PROTECTED SOURCE SCRIPT

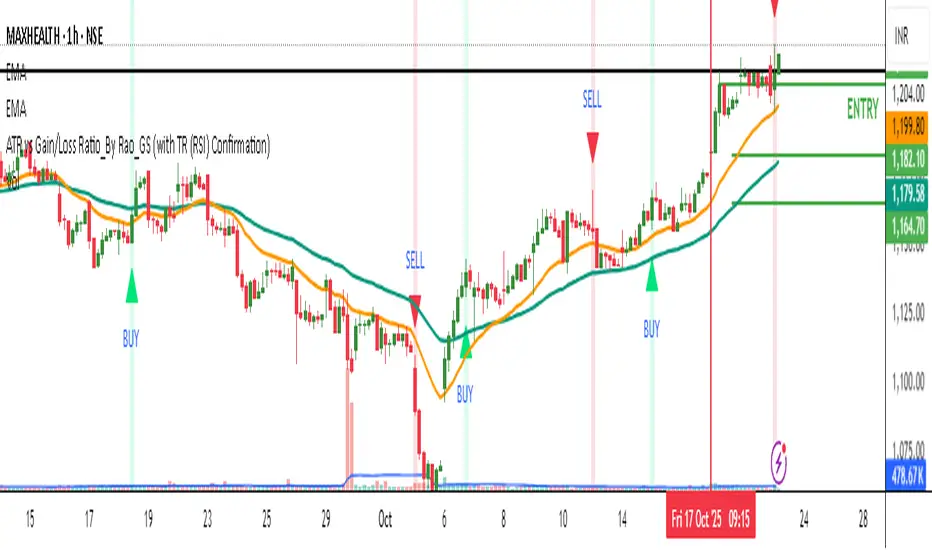

ATR vs Gain/Loss Ratio_By Rao_GS (with TR (RSI) Confirmation)

Description: ATR vs Gain/Loss Ratio_By Rao_GS (with TR (RSI) Confirmation)

🔍 Overview

The ATR vs Gain/Loss Ratio indicator by Rao_GS is a volatility-driven momentum tool designed to detect strong directional shifts confirmed by the relationship between Average True Range (ATR) and the average Gain/Loss ratios.

It helps identify points where volatility expansion aligns with momentum reversal — providing high-probability BUY and SELL zones.

⚙️ Core Logic

ATR (Average True Range):

Measures volatility using the range between high and low prices.

Gain/Loss Averages:

Calculates the average of positive (gain) and negative (loss) movements over a user-defined period.

ATR Ratios:

ATR / Avg Gain and ATR / Avg Loss create two oscillating curves.

Crossover Detection:

Buy Signal → When the ATR/Gain ratio crosses above the ATR/Loss ratio during high volatility.

Sell Signal → When the ATR/Gain ratio crosses below the ATR/Loss ratio during high volatility.

Volatility Confirmation (TR Filter):

The True Range (TR) must be at least a certain multiple of ATR (default 1.1×) to confirm genuine market momentum.

🎯 Signals

🟢 BUY:

Occurs when bullish momentum strengthens (ATR/Gain > ATR/Loss) and volatility confirms the move.

🔴 SELL:

Occurs when bearish momentum dominates (ATR/Loss > ATR/Gain) under heightened volatility.

Background color highlights active signal zones:

Light Green → Confirmed BUY zone

Light Red → Confirmed SELL zone

📈 Visualization

Lime Line: ATR/Gain ratio

Red Line: ATR/Loss ratio

Triangles:

🟢 Up triangle → Buy

🔴 Down triangle → Sell

This design allows traders to see both volatility shifts and momentum transitions together on a single overlay chart.

🔍 Overview

The ATR vs Gain/Loss Ratio indicator by Rao_GS is a volatility-driven momentum tool designed to detect strong directional shifts confirmed by the relationship between Average True Range (ATR) and the average Gain/Loss ratios.

It helps identify points where volatility expansion aligns with momentum reversal — providing high-probability BUY and SELL zones.

⚙️ Core Logic

ATR (Average True Range):

Measures volatility using the range between high and low prices.

Gain/Loss Averages:

Calculates the average of positive (gain) and negative (loss) movements over a user-defined period.

ATR Ratios:

ATR / Avg Gain and ATR / Avg Loss create two oscillating curves.

Crossover Detection:

Buy Signal → When the ATR/Gain ratio crosses above the ATR/Loss ratio during high volatility.

Sell Signal → When the ATR/Gain ratio crosses below the ATR/Loss ratio during high volatility.

Volatility Confirmation (TR Filter):

The True Range (TR) must be at least a certain multiple of ATR (default 1.1×) to confirm genuine market momentum.

🎯 Signals

🟢 BUY:

Occurs when bullish momentum strengthens (ATR/Gain > ATR/Loss) and volatility confirms the move.

🔴 SELL:

Occurs when bearish momentum dominates (ATR/Loss > ATR/Gain) under heightened volatility.

Background color highlights active signal zones:

Light Green → Confirmed BUY zone

Light Red → Confirmed SELL zone

📈 Visualization

Lime Line: ATR/Gain ratio

Red Line: ATR/Loss ratio

Triangles:

🟢 Up triangle → Buy

🔴 Down triangle → Sell

This design allows traders to see both volatility shifts and momentum transitions together on a single overlay chart.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode usar ele livremente e sem nenhuma limitação – saiba mais aqui.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode usar ele livremente e sem nenhuma limitação – saiba mais aqui.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.