PROTECTED SOURCE SCRIPT

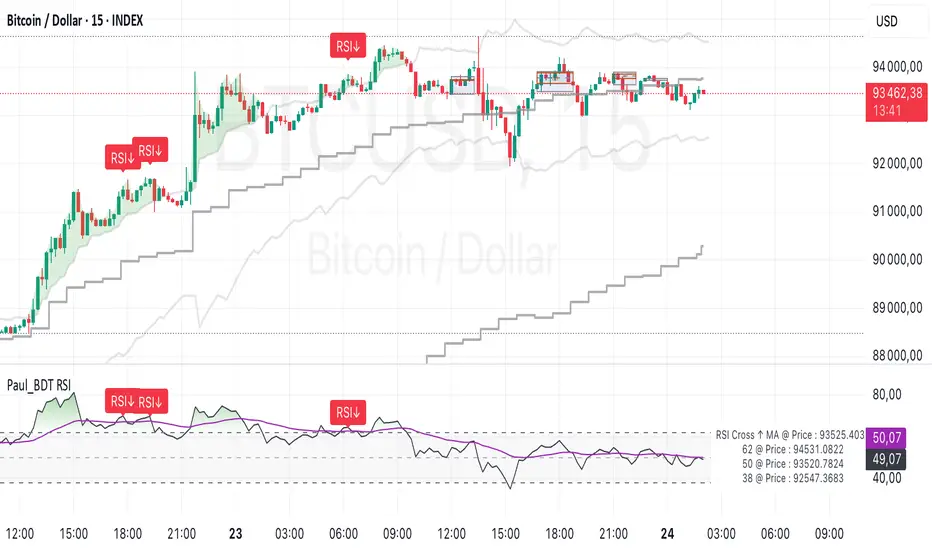

Atualizado Paul_BDT Osc. RSI with Divergence, Order Blocks & Channel

//=====================================================================

// Combination of:

// 1. Classic RSI with overbought/oversold thresholds

// 2. Adaptive bands on RSI (dynamically calculated with EMA of gains/losses)

// 3. Moving averages on RSI (optional, including SMA + Bollinger Bands)

// 4. Detection of RSI/price divergences (classic: bullish and bearish)

// 5. Detection of ranges (consolidation zones) with Order Blocks and extensions

// 6. Candle coloring based on dynamic RSI thresholds (breakout/breakdown)

//

// All with multi-timeframe options (displaying adaptive bands from a higher timeframe).

//=====================================================================

//=======================//

// 1. INPUTS (Parameters)

//=======================//

// RSI parameters: source, length, OB/OS thresholds, higher timeframe, divergence activation, adaptive bands display

// Smoothing parameters: choice of MA type applied to RSI (SMA, EMA, etc.) + optional Bollinger Bands

// Order Block parameters: display of ranges, order blocks, zone and candle colors

//=======================//

// 2. CALCULATIONS

//=======================//

// Base RSI calculated on the selected source (default: close)

// Smoothing: applies a chosen moving average to the RSI

// If 'SMA + Bollinger Bands' is selected, also calculates standard deviation to plot the bands

// Adaptive RSI bands: calculated via EMA method of gains/losses over a specific period (close to Wilder's RSI)

// Two adaptive thresholds are defined: upper (overbought) and lower (oversold), which adjust according to the market

// Multi-timeframes:

// Retrieves adaptive bands calculated on a higher timeframe (e.g., daily if TF = 'D')

// Allows overlaying adaptive RSI thresholds from different timeframes

// Dynamic definition of RSI thresholds for candle coloring:

// - Bullish/bearish center: 55/45

// - Adjusts the thresholds based on the price position relative to SMA 200 (if > SMA200, bullish center is used)

//=======================//

// 3. PLOTS (Displays)

//=======================//

// Display of the classic RSI with its OB/OS thresholds + gradient fill to better visualize the zones

// Display of moving averages on RSI and optional Bollinger Bands (if enabled)

// Display of adaptive RSI bands:

// - Those from the higher timeframe (always displayed)

// - Those from the current timeframe (optional display)

// Candle coloring (barcolor):

// - Green if RSI exceeds the dynamic upper threshold (breakout)

// - Red if RSI drops below the dynamic lower threshold (breakdown)

// - Specific color for candles within the neutral zone (range candle color)

//=======================//

// 4. DIVERGENCES

//=======================//

// Detection of regular RSI/price divergences:

// - Bullish divergence: price forms a new lower low, RSI forms a higher low

// - Bearish divergence: price forms a new higher high, RSI forms a lower high

// Display on the RSI panel:

// - Curves and labels (Bull/Bear) at divergence points

//=======================//

// 5. RANGE DETECTION & ORDER BLOCKS

//=======================//

// Automatic detection of ranges (consolidation zones):

// - Based on dynamic RSI thresholds (if RSI oscillates within a defined band)

// - Identifies the range's highs/lows (with configurable future extensions)

// Two types of zones plotted with 'boxes':

// 1. **Range close box**: frames the main consolidation zone (candle bodies)

// 2. **Order block box**: tighter zone around the extremes (highs/lows of closes)

// A midline is drawn at the center of the order block (dashed)

// If price breaks the range boundaries, the zone is removed (range ended)

// Combination of:

// 1. Classic RSI with overbought/oversold thresholds

// 2. Adaptive bands on RSI (dynamically calculated with EMA of gains/losses)

// 3. Moving averages on RSI (optional, including SMA + Bollinger Bands)

// 4. Detection of RSI/price divergences (classic: bullish and bearish)

// 5. Detection of ranges (consolidation zones) with Order Blocks and extensions

// 6. Candle coloring based on dynamic RSI thresholds (breakout/breakdown)

//

// All with multi-timeframe options (displaying adaptive bands from a higher timeframe).

//=====================================================================

//=======================//

// 1. INPUTS (Parameters)

//=======================//

// RSI parameters: source, length, OB/OS thresholds, higher timeframe, divergence activation, adaptive bands display

// Smoothing parameters: choice of MA type applied to RSI (SMA, EMA, etc.) + optional Bollinger Bands

// Order Block parameters: display of ranges, order blocks, zone and candle colors

//=======================//

// 2. CALCULATIONS

//=======================//

// Base RSI calculated on the selected source (default: close)

// Smoothing: applies a chosen moving average to the RSI

// If 'SMA + Bollinger Bands' is selected, also calculates standard deviation to plot the bands

// Adaptive RSI bands: calculated via EMA method of gains/losses over a specific period (close to Wilder's RSI)

// Two adaptive thresholds are defined: upper (overbought) and lower (oversold), which adjust according to the market

// Multi-timeframes:

// Retrieves adaptive bands calculated on a higher timeframe (e.g., daily if TF = 'D')

// Allows overlaying adaptive RSI thresholds from different timeframes

// Dynamic definition of RSI thresholds for candle coloring:

// - Bullish/bearish center: 55/45

// - Adjusts the thresholds based on the price position relative to SMA 200 (if > SMA200, bullish center is used)

//=======================//

// 3. PLOTS (Displays)

//=======================//

// Display of the classic RSI with its OB/OS thresholds + gradient fill to better visualize the zones

// Display of moving averages on RSI and optional Bollinger Bands (if enabled)

// Display of adaptive RSI bands:

// - Those from the higher timeframe (always displayed)

// - Those from the current timeframe (optional display)

// Candle coloring (barcolor):

// - Green if RSI exceeds the dynamic upper threshold (breakout)

// - Red if RSI drops below the dynamic lower threshold (breakdown)

// - Specific color for candles within the neutral zone (range candle color)

//=======================//

// 4. DIVERGENCES

//=======================//

// Detection of regular RSI/price divergences:

// - Bullish divergence: price forms a new lower low, RSI forms a higher low

// - Bearish divergence: price forms a new higher high, RSI forms a lower high

// Display on the RSI panel:

// - Curves and labels (Bull/Bear) at divergence points

//=======================//

// 5. RANGE DETECTION & ORDER BLOCKS

//=======================//

// Automatic detection of ranges (consolidation zones):

// - Based on dynamic RSI thresholds (if RSI oscillates within a defined band)

// - Identifies the range's highs/lows (with configurable future extensions)

// Two types of zones plotted with 'boxes':

// 1. **Range close box**: frames the main consolidation zone (candle bodies)

// 2. **Order block box**: tighter zone around the extremes (highs/lows of closes)

// A midline is drawn at the center of the order block (dashed)

// If price breaks the range boundaries, the zone is removed (range ended)

Notas de Lançamento

//=====================================================================RSI with Divergence, Order Blocks, Channel & Prediction panel

// Combines:

// 1. Classic RSI with overbought/oversold levels

// 2. Adaptive RSI bands (calculated dynamically with EMA of gains/losses)

// 3. Optional RSI smoothing and Bollinger Bands

// 4. Detection of regular RSI/price divergences (bullish and bearish)

// 5. Range detection (consolidation zones) with Order Blocks and dynamic extensions

// 6. Candle coloring based on dynamic RSI momentum thresholds (breakout/breakdown)

// 7. Reverse RSI price level panel for predictive price zones

//

// Features multi-timeframe adaptive bands display (current and higher timeframe).

//=====================================================================

//=======================//

// 1. INPUTS

//=======================//

// - RSI settings: source, length, overbought/oversold levels, higher timeframe, divergence activation and display, adaptive band display

// - Smoothing settings: moving average type for RSI (SMA, EMA, SMMA, WMA, VWMA, or SMA + Bollinger Bands)

// - Order Blocks settings: toggle range boxes, order block boxes, candle colors, customization of zone colors and extensions

// - Prediction panel: displays key RSI price levels (reverse-engineered from RSI thresholds)

// - Agreement toggle: confirms acceptance before usage

//=======================//

// 2. CALCULATIONS

//=======================//

// - Base RSI calculated from the chosen source

// - Optional smoothing applied to RSI with selected MA type (and Bollinger Bands if enabled)

// - Adaptive RSI bands calculated with EMA of gains/losses (close to Wilder's RSI method), dynamically adjusting overbought/oversold levels

// - Multi-timeframe support: fetches adaptive bands from a higher timeframe (e.g., daily) and displays them alongside current timeframe bands

// - Dynamic breakout thresholds based on the price position relative to the 200-period SMA:

// - Bullish center (55) if price > SMA200

// - Bearish center (45) if price <= SMA200

// - Spread of ±2 for breakout/breakdown zones

//=======================//

// 3. PLOTS

//=======================//

// - Classic RSI with overbought/oversold lines and background gradient fill

// - RSI smoothing (MA line) and optional Bollinger Bands

// - Adaptive RSI bands (current and higher timeframe)

// - Candle coloring (barcolor):

// - Green: breakout above upper momentum threshold

// - Red: breakdown below lower momentum threshold

// - Custom color within the neutral momentum zone

//=======================//

// 4. DIVERGENCES

//=======================//

// - Detects regular bullish and bearish RSI/price divergences:

// - Bullish: price forms lower lows, RSI forms higher lows

// - Bearish: price forms higher highs, RSI forms lower highs

// - Displays divergence labels on both the RSI panel and the chart

//=======================//

// 5. RANGE DETECTION & ORDER BLOCKS

//=======================//

// - Automatically detects consolidation ranges based on RSI momentum thresholds

// - Two box types drawn:

// 1. **Range close box**: frames the primary consolidation zone (candle bodies)

// 2. **Order block box**: tighter zone around extreme closes (highs/lows)

// - Midline plotted at the center of the order block box (dashed line)

// - Range zones are dynamically extended into the future and removed if the price breaks out of range

//=======================//

// 6. REVERSE RSI PRICE PANEL

//=======================//

// - Reverse RSI calculations to project RSI threshold levels back to price values:

// - Displays projected prices for RSI 50 crossing, overbought/oversold levels, and user-defined RSI value

// - Price prediction panel shows these levels with custom offsets and decimal precision

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.