OPEN-SOURCE SCRIPT

Atualizado 3x Supertrend + EMA200 Signal Buy/Sell [nsen]

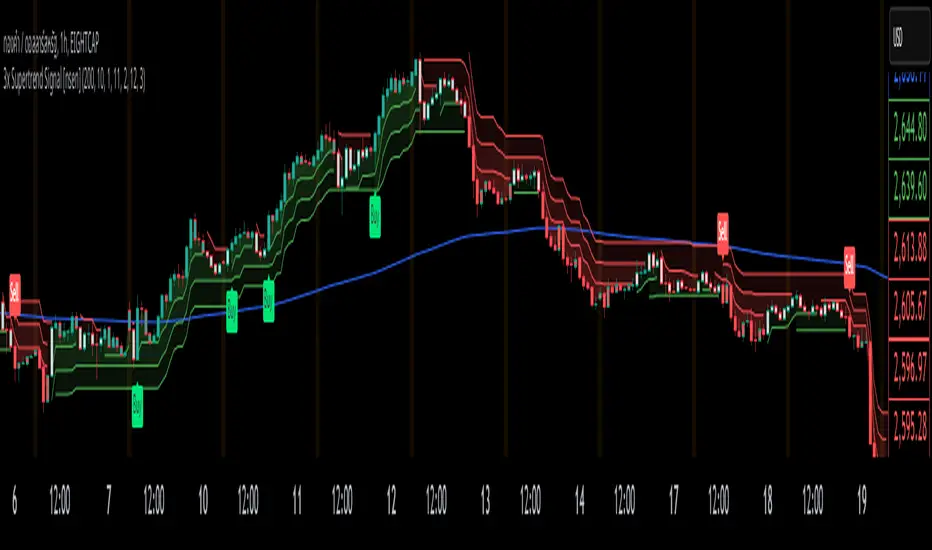

The indicator uses signals from three Supertrend lines to determine whether to trade Buy or Sell, with the assistance of a moving average for bias.

Buy/Sell signals are generated when the conditions are met:

A Buy signal is triggered when all three Supertrend lines indicate a bullish trend and are above the EMA.

A Sell signal is triggered when all three Supertrend lines indicate a bearish trend and are below the EMA.

Indicator ใช้สัญญาณจาก Supertrend ทั้งหมด 3 เส้น โดยใช้ในการกำหนดว่าจะเลือกเทรด Buy หรือ Sell โดยการใช้ moveing average เข้ามาช่วยในการ bias

แสดงสัญญาณ Buy/Sell เมื่อเข้าเงื่อนไข

- Supertrend ทั้ง 3 เส้นเป็นสัญญาณ Bullish และอยู่เหนือเส้น EMA จะเปิดสัญญาณ Buy

- Supertrend ทั้ง 3 เส้นเป็นสัญญาณ Bearish และอยู่ใต้เส้น EMA จะเปิดสัญญาณ Sell

Buy/Sell signals are generated when the conditions are met:

A Buy signal is triggered when all three Supertrend lines indicate a bullish trend and are above the EMA.

A Sell signal is triggered when all three Supertrend lines indicate a bearish trend and are below the EMA.

Indicator ใช้สัญญาณจาก Supertrend ทั้งหมด 3 เส้น โดยใช้ในการกำหนดว่าจะเลือกเทรด Buy หรือ Sell โดยการใช้ moveing average เข้ามาช่วยในการ bias

แสดงสัญญาณ Buy/Sell เมื่อเข้าเงื่อนไข

- Supertrend ทั้ง 3 เส้นเป็นสัญญาณ Bullish และอยู่เหนือเส้น EMA จะเปิดสัญญาณ Buy

- Supertrend ทั้ง 3 เส้นเป็นสัญญาณ Bearish และอยู่ใต้เส้น EMA จะเปิดสัญญาณ Sell

Notas de Lançamento

Indicator Name: Multi-Supertrend with EMA ConfirmationConcept and Functionality

This indicator combines three Supertrend levels (Fast, Medium, Slow) with an Exponential Moving Average (EMA) to detect market trends and generate more reliable buy/sell signals.

• Supertrend Indicator is a trend-following tool that uses the Average True Range (ATR) to create dynamic support and resistance levels.

• EMA (Exponential Moving Average) acts as an additional trend filter to reduce false signals.

This indicator is designed to help traders identify market trends and precise entry points using a multi-timeframe confirmation approach.

===========================================

Calculation and Key Components

EMA (Exponential Moving Average)

• Uses a 200-period EMA as a dynamic support/resistance level.

• Price closing above the EMA suggests an uptrend.

• Price closing below the EMA suggests a downtrend.

Three Supertrend Levels

• Each Supertrend is calculated using different ATR lengths and factors (Fast, Medium, Slow).

• Helps detect trend direction and potential reversals.

Trend Identification

• Bullish Trend: All three Supertrend lines are in an uptrend, and price is above the EMA.

• Bearish Trend: All three Supertrend lines are in a downtrend, and price is below the EMA.

• Neutral Trend: When the Supertrend signals are mixed.

Candle Coloring for Trend Visualization

• Green: Strong uptrend (All three Supertrends are bullish).

• Red: Strong downtrend (All three Supertrends are bearish).

• Lighter colors: Transition phases.

Buy/Sell Signal Conditions

• Buy Signal:

- All three Supertrend lines are bullish.

- Price is above the EMA.

- Trend shift from bearish to bullish.

• Sell Signal:

- All three Supertrend lines are bearish.

- Price is below the EMA.

- Trend shift from bullish to bearish.

Alerts System

• The indicator includes built-in alerts when buy or sell signals are triggered based on the conditions above.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.