OPEN-SOURCE SCRIPT

Atualizado Smash + Proba + BF

This script is designed to automatically display various levels that can be useful for trading.

These levels must be entered in the script as parameters in the form of lists separated by semicolons (";").

There are three groups of levels:

These levels must be entered in the script as parameters in the form of lists separated by semicolons (";").

There are three groups of levels:

- Smash: Levels provided in the Smashelito newsletter

- Proba: Probability levels (50% and 70%) of reaching certain price points, calculated using options data

- BF: Option-related levels provided by Krechendo Connect / BlackFlag

Example :

Notas de Lançamento

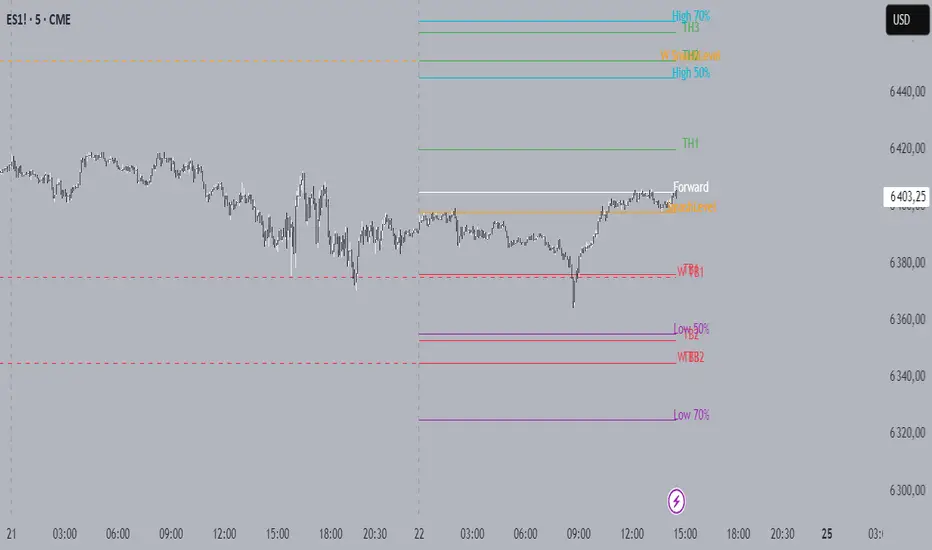

A comprehensive multi-timeframe support and resistance indicator that displays key trading levels across daily and weekly timeframes.Features

Daily Levels (Solid Lines)

Smash Level: Key breakout/breakdown level (Orange)

Target High 1-3 (TH1-TH3): Upside targets (Green)

Target Low 1-3 (TB1-TB3): Downside targets (Red)

Weekly Levels (Dashed Lines)

Same structure as daily levels but displayed across the entire current week

Semi-transparent styling for clear distinction from daily levels

Probability Levels

High 70%/50%: Upper probability zones (Aqua)

Low 50%/70%: Lower probability zones (Purple)

Book Flow (BF) Levels

Call Resistance: Key call option resistance levels (Lime)

Put Support: Key put option support levels (Red)

Dominant Buy/Sell: Order flow dominance levels (Green/Red)

HVL (High Volume Levels): Both regular and 0DTE versions (Blue)

1D Min/Max: Daily range extremes (Yellow)

Gamma Wall: Critical gamma hedging levels (Aqua)

Input Format

Enter levels separated by semicolons (;) in the format: Level1;Level2;Level3;etc.

Usage

Perfect for traders who need to track multiple support/resistance levels across different timeframes and market dynamics. The indicator automatically updates and extends lines as new bars form, providing real-time level tracking with clear visual differentiation between daily and weekly levels.

Notas de Lançamento

# Smash + Proba + BF Levels IndicatorA comprehensive multi-timeframe support and resistance indicator that displays key trading levels across daily and weekly timeframes.

## Features

### Daily Levels (Solid Lines)

- **Smash Level**: Key breakout/breakdown level (Orange)

- **Target High 1-3 (TH1-TH3)**: Upside targets (Green)

- **Target Low 1-3 (TB1-TB3)**: Downside targets (Red)

### Weekly Levels (Dashed Lines)

- Same structure as daily levels but displayed across the entire current week

- Semi-transparent styling for clear distinction from daily levels

### Probability Levels

- **High 70%/50%**: Upper probability zones (Aqua)

- **Low 50%/70%**: Lower probability zones (Purple)

### Book Flow (BF) Levels

- **Call Resistance**: Key call option resistance levels (Lime)

- **Put Support**: Key put option support levels (Red)

- **Dominant Buy/Sell**: Order flow dominance levels (Green/Red)

- **HVL (High Volume Levels)**: Both regular and 0DTE versions (Blue)

- **1D Min/Max**: Daily range extremes (Yellow)

- **Gamma Wall**: Critical gamma hedging levels (Aqua)

## Input Format

Enter levels separated by semicolons (;) in the format: `Level1;Level2;Level3;etc.`

## Usage

Perfect for traders who need to track multiple support/resistance levels across different timeframes and market dynamics. The indicator automatically updates and extends lines as new bars form, providing real-time level tracking with clear visual differentiation between daily and weekly levels.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.