OPEN-SOURCE SCRIPT

Filter Wave

1. Indicator Name

Filter Wave

2. One-line Introduction

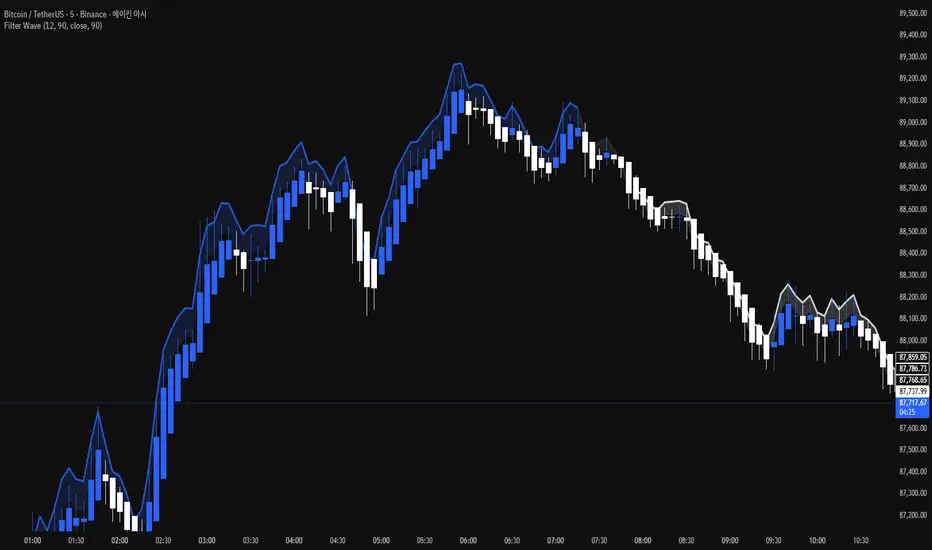

A visually enhanced trend strength indicator that uses linear regression scoring to render smoothed, color-shifting waves synced to price action.

3. General Overview

Filter Wave+ is a trend analysis tool designed to provide an intuitive and visually dynamic representation of market momentum.

It uses a pairwise comparison algorithm on linear regression values over a lookback period to determine whether price action is consistently moving upward or downward.

The result is a trend score, which is normalized and translated into a color-coded wave that floats above or below the current price. The wave's opacity increases with trend strength, giving a visual cue for confidence in the trend.

The wave itself is not a raw line—it goes through a three-stage smoothing process, producing a natural, flowing curve that is aesthetically aligned with price movement.

This makes it ideal for traders who need a quick visual context before acting on signals from other tools.

While Filter Wave+ does not generate buy/sell signals directly, its secure and efficient design allows it to serve as a high-confidence trend filter in any trading system.

4. Key Advantages

🌊 Smooth, Dynamic Wave Output

3-stage smoothed curves give clean, flowing visual feedback on market conditions.

🎨 Trend Strength Visualized by Color Intensity

Stronger trends appear with more solid coloring, while weak/neutral trends fade visually.

🔍 Quantitative Trend Detection

Linear regression ordering delivers precise, math-based trend scoring for confidence assessment.

📊 Price-Synced Floating Wave

Wave is dynamically positioned based on ATR and price to align naturally with market structure.

🧩 Compatible with Any Strategy

No conflicting signals—Filter Wave+ serves as a directional overlay that enhances clarity.

🔒 Secure Core Logic

Core algorithm is lightweight and secure, with minimal code exposure and strong encapsulation.

📘 Indicator User Guide

📌 Basic Concept

Filter Wave+ calculates trend direction and intensity using linear regression alignment over time.

The resulting wave is rendered as a smoothed curve, colored based on trend direction (green for up, red for down, gray for neutral), and adjusted in transparency to reflect trend strength.

This allows for fast trend interpretation without overwhelming the chart with signals.

⚙️ Settings Explained

Lookback Period: Number of bars used for pairwise regression comparisons (higher = smoother detection)

Range Tolerance (%): Threshold to qualify as an up/down trend (lower = more sensitive)

Regression Source: The price input used in regression calculation (default: close)

Linear Regression Length: The period used for the core regression line

Bull/Bear Color: Customize the color for bullish and bearish waves

📈 Timing Example

Wave color changes to green and becomes more visible (less transparent)

Wave floats above price and aligns with an uptrend

Use as trend confirmation when other signals are present

📉 Timing Example

Wave shifts to red and darkens, floating below the price

Regression direction down; price continues beneath the wave

Acts as bearish confirmation for short trades or risk-off positioning

🧪 Recommended Use Cases

Use as a trend confidence overlay on your existing strategies

Especially useful in swing trading for detecting and confirming dominant market direction

Combine with RSI, MACD, or price action for high-accuracy setups

🔒 Precautions

This is not a signal generator—intended as a trend filter or directional guide

May respond slightly slower in volatile reversals; pair with responsive indicators

Wave position is influenced by ATR and price but does not represent exact entry/exit levels

Parameter optimization is recommended based on asset class and timeframe

Filter Wave

2. One-line Introduction

A visually enhanced trend strength indicator that uses linear regression scoring to render smoothed, color-shifting waves synced to price action.

3. General Overview

Filter Wave+ is a trend analysis tool designed to provide an intuitive and visually dynamic representation of market momentum.

It uses a pairwise comparison algorithm on linear regression values over a lookback period to determine whether price action is consistently moving upward or downward.

The result is a trend score, which is normalized and translated into a color-coded wave that floats above or below the current price. The wave's opacity increases with trend strength, giving a visual cue for confidence in the trend.

The wave itself is not a raw line—it goes through a three-stage smoothing process, producing a natural, flowing curve that is aesthetically aligned with price movement.

This makes it ideal for traders who need a quick visual context before acting on signals from other tools.

While Filter Wave+ does not generate buy/sell signals directly, its secure and efficient design allows it to serve as a high-confidence trend filter in any trading system.

4. Key Advantages

🌊 Smooth, Dynamic Wave Output

3-stage smoothed curves give clean, flowing visual feedback on market conditions.

🎨 Trend Strength Visualized by Color Intensity

Stronger trends appear with more solid coloring, while weak/neutral trends fade visually.

🔍 Quantitative Trend Detection

Linear regression ordering delivers precise, math-based trend scoring for confidence assessment.

📊 Price-Synced Floating Wave

Wave is dynamically positioned based on ATR and price to align naturally with market structure.

🧩 Compatible with Any Strategy

No conflicting signals—Filter Wave+ serves as a directional overlay that enhances clarity.

🔒 Secure Core Logic

Core algorithm is lightweight and secure, with minimal code exposure and strong encapsulation.

📘 Indicator User Guide

📌 Basic Concept

Filter Wave+ calculates trend direction and intensity using linear regression alignment over time.

The resulting wave is rendered as a smoothed curve, colored based on trend direction (green for up, red for down, gray for neutral), and adjusted in transparency to reflect trend strength.

This allows for fast trend interpretation without overwhelming the chart with signals.

⚙️ Settings Explained

Lookback Period: Number of bars used for pairwise regression comparisons (higher = smoother detection)

Range Tolerance (%): Threshold to qualify as an up/down trend (lower = more sensitive)

Regression Source: The price input used in regression calculation (default: close)

Linear Regression Length: The period used for the core regression line

Bull/Bear Color: Customize the color for bullish and bearish waves

📈 Timing Example

Wave color changes to green and becomes more visible (less transparent)

Wave floats above price and aligns with an uptrend

Use as trend confirmation when other signals are present

📉 Timing Example

Wave shifts to red and darkens, floating below the price

Regression direction down; price continues beneath the wave

Acts as bearish confirmation for short trades or risk-off positioning

🧪 Recommended Use Cases

Use as a trend confidence overlay on your existing strategies

Especially useful in swing trading for detecting and confirming dominant market direction

Combine with RSI, MACD, or price action for high-accuracy setups

🔒 Precautions

This is not a signal generator—intended as a trend filter or directional guide

May respond slightly slower in volatile reversals; pair with responsive indicators

Wave position is influenced by ATR and price but does not represent exact entry/exit levels

Parameter optimization is recommended based on asset class and timeframe

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.