OPEN-SOURCE SCRIPT

Atualizado X mirror

X σ Mirror — Volatility Projection & Price Action Guide

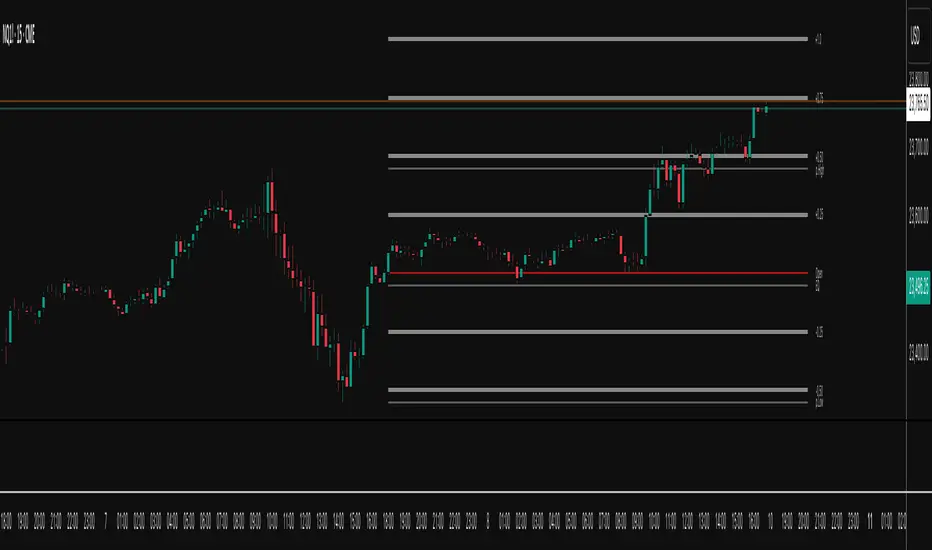

The X σ Mirror is a volatility-mapping tool that measures the prior period’s trading range, then mirrors and projects that range onto the current period. Anchored from the current period’s opening price, the indicator divides this projected range into quartiles, creating a structured price map that adapts to the asset’s recent volatility profile.

Core Methodology

Range Measurement – At the close of each user-selected higher timeframe (daily, 4-hour, weekly, etc.), the indicator captures the prior period’s high, low, and midpoint (equilibrium). This defines the “volatility envelope” for the next period.

Projection from the Open – The full prior range is projected above and below the current period’s open. This symmetrical mirroring anchors the volatility measurement to a logical starting point for intraperiod price movement.

Quartile Breakdown – The projected range is segmented into precise increments: 0.25×, 0.50×, 0.75×, 1.0×, 1.25×, 1.5×, and 2.0× of the prior range. These serve as price “checkpoints” that reflect proportional expansions or contractions relative to historical volatility.

How It Guides Price Action

Dynamic Support & Resistance – Quartile levels often act as temporary barriers or accelerators for price movement, highlighting areas where order flow may cluster.

Momentum Tracking – Price acceptance above successive quartiles suggests sustained directional strength, while repeated failures to breach a quartile indicate exhaustion.

Risk Management – The mirrored range and quartile levels help traders size positions, define stop placements, and set profit targets with volatility-adjusted precision.

Market Context – By anchoring the projection from the open, the indicator aligns volatility expectations with the session’s actual market structure, rather than static fixed levels.

Application

The X σ Mirror is adaptable across assets and timeframes, making it suitable for intraday traders tracking the unfolding session, as well as swing traders monitoring multi-day expansion potential. By combining historical range analysis with real-time market positioning, it provides a balanced framework for anticipating price behavior within a probabilistic structure.

The X σ Mirror is a volatility-mapping tool that measures the prior period’s trading range, then mirrors and projects that range onto the current period. Anchored from the current period’s opening price, the indicator divides this projected range into quartiles, creating a structured price map that adapts to the asset’s recent volatility profile.

Core Methodology

Range Measurement – At the close of each user-selected higher timeframe (daily, 4-hour, weekly, etc.), the indicator captures the prior period’s high, low, and midpoint (equilibrium). This defines the “volatility envelope” for the next period.

Projection from the Open – The full prior range is projected above and below the current period’s open. This symmetrical mirroring anchors the volatility measurement to a logical starting point for intraperiod price movement.

Quartile Breakdown – The projected range is segmented into precise increments: 0.25×, 0.50×, 0.75×, 1.0×, 1.25×, 1.5×, and 2.0× of the prior range. These serve as price “checkpoints” that reflect proportional expansions or contractions relative to historical volatility.

How It Guides Price Action

Dynamic Support & Resistance – Quartile levels often act as temporary barriers or accelerators for price movement, highlighting areas where order flow may cluster.

Momentum Tracking – Price acceptance above successive quartiles suggests sustained directional strength, while repeated failures to breach a quartile indicate exhaustion.

Risk Management – The mirrored range and quartile levels help traders size positions, define stop placements, and set profit targets with volatility-adjusted precision.

Market Context – By anchoring the projection from the open, the indicator aligns volatility expectations with the session’s actual market structure, rather than static fixed levels.

Application

The X σ Mirror is adaptable across assets and timeframes, making it suitable for intraday traders tracking the unfolding session, as well as swing traders monitoring multi-day expansion potential. By combining historical range analysis with real-time market positioning, it provides a balanced framework for anticipating price behavior within a probabilistic structure.

Notas de Lançamento

code clean upNotas de Lançamento

minor code clean up Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.