OPEN-SOURCE SCRIPT

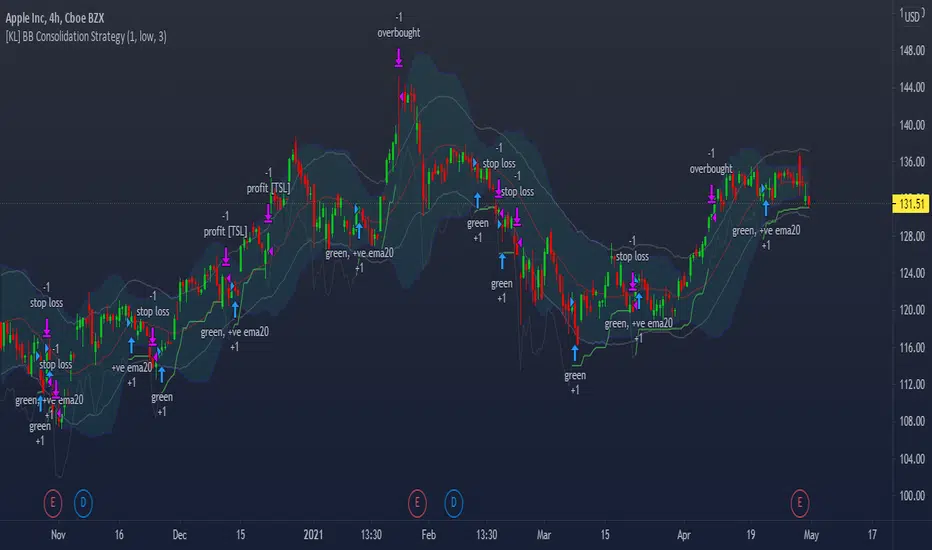

Atualizado [KL] Bollinger Bands Consolidation Strategy

This strategy will enter into long position based on the volatility of prices implied by indicators of (a) Bollinger bands, and (b) ATR.

Application of Bollinger bands ("BOLL")

Using plain vanilla settings for BOLL (i.e. 20 period moving average, and 2 standard deviations of closing prices), we are interested to know about the shape of the area that is bounded by the upper and lower bands.

In theory, consolidation happens when volatility of price decreases. Visually speaking, this is represented by the narrowing of the upper/lower bands. This strategy considers the narrowing of BOLL bands as the primary indicator for long-entry.

Application of ATRs (as confirmations)

Firstly, to confirm that BOLL bands are narrowing (as mentioned above), the ATR at a potential point of entry is compared against the standard deviation of prices over BOLL's lookback periods. Once again, visualizing the shape of BOLL bands during consolidation, we assume the lines begin to squeeze when the distance between the center line and upper/lower band is less than two current ATRs.

Secondly, this strategy looks into the moving average of ATRs to assure that prices are not too choppy when entering into market. If the moving average of ATR decreases at a point in time such that all the above conditions are met, then we can assert that the volatility of price is decreasing.

Thirdly, ATR is used for determining the size of our trailing stop loss. We will keep the multiplier fixed at two.

Application of Bollinger bands ("BOLL")

Using plain vanilla settings for BOLL (i.e. 20 period moving average, and 2 standard deviations of closing prices), we are interested to know about the shape of the area that is bounded by the upper and lower bands.

In theory, consolidation happens when volatility of price decreases. Visually speaking, this is represented by the narrowing of the upper/lower bands. This strategy considers the narrowing of BOLL bands as the primary indicator for long-entry.

Application of ATRs (as confirmations)

Firstly, to confirm that BOLL bands are narrowing (as mentioned above), the ATR at a potential point of entry is compared against the standard deviation of prices over BOLL's lookback periods. Once again, visualizing the shape of BOLL bands during consolidation, we assume the lines begin to squeeze when the distance between the center line and upper/lower band is less than two current ATRs.

Secondly, this strategy looks into the moving average of ATRs to assure that prices are not too choppy when entering into market. If the moving average of ATR decreases at a point in time such that all the above conditions are met, then we can assert that the volatility of price is decreasing.

Thirdly, ATR is used for determining the size of our trailing stop loss. We will keep the multiplier fixed at two.

Notas de Lançamento

Added a dropdown menu in Settings allowing user to select between different buy setups.Notas de Lançamento

- Added lines plotting ATR relative to center line of Bollinger bands- Added additional buy confirmation signals (i.e. MACD) for entry during consolidation

- Added exit signals, selectable in settings (i.e. risk-reward ratio, and bearish price action signals)

Notas de Lançamento

Added option to ignore exit signals during consolidation (unless hitting stop loss)Notas de Lançamento

What's new in the latest update:- added alerts

- additional buy and exit setups

Notas de Lançamento

Reduced the frequency of alertsNotas de Lançamento

Combined entry and exit confirmations, script will now apply setups in combinations, no longer need to select them individually in settings.Notas de Lançamento

- Simplified entry setup by reducing the number of confirmations to looks for (i.e. no need to refer to MACD when there is not much price momentum during squeeze)- For exit signal with respect to bearish candlesticks, script will now consider the length of red-bar vs ATR

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Read Faster & Learn Anything with Coral AI! getcoralai.com//?ref=dojiemoji

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Read Faster & Learn Anything with Coral AI! getcoralai.com//?ref=dojiemoji

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.