OPEN-SOURCE SCRIPT

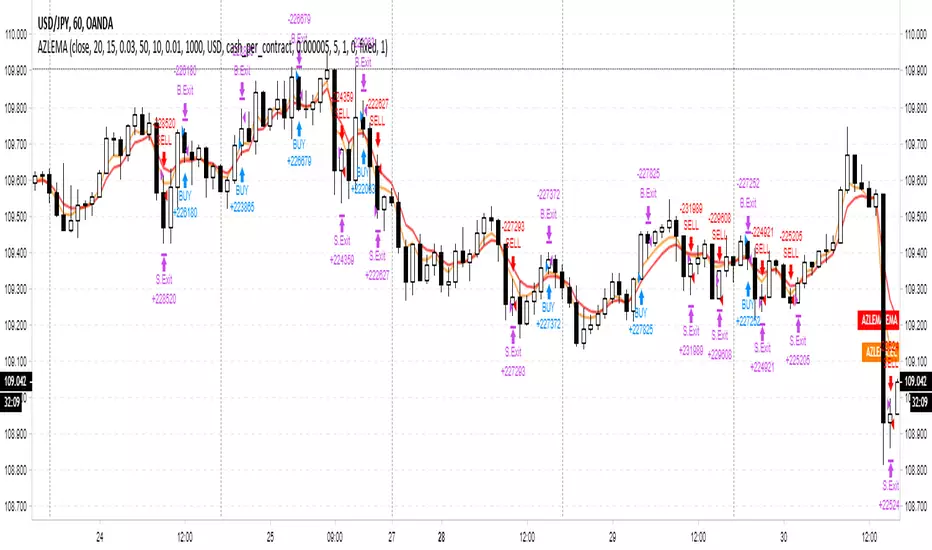

Adaptive Zero Lag EMA Strategy [Ehlers + Ric]

Behold! A strategy that makes use of Ehlers research into the field of signal processing and wins so consistently, on multiple time frames AND on multiple currency pairs.

The Adaptive Zero Lag EMA (AZLEMA) is based on an informative report by Ehlers and Ric [1].

I've modified it by using Cosine IFM, a method by Ehlers on determining the dominant cycle period without using fast-Fourier transforms [2] [3]

Instead, we use some basic differential equations that are simplified to approximate the cycle period over a 100 bar sample size.

The settings for this strategy allow you to scalp or swing trade! High versatility!

Since this strategy is frequency based, you can run it on any timeframe (M1 is untested) and even have the option of using adaptive settings for a best-fit.

>Settings

[1] mesasoftware.com/papers/ZeroLag.pdf

[2] jamesgoulding.com/Research_II/Ehlers/Ehlers (Measuring Cycles).doc

[3]![Cosine IFM [Ehlers]](https://s3.tradingview.com/5/5WqrAJgu_mid.png)

The Adaptive Zero Lag EMA (AZLEMA) is based on an informative report by Ehlers and Ric [1].

I've modified it by using Cosine IFM, a method by Ehlers on determining the dominant cycle period without using fast-Fourier transforms [2] [3]

Instead, we use some basic differential equations that are simplified to approximate the cycle period over a 100 bar sample size.

The settings for this strategy allow you to scalp or swing trade! High versatility!

Since this strategy is frequency based, you can run it on any timeframe (M1 is untested) and even have the option of using adaptive settings for a best-fit.

>Settings

- Source : Choose the value for calculations (close, open, high + low / 2, etc...)

- Period : Choose the dominant cycle for the ZLEMA (typically under 100)

- Adaptive? : Allow the strategy to continuously update the Period for you (disables Period setting)

- Gain Limit : Higher = faster response. Lower = smoother response. See [2] for more information.

- Threshold : Provides a bit more control over entering a trade. Lower = less selective. Higher = More selective. (range from 0 to 1)

- SL Points : Stop Poss level in points (10 points = 1 pip)

- TP Points : Take Profit level in points

- Risk : Percent of current balance to risk on each trade (0.01 = 1%)

[1] mesasoftware.com/papers/ZeroLag.pdf

[2] jamesgoulding.com/Research_II/Ehlers/Ehlers (Measuring Cycles).doc

[3]

![Cosine IFM [Ehlers]](https://s3.tradingview.com/5/5WqrAJgu_mid.png)

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Algo Trading Simplified 👉 PaxProfits.com

Discover the easy way to manage Forex trading accounts. Trusted by traders globally.

Discover the easy way to manage Forex trading accounts. Trusted by traders globally.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Algo Trading Simplified 👉 PaxProfits.com

Discover the easy way to manage Forex trading accounts. Trusted by traders globally.

Discover the easy way to manage Forex trading accounts. Trusted by traders globally.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.