OPEN-SOURCE SCRIPT

Rate Of Change - Weekly Signals

Rate of Change - Weekly Signals

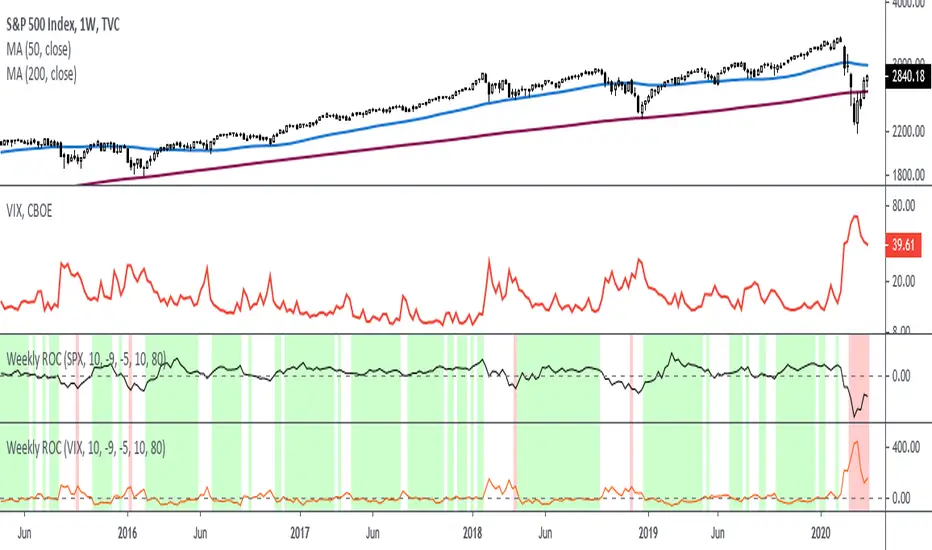

This indicator gives a potential "buy signal" using Rate of Change of SPX and VIX together,

using the following criteria:

SPX Weekly ROC(10) has been BELOW -9 and now rises ABOVE -5

*PLUS*

VIX Weekly ROC(10) has been ABOVE +80 and now falls BELOW +10

The background will turn RED when ROC(SPX) is below -9 and ROC(VIX) is above +80.

The background will turn GREEN when ROC(SPX) is above -5 and ROC(VIX) is below +10.

So the potential "buy signal" is when you start to get GREEN BARS AFTER RED - usually with

some white/empty bars in between...but wait for the green. This indicates that the volatility

has settled down, and the market is starting to turn up.

This indicator gives excellent entry points, but be careful of the occasional false signals.

See Nov. 2001 and Nov. 2008, in both cases the market dropped another 25-30% before the final

bottom was formed. Always have an exit strategy, especially when buying in after a downtrend.

How I use this indicator, pretty much as shown in the preview. Weekly SPX as the main chart with

some medium/long moving averages to identify the trend, VIX added as a "Compare Symbol" in red,

and then the Weekly ROC signals below.

For the ROC graphs, you can show SPX+VIX together, SPX alone, or VIX alone. I prefer to display

them separately because they don't scale well together (VIX crowds out the SPX when it spikes).

Background color is still based on both SPX/VIX together, regardless of which graph is shown.

Note that there is no VIX data available on Trading View prior to 1990, so for those dates the

formula is using only ROC(SPX) and the assigned thresholds (-9 and -5, or whatever you choose).

This indicator gives a potential "buy signal" using Rate of Change of SPX and VIX together,

using the following criteria:

SPX Weekly ROC(10) has been BELOW -9 and now rises ABOVE -5

*PLUS*

VIX Weekly ROC(10) has been ABOVE +80 and now falls BELOW +10

The background will turn RED when ROC(SPX) is below -9 and ROC(VIX) is above +80.

The background will turn GREEN when ROC(SPX) is above -5 and ROC(VIX) is below +10.

So the potential "buy signal" is when you start to get GREEN BARS AFTER RED - usually with

some white/empty bars in between...but wait for the green. This indicates that the volatility

has settled down, and the market is starting to turn up.

This indicator gives excellent entry points, but be careful of the occasional false signals.

See Nov. 2001 and Nov. 2008, in both cases the market dropped another 25-30% before the final

bottom was formed. Always have an exit strategy, especially when buying in after a downtrend.

How I use this indicator, pretty much as shown in the preview. Weekly SPX as the main chart with

some medium/long moving averages to identify the trend, VIX added as a "Compare Symbol" in red,

and then the Weekly ROC signals below.

For the ROC graphs, you can show SPX+VIX together, SPX alone, or VIX alone. I prefer to display

them separately because they don't scale well together (VIX crowds out the SPX when it spikes).

Background color is still based on both SPX/VIX together, regardless of which graph is shown.

Note that there is no VIX data available on Trading View prior to 1990, so for those dates the

formula is using only ROC(SPX) and the assigned thresholds (-9 and -5, or whatever you choose).

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.