OPEN-SOURCE SCRIPT

PCE Inflation Monitor (Change YoY & MoM)

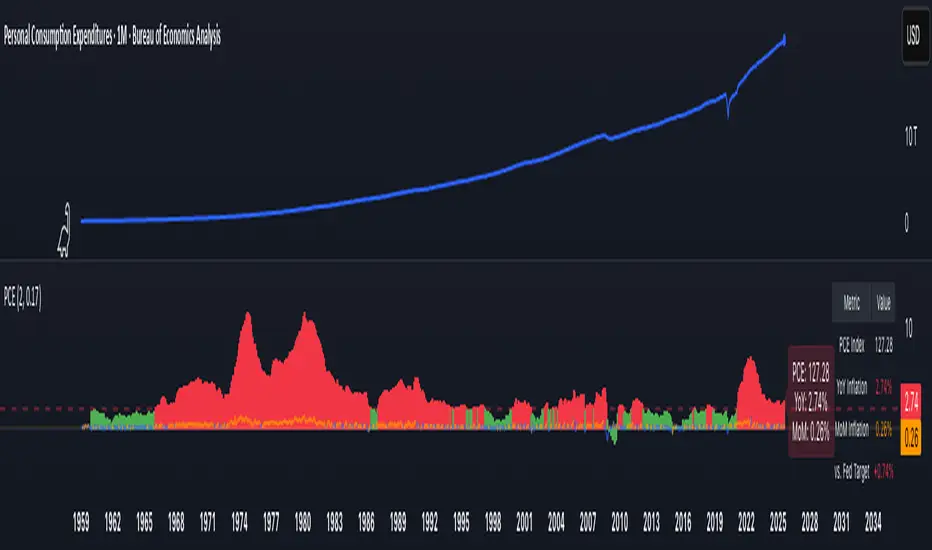

📊 PCE Inflation Monitor - The Fed's Most Important Metric

Personal Consumption Expenditures (PCE) is the Federal Reserve's preferred inflation measure and THE metric they target for their 2% inflation goal. If you want to predict Fed policy, you need to watch PCE.

🎯 KEY FEATURES:

- Dual Perspective Analysis:

- Year-over-Year (YoY): Histogram bars showing annual PCE inflation

- Month-over-Month (MoM): Line overlay showing monthly consumption price changes

- Visual Reference System:

- Dashed line at 2% (Fed's official PCE inflation target)

- Dotted line at 0.17% (equivalent monthly target)

- Color-coded bars: Red above Fed target, Green below target

- Real-Time Data Table:

- Current PCE Index value

- YoY inflation rate vs. Fed's 2% target

- MoM inflation rate with color coding

- Exact deviation from Fed target (critical for policy predictions)

- Automated Alerts:

- PCE crosses Fed's 2% target (major policy signal!)

- MoM crosses monthly target

- Stay informed of Fed-relevant inflation changes

📈 WHY PCE IS DIFFERENT (AND MORE IMPORTANT):

PCE vs. CPI differences:

- Flexible basket: PCE adjusts for substitution (beef → chicken if prices rise)

- Broader coverage: Includes healthcare paid by insurance/government

- Lower readings: Typically 0.2-0.4% below CPI

- Fed's choice: Explicitly stated as their target metric

Most importantly: When Powell speaks about "our 2% target," he means PCE, not CPI!

🔍 TRADING IMPLICATIONS:

PCE Above 2% (Red Zone):

→ Fed under pressure to maintain/raise rates

→ Hawkish policy stance likely

→ Negative for growth stocks, crypto

→ Positive for USD, bearish for gold

PCE Below 2% (Green Zone):

→ Fed has flexibility to cut rates

→ Dovish policy stance possible

→ Positive for risk assets, growth stocks

→ Negative for USD, bullish for commodities

PCE Approaching 2% from Above:

→ Fed "mission accomplished" narrative

→ Rate cut cycle becomes possible

→ Major bullish signal for equities/crypto

💡 ADVANCED STRATEGIES:

1. Fed Meeting Preparation: Check PCE before FOMC meetings for policy clues

2. Dot Plot Predictions: PCE trend determines Fed's rate forecast updates

3. Pivot Timing: When PCE MoM turns negative, Fed pivot becomes realistic

4. Press Conference Analysis: Compare Powell's comments to PCE deviation

🎯 KEY LEVELS TO WATCH:

- 2.0% YoY: Fed's official target - crossing this level is major news

- 2.5% YoY: "Uncomfortably high" - Fed forced to stay restrictive

- 3.0% YoY: "Crisis mode" - Fed turns very hawkish

- 1.5% YoY: "Below target" - Rate cuts become likely

🔄 COMBINE WITH:

- CPI: Public perception vs. Fed's metric (often diverge)

- Core PCE: Even more important (excludes food/energy volatility)

- Fed Funds Rate: Is Fed responding appropriately to PCE?

📊 DATA SOURCE:

Official PCE data from FRED (Federal Reserve Economic Data), updated monthly typically in the last week of each month (after CPI/PPI releases).

🎨 CUSTOMIZATION:

Fully customizable:

- Toggle YoY/MoM displays

- Adjust Fed target if needed

- Customize colors

- Show/hide absolute PCE values

Perfect for: Fed watchers, macro traders, policy analysts, and serious investors who want to predict monetary policy changes before they happen.

⚠️ CRITICAL INSIGHT: While media focuses on CPI, the Fed focuses on PCE. Trade what the Fed trades, not what the headlines say.

🎓 Pro Tip: Fed members often mention "Core PCE" (excluding food/energy). Consider adding that indicator alongside this one for complete Fed policy analysis.

Personal Consumption Expenditures (PCE) is the Federal Reserve's preferred inflation measure and THE metric they target for their 2% inflation goal. If you want to predict Fed policy, you need to watch PCE.

🎯 KEY FEATURES:

- Dual Perspective Analysis:

- Year-over-Year (YoY): Histogram bars showing annual PCE inflation

- Month-over-Month (MoM): Line overlay showing monthly consumption price changes

- Visual Reference System:

- Dashed line at 2% (Fed's official PCE inflation target)

- Dotted line at 0.17% (equivalent monthly target)

- Color-coded bars: Red above Fed target, Green below target

- Real-Time Data Table:

- Current PCE Index value

- YoY inflation rate vs. Fed's 2% target

- MoM inflation rate with color coding

- Exact deviation from Fed target (critical for policy predictions)

- Automated Alerts:

- PCE crosses Fed's 2% target (major policy signal!)

- MoM crosses monthly target

- Stay informed of Fed-relevant inflation changes

📈 WHY PCE IS DIFFERENT (AND MORE IMPORTANT):

PCE vs. CPI differences:

- Flexible basket: PCE adjusts for substitution (beef → chicken if prices rise)

- Broader coverage: Includes healthcare paid by insurance/government

- Lower readings: Typically 0.2-0.4% below CPI

- Fed's choice: Explicitly stated as their target metric

Most importantly: When Powell speaks about "our 2% target," he means PCE, not CPI!

🔍 TRADING IMPLICATIONS:

PCE Above 2% (Red Zone):

→ Fed under pressure to maintain/raise rates

→ Hawkish policy stance likely

→ Negative for growth stocks, crypto

→ Positive for USD, bearish for gold

PCE Below 2% (Green Zone):

→ Fed has flexibility to cut rates

→ Dovish policy stance possible

→ Positive for risk assets, growth stocks

→ Negative for USD, bullish for commodities

PCE Approaching 2% from Above:

→ Fed "mission accomplished" narrative

→ Rate cut cycle becomes possible

→ Major bullish signal for equities/crypto

💡 ADVANCED STRATEGIES:

1. Fed Meeting Preparation: Check PCE before FOMC meetings for policy clues

2. Dot Plot Predictions: PCE trend determines Fed's rate forecast updates

3. Pivot Timing: When PCE MoM turns negative, Fed pivot becomes realistic

4. Press Conference Analysis: Compare Powell's comments to PCE deviation

🎯 KEY LEVELS TO WATCH:

- 2.0% YoY: Fed's official target - crossing this level is major news

- 2.5% YoY: "Uncomfortably high" - Fed forced to stay restrictive

- 3.0% YoY: "Crisis mode" - Fed turns very hawkish

- 1.5% YoY: "Below target" - Rate cuts become likely

🔄 COMBINE WITH:

- CPI: Public perception vs. Fed's metric (often diverge)

- Core PCE: Even more important (excludes food/energy volatility)

- Fed Funds Rate: Is Fed responding appropriately to PCE?

📊 DATA SOURCE:

Official PCE data from FRED (Federal Reserve Economic Data), updated monthly typically in the last week of each month (after CPI/PPI releases).

🎨 CUSTOMIZATION:

Fully customizable:

- Toggle YoY/MoM displays

- Adjust Fed target if needed

- Customize colors

- Show/hide absolute PCE values

Perfect for: Fed watchers, macro traders, policy analysts, and serious investors who want to predict monetary policy changes before they happen.

⚠️ CRITICAL INSIGHT: While media focuses on CPI, the Fed focuses on PCE. Trade what the Fed trades, not what the headlines say.

🎓 Pro Tip: Fed members often mention "Core PCE" (excluding food/energy). Consider adding that indicator alongside this one for complete Fed policy analysis.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.