OPEN-SOURCE SCRIPT

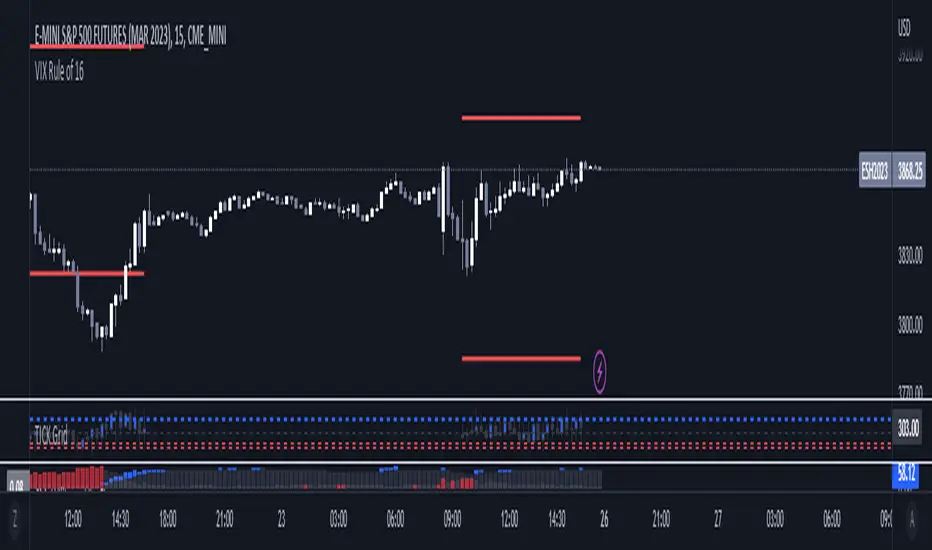

VIX Rule of 16

There’s an interesting aspect of VIX that has to do with the number 16. (approximately the square root of the number of trading days in a year).

In any statistical model, 68.2% of price movement falls within one standard deviation (1 SD ). The rest falls into the “tails” outside of 1 SD .

When you divide any implied volatility (IV) reading (such as VIX ) by 16, the annualized number becomes a daily number

The essence of the “rule of 16.” Once you get it, you can do all sorts of tricks with it.

If the VIX is trading at 16, then one-third of the time, the market expects the S&P 500 Index (SPX) to trade up or down by more than 1% (because 16/16=1). A VIX at 32 suggests a move up or down of more than 2% a third of the time, and so on.

• VIX of 16 – 1/3 of the time the SPX will have a daily change of at least 1%

• VIX of 32 – 1/3 of the time the SPX will have a daily change of at least 2%

• VIX of 48 – 1/3 of the time the SPX will have a daily change of at least 3%

In any statistical model, 68.2% of price movement falls within one standard deviation (1 SD ). The rest falls into the “tails” outside of 1 SD .

When you divide any implied volatility (IV) reading (such as VIX ) by 16, the annualized number becomes a daily number

The essence of the “rule of 16.” Once you get it, you can do all sorts of tricks with it.

If the VIX is trading at 16, then one-third of the time, the market expects the S&P 500 Index (SPX) to trade up or down by more than 1% (because 16/16=1). A VIX at 32 suggests a move up or down of more than 2% a third of the time, and so on.

• VIX of 16 – 1/3 of the time the SPX will have a daily change of at least 1%

• VIX of 32 – 1/3 of the time the SPX will have a daily change of at least 2%

• VIX of 48 – 1/3 of the time the SPX will have a daily change of at least 3%

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.