OPEN-SOURCE SCRIPT

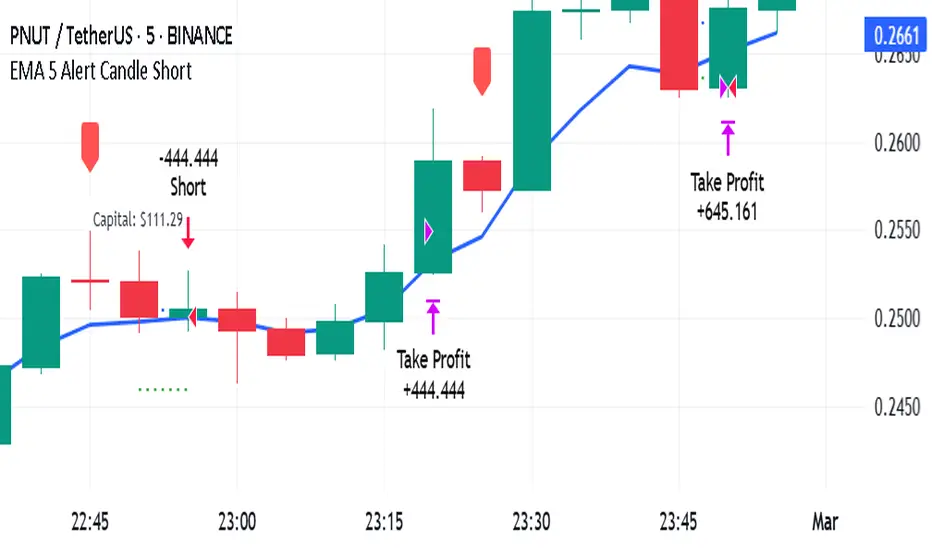

Atualizado EMA 5 Alert Candle Short

The 5 EMA (Exponential Moving Average) Strategy is a simple yet effective trading strategy that helps traders identify short-term trends and potential entry and exit points. This strategy is widely used in intraday and swing trading, particularly in forex, stocks, and crypto markets.

Components of the 5 EMA Strategy

5 EMA: A fast-moving average that reacts quickly to price movements.

15-minute or 1-hour timeframe (commonly used, but adaptable to other timeframes).

Candlestick Patterns: To confirm entry signals.

How the 5 EMA Strategy Works

Buy (Long) Setup:

Price Above the 5 EMA: The price should be trading above the 5 EMA.

Pullback to the 5 EMA: A minor retracement or consolidation near the 5 EMA.

Bullish Candlestick Confirmation: A bullish candle (e.g., engulfing or pin bar) forms near the 5 EMA.

Entry: Enter a long trade at the close of the bullish candle.

Stop Loss: Place below the recent swing low or 5-10 pips below the 5 EMA.

Take Profit: Aim for a risk-reward ratio of at least 1:2 or trail the stop using a higher EMA (e.g., 10 or 20 EMA).

Sell (Short) Setup:

Price Below the 5 EMA: The price should be trading below the 5 EMA.

Pullback to the 5 EMA: A small retracement towards the 5 EMA.

Bearish Candlestick Confirmation: A bearish candle (e.g., engulfing or pin bar) near the 5 EMA.

Entry: Enter a short trade at the close of the bearish candle.

Stop Loss: Place above the recent swing high or 5-10 pips above the 5 EMA.

Take Profit: Aim for a 1:2 risk-reward ratio or use a trailing stop.

Additional Filters for Better Accuracy

Higher Timeframe Confirmation: Check the trend on a higher timeframe (e.g., 1-hour or 4-hour).

Volume Confirmation: Enter trades when volume is increasing.

Avoid Sideways Market: Use the strategy only when the market is trending.

Advantages of the 5 EMA Strategy

✔️ Simple and easy to use.

✔️ Works well in trending markets.

✔️ Helps traders capture short-term momentum.

Disadvantages

❌ Less effective in choppy or sideways markets.

❌ Requires discipline in following stop-loss rules.

Components of the 5 EMA Strategy

5 EMA: A fast-moving average that reacts quickly to price movements.

15-minute or 1-hour timeframe (commonly used, but adaptable to other timeframes).

Candlestick Patterns: To confirm entry signals.

How the 5 EMA Strategy Works

Buy (Long) Setup:

Price Above the 5 EMA: The price should be trading above the 5 EMA.

Pullback to the 5 EMA: A minor retracement or consolidation near the 5 EMA.

Bullish Candlestick Confirmation: A bullish candle (e.g., engulfing or pin bar) forms near the 5 EMA.

Entry: Enter a long trade at the close of the bullish candle.

Stop Loss: Place below the recent swing low or 5-10 pips below the 5 EMA.

Take Profit: Aim for a risk-reward ratio of at least 1:2 or trail the stop using a higher EMA (e.g., 10 or 20 EMA).

Sell (Short) Setup:

Price Below the 5 EMA: The price should be trading below the 5 EMA.

Pullback to the 5 EMA: A small retracement towards the 5 EMA.

Bearish Candlestick Confirmation: A bearish candle (e.g., engulfing or pin bar) near the 5 EMA.

Entry: Enter a short trade at the close of the bearish candle.

Stop Loss: Place above the recent swing high or 5-10 pips above the 5 EMA.

Take Profit: Aim for a 1:2 risk-reward ratio or use a trailing stop.

Additional Filters for Better Accuracy

Higher Timeframe Confirmation: Check the trend on a higher timeframe (e.g., 1-hour or 4-hour).

Volume Confirmation: Enter trades when volume is increasing.

Avoid Sideways Market: Use the strategy only when the market is trending.

Advantages of the 5 EMA Strategy

✔️ Simple and easy to use.

✔️ Works well in trending markets.

✔️ Helps traders capture short-term momentum.

Disadvantages

❌ Less effective in choppy or sideways markets.

❌ Requires discipline in following stop-loss rules.

Notas de Lançamento

Strategy Description: EMA 5 Alert Candle ShortOverview:

This strategy is designed for short trades based on price interactions with the 5-period Exponential Moving Average (EMA). The system identifies a special "Alert Candle" that meets specific conditions and waits for a breakout of its low to enter a short position. Position sizing is calculated dynamically based on the length of the alert candle, ensuring a fixed risk of $2 per trade.

Entry Criteria:

EMA 5 Interaction Check:

The last three candles must have touched or been close to the 5 EMA.

The current candle must be significantly above the 5 EMA, meaning it does not touch it.

Alert Candle Formation:

If the above conditions are met, the current candle is marked as an Alert Candle.

The high and low of this candle are recorded as reference points.

Short Entry Condition:

The next candle must break below the low of the Alert Candle.

Once this happens, a short position is entered.

Risk Management & Position Sizing:

✅ Fixed Risk Per Trade: $2

✅ Position Size Calculation:

The length of the Alert Candle is calculated as:

Alert Candle Range = High - Low

Position size is determined using the formula:

Position Size = $2 / Alert Candle Range

Capital used is calculated as:

Capital Used = Position Size × Short Entry Price

✅ Trade Execution:

Stop Loss: The high of the Alert Candle.

Take Profit: Equal to the stop-loss distance (1:1 Risk-Reward Ratio).

✅ Capital Used is displayed on the chart for easy tracking.

Trade Execution Logic:

🔴 Step 1: Identify the Alert Candle (Based on EMA & candle positioning).

🟡 Step 2: Wait for Breakout Below the Alert Candle’s Low.

🟢 Step 3: Enter Short Position.

🔵 Step 4: Exit at Stop Loss (Alert Candle High) or Take Profit (1:1 RR).

Visual Aids in the Strategy:

📌 EMA 5 Line: Blue line for trend tracking.

📌 Alert Candle Marker: Red label above the Alert Candle.

📌 Trade Setup Lines:

Entry Line: Blue (short entry).

Stop Loss Line: Red (above entry).

Take Profit Line: Green (below entry).

📌 Capital Used Label: White text above the Alert Candle.

Advantages of This Strategy:

✅ Simple & Effective for Trend Reversals.

✅ Dynamic Position Sizing Adjusts to Market Conditions.

✅ Fixed Risk Per Trade Ensures Consistent Risk Management.

✅ Visually Clear Entries & Exits for Easy Execution.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.