PROTECTED SOURCE SCRIPT

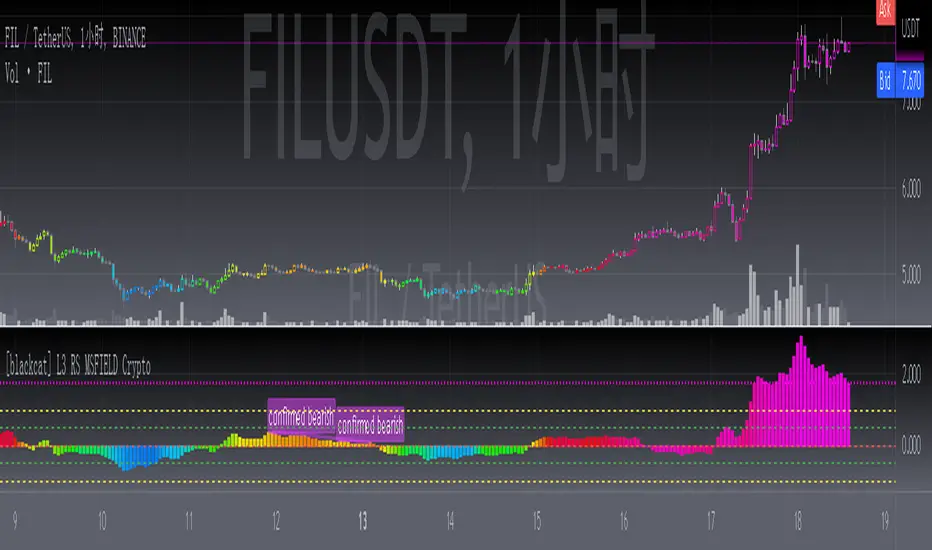

Atualizado [blackcat] L3 RS MSFIELD Crypto

Level: 3

Background

When a wave of market conditions in the cryptocurrency market comes, how do you choose which cryptocurrency target to operate?

Function

The function of this indicator is to compare the strength of a single target with the strength of the crypto market. For any cryptocurrency, if its strength is lower than the rise of the cryptocurrency index, then this target is a manifestation of weakness, and you can short it at this time. On the contrary, if a single target rises higher than the cryptocurrency index, then it may be the leader of this wave of market. Therefore, in a bull market, those indicators that are stronger than the crypto market should be our long-term targets; in a bear market, Those indicators that are weaker than the crypto market are all short-selling targets that we should pay attention to.

Its specific use method is as follows:

1. If the market is in the recovery period at the end of the bear market, the indicator can approach 0 from below 0. Its direction is continuously upward, which means that the target is in a rebound market and can be long. If the rising market continues and can maintain a strong market for a long time, the indicator must be in a strong area above the 0 axis. In the same way, the bear market adopts a strategy below the 0 axis.

2. If you want to achieve a stable transaction, the buying point for long positions must be above the 0 axis, and the selling point for short positions must be below the 0 axis.

3. If the retracement falls below the zero axis in the bull market, it means that it is not a market relay, but a market reversal.

4. This indicator does not provide specific buying and selling points, but can only provide a reference relative to the crypto market. The specific buying and selling points and trends still need to be realized in conjunction with other technical indicators.

I distinguish the trend strength by color, which can be interpreted corresponding to RSI 0-100:

1. Deep Bear 0-20, blue

2. Bearish 20-40, green

3. Shock market 40-60, yellow

5. Bullish 60-80, red

6. Deep Bull Market 80-100, Fuchsia

Remarks

This indicator DOES NOT provide long/short entry points. You need combine other indicators to trade.

Feedbacks are appreciated.

Background

When a wave of market conditions in the cryptocurrency market comes, how do you choose which cryptocurrency target to operate?

Function

The function of this indicator is to compare the strength of a single target with the strength of the crypto market. For any cryptocurrency, if its strength is lower than the rise of the cryptocurrency index, then this target is a manifestation of weakness, and you can short it at this time. On the contrary, if a single target rises higher than the cryptocurrency index, then it may be the leader of this wave of market. Therefore, in a bull market, those indicators that are stronger than the crypto market should be our long-term targets; in a bear market, Those indicators that are weaker than the crypto market are all short-selling targets that we should pay attention to.

Its specific use method is as follows:

1. If the market is in the recovery period at the end of the bear market, the indicator can approach 0 from below 0. Its direction is continuously upward, which means that the target is in a rebound market and can be long. If the rising market continues and can maintain a strong market for a long time, the indicator must be in a strong area above the 0 axis. In the same way, the bear market adopts a strategy below the 0 axis.

2. If you want to achieve a stable transaction, the buying point for long positions must be above the 0 axis, and the selling point for short positions must be below the 0 axis.

3. If the retracement falls below the zero axis in the bull market, it means that it is not a market relay, but a market reversal.

4. This indicator does not provide specific buying and selling points, but can only provide a reference relative to the crypto market. The specific buying and selling points and trends still need to be realized in conjunction with other technical indicators.

I distinguish the trend strength by color, which can be interpreted corresponding to RSI 0-100:

1. Deep Bear 0-20, blue

2. Bearish 20-40, green

3. Shock market 40-60, yellow

5. Bullish 60-80, red

6. Deep Bull Market 80-100, Fuchsia

Remarks

This indicator DOES NOT provide long/short entry points. You need combine other indicators to trade.

Feedbacks are appreciated.

Notas de Lançamento

delete someting uselessScript protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.