PROTECTED SOURCE SCRIPT

Signal Tester EN [Abusuhil]

Signal Tester [Abusuhil] - Complete Description

Overview

Signal Tester is a comprehensive trading tool designed to backtest and analyze external trading signals with advanced risk management capabilities. The indicator provides seven different calculation methods for stop-loss and take-profit levels, along with detailed performance statistics and real-time tracking of active trades.

Important Disclaimer: This indicator is a tool for analysis and education purposes only. Past performance does not guarantee future results. Trading involves substantial risk of loss and is not suitable for all investors. Always conduct your own research and consider seeking advice from a qualified financial advisor before making trading decisions.

Key Features

7 Calculation Methods for customizable risk management

External Signal Integration via any oscillator or indicator

Real-time Trade Tracking with visual entry/exit points

Comprehensive Statistics Table showing win rate, profit/loss, and active trades

Date Filtering for focused backtesting periods

Custom Alerts for new buy signals

Multi-Target System with up to 5 take-profit levels

How to Use

Step 1: Connect External Signal

The indicator requires an external signal source to generate buy signals.

Add your preferred indicator to the chart (RSI, MACD, Stochastic, custom indicator, etc.)

In Signal Tester settings, locate "External Indicator" input

Click the input and select your indicator's plot line

Buy signals are generated when the external source crosses above zero

Example: If using RSI, connect the RSI line. A buy signal triggers when RSI crosses above the zero reference (if plotted as oscillator).

Step 2: Choose Your Calculation Method

Select one of seven methods under "Calculation Method":

1. Percentage %

The simplest method using fixed percentage values.

Settings:

Stop Loss %: Distance from entry to stop-loss (default: 2%)

Target 1-5 %: Distance from entry to each take-profit level

Example: Entry at $100

Stop Loss (2%): $98

Target 1 (2%): $102

Target 2 (4%): $104

Best For: Beginners, markets with consistent volatility

2. ATR Multiplier

Uses Average True Range for dynamic levels based on market volatility.

Settings:

ATR Period: Calculation period (default: 14)

Stop Multiplier: ATR multiplier for stop-loss (default: 1.5)

Target Multipliers: ATR multipliers for each take-profit

Example: Entry at $100, ATR = $2

Stop Loss (1.5x ATR): $100 - $3 = $97

Target 1 (2x ATR): $100 + $4 = $104

Best For: Volatile markets, adapting to changing conditions

3. Risk:Reward Ratio

Calculates targets based on risk-to-reward ratios.

Settings:

Stop Loss %: Initial risk percentage

Target Ratios: R:R ratio for each target (1:1.5, 1:2, 1:3, etc.)

Example: Entry at $100, Stop at $98 (2% risk = $2)

Target 1 (1:1.5): $100 + ($2 × 1.5) = $103

Target 2 (1:2): $100 + ($2 × 2) = $104

Target 3 (1:3): $100 + ($2 × 3) = $106

Best For: Traders focused on risk management and position sizing

4. Swing High/Low

Places stop-loss at recent swing low with targets as multiples of the risk.

Settings:

Swing Lookback Candles: Number of bars to find swing low (default: 5)

Stop Safety Distance %: Buffer below swing low

Target Multipliers: Risk multiples for each target

Example: Entry at $105, Swing Low at $100

Stop Loss: $100 - 0.1% = $99.90 (risk = $5.10)

Target 1 (1.5x): $105 + ($5.10 × 1.5) = $112.65

Best For: Swing traders, respecting market structure

5. Partial Take Profit

Sells portions of the position at each target level, moving stop to entry after first target.

Settings:

Stop Loss %: Initial stop distance

Target 1-5 %: Price levels for partial exits

Sell % at TP1-4: Percentage of position to close at each level

Example: 100% position, 50% sell at each target

TP1 hit: Sell 50%, remaining 50%, stop moves to entry

TP2 hit: Sell 25% (50% of remaining), remaining 25%

TP3 hit: Sell 12.5%, remaining 12.5%

Best For: Conservative traders, locking in profits gradually

6. Trailing Stop

Similar to Partial Take Profit but trails the stop-loss to each achieved target.

Settings:

Stop Loss %: Initial stop distance

Target 1-5 %: Price levels for trailing stops

Sell % at TP1-4: Percentage to close at each level

Example:

TP1 ($102) hit: Sell 50%, stop trails to $102

TP2 ($104) hit: Sell 25%, stop trails to $104

Price retraces to $104: Exit with locked profits

Best For: Trend followers, maximizing profit in strong moves

7. Smart Exit

Advanced method that moves stop to entry after first target, then exits based on technical conditions.

Settings:

Stop Loss %: Initial stop distance

First Target %: When hit, stop moves to breakeven

Exit Method: Choose from 8 exit strategies

Exit Methods:

Close < EMA 21: Exits when price closes below 21-period EMA

Close < MA 20: Exits when price closes below 20-period Moving Average

Supertrend Flip: Exits when Supertrend indicator flips bearish

ATR Trailing Stop: Dynamic trailing stop based on ATR

MACD Crossover: Exits on MACD bearish crossover

RSI < 50: Exits when RSI drops below specified level

Parabolic SAR Flip: Exits when SAR flips above price

Bollinger Bands: Exits when price closes below middle or lower band

Best For: Advanced traders, letting winners run with protection

Date Filtering

Control which trades are included in backtesting.

Filter Types:

Specific Date: Only trades after selected date

Number of Weeks: Last X weeks (default: 12)

Number of Months: Last X months (default: 3)

How to Enable:

Check "Enable Date Filter"

Select filter type

Set the date or number of weeks/months

Use Case: Test strategy performance in recent market conditions or specific periods

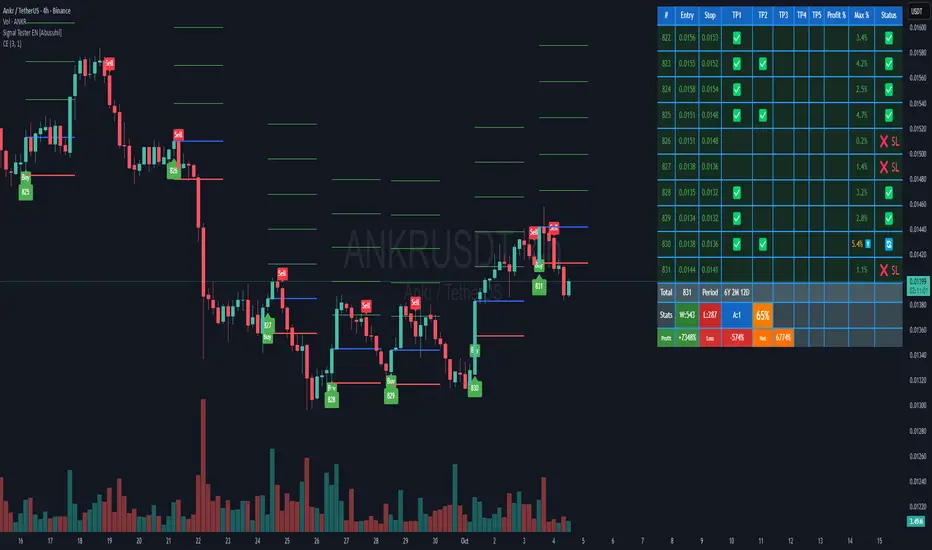

Understanding the Statistics Table

The table displays the last 10 trades plus comprehensive statistics:

Trade Columns:

#: Trade number

Entry: Entry price

Stop: Current stop-loss level

TP1-TP5: Checkmarks (✅) when targets are hit

Profit %: Realized profit for the trade

Max %: Maximum unrealized profit reached (⬆️ indicates active trade)

Status:

🔄 Active trade

✅ Closed winner

❌ SL - Stopped out

Summary Row:

Total: Number of trades executed

Period: Duration of trading period (Years, Months, Days)

Statistics Row:

W: Number of winning trades

L: Number of losing trades

A: Number of active (open) trades

Win Rate %: (Wins / Total Trades) × 100

Performance Row:

Profit: Total profit from all winning trades

Loss: Total loss from all losing trades

Net: Net profit/loss (Profit - Loss)

Visual Elements

When a buy signal triggers, the indicator draws:

Blue Line: Entry price

Red Line: Stop-loss level

Green Lines: Take-profit levels (up to 5)

Green Label: Trade number below the entry bar

Green Triangle: Buy signal marker

Alerts

The indicator includes customizable alerts for new buy signals.

Setting Up Alerts:

Click the "⏰" icon in TradingView

Select "Signal Tester [Abusuhil]"

Choose condition: "Buy"

Configure notification preferences (popup, email, webhook)

Click "Create"

Alert Message Format:

🚀 New Buy Signal!

Price: [Entry Price]

Trade #: [Trade Number]

Best Practices

Backtest First: Test each calculation method on historical data before live trading

Match Timeframe: Use the indicator on the timeframe you plan to trade

Combine with Analysis: Use alongside support/resistance, trend analysis, and other tools

Risk Management: Never risk more than 1-2% of capital per trade

Review Statistics: Regularly check win rate and profit/loss metrics

Adjust Settings: Optimize parameters based on the asset's volatility and your risk tolerance

Limitations

Requires external signal source (does not generate signals independently)

Backtesting assumes perfect entry/exit execution (real trading includes slippage)

Past performance does not guarantee future results

Should be used as one component of a complete trading strategy

Version Information

Version: 1.0

Pine Script Version: v5

Type: Overlay Indicator

Author: Abusuhil

Support and Updates

This indicator is provided as-is for educational and analytical purposes. Users are responsible for their own trading decisions and should thoroughly test any strategy before implementing it with real capital.

Risk Warning: Trading financial instruments carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. Only trade with money you can afford to lose.

Overview

Signal Tester is a comprehensive trading tool designed to backtest and analyze external trading signals with advanced risk management capabilities. The indicator provides seven different calculation methods for stop-loss and take-profit levels, along with detailed performance statistics and real-time tracking of active trades.

Important Disclaimer: This indicator is a tool for analysis and education purposes only. Past performance does not guarantee future results. Trading involves substantial risk of loss and is not suitable for all investors. Always conduct your own research and consider seeking advice from a qualified financial advisor before making trading decisions.

Key Features

7 Calculation Methods for customizable risk management

External Signal Integration via any oscillator or indicator

Real-time Trade Tracking with visual entry/exit points

Comprehensive Statistics Table showing win rate, profit/loss, and active trades

Date Filtering for focused backtesting periods

Custom Alerts for new buy signals

Multi-Target System with up to 5 take-profit levels

How to Use

Step 1: Connect External Signal

The indicator requires an external signal source to generate buy signals.

Add your preferred indicator to the chart (RSI, MACD, Stochastic, custom indicator, etc.)

In Signal Tester settings, locate "External Indicator" input

Click the input and select your indicator's plot line

Buy signals are generated when the external source crosses above zero

Example: If using RSI, connect the RSI line. A buy signal triggers when RSI crosses above the zero reference (if plotted as oscillator).

Step 2: Choose Your Calculation Method

Select one of seven methods under "Calculation Method":

1. Percentage %

The simplest method using fixed percentage values.

Settings:

Stop Loss %: Distance from entry to stop-loss (default: 2%)

Target 1-5 %: Distance from entry to each take-profit level

Example: Entry at $100

Stop Loss (2%): $98

Target 1 (2%): $102

Target 2 (4%): $104

Best For: Beginners, markets with consistent volatility

2. ATR Multiplier

Uses Average True Range for dynamic levels based on market volatility.

Settings:

ATR Period: Calculation period (default: 14)

Stop Multiplier: ATR multiplier for stop-loss (default: 1.5)

Target Multipliers: ATR multipliers for each take-profit

Example: Entry at $100, ATR = $2

Stop Loss (1.5x ATR): $100 - $3 = $97

Target 1 (2x ATR): $100 + $4 = $104

Best For: Volatile markets, adapting to changing conditions

3. Risk:Reward Ratio

Calculates targets based on risk-to-reward ratios.

Settings:

Stop Loss %: Initial risk percentage

Target Ratios: R:R ratio for each target (1:1.5, 1:2, 1:3, etc.)

Example: Entry at $100, Stop at $98 (2% risk = $2)

Target 1 (1:1.5): $100 + ($2 × 1.5) = $103

Target 2 (1:2): $100 + ($2 × 2) = $104

Target 3 (1:3): $100 + ($2 × 3) = $106

Best For: Traders focused on risk management and position sizing

4. Swing High/Low

Places stop-loss at recent swing low with targets as multiples of the risk.

Settings:

Swing Lookback Candles: Number of bars to find swing low (default: 5)

Stop Safety Distance %: Buffer below swing low

Target Multipliers: Risk multiples for each target

Example: Entry at $105, Swing Low at $100

Stop Loss: $100 - 0.1% = $99.90 (risk = $5.10)

Target 1 (1.5x): $105 + ($5.10 × 1.5) = $112.65

Best For: Swing traders, respecting market structure

5. Partial Take Profit

Sells portions of the position at each target level, moving stop to entry after first target.

Settings:

Stop Loss %: Initial stop distance

Target 1-5 %: Price levels for partial exits

Sell % at TP1-4: Percentage of position to close at each level

Example: 100% position, 50% sell at each target

TP1 hit: Sell 50%, remaining 50%, stop moves to entry

TP2 hit: Sell 25% (50% of remaining), remaining 25%

TP3 hit: Sell 12.5%, remaining 12.5%

Best For: Conservative traders, locking in profits gradually

6. Trailing Stop

Similar to Partial Take Profit but trails the stop-loss to each achieved target.

Settings:

Stop Loss %: Initial stop distance

Target 1-5 %: Price levels for trailing stops

Sell % at TP1-4: Percentage to close at each level

Example:

TP1 ($102) hit: Sell 50%, stop trails to $102

TP2 ($104) hit: Sell 25%, stop trails to $104

Price retraces to $104: Exit with locked profits

Best For: Trend followers, maximizing profit in strong moves

7. Smart Exit

Advanced method that moves stop to entry after first target, then exits based on technical conditions.

Settings:

Stop Loss %: Initial stop distance

First Target %: When hit, stop moves to breakeven

Exit Method: Choose from 8 exit strategies

Exit Methods:

Close < EMA 21: Exits when price closes below 21-period EMA

Close < MA 20: Exits when price closes below 20-period Moving Average

Supertrend Flip: Exits when Supertrend indicator flips bearish

ATR Trailing Stop: Dynamic trailing stop based on ATR

MACD Crossover: Exits on MACD bearish crossover

RSI < 50: Exits when RSI drops below specified level

Parabolic SAR Flip: Exits when SAR flips above price

Bollinger Bands: Exits when price closes below middle or lower band

Best For: Advanced traders, letting winners run with protection

Date Filtering

Control which trades are included in backtesting.

Filter Types:

Specific Date: Only trades after selected date

Number of Weeks: Last X weeks (default: 12)

Number of Months: Last X months (default: 3)

How to Enable:

Check "Enable Date Filter"

Select filter type

Set the date or number of weeks/months

Use Case: Test strategy performance in recent market conditions or specific periods

Understanding the Statistics Table

The table displays the last 10 trades plus comprehensive statistics:

Trade Columns:

#: Trade number

Entry: Entry price

Stop: Current stop-loss level

TP1-TP5: Checkmarks (✅) when targets are hit

Profit %: Realized profit for the trade

Max %: Maximum unrealized profit reached (⬆️ indicates active trade)

Status:

🔄 Active trade

✅ Closed winner

❌ SL - Stopped out

Summary Row:

Total: Number of trades executed

Period: Duration of trading period (Years, Months, Days)

Statistics Row:

W: Number of winning trades

L: Number of losing trades

A: Number of active (open) trades

Win Rate %: (Wins / Total Trades) × 100

Performance Row:

Profit: Total profit from all winning trades

Loss: Total loss from all losing trades

Net: Net profit/loss (Profit - Loss)

Visual Elements

When a buy signal triggers, the indicator draws:

Blue Line: Entry price

Red Line: Stop-loss level

Green Lines: Take-profit levels (up to 5)

Green Label: Trade number below the entry bar

Green Triangle: Buy signal marker

Alerts

The indicator includes customizable alerts for new buy signals.

Setting Up Alerts:

Click the "⏰" icon in TradingView

Select "Signal Tester [Abusuhil]"

Choose condition: "Buy"

Configure notification preferences (popup, email, webhook)

Click "Create"

Alert Message Format:

🚀 New Buy Signal!

Price: [Entry Price]

Trade #: [Trade Number]

Best Practices

Backtest First: Test each calculation method on historical data before live trading

Match Timeframe: Use the indicator on the timeframe you plan to trade

Combine with Analysis: Use alongside support/resistance, trend analysis, and other tools

Risk Management: Never risk more than 1-2% of capital per trade

Review Statistics: Regularly check win rate and profit/loss metrics

Adjust Settings: Optimize parameters based on the asset's volatility and your risk tolerance

Limitations

Requires external signal source (does not generate signals independently)

Backtesting assumes perfect entry/exit execution (real trading includes slippage)

Past performance does not guarantee future results

Should be used as one component of a complete trading strategy

Version Information

Version: 1.0

Pine Script Version: v5

Type: Overlay Indicator

Author: Abusuhil

Support and Updates

This indicator is provided as-is for educational and analytical purposes. Users are responsible for their own trading decisions and should thoroughly test any strategy before implementing it with real capital.

Risk Warning: Trading financial instruments carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. Only trade with money you can afford to lose.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.