OPEN-SOURCE SCRIPT

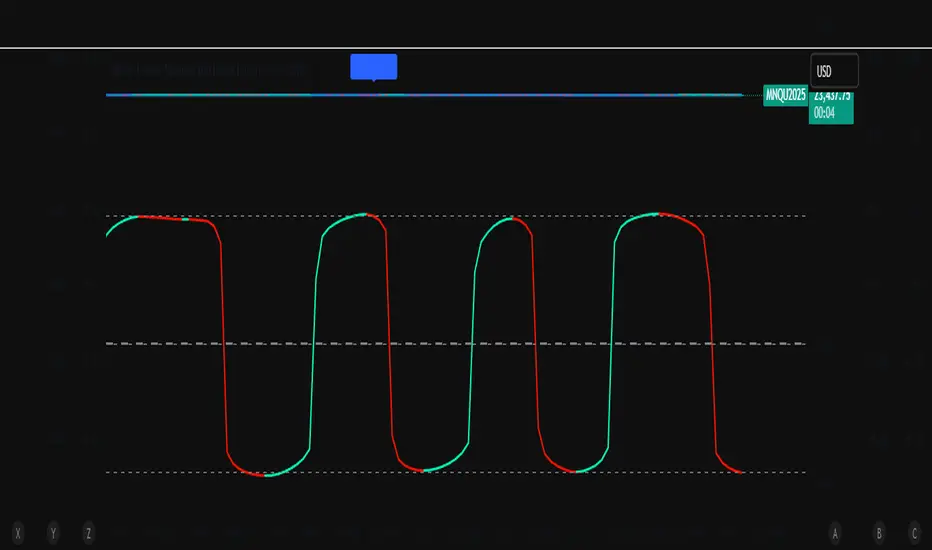

ZoneShift+StochZ+LRO + AI Breakout Bands [Combined]

This composite Pine Script brings together four powerful trend and momentum tools into a single, easy-to-read overlay:

ZoneShift

Computes a dynamic “zone” around price via an EMA/HMA midpoint ± average high-low range.

Flags flips when price closes convincingly above or below that zone, coloring candles and drawing the zone lines in bullish or bearish hues.

Stochastic Z-Score

Converts your chosen price series into a statistical Z-score, then runs a Stochastic oscillator on it and HMA-smooths the result.

Marks momentum flips in extreme over-sold (below –2) or over-bought (above +2) territory.

Linear Regression Oscillator (LRO)

Builds a bar-indexed linear regression, normalizes it to standard deviations, and shows area-style up/down coloring.

Highlights local reversals when the oscillator crosses its own look-back values, and optionally plots LRO-colored candles on price.

AI Breakout Bands (Kalman + KNN)

Applies a Kalman filter to price, smooths it further with a KNN-weighted average, then measures mean-absolute-error bands around that smoothed line.

Colors the Kalman trend line and bands for bullish/bearish breaks, giving you a data-driven channel to trade.

Composite Signals & Alerts

Whenever the ZoneShift flip, Stoch Z-Score flip, and LRO reversal all agree and price breaks the AI bands in the same direction, the script plots a clear ▲ (bull) or ▼ (bear) on the chart and fires an alert. This triple-confirmation approach helps you zero in on high-probability reversal points, filtering out noise and combining trend, momentum, and statistical breakout criteria into one unified signal.

ZoneShift

Computes a dynamic “zone” around price via an EMA/HMA midpoint ± average high-low range.

Flags flips when price closes convincingly above or below that zone, coloring candles and drawing the zone lines in bullish or bearish hues.

Stochastic Z-Score

Converts your chosen price series into a statistical Z-score, then runs a Stochastic oscillator on it and HMA-smooths the result.

Marks momentum flips in extreme over-sold (below –2) or over-bought (above +2) territory.

Linear Regression Oscillator (LRO)

Builds a bar-indexed linear regression, normalizes it to standard deviations, and shows area-style up/down coloring.

Highlights local reversals when the oscillator crosses its own look-back values, and optionally plots LRO-colored candles on price.

AI Breakout Bands (Kalman + KNN)

Applies a Kalman filter to price, smooths it further with a KNN-weighted average, then measures mean-absolute-error bands around that smoothed line.

Colors the Kalman trend line and bands for bullish/bearish breaks, giving you a data-driven channel to trade.

Composite Signals & Alerts

Whenever the ZoneShift flip, Stoch Z-Score flip, and LRO reversal all agree and price breaks the AI bands in the same direction, the script plots a clear ▲ (bull) or ▼ (bear) on the chart and fires an alert. This triple-confirmation approach helps you zero in on high-probability reversal points, filtering out noise and combining trend, momentum, and statistical breakout criteria into one unified signal.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.