PROTECTED SOURCE SCRIPT

Atualizado 🎯 Advanced ST Pro-X-J-Algo

🎯 Advanced ICT Concepts Suite

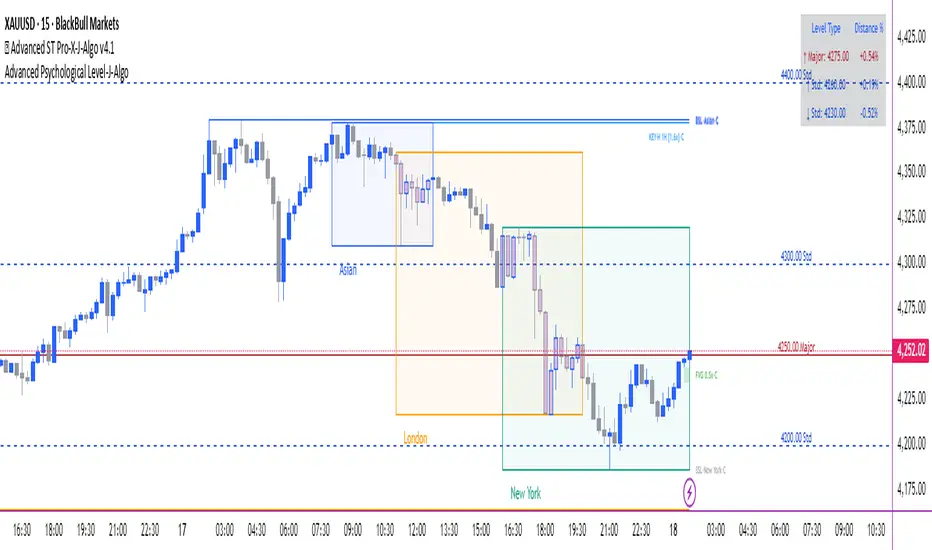

A comprehensive visualization tool for Inner Circle Trader (ICT) market structure concepts with anti-repainting technology.

Overview

This indicator combines multiple ICT-based market structure concepts into a single, configurable tool. It provides visual identification of liquidity zones, order blocks, fair value gaps, and trading session boundaries. The indicator includes advanced anti-repainting controls to ensure historical accuracy.

Key Features

📦 Order Blocks

Identifies institutional order zones based on swing structure

Tracks mitigation levels with customizable violation methods

Adjustable overlap filtering and display limits

💧 Liquidity Analysis

Standard timeframe liquidity sweeps (buyside/sellside)

Higher timeframe liquidity levels with multi-timeframe analysis

Session-based liquidity zone classification

🔲 Fair Value Gaps (FVG)

Detects price inefficiencies based on 3-candle patterns

Inverse Fair Value Gap (iFVG) identification

Customizable gap size filtering and fill thresholds

🕐 Trading Sessions

Asian, London, and New York session visualization

Session overlap detection and highlighting

High/low level tracking with customizable time zones

⚙️ Anti-Repainting Controls

Toggle between live signals and confirmed signals

Adjustable confirmation periods (1-5 bars)

Reliable backtesting with historical accuracy

Configuration Options

Master Controls: Enable/disable individual components

Repainting Settings: Choose between speed vs reliability

Visual Customization: Colors, line styles, label sizes

Performance Optimization: Display limits and memory management

Important Notes

Educational Purpose: This indicator is designed for educational exploration of ICT concepts and market structure analysis.

Not Financial Advice: The signals and patterns displayed are interpretive tools, not trading recommendations.

Backtesting Disclaimer: Past performance of any signals does not predict future results. Always use proper risk management.

Confirmation Required: All signals should be confirmed with additional analysis and proper risk assessment before making trading decisions.

Best Practices

Use confirmed signal mode for backtesting accuracy

Combine with traditional technical analysis

Practice on demo accounts before live trading

Understand each component before using in combination

Maintain realistic expectations about signal effectiveness

Risk Warning: Trading involves substantial risk of loss. This indicator is an educational tool and should not be the sole basis for trading decisions.

Technical Requirements: Pine Script v6, TradingView Pro+ recommended for multi-timeframe features

This indicator is provided for educational purposes. The concepts displayed are interpretive frameworks popular in trading education but lack independent empirical validation. Always conduct your own analysis and risk assessment.

A comprehensive visualization tool for Inner Circle Trader (ICT) market structure concepts with anti-repainting technology.

Overview

This indicator combines multiple ICT-based market structure concepts into a single, configurable tool. It provides visual identification of liquidity zones, order blocks, fair value gaps, and trading session boundaries. The indicator includes advanced anti-repainting controls to ensure historical accuracy.

Key Features

📦 Order Blocks

Identifies institutional order zones based on swing structure

Tracks mitigation levels with customizable violation methods

Adjustable overlap filtering and display limits

💧 Liquidity Analysis

Standard timeframe liquidity sweeps (buyside/sellside)

Higher timeframe liquidity levels with multi-timeframe analysis

Session-based liquidity zone classification

🔲 Fair Value Gaps (FVG)

Detects price inefficiencies based on 3-candle patterns

Inverse Fair Value Gap (iFVG) identification

Customizable gap size filtering and fill thresholds

🕐 Trading Sessions

Asian, London, and New York session visualization

Session overlap detection and highlighting

High/low level tracking with customizable time zones

⚙️ Anti-Repainting Controls

Toggle between live signals and confirmed signals

Adjustable confirmation periods (1-5 bars)

Reliable backtesting with historical accuracy

Configuration Options

Master Controls: Enable/disable individual components

Repainting Settings: Choose between speed vs reliability

Visual Customization: Colors, line styles, label sizes

Performance Optimization: Display limits and memory management

Important Notes

Educational Purpose: This indicator is designed for educational exploration of ICT concepts and market structure analysis.

Not Financial Advice: The signals and patterns displayed are interpretive tools, not trading recommendations.

Backtesting Disclaimer: Past performance of any signals does not predict future results. Always use proper risk management.

Confirmation Required: All signals should be confirmed with additional analysis and proper risk assessment before making trading decisions.

Best Practices

Use confirmed signal mode for backtesting accuracy

Combine with traditional technical analysis

Practice on demo accounts before live trading

Understand each component before using in combination

Maintain realistic expectations about signal effectiveness

Risk Warning: Trading involves substantial risk of loss. This indicator is an educational tool and should not be the sole basis for trading decisions.

Technical Requirements: Pine Script v6, TradingView Pro+ recommended for multi-timeframe features

This indicator is provided for educational purposes. The concepts displayed are interpretive frameworks popular in trading education but lack independent empirical validation. Always conduct your own analysis and risk assessment.

Notas de Lançamento

Small UpdateNotas de Lançamento

Add Session Open and Close StatusWhat Changed:

Green dot (🟢) = Session is currently OPEN

Red dot (🔴) = Session has CLOSED

Notas de Lançamento

Update Some SettingsNotas de Lançamento

✅ New Combined Label Feature:Smart Detection: Automatically combines when FVG and iFVG overlap

How The Combining Works:

Both FVG and iFVG boxes draw normally (solid and dashed)

After drawing, the combiner checks for overlaps

When detected, it:

Deletes individual labels

Creates combined text: "FVG 1.2x + iFVG 0.8x"

Positions at average level

Colors in purple for visibility

Notas de Lançamento

Name UpdateNotas de Lançamento

RenamedNotas de Lançamento

🎯 Advanced ST Pro-X-J-Algo v2.0 - Technical UpdateWhat's New

Enhanced Liquidity Sweep Detection

Added three sweep detection methods: Wick Break, Close Break, and Full Retrace

Configurable sweep buffer (ATR-based) for additional confirmation

Choose the sensitivity level that matches your trading style

Improved Order Block Quality Filters

Minimum size filter to eliminate insignificant zones

Optional volume confirmation (requires above-average volume)

Price imbalance validation for stronger institutional footprints

Results in fewer but potentially higher-quality signals

Technical Improvements

Fixed HTF pivot calculations to eliminate rounding issues

More accurate multi-timeframe analysis

Optimized request.security() calls for better performance

New Settings

Liquidity Settings:

Sweep Detection Type (Wick Break/Close Break/Full Retrace)

Sweep Buffer (ATR multiplier)

Order Block Settings:

Min OB Size (ATR)

Require Above Average Volume (toggle)

Volume Multiplier

Require Price Imbalance (toggle)

Important Notes

All original features remain functional

New filters are optional - disable them to use original logic

The confirmed signals mode still prevents repainting

Recommended to backtest new settings on your specific instruments and timeframes before live trading

Backward Compatibility

If you prefer the original behavior, simply:

Set "Sweep Detection Type" to "Full Retrace"

Disable "Require Above Average Volume"

Disable "Require Price Imbalance"

Disclaimer: This indicator is for educational purposes. Past performance does not guarantee future results. Always use proper risk management and test thoroughly before live trading.

Notas de Lançamento

Session Status FixedNotas de Lançamento

🎯 Advanced ST Pro-X-J-Algo v3 - HTF Key Liquidity Update🆕 Version 3.0 Update - Enhanced HTF Key Liquidity

What's New

The HTF (Higher Timeframe) Liquidity system has been completely enhanced with intelligent strength-based filtering, bringing it to the same advanced level as the LTF implementation.

New HTF Key Liquidity Features

✅ Strength-Based Ranking

HTF pivots are now rated by actual price movement

Normalized by ATR for consistent strength measurement across different assets

Only levels with significant institutional interest are displayed

✅ Smart Distance Filtering

Prevents clustered, overlapping HTF levels

Minimum distance between levels (default 3.0x ATR)

Ensures clean, readable charts with distinct key levels

✅ Quality Over Quantity

Shows only the top strongest HTF levels (default: 3)

Levels are automatically ranked by strength

Focus on what matters most

✅ Strength Display in Labels

Optional strength ratings shown (e.g., "KEY-H 4H [2.5x]")

Helps prioritize which levels to watch

Higher numbers indicate stronger institutional levels

✅ Enhanced Configuration

Min Pivot Strength (default 2.0x ATR) - Filter weak pivots

Min Distance Between Levels (default 3.0x ATR) - Prevent clustering

Max HTF Key Liquidity Levels (default 3) - Control display

Show Strength in Label (default ON) - Display strength ratings

Why This Matters

Previous HTF liquidity showed all detected pivots, which could clutter charts and make it difficult to identify truly significant institutional levels. The new system filters noise and highlights only the strongest, most relevant HTF liquidity zones where major price reactions are likely to occur.

Settings Explained

Min Pivot Strength - How strong must a pivot be to qualify?

1.0-1.5x = More levels (moderate strength)

2.0-3.0x = Recommended (strong levels only)

3.0+x = Ultra-selective (institutional-grade only)

Min Distance Between Levels - How far apart should levels be?

Prevents multiple levels clustering together

Higher values = fewer, more spaced levels

Default 3.0x ATR works well for most timeframes

Max Levels - How many to display?

1-3 = Ultra-clean (recommended)

4-6 = Moderate

7-10 = Detailed analysis

Result

Clean, professional HTF liquidity display showing only the most significant institutional levels that truly matter for your trading decisions.

v3.0 Release - HTF Key Liquidity Enhanced with Strength-Based IntelligenceRetryClaude can make mistakes. Please double-check responses.

Notas de Lançamento

# 🎯 Advanced ST Pro-X-J-Algo v3.1 Update## ✨ NEW FEATURES

### 🕐 Session Open/Close Alerts

Added comprehensive session alert system to keep you informed of market sessions in real-time:

- **Single Toggle Control**: Enable/disable all session alerts with one setting

- **Clear Status Indicators**:

- 🟢 OPEN alerts when sessions begin

- 🔴 CLOSED alerts when sessions end

- **Multi-Session Support**:

- Asian Session alerts

- London Session alerts

- New York Session alerts

- **Customizable Notifications**: Configure alerts for push notifications, email, SMS, or webhooks

**Alert Messages:**

- "Asian Session 🟢 OPEN"

- "London Session 🔴 CLOSED"

- "New York Session 🟢 OPEN"

- etc.

## 🔧 IMPROVEMENTS

### Code Optimization

- Fixed Pine Script consistency warnings for pivot strength calculations

- Improved function call patterns for better performance

- Enhanced variable scoping for session state tracking

### Alert System Integration

- Seamless integration with existing liquidity sweep alerts

- Non-repainting alert logic for reliable notifications

- Frequency-controlled alerts to prevent spam

## 📋 HOW TO USE NEW ALERTS

1. Open indicator settings

2. Navigate to "Alert Settings" section

3. Enable "Enable Alerts" ✅

4. Enable "🕐 Alert on Session Changes" ✅

5. Right-click chart → Add Alert → Select "Any alert() function call"

6. Configure your preferred notification method

7. Done! You'll receive alerts when sessions open/close

## 🎨 EXISTING FEATURES (Unchanged)

- ✅ Non-repainting signals with confirmation bars

- ✅ Multi-timeframe liquidity sweeps (HTF & LTF)

- ✅ Smart order blocks with volume validation

- ✅ Fair Value Gaps (FVG) and Inverse FVG detection

- ✅ Trading session visualization

- ✅ Session high/low tracking

- ✅ Customizable colors and styles

## 🐛 BUG FIXES

- Resolved "Cannot modify global variable" error in session tracking

- Fixed Pine Script consistency warnings

- Improved memory management for long-running charts

## 💡 TIPS

- Combine session alerts with liquidity sweep alerts for complete market awareness

- Use session alerts to time your entries during high-volume periods

- Enable only the sessions relevant to your trading strategy

- Session alerts respect your confirmed signals setting for consistency

---

**Version**: 3.1

**Date**: October 2024

**Compatibility**: Pine Script v6

**Status**: Stable Release

### Support & Feedback

If you find this indicator helpful, please leave a like and comment! For issues or suggestions, feel free to reach out.

**Happy Trading! 📈**

Notas de Lançamento

# 🎯 Advanced ST Pro-X-J-Algo v4 - Update Notes## 📋 Version 4.0 Release - Session Box Border Enhancement

### 🆕 What's New in v4

#### **Enhanced Session Box Visualization**

We've added powerful new customization options for trading session boxes, making them more visible and easier to distinguish on your charts.

---

### ✨ New Features

#### **1. Session Box Borders**

- **Customizable Borders**: Session boxes now feature optional visible borders that make them stand out clearly on any chart background

- **Fully Opaque Border Colors**: Borders use the session's base color at full opacity for maximum visibility

- **Toggle Control**: Easily enable or disable borders with a single checkbox

#### **2. Border Width Control**

- **Adjustable Width**: Choose border thickness from 1-5 pixels

- **Precision Styling**: Fine-tune the visual weight of your session boxes to match your chart aesthetics

- **Default Setting**: Ships with a 2-pixel border width for optimal visibility

---

### 🎨 Visual Improvements

**Before v4:**

- Session boxes had subtle, semi-transparent backgrounds

- Borders were not visible (border_color=na)

- Sessions could blend into chart backgrounds

**After v4:**

- Session boxes now have clear, defined borders

- Enhanced visual separation between sessions

- Better contrast against any chart theme

- Professional, polished appearance

---

### ⚙️ New Settings Location

Navigate to **Indicator Settings → "═══ Trading Sessions ═══"**

New controls added:

```

✅ Show session box borders (Default: ON)

📏 Session border width (Default: 2, Range: 1-5)

```

---

### 🔧 Technical Details

**Code Enhancement:**

- Modified `createSessionDisplay()` method

- Dynamic border color assignment based on session color

- Conditional border rendering for performance optimization

- Backward compatible with all existing settings

**Performance:**

- Zero impact on indicator calculation speed

- Efficient border rendering

- Maintains all existing functionality

---

### 📊 Use Cases

**Enhanced for:**

- 🌙 **Night Mode Traders**: Borders improve visibility on dark themes

- ☀️ **Light Mode Users**: Clear definition against bright backgrounds

- 📱 **Mobile Traders**: Better session distinction on smaller screens

- 🎨 **Custom Themes**: Borders adapt to any color scheme

---

### 🚀 How to Use

1. **Enable Borders:**

- Open indicator settings

- Navigate to "Trading Sessions" section

- Check "Show session box borders"

2. **Customize Width:**

- Adjust "Session border width" slider (1-5)

- Preview changes in real-time

- Find your perfect visual balance

3. **Quick Toggle:**

- Uncheck "Show session box borders" to return to classic borderless style

- Perfect for users who prefer the original look

---

### 🔄 Backward Compatibility

✅ **100% Compatible** with v3 settings

✅ All existing features remain unchanged

✅ No breaking changes to alerts or indicators

✅ Seamless upgrade experience

---

### 📈 All v3 Features Included

- ✅ **Multi-Timeframe Liquidity Detection** (HTF/LTF)

- ✅ **Enhanced Order Blocks** with volume confirmation

- ✅ **Fair Value Gaps (FVG)** detection

- ✅ **Inverse Fair Value Gaps (iFVG)**

- ✅ **Non-Repainting Signals** option

- ✅ **Session Overlap Detection**

- ✅ **Liquidity Sweep Alerts**

- ✅ **Customizable Session Times**

- ✅ **High/Low Lines** for each session

- ✅ **Session Status Indicators** (🟢/🔴)

---

### 🎯 Recommended Settings

**For Maximum Visibility:**

```

Show session box borders: ✅ ON

Session border width: 2-3

```

**For Subtle Style:**

```

Show session box borders: ✅ ON

Session border width: 1

```

**For Classic Look:**

```

Show session box borders: ❌ OFF

```

---

### 💡 Pro Tips

1. **Dark Charts**: Use 2-3 pixel borders for optimal visibility

2. **Light Charts**: 1-2 pixel borders work best

3. **Busy Charts**: Thicker borders (3-4) help sessions stand out

4. **Clean Charts**: Thinner borders (1-2) maintain elegance

---

### 🐛 Bug Fixes

- Improved session box rendering consistency

- Enhanced border color opacity calculations

- Optimized memory cleanup for session objects

---

### 📝 Coming Soon (Future Updates)

- Custom border colors independent of session colors

- Border style options (solid, dashed, dotted)

- Gradient border effects

- Per-session border customization

---

### 🙏 Feedback Welcome

Have suggestions for v5? Want additional border customization options?

**Let us know!** We're committed to making this the most powerful Smart Money Concepts indicator on TradingView.

---

### 📜 Version History

**v4.0** - Session Border Enhancement (Current)

**v3.0** - Multi-Timeframe Liquidity & Advanced OB Detection

**v2.0** - Fair Value Gaps & Session Overlaps

**v1.0** - Initial Release

---

## 🎉 Thank You for Using Advanced ST Pro-X-J-Algo!

*Professional Smart Money Concepts indicator with institutional-grade precision.*

---

**Indicator Name:** 🎯 Advanced ST Pro-X-J-Algo v4

**Version:** 4.0

**Last Updated:** 2025

**Compatibility:** Pine Script v6

**Category:** Smart Money Concepts / Order Flow / ICT

---

### Tags

`#SmartMoneyConcepts` `#OrderBlocks` `#Liquidity` `#FVG` `#ICT` `#Sessions` `#TradingView` `#ForexTrading` `#CryptoTrading` `#InstitutionalTrading`

Notas de Lançamento

🎯 Advanced ST Pro-X-J-Algo v4 - Major Feature UpdateLatest Updates (v4.1) - NEW FEATURE ADDED

🆕 OPTIMAL TRADE ENTRY (OTE) - NOW AVAILABLE!

We've added the highly-requested OTE (Optimal Trade Entry) zones based on ICT methodology:

What is OTE?

Identifies premium Fibonacci retracement zones (0.618 - 0.786) after structure breaks

Provides precise entry opportunities during pullbacks in trending markets

Used by professional Smart Money Concepts traders worldwide

OTE Features:

✅ Automatic swing detection and Fibonacci calculation

✅ Structure break validation (only shows OTE after confirmed breakouts)

✅ Smart entry detection with rejection confirmation

✅ Visual zones with 0.618, 0.705, and 0.786 levels clearly marked

✅ Bullish OTE: Price breaks high → retraces to zone → enters long

✅ Bearish OTE: Price breaks low → retraces to zone → enters short

✅ Customizable swing length, colors, and zone visibility

✅ Entry alerts with confirmed/live options

✅ Non-repainting when "Confirmed Signals" mode enabled

OTE Settings Include:

Swing Length (5-50 bars)

Show/hide individual Fibonacci levels (0.618, 0.705, 0.786)

OTE zone highlighting

Require structure break (on/off)

Maximum zones to display

Entry alerts with confirmation status

Visual Indicators:

🎯 OTE zones displayed as colored boxes

Dashed/solid lines for each Fibonacci level

"✓ ENTRY" label appears when valid setup triggers

Green highlighting on confirmed entries

Direction arrows (↑ bullish / ↓ bearish)

Complete Feature Set:

Core Smart Money Concepts:

💧 Liquidity Sweeps (Buyside/Sellside with session labels)

💧 HTF Key Liquidity (4H/Daily levels with strength calculation)

💧 LTF Key Liquidity (1H/15min precision levels)

📦 Order Blocks (with volume & imbalance filters)

🔲 Fair Value Gaps (FVG detection & fill tracking)

🔄 Inverse Fair Value Gaps (iFVG reversal patterns)

🎯 OTE Zones (NEW!) - Premium retracement entries

Session Tracking:

🕐 Asian, London, and New York sessions

Session high/low levels with color coding

Session overlap detection and highlighting

Session-labeled liquidity (BSL-London, SSL-Asian, etc.)

Session open/close alerts

Advanced Features:

⚙️ Non-Repainting Controls (confirmed signals mode)

🔔 Comprehensive alert system

📊 Multi-timeframe analysis

🎨 Fully customizable colors and styles

🧹 Memory management for smooth performance

Perfect For:

ICT (Inner Circle Trader) methodology followers

Smart Money Concepts (SMC) traders

Session-based trading strategies

Multi-timeframe liquidity traders

Fibonacci retracement traders

Recommended Settings for OTE:

OTE Swing Length: 10 bars

Show OTE Zone: ON

Show 0.618 Level: ON

Show 0.705 Level: ON

Show 0.786 Level: ON

Require Structure Break: ON (recommended)

Max OTE Zones: 2-3

OTE Entry Alerts: ON

How to Use OTE:

Wait for price to break structure (swing high/low)

OTE zone appears automatically after breakout

Watch for price to retrace into 0.618-0.786 zone

Entry confirmed when price shows rejection (✓ ENTRY label)

Take trade in direction of structure break

📌 Note: Use "Confirmed Signals" mode with 2 confirmation bars for non-repainting OTE signals.

🎓 Educational: Based on ICT's Optimal Trade Entry concept - the sweet spot for entries after institutional moves.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode usar ele livremente e sem nenhuma limitação – saiba mais aqui.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode usar ele livremente e sem nenhuma limitação – saiba mais aqui.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.