OPEN-SOURCE SCRIPT

Atualizado Index Reversal Range with Volatility Index or VIX

What is the Indicator?

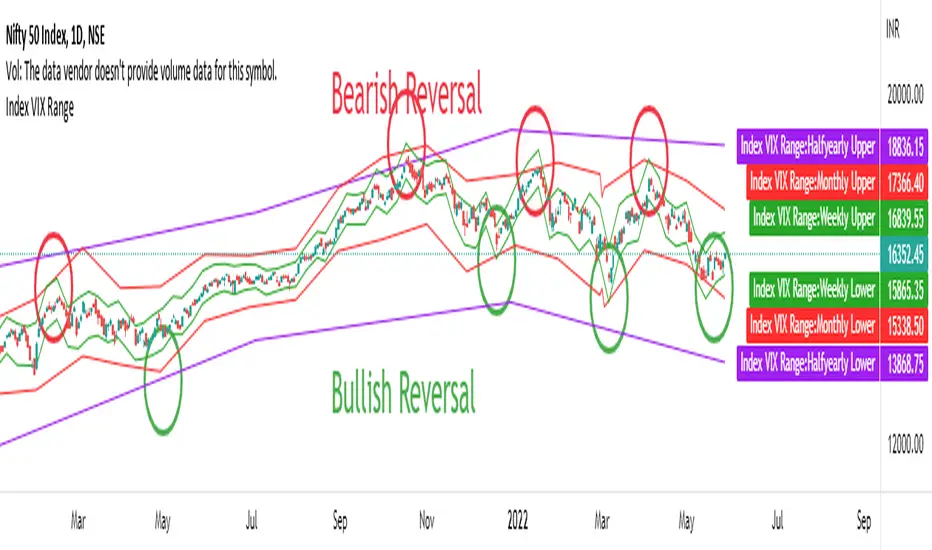

• The indicator is a visualization of maximum price in which the respective index can go up to in comparison with it's Volatility Index or VIX.

Who to use?

• Intraday

• Swing

• Position

• Long term Investors

• Futures

• Options

• Portfolio Managers

• Mutual Fund Managers

• Index Traders

• Volatility based Traders

• Long term Investors and Options Traders gets the maximum benefit

What timeframe to use?

• 1 Year: Position & Investors

• 6 Months: Position & Investors

• 3 Months: Swing & Position

• 1 Month: Swing & Position

• 1 Week: Swing

• 1 Day: Swing

• 1 Hour: Intraday & Swing

What are Upper and Lower lines?

• Upper Line: If the index price reach closer to the Upper line there is a high chance of reversal to Bearish trend.

• Lower Line: If the index price reach closer to the Lower line there is a high chance of reversal to Bullish trend.

• This need to be confirmed with multiple levels like Daily, Weekly, Monthly etc.

How to use?

• If the price reach closer to that level there is a high chance of reversal from the current trend.

• To identify the reversal zone of the index.

• To identify the trend.

• Option Traders can Sell a Call or Put Option from that level.

• Long term Investors, Position or Swing traders can plan for a Long entry.

• Intraday traders can use lower timeframes to do the same.

Indicator Menu

• Input VIX: Identify the VIX Symbol of your Index and type it in the box.

• For example for NIFTY Index chart type INDIAVIX in the box.

• Choose multiple timeframes according to your convenience.

How to turn on indicator Name and Value labels?

• Right side of the screen >

• Right click on the Price scale >

• Labels > Indicators and financial name labels, Indicators and financial value labels

Further Reading:

• Various videos and reading materials are available about this method.

• The indicator is a visualization of maximum price in which the respective index can go up to in comparison with it's Volatility Index or VIX.

Who to use?

• Intraday

• Swing

• Position

• Long term Investors

• Futures

• Options

• Portfolio Managers

• Mutual Fund Managers

• Index Traders

• Volatility based Traders

• Long term Investors and Options Traders gets the maximum benefit

What timeframe to use?

• 1 Year: Position & Investors

• 6 Months: Position & Investors

• 3 Months: Swing & Position

• 1 Month: Swing & Position

• 1 Week: Swing

• 1 Day: Swing

• 1 Hour: Intraday & Swing

What are Upper and Lower lines?

• Upper Line: If the index price reach closer to the Upper line there is a high chance of reversal to Bearish trend.

• Lower Line: If the index price reach closer to the Lower line there is a high chance of reversal to Bullish trend.

• This need to be confirmed with multiple levels like Daily, Weekly, Monthly etc.

How to use?

• If the price reach closer to that level there is a high chance of reversal from the current trend.

• To identify the reversal zone of the index.

• To identify the trend.

• Option Traders can Sell a Call or Put Option from that level.

• Long term Investors, Position or Swing traders can plan for a Long entry.

• Intraday traders can use lower timeframes to do the same.

Indicator Menu

• Input VIX: Identify the VIX Symbol of your Index and type it in the box.

• For example for NIFTY Index chart type INDIAVIX in the box.

• Choose multiple timeframes according to your convenience.

How to turn on indicator Name and Value labels?

• Right side of the screen >

• Right click on the Price scale >

• Labels > Indicators and financial name labels, Indicators and financial value labels

Further Reading:

• Various videos and reading materials are available about this method.

Notas de Lançamento

Updated on 29 May 2022- Added dots between lines.

Notas de Lançamento

Updated on 31 May 2022- Updated with current Volatility levels as Lines and Labels.

- The number in % is the Volatility Percentage which appear at the end of each label.

- Removed the dots on lines as it looks clustered.

Notas de Lançamento

Updated on 10 June 2022- Added timeframes 30, 5 and 1 minutes.

Note: The gap between lines is the limitation of script. Draw a line manually to fill that for now.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.