OPEN-SOURCE SCRIPT

Atualizado [blackcat] L1 Old Duck Head

Level 1

Background

The old duck head is a classic form formed by a series of behaviors such as bankers opening positions, washing dishes, and pulling over the top of the duck head.

Function

A form of stock candles:

(1) Moving averages using 5, 10 and 60 parameters. When the 5-day and 10-day moving averages crossed the 60-day moving average, a duck neck was formed.

(2) The high point when the stock price fell back formed a duck head.

(3) When the stock price fell back soon, the 5-day and 10-day moving averages again turned up to form a duckbill.

(4) Duck nose refers to the hole formed when the 5-day moving average crosses the 10-day moving average and the two lines cross again.

Market significance:

(1) When the dealer starts to collect chips, the stock price rises slowly, and the 5-day and 10-day moving averages cross the 60-day moving average, forming a duck neck.

(2) When the stock price of the banker shakes the position and starts to pull back, the high point of the stock price forms the top of the duck's head.

(3) When the dealer builds a position again to collect chips, the stock price rises again, forming a duck bill.

Operation method:

(1) Buy when the 5-day and 10-day moving averages cross the 60-day moving average and form a duck neck.

(2) Buy on dips near the sesame point of trading volume near the duckbill.

(3) Intervene when the stock price crosses the top of the duck's head in heavy volume.

The top of the duck’s head should be a little far away from the 60-day moving average, otherwise it means that the dealer is not willing to open a position at this old duck’s head, and the bottom of the old duck’s head must be heavy. Small is better, nothing is the strongest! There must be a lot of sesame dots under the nostrils of the duck, otherwise it means that the dealer has poor control. There must be ventilation under the duck bill, the higher the ventilation, the better!

Remarks

Feedbacks are appreciated.

Background

The old duck head is a classic form formed by a series of behaviors such as bankers opening positions, washing dishes, and pulling over the top of the duck head.

Function

A form of stock candles:

(1) Moving averages using 5, 10 and 60 parameters. When the 5-day and 10-day moving averages crossed the 60-day moving average, a duck neck was formed.

(2) The high point when the stock price fell back formed a duck head.

(3) When the stock price fell back soon, the 5-day and 10-day moving averages again turned up to form a duckbill.

(4) Duck nose refers to the hole formed when the 5-day moving average crosses the 10-day moving average and the two lines cross again.

Market significance:

(1) When the dealer starts to collect chips, the stock price rises slowly, and the 5-day and 10-day moving averages cross the 60-day moving average, forming a duck neck.

(2) When the stock price of the banker shakes the position and starts to pull back, the high point of the stock price forms the top of the duck's head.

(3) When the dealer builds a position again to collect chips, the stock price rises again, forming a duck bill.

Operation method:

(1) Buy when the 5-day and 10-day moving averages cross the 60-day moving average and form a duck neck.

(2) Buy on dips near the sesame point of trading volume near the duckbill.

(3) Intervene when the stock price crosses the top of the duck's head in heavy volume.

The top of the duck’s head should be a little far away from the 60-day moving average, otherwise it means that the dealer is not willing to open a position at this old duck’s head, and the bottom of the old duck’s head must be heavy. Small is better, nothing is the strongest! There must be a lot of sesame dots under the nostrils of the duck, otherwise it means that the dealer has poor control. There must be ventilation under the duck bill, the higher the ventilation, the better!

Remarks

Feedbacks are appreciated.

Notas de Lançamento

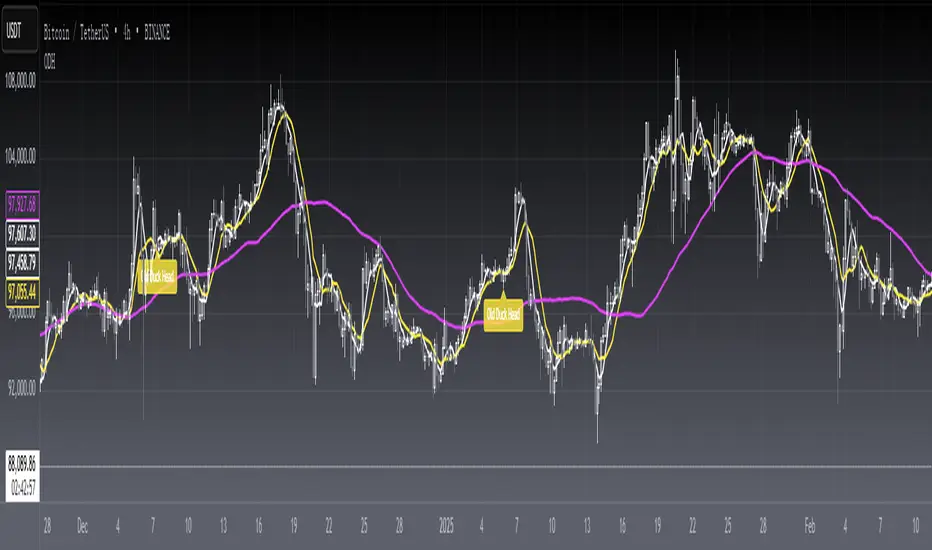

OVERVIEWThe L1 Old Duck Head indicator is a comprehensive trading tool designed to detect potential reversal patterns in financial markets. It combines multiple technical analysis components including moving averages and crossover patterns to identify bullish signals. The script uses three distinct moving averages (5-period, 10-period, and 60-period) to generate reliable entry points, making it particularly useful for traders looking to capitalize on market reversals.

FEATURES

• Dynamic Moving Averages: Three customizable MAs provide versatile trend identification:

Short-term MA (5-periods)

Medium-term MA (10-periods)

Long-term MA (60-periods)

• Pattern Recognition: Detects the "Old Duck Head" formation through specific conditions:

Crossovers between different MA periods

Consecutive cross-under checks

Price action analysis within defined ranges

• Signal Validation: Implements rigorous verification steps:

Checks for consecutive true conditions over a 5-bar period

Ensures proper relationship between MA crossovers

Validates price position relative to moving averages

HOW TO USE

Apply the indicator to your chart using the default settings.

Wait for the yellow "Old Duck Head" labels to appear, indicating potential buy signals.

Verify the signal strength by observing multiple consecutive occurrences.

Consider additional confirmation from other indicators before taking positions.

LIMITATIONS

⚠️ Please note:

The indicator may produce false signals during highly volatile market conditions.

Best suited for longer timeframe charts (Daily/Weekly).

Requires careful validation of signals before executing trades.

NOTES

This script was developed based on traditional technical analysis principles and should be used as part of a broader trading strategy. Always backtest thoroughly before applying to live markets.

THANKS

Special thanks to the TradingView community for providing valuable feedback and suggestions during development.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.