plots the Opening Range High and Low for the session based on a user-defined start time and duration.

This tool is designed for traders who want a clean, no-noise display of the ORB zone without extra indicators or automation.

Features:

Customizable Opening Range start time

Customizable Opening Range duration

Automatically resets daily

Plots ORB High, ORB Low, and optional ORB Midline

Shaded range zone for improved clarity

Works on all timeframes and markets

How to Use:

Set the ORB start time (default 9:30 New York)

Set the ORB duration (default 15 minutes)

The indicator will draw the ORB zone once the range completes

Use the outlines or shaded zone to visually identify potential breakout areas

This free tool is intended as a simple, reliable ORB visualizer without alerts, filters, or strategy logic.

ES

Micro/Mini P&L [LDT]Overview

Micro/Mini P&L is a risk and P&L visualization tool built primarily for futures traders.

It provides accurate dollar-based calculations for either micros or minis, regardless of which contract type you are currently charting.

The indicator automatically detects your instrument (NQ, MNQ, ES, MES, YM, RTY, CL, GC, etc.) and adjusts point-value data accordingly, allowing you to chart one contract while evaluating risk for another.

This removes the need for manual conversions and keeps your position data consistent at all times.

Although optimized for futures, the tool also works on any other asset for general trade-level visualization.

Features

• Automatic instrument detection for major futures markets including NQ/MNQ, ES/MES, YM/MYM, RTY/M2K, CL/MCL, GC/MGC and others.

Point-value logic adjusts instantly based on the detected symbol ensuring accurate calculations without manual configuration.

• Micro/Mini display toggle, allowing you to calculate dollar values for either contract type regardless of which contract is on your chart.

Useful for traders who prefer charting minis whilst trading micros or the opposite.

• Trade-level visualization, including Entry, Take Profit and Stop Loss levels with automatically drawn lines and optional TP/SL zone shading for clear and structured display on the chart.

• Dynamic P/L calculations, showing both point-based and dollar-based metrics in real time.

This includes TP/SL dollar values, points to target/stop, real-time P/L and an optional risk-reward ratio.

• Adaptive risk table, displaying contract counts from 1 up to your selected maximum, total dollar risk for each row and highlighting your chosen contract size.

This provides a straightforward method for evaluating risk, scaling and position sizing.

• Customizable display options, including color settings, label visibility, extension length, bar offsets and table positioning.

This allows the tool to remain clean, unobtrusive and easy to integrate into any chart layout.

Purpose

This tool is designed to give futures traders a clear, consistent and reliable way to view dollar-accurate risk per contract without performing manual conversions.

Whether you trade micros or minis, the displayed values always align with your selected contract type, even when charting the opposite market.

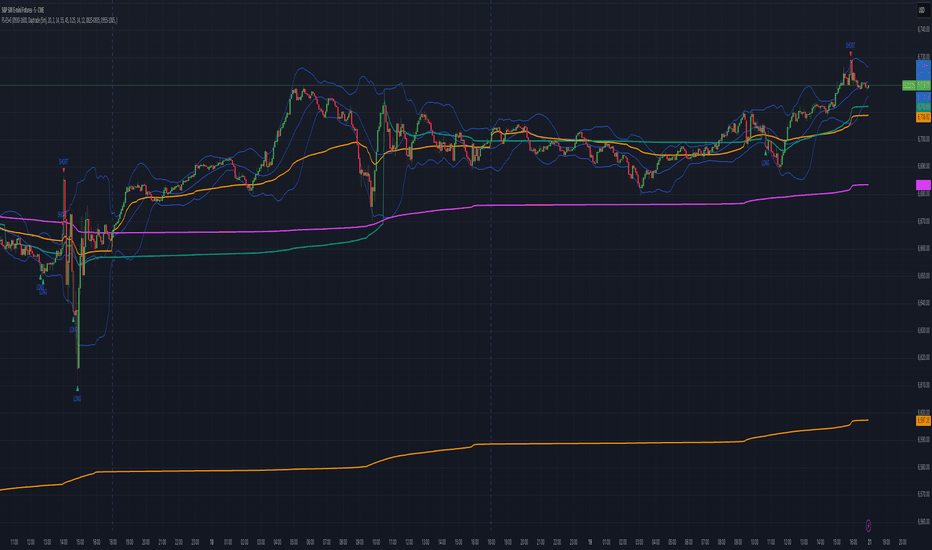

FlowSpike ES — BB • RSI • VWAP + AVWAP + News MuteThis indicator is purpose-built for E-mini S&P 500 (ES) futures traders, combining volatility bands, momentum filters, and session-anchored levels into a streamlined tool for intraday execution.

Key Features:

• ES-Tuned Presets

Automatically optimized settings for scalping (1–2m), daytrading (5m), and swing trading (15–60m) timeframes.

• Bollinger Band & RSI Signals

Entry signals trigger only at statistically significant extremes, with RSI filters to reduce false moves.

• VWAP & Anchored VWAPs

Session VWAP plus anchored VWAPs (RTH open, weekly, monthly, and custom) provide high-confidence reference levels used by professional order-flow traders.

• Volatility Filter (ATR in ticks)

Ensures signals are only shown when the ES is moving enough to offer tradable edges.

• News-Time Mute

Suppresses signals around scheduled economic releases (customizable windows in ET), helping traders avoid whipsaw conditions.

• Clean Alerts

Long/short alerts are generated only when all conditions align, with optional bar-close confirmation.

Why It’s Tailored for ES Futures:

• Designed around ES tick size (0.25) and volatility structure.

• Session settings respect RTH hours (09:30–16:00 ET), the period where most liquidity and institutional flows concentrate.

• ATR thresholds and RSI bands are pre-tuned for ES market behavior, reducing the need for manual optimization.

⸻

This is not a generic indicator—it’s a futures-focused tool created to align with the way ES trades day after day. Whether you scalp the open, manage intraday swings, or align to weekly/monthly anchored flows, FlowSpike ES gives you a clear, rules-based signal framework.

ES Gap Trading Levels# ES Gap Trading Levels

## Overview

A professional gap trading indicator designed specifically for ES Futures traders. This indicator automatically captures the closing price at 3:59 PM ET (NYSE close) and immediately displays key gap levels for the evening trading session starting at 6:00 PM ET.

## Key Features

### ✅ **Automatic Gap Level Detection**

- Captures ES Futures closing price at 3:59-4:00 PM ET

- Instantly displays gap levels for immediate session planning

- Resets daily for fresh gap analysis

### ✅ **Six Critical Gap Levels**

- **±10 Points** (White lines) - Short-term gap targets

- **±20 Points** (Light Blue lines) - Medium gap targets

- **±30 Points** (Red lines) - Extended gap targets

### ✅ **Professional Display**

- Clean horizontal lines with customizable colors

- Clear labels showing point values (+30, +20, +10, -10, -20, -30)

- Gap levels table showing exact price targets

- Optional closing price reference line

### ✅ **Customizable Settings**

- Adjustable line colors, width, and extension

- Toggle labels and reference table on/off

- Manual closing price override for testing

- Debug mode for troubleshooting

### ✅ **Smart Management**

- Automatic cleanup of previous day's levels

- Lines appear immediately after market close

- Optimized for ES1!, MES1!, and other ES futures contracts

## How It Works

1. **Market Close Capture**: At 3:59 PM ET, the indicator captures the ES closing price

2. **Instant Display**: Gap levels immediately appear on your chart

3. **Evening Session Ready**: Lines are positioned for 6:00 PM ET session start

4. **Daily Reset**: Old levels are automatically cleared each new trading day

## Perfect For:

- Gap trading strategies

- Overnight futures trading

- ES futures scalping

- Session transition analysis

- Risk management levels

## Usage Tips:

- Best used on 1-15 minute ES futures charts

- Ensure chart timezone shows ET times

- Use manual mode for backtesting specific dates

- Combine with volume and momentum indicators

## Settings Guide:

- **Display Settings**: Control lines, labels, and table visibility

- **Colors**: Customize each gap level color scheme

- **Manual Settings**: Override closing price for testing

- **Debug**: View time detection and diagnostic information

*Designed by traders, for traders. Clean, professional, and reliable gap level detection for serious ES futures trading.*

Implied SPX from ES Implied SPX from ES Futures (ETH)

Description:

This script calculates the implied SPX index level based on real-time ES futures pricing during extended trading hours (ETH). It uses the spread between the previous day’s ES and SPX RTH closes to adjust for fair value and intraday divergence.

📈 Features:

Tracks current ES price vs. yesterday's RTH spread to estimate SPX

Useful for SPX options traders who want to monitor synthetic index levels during ETH

Ideal for assessing SPX movement when the cash market is closed

This tool is especially helpful for those trading SPX index options overnight or seeking to align SPX levels with ES futures movement.

MACD & Bollinger Bands Overbought OversoldMACD & Bollinger Bands Reversal Detector

This indicator combines the power of MACD divergence analysis with Bollinger Bands to help traders identify potential reversal points in the market.

Key Features:

MACD Calculation & Divergence:

The script calculates the standard MACD components (MACD line, Signal line, and Histogram) using configurable fast, slow, and signal lengths. It includes a simplified divergence detection mechanism that flags potential bearish divergence—when the price makes a new swing high but the MACD fails to confirm the move. This divergence can serve as an early warning that the bullish momentum is waning.

Bollinger Bands:

A 20-period simple moving average (SMA) is used as the basis, with upper and lower bands drawn at 2 standard deviations. These bands help visualize overbought and oversold conditions. For example, a close at or above the upper band suggests the market may be overextended (overbought), while a close at or below the lower band may indicate oversold conditions.

Visual Alerts:

The indicator plots the Bollinger Bands on the chart along with labels marking overbought and oversold conditions. Additionally, it marks potential bearish divergence with a downward triangle, providing a quick visual cue to traders.

Usage Suggestions:

Confluence with Other Signals:

Use the divergence signals and Bollinger Band conditions as filters. For example, even if another indicator suggests a long entry, you might avoid it if the price is overbought or if MACD divergence warns of weakening momentum.

Customization:

All key parameters, such as the MACD lengths, Bollinger Band period, and multiplier, are fully configurable. This flexibility allows you to adjust the indicator to suit different markets or trading styles.

Disclaimer:

This script is provided for educational purposes only. Always perform your own analysis and backtesting before trading with live capital.

QQQ and SPY Price Levels [MW]Introduction:

Don’t let SPY and QQQ resistance levels hurt your futures trading anymore. The QQQ and SPY Price Levels indicator automagically provides easily accessible QQQ price levels for NASDAQ-related charts such as QQQ, /NQ and /MNQ futures, and leveraged ETFs such as TQQQ and SQQQ as well as for SPY price levels for S&P 500-related charts such as SPY, /ES and /MES futures, SPX, and leveraged ETFs such as UPRO and SPXU. If you’ve ever traded futures, or anything QQQ- or SPY-related and wanted to know at what price would the corresponding asset reach a key whole number level of QQQ or SPY, like 400, 440, 445, or even 447.50, this tool is for you. Key 10x, 5x, and even 2.5x multiples of QQQ and SPY can act as support or resistance for other related-assets. Until now, there hasn’t been an indicator that can serve as an easy visual cue to know exactly when that is about to happen across assets.

This indicator is a fork of the original SPY Price Levels indicator, which only considered SPY-related assets.

Settings:

QQQ/SPY 2.5x: Show closest levels above and below that are multiples of 2.5 on QQQ

QQQ/SPY 5x: Show closest levels above and below that are multiples of 5 on QQQ

QQQ/SPY 10x: Show closest levels above and below that are multiples of 10 on QQQ

Show QQQ/SPY Price Label: Show the current QQQ/SPY price

Extend lines to the left: Extend label lines for each price level to the beginning of the chart

Calculations:

This indicator defines the ratio between the price of QQQ/SPY and another NASDAQ/S&P-related asset and uses that multiplier once the user-defined price increments are defined. For example, if /MNQ is at 19000 and QQQ is at 465, then the ratio would be 40.8.

The incremental QQQ levels that are above and below the QQQ price are calculated using the following equations:

qqqLevelUp = _multiplier * math.ceil(_qqqClose / _multiplier)

qqqLevelDown = _multiplier * math.floor(_qqqClose / _multiplier)

The conversion ratio is then multiplied by that amount to get the final estimated corresponding price using the calculation:

levelUp := _conversion * qqqLevelUp

levelDown := _conversion * qqqLevelDown

For leveraged assets, the conversion must be used on the difference between the current QQQ price and the incremental upper and lower levels.

For example, the calculation for the next level up looks like the following:

levelUpDelta := math.abs(_qqqClose - qqqLevelUp)

levelUp := close + _conversion * (levelUpDelta * _leverage)

This logic is identical for SPY-related assets.

How to Use:

The QQQ and SPY Price Levels indicator aims to be as unobtrusive as possible. The default view shows 3 labels and 2 lines that are all aligned to the right of the main chart, so that it interferes as little as possible with any other indicators. It can be added to any /NQ or /MNQ futures chart, SQQQ, TQQQ, and, of course, QQQ as well as any /ES /MES futures chart, SPXU, UPRO, SPX, and of course SPY. The most immediate price levels for each multiplier appears above and below the current price along with the price of QQQ/SPY.

For example, MNQU2024 is currently at 19594. By looking at the indicator the next QQQ increment below is at 475, or 19556 on the MNQU2024 chart. This potential support is marked with a green label that shows both prices. The next increment above is at QQQ 477.50, or 19659 on the MESU2024 chart. And the QQQ price itself, is also shown (and can be removed) at 475.92.

QQQ and SPY price increments of 2.5, 5, and 10 tend to consistently act at the very least as emotional support and resistance levels. Weak, or weakening volume and/or momentum when these levels are hit can trigger a strong rejection, and can sometimes precipitate lengthy consolidation periods at those levels. Watching an NASDAQ- and S&P 500-related asset come to a halt, fall off a cliff, or react in some other unintuitive way could very well be the result of a QQQ/SPY level being reached. Even though many of us know that this relationship exists, it’s easy to forget. So, this indicator helps to ensure that its users keep that relationship front and center.

By extending the lines into the past on QQQ/SPY and their related assets, you can see what reactions happened at these key levels.

Other Usage Notes and Limitations:

The calculations used only provide an estimated relationship or a close approximation, and are not exact.

It's important for traders to be aware of the limitations of any indicator and to use them as part of a broader, well-rounded trading strategy that includes risk management, fundamental analysis, and other tools that can help with reducing false signals, determining trend direction, and providing additional confirmation for a trade decision. Diversifying strategies and not relying solely on one type of indicator or analysis can help mitigate some of these risks.

High/Low of week: Stats & Day of Week tendencies// Purpose:

-To show High of Week (HoW) day and Low of week (LoW) day frequencies/percentages for an asset.

-To further analyze Day of Week (DoW) tendencies based on averaged data from all various custom weeks. Giving a more reliable measure of DoW tendencies ('Meta Averages').

-To backtest day-of-week tendencies: across all asset history or across custom user input periods (i.e. consolidation vs trending periods).

-Education: to see how how data from a 'hard-defined-week' may be misleading when seeking statistical evidence of DoW tendencies.

// Notes & Tips:

-Only designed for use on DAILY timeframe.

-Verification table is to make sure HoW / LoW DAY (referencing previous finished week) is printing correctly and therefore the stats table is populating correctly.

-Generally, leaving Timezone input set to "America/New_York" is best, regardless of your asset or your chart timezone. But if misaligned by 1 day =>> tweak this timezone input to correct

-If you want to use manual backtesting period (e.g. for testing consolidation periods vs trending periods): toggle these settings on, then click the indicator display line three dots >> 'Reset Points' to quickly set start & end dates.

// On custom week start days:

-For assets like BTC which trade 7 days a week, this is quite simple. Pick custom start day, use verification table to check all is well. See the start week day & time in said verification table.

-For traditional assets like S&P which trade only 5 days a week and suffer from occasional Holidays, this is a bit more complicated. If the custom start day input is a bank holiday, its custom 'week' will be discounted from the data set. E.g.1: if you choose 'use custom start day' and set it to Monday, then bank holiday Monday weeks will be discounted from the data set. E.g.2: If you choose 'use custom start day' and set it to Thursday, then the Holiday Thursday custom week (e.g Thanksgiving Thursday >> following Weds) would be discounted from the data set.

// On 'Meta Averages':

-The idea is to try and mitigate out the 'continuation bias' that comes from having a fixed week start/end time: i.e. sometimes a market is trending through the week start/end time, so the start/end day stats are over-weighted if one is trying to tease out typical weekly profile tendencies or typical DoW tendencies. You'll notice this if you compare the stats with various custom start days ('bookend' start/end days are always more heavily weighted). I wanted to try to mitigate out this 'bias' by cycling through all the possible new week start/end days and taking an average of the results. i.e. on BTC/USD the 'meta average' for Tuesday would be the average of the Tuesday HoW frequencies from the set of all 7 possible custom weeks(Mon-Sun, Tues-Mon, Weds-Tues, etc etc).

// User Inputs:

~Week Start:

-use custom week start day (default toggled OFF); Choose custom week start day

-show Meta Averages (default toggled ON)

~Verification Table:

-show table, show new week lines, number of new week lines to show

-table formatting options (position, color, size)

-timezone (only for tweaking if printed DoW is misaligned by 1 day)

~Statistics Table:

-show table, table formatting options (position, color, size)

~Manual Backtesting:

-Use start date (default toggled OFF), choose start date, choose vline color

-Use end date (defautl toggled OFF), choose end date, choose vline color

// Demo charts:

NQ1! (Nasdaq), Full History, Traditional week (Mon>>Friday) stats. And Meta Averages. Annotations in purple:

NQ1! (Nasdaq), Full History, Custom week (custom start day = Wednesday). And Meta Averages. Annotations in purple:

SPY SPX ES Price Converter [Pt]A must have tool for SPY SPX ES traders~!!!

Description

The SPY SPX ES Price Converter is a powerful and easy-to-use tool that allows traders to view corresponding price levels for linked instruments in real-time. This includes SPY, SPX, ES, and SPX500USD. Although these instruments often move in sync, differences in price movements, volume, and trading hours can create unique key levels and support/resistance areas for each. By mapping these levels on the same chart, traders can more easily spot trading opportunities and improve their chances of success.

Customizable features

- multiplier from the closest whole number price level

- line color

- line style

- label position / size

- # of levels to display

- toggle current price display table

Pre-market Highs & Lows on regular trading hours (RTH) chartShows pre-market highs and lows on RTH or ETH chart

-Pre-market duration user input (default is 16 'bar hours'; covering the time from S&P RTH close at 4pm >> 9:30am RTH open next day

-Displays on both RTH and ETH charts

-Written for ES (ES1! or e.g ESM2023), but tested and working on SPY, SPX

-Works across timeframes

Example usage on Electronic trading hours (ETH) chart; showing the 'bar hours' user input lookback duration visually

Session LiquidityThe “Session Liquidity” TradingView indicator by Infinity Trading creates dynamic horizontal lines at the high and low points of a specified time span within the trading day. This indicator gives the user control of three separate time spans so the user can dynamically see the highs and lows of their favorite daily time spans.

Purpose

This indicator is similar to my TradingView indicator “Futures Exchange Sessions 3.0”. In that indicator the user gets control of dynamic price boxes. For me, these boxes made it difficult to spot ICT’s Orderblocks. So instead of boxes I made independently controllable lines and now I can spot ICT Orderblocks and easily identify Liquidity Pools.

Inputs and Style

Everything about the three dynamic lines can but independently configured. Start & End Times, Line Color, Line Style, Line Width, Text Characters, Text Size, Text Color can all be adjusted. The high and low lines as well as their text labels can be individually toggled on or off for maximum control.

Timezone

All of the start and end times are in EST. Additionally, each time span line needs a specific start of each day. This is controlled by a setting called “Line Start Day Timezone” where the user sets a timezone that corresponds with the start time. In general if a timespan resides within a particular Session pick the corresponding timezone. If the users line fits in the Asian Session then choose Asia/Shanghai. If the line is within the London Session then choose Europe/London. And the same goes for the New York Session.

Special Notes

If the Line Start Time is within one candle of the Start Day Timezone in the Settings, then the line/box won’t display. So choose the previous timezone

Lines only display when the timeframe is <= 30 minute

Gallery

Convert ETF to Futures/IndexThis indicator is used to automatically map an ETF's VWAP and 10 levels above and below the strike of your choice, to the futures or index instrument currently being viewed/traded. This works very well when using both SPY to ES/MES/SPX or QQQ to NQ/MNQ/NDX to plot the ETF strikes and can lead to some incredible trades, especially when trading level to level. Since SPY, QQQ, IWM, and DIA have the same price action as their futures iteration, there seems to be a direct correlation between their levels and VWAP . This indicator is made to easily map these key levels to the appropriate futures instrument. If you have a way to measure GEX centered around a certain level, I recommend color coding the lines to help indicate whether the level will have strong positive or negative gamma hedging associated with it.

Seasonality DOW - Day Of the Week - Tabular FormUse this indicator on Daily Timeframe

This indicator displays the seasonality data for any instrument (index/stock/ futures /currency) in a tabular data by day of the week - DOW ( Sun - Mon - Tue - Wed - Thu - Fri - Sat ).

User can change the start of the year for analysis from the inputs.

Year is represented in rows and Day of the week (DOW) is represented in cols.

This indicator uses Daily Data feed to calculate the % change

Summary data for DOW displayed as the last row

SPY to ES or QQQ to NQThis indicator is used to automatically map SPY VWAP and 10 levels of your choice to ES / MES or map QQQ VWAP and 10 levels of your choice to NQ / MNQ . Since SPY and QQQ have the same price action as their futures iteration, there seems to a direct correlation between their levels and VWAP. This indicator is made to easily map the key levels of your choice to the appropriate futures instrument.

Futures Exchange Sessions 3.0Description

The ultimate conclusion to the Futures Exchange Sessions 2.0 indicator. In version 3.0 the user gets full control of the start and end times of three separate dynamic boxes and one horizontal line. If the user wants to visually keep track of killzones, lunches, or any other time span in a trading day, version 3.0 will dynamically expand and keep track of price within the time specified by the user.

Inputs and Style

Everything about the three dynamic boxes and one horizontal line can but independently configured. Color, style, border, width can all be adjusted. In the Settings each box has a text box so the user can give each one a unique name.

Timezone

All of the start and end times are in EST. Additionally, each box and line need a dependent start of each day. This is controlled by a setting where the user can specify a timezone called Start Day Timezone which would be midnight of the respective timezone. In general if a box or line resides within a particular Session pick the corresponding timezone. If the users box/line fits in the Asian Session then choose Asia/Shanghai. If the box/line is within the London Session then choose Europe/London. And the same goes for the New York Session.

Special Notes

If start time is within one period of the Start Day Timezone in the Settings, then the line/box won't display

Boxes and time lines only display when timeframe is <= 30 minute

To turn off box text label set opacity to 0%

Futures Exchange Sessions 2.0Description

Successor to Futures Exchange Sessions indicator. Completely rebuilt code from the ground up. Every feature has been redesigned and refactored to be the most beneficial while allowing for complete configuration by the user.

This indicator displays Futures Sessions as live boxes that expand dynamically as price moves over the time interval. These boxes make liquidity levels extremely easy to spot and visualize. It helps the user identify market structure and develop their own bias of price action. Everything about the Session boxes can be configured. Box color, border color, border style, and border width are all individually controllable. Each Future Session can be turned on or off at any time. Also, each box has their own text label (Asian Session, London Session, New York Session) and this text can be moved around the box, change color, and change size.

Previous days highs and lows (major liquidity levels) are always important to the futures trader. This indicator now allows the user to individually display the three previous days highs and low levels as lines with optional label. Each line can be independently toggled on or off and like always, every conceivable customization option is available to the user. And the labels can be moved to the right (via the Input Settings) to allow unobstructed views of candles.

The midnight EST open and 8:30 AM EST open horizontal lines (developed by the Inner Circle Trader) are returning in this indicator. But the biggest improvement is that the lines stop at the current bar or the last bar of the trading day. Additionally, the time lines are displayed on previous days so the user can easily see how the candles reacted to these important times of the day.

The Session boxes and the horizontal time lines now can be set to only display a certain number of day back. If the user wants just to see Session boxes for the previous day only, they can do that. If the user wants to see the last 15 days of boxes or lines it is very easy to increase the days back in the settings. Currently, the max days back is 80 calendar days.

Additional Images

Easily visualize and understand price action across time

Everything is customizable so the user can easily match this indicator to their color preferences

Special Notes

To turn off box session text set opacity to 0%

Boxes and horizontal time lines only display when timeframe is <= 30 minute

S&P Sector Advance/Decline Weighted -Tom1traderEnjoy, enhance your trading (I hope), copy or adapt to your needs and keep smiling!

Thanks to @MartinShkreli. The sector variables and the "repaint" option (approx lines 20 through 32 of this script) are used directly from your script "Sectors"

RECOMMENDATION: Update the sector weightings -inputs are provided. They change as often as monthly and the

annual changes are certainly significant. When updating weighting percentages use the decimal value. I.E. 29% is .29

Good on any time frame. Especially SPY, SPX and ES scalpers and 0DTE options traders may like this a lot.

This gives good signals on S & P and related (ES, SPY) and indicates / plots differently than the AD line or ratio.

Each sector's entire % weight is added or subtracted depending of whether that sector advanced or declined.

Example: Information Tech weight at 29% so that % of 500 (145) is added if InfoTech is up a penny and subtracted if it is

down a penny. All sectors processed the same way so that for a given bar/candle the value will be between +500 (all

sectors up) and -500 (all sectors down). This weighted AD line of sectors is scaled to +/- 350 and plotted as a red/green line

along with aqua/fuchsia columns of its 5 period ema. The line is actual sector behavior and the columns seem to make a

good signal with column zero crosses standing out.

The columns aqua / fuchsia are a 5 period ema of the Sector AD line and give pretty good signals at

zero cross for SPX. I colored the AD red green line also to emphasize the times it opposes the ema

for example the histo/colums zero cross signal is NOT true when the AD line is showing all or most sectors

going the other way.

For readability, the AD line itself is scaled to 350. This lets the columns of the ema stand out better. The hlines at

350 and at 175 give an idea for the AD green red line how much of the sector's weight is up or down.

350 is all sectors up (advancing) and -350 is all sectors down (declining). The hlines at +/- 175 seem to outline

a more or less "neutral" zone. For example in an uptrend with most of the AD level positive and the columns positive;

a negative spike that does not pass the -175 line and returns positive does not seem to impact the price as much as

a deeper negative spike.

GMS: Mr. Yen's Color ZoneThis is Mr. Yen's color zone. I have also added an input to adjust the sizes of each box. Mainly targeted for MES and ES.

The default settings are as he describes:

white line is the previous day close

red zone = +/- 20 from the previous day close

yellow zone = +/- 40 from the previous day close

green zone = +/- 60 from the previous day close

blue zone = +/- 100 from the previous day close

The source code is open, so feel free to take a look and see whats up. This indicator is quite similar to his, however there is a gap at the cash close to overnight open on his chart that I'm not sure how to adjust for. In any case, this one is still pretty good!

I hope it helps,

Andre

(JS)S&P 500 Volatility Oscillator For Options 2.0I am going to start taking requests to open source my indicators and they will also be updated to Version 4 of Pinescript.

I added some features to the original code such the ability to smooth the oscillator and select the look back periods for the historical volatility.

Link to original:

Original post:

"The idea for this started here: www.tradingview.com with the user @dime

This should only be used on SPX or SPY (though you could use it on other things for correlation I suppose) given that the instrument used to create this calculation is derived from the S&P 500 (thank you VIX ). There's a lot of moving parts here though, so allow me to explain...

First: The main signal is when Implied Volatility (from VIX ) drops beneath Historical Volatility - which is what you want to see so you aren't purchasing a ton of premium on long options. Green and above 0 means that IV% has dropped lower than Historical Volatility . (this signal, for example, would suggest using a Long Call or Put depending on your sentiment)

Second: The green line running underneath zero is the bottom portion of the "Average True Range" derived from the values used to create the oscillator. the closer the bottom histogram is to the green line, the more "normal" IV% is. Obviously, if this gets far away from the line then it could be setting up nicely to short options and sell the IV premium to someone else. (this signal, for example, would suggest using something like a Bull Put Spread)

Third: The red background along with the white line that drops down below zero signals when (and how far) the IV% from 3 months out (from VIX3M ) is less than the current IV%. This would signal the current environment has IV way too high, a signal to short options once again (and don't take any long option positions!).

Tried to make this simple, yet effective. If you trade options on SPX , SPY , even ES1! futures - this is a tool tailored specifically for you! As I said before, if you want you can use it for correlation on other securities. Any other ideas or suggestions surrounding this, please let me know! Enjoy!

Feb 17, 2019

Release Notes: Cosmetic update for a much cleaner look:

-Replaced the "HIGH IV" with a simlple "H"

-Now the white line is constantly showing you the relationship between VIX and VIX3M - when VIX is greater than VIX3M the background still goes red

-However, now when VIX drops below Historical Volatility, the background is bright green

-When both above are true - it's dark green

-The Average True Range on the bottom is now a series of crosses"

Calendar Spread - OldinvestorSimply choose what two securities (symbols) you want to compare. The study will subtract Open, High, Low, and Close of second input from the first. You may also move the plot line wherever you choose. It may be necessary to move the plot line in order for some charts to look right.

@WACC Volatility Weighted PUT/CALL Positions [SPX]This indicator is based on Volatility and Market Sentiment. When volatility is high, and market sentiment is positive, the indicator is in a low or 'buy state'. When volatility is low and market sentiment is poor, the indicator is high.

The indicator uses the VIX as it's volatility input.

The indicator uses the spread between the Call Volume on SPX/SPY and the Put Volume.

This is pulled from CVSPX and PVSPX.

When volatility and put/call reaches a critical level, such as the levels present in a crisis or a sell off, the line will be green. See Sept 2015, 2008, and Feb 2018.

This level can be edited in the source code.

As the indicator is based on Put/Call, the indicator works best on larger time frames as the put/call ratio becomes a more discernible measure of sentiment over time.

B3 Fibonacci Pivot S/RFor my second share, I give you some levels I look at everyday for the ES minis. HLC/3 of the MTF (multi-time-frame) inputs = mean and Fib-levels formed as support and resistance zones. There are some websites that will show you 20 ways to figure out a pivot for the day's intraday workings, and this one always rang true for me. I keep it set at Res=D and Len=3or5 and use on hourly charts. This indicator is capable of doing like a Res=60m Len=8 for a 5m chart or something of that nature if you wish to test it out.

I haven't tested it out for tick charts and I have noticed that this is good on index and commodity futures, and not so much other things.

Uncanny to me how well this works as reversal awareness for ES. Doesn't mean that one will happen, or if it does that it will have trade-able juice, though it is very important awareness never-the-less.

screencast.com