PROTECTED SOURCE SCRIPT

Atualizado Fibonacci Dynamic Levels

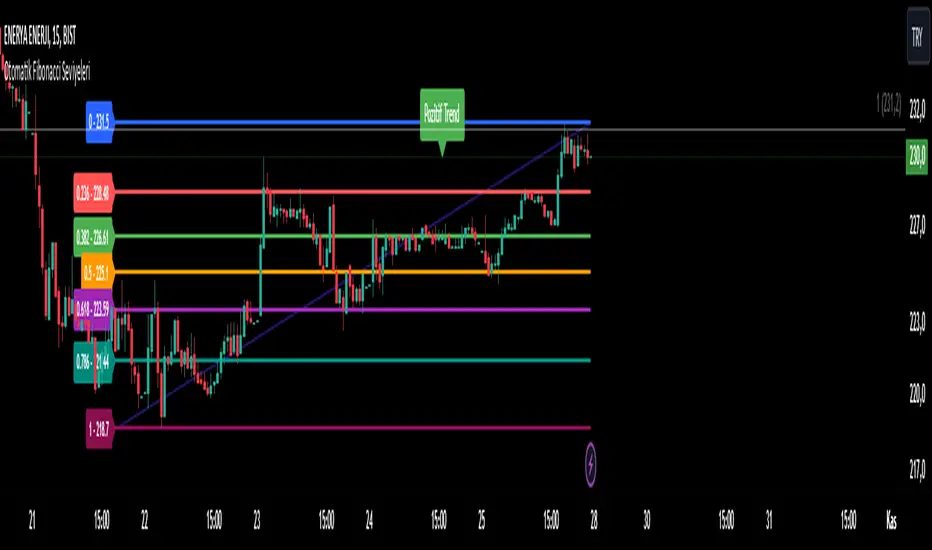

This Pine Script code implements an Automatic Fibonacci Levels indicator for TradingView, designed to analyze market trends and visualize key Fibonacci retracement levels dynamically on the chart.

1. User Inputs and Settings

The script begins by defining several user-configurable settings. These include options to extend the Fibonacci lines left or right, display an anchor line (a diagonal line connecting the most recent swing high and low), and customize its color and width. Additionally, users can select the size of the swing detection (small, medium, or large) and enable or disable individual Fibonacci levels such as 0, 0.236, 0.382, and so forth, allowing for personalized adjustments based on trading preferences.

2. Trend Information

The script also incorporates a label that provides real-time trend information. Users can choose where to position this trend label on the chart (e.g., top right, bottom left), enhancing the indicator's usability by providing context on the market’s current direction.

3. Swing Detection

A crucial part of the script involves detecting swing highs and lows based on the selected swing size. This is achieved by applying a lookback period (34, 89, or 144 bars) to determine the highest and lowest points within that range. This detection is pivotal for accurately calculating the Fibonacci levels based on the identified swing points.

4. Fibonacci Level Calculation

The Fibonacci levels are drawn dynamically based on the trend direction determined by comparing the current price with a simple moving average (SMA) over 50 periods.

In a downtrend, Fibonacci levels are calculated from the swing low to the swing high, indicating potential resistance levels where prices might retrace.

Conversely, in an uptrend, Fibonacci levels are calculated from the swing high to the swing low, highlighting potential support levels where prices could bounce back.

For each Fibonacci level that is enabled, the script creates a line and a corresponding label displaying the level value and price, providing clear visual cues for traders.

5. Anchor Line Feature

The anchor line visually connects the most recent swing high and low points, offering a quick reference for traders to gauge the price action's context. This line is updated dynamically as new swing points are detected, reflecting the most current market conditions.

6. Trend Label

The trend label provides a summary of the market trend—either positive (uptrend), negative (downtrend), or flat. This label updates in real time, ensuring traders can quickly ascertain the prevailing market sentiment at a glance.

7. Cleanup Mechanism

Finally, the script includes mechanisms to clean up the drawn lines and labels whenever conditions change or when settings are modified. This ensures that the chart remains uncluttered and only displays relevant information based on the user's current settings.

1. User Inputs and Settings

The script begins by defining several user-configurable settings. These include options to extend the Fibonacci lines left or right, display an anchor line (a diagonal line connecting the most recent swing high and low), and customize its color and width. Additionally, users can select the size of the swing detection (small, medium, or large) and enable or disable individual Fibonacci levels such as 0, 0.236, 0.382, and so forth, allowing for personalized adjustments based on trading preferences.

2. Trend Information

The script also incorporates a label that provides real-time trend information. Users can choose where to position this trend label on the chart (e.g., top right, bottom left), enhancing the indicator's usability by providing context on the market’s current direction.

3. Swing Detection

A crucial part of the script involves detecting swing highs and lows based on the selected swing size. This is achieved by applying a lookback period (34, 89, or 144 bars) to determine the highest and lowest points within that range. This detection is pivotal for accurately calculating the Fibonacci levels based on the identified swing points.

4. Fibonacci Level Calculation

The Fibonacci levels are drawn dynamically based on the trend direction determined by comparing the current price with a simple moving average (SMA) over 50 periods.

In a downtrend, Fibonacci levels are calculated from the swing low to the swing high, indicating potential resistance levels where prices might retrace.

Conversely, in an uptrend, Fibonacci levels are calculated from the swing high to the swing low, highlighting potential support levels where prices could bounce back.

For each Fibonacci level that is enabled, the script creates a line and a corresponding label displaying the level value and price, providing clear visual cues for traders.

5. Anchor Line Feature

The anchor line visually connects the most recent swing high and low points, offering a quick reference for traders to gauge the price action's context. This line is updated dynamically as new swing points are detected, reflecting the most current market conditions.

6. Trend Label

The trend label provides a summary of the market trend—either positive (uptrend), negative (downtrend), or flat. This label updates in real time, ensuring traders can quickly ascertain the prevailing market sentiment at a glance.

7. Cleanup Mechanism

Finally, the script includes mechanisms to clean up the drawn lines and labels whenever conditions change or when settings are modified. This ensures that the chart remains uncluttered and only displays relevant information based on the user's current settings.

Notas de Lançamento

UpdateInformation on Swing Size Conversion

In this indicator, the "Swing Size" setting is used to analyze price movements and accurately identify trend changes. There are four different options available: "small," "medium," "large," and "xlarge."

Small: Uses a 34-bar lookback to capture small fluctuations, making it suitable for short-term trading.

Medium: Utilizes an 89-bar lookback to identify medium-sized swings, providing a balanced approach.

Large: Applies a 144-bar lookback to analyze larger fluctuations and determine longer-term trends.

Xlarge: Employs a 233-bar lookback to capture very large swings, offering a broader perspective.

Each size option helps traders pinpoint the most appropriate swing points for their trading strategies. This ensures that Fibonacci levels are always drawn between accurate points, enabling more reliable buy and sell decisions.

Notas de Lançamento

The recent updates to the "Automatic Fibonacci Levels" indicator code introduce significant flexibility. The first update allows users to change the position of the Fibonacci level labels to either "Start" or "End," enabling them to better adjust the appearance on the chart according to their preferences. The second update permits the repositioning of the trend information label, allowing users to display it above the most recent candle, at the highest price, or at the lowest price. These enhancements aim to improve user experience and customization options.Notas de Lançamento

ALARM UPDATESWith the latest update, alarm features have been added to send instant notifications to users when Fibonacci levels are breached, either upward or downward. This enhancement allows for more effective evaluation of trading opportunities by monitoring movements at specific levels. Additionally, a hash code has been included for each transaction to facilitate better management of the code and track changes. This hash code uniquely identifies each version of the indicator, enabling users to easily follow updates and compare them with previous versions. As a result, users can enjoy an improved experience while technical developments are supported in a sustainable manner.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.