OPEN-SOURCE SCRIPT

Standard Deviation of Returns: Divergence

Purpose:

The "Standard Deviation of Returns: Divergence" indicator is designed to help traders identify potential trend reversals or continuation signals by analyzing divergences between price action and the statistical volatility of returns. Divergences can signal weakening momentum in the prevailing trend, offering insight into potential buying or selling opportunities.

Key Components

1. Returns Calculation:

* The indicator uses logarithmic returns (log(close / close[1])) to measure relative price changes in a normalized manner.

* Log returns are more effective than simple price differences when analyzing data across varying price levels, as they account for percentage-based changes.

2. Standard Deviation of Returns:

* The script computes the standard deviation of returns over a user-defined lookback period (ta.stdev(returns, lookback)).

* Standard deviation measures the dispersion of returns around their average, effectively quantifying market volatility.

* A higher standard deviation indicates increased volatility, while lower standard deviation reflects a calmer market.

3. Price Action:

* Detects higher highs (new peaks in price) and lower lows (new troughs in price) over the lookback period.

* Price trends are compared to the behavior of the standard deviation.

4. Divergence Detection:

A divergence occurs when price action (higher highs or lower lows) is not confirmed by a corresponding movement in standard deviation:

Bullish Divergence: Price makes a lower low, but the standard deviation does not, signaling potential upward momentum.

Bearish Divergence: Price makes a higher high, but the standard deviation does not, signaling potential downward momentum.

5. Visual Cues:

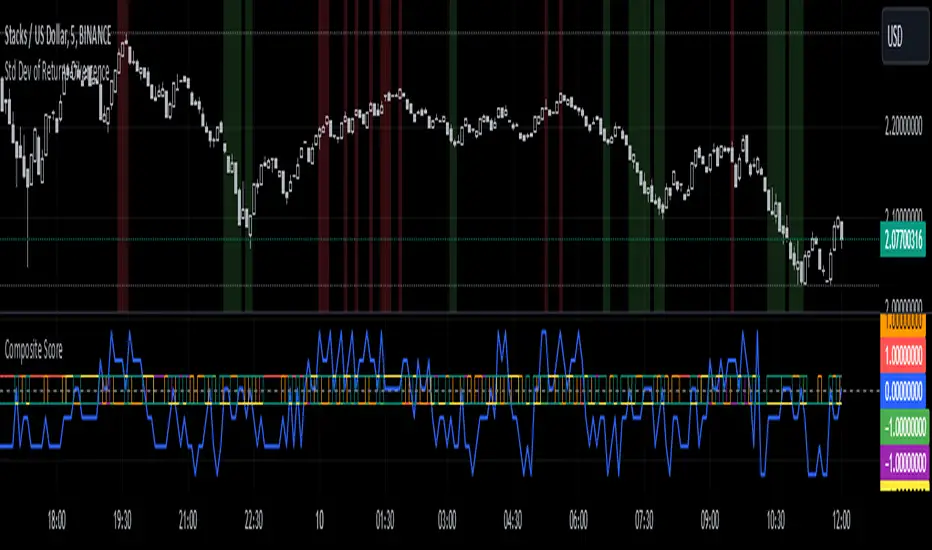

The script highlights divergence regions directly on the chart:

Green Background: Indicates a bullish divergence (potential buy signal).

Red Background: Indicates a bearish divergence (potential sell signal).

How It Works

Inputs:

* The user specifies the lookback period (lookback) for calculating the standard deviation and detecting divergences.

Calculation:

* Each bar’s returns are computed and used to calculate the standard deviation over the specified lookback period.

* The indicator evaluates price highs/lows and compares these with the highest and lowest values of the standard deviation within the same lookback period.

Highlight of Divergences:

When divergences are detected:

Bullish Divergence: The background of the chart is shaded green.

Bearish Divergence: The background of the chart is shaded red.

Trading Application

Bullish Divergence:

* Occurs when the market is oversold, or downward momentum is weakening.

* Suggests a potential reversal to an uptrend, signaling a buying opportunity.

Bearish Divergence:

* Occurs when the market is overbought, or upward momentum is weakening.

* Suggests a potential reversal to a downtrend, signaling a selling opportunity.

Contextual Use:

* Use this indicator in conjunction with other technical tools like RSI, MACD, or moving averages to confirm signals.

* Effective in volatile or ranging markets to help anticipate shifts in momentum.

Summary

The "Standard Deviation of Returns: Divergence" indicator is a robust tool for spotting divergences that can signal weakening market trends. It combines statistical volatility with price action analysis to highlight key areas of potential reversals. By integrating this tool into your trading strategy, you can gain additional confirmation for entries or exits while keeping a close watch on momentum shifts.

Disclaimer: This is not a financial advise; please consult your financial advisor for personalized advice.

The "Standard Deviation of Returns: Divergence" indicator is designed to help traders identify potential trend reversals or continuation signals by analyzing divergences between price action and the statistical volatility of returns. Divergences can signal weakening momentum in the prevailing trend, offering insight into potential buying or selling opportunities.

Key Components

1. Returns Calculation:

* The indicator uses logarithmic returns (log(close / close[1])) to measure relative price changes in a normalized manner.

* Log returns are more effective than simple price differences when analyzing data across varying price levels, as they account for percentage-based changes.

2. Standard Deviation of Returns:

* The script computes the standard deviation of returns over a user-defined lookback period (ta.stdev(returns, lookback)).

* Standard deviation measures the dispersion of returns around their average, effectively quantifying market volatility.

* A higher standard deviation indicates increased volatility, while lower standard deviation reflects a calmer market.

3. Price Action:

* Detects higher highs (new peaks in price) and lower lows (new troughs in price) over the lookback period.

* Price trends are compared to the behavior of the standard deviation.

4. Divergence Detection:

A divergence occurs when price action (higher highs or lower lows) is not confirmed by a corresponding movement in standard deviation:

Bullish Divergence: Price makes a lower low, but the standard deviation does not, signaling potential upward momentum.

Bearish Divergence: Price makes a higher high, but the standard deviation does not, signaling potential downward momentum.

5. Visual Cues:

The script highlights divergence regions directly on the chart:

Green Background: Indicates a bullish divergence (potential buy signal).

Red Background: Indicates a bearish divergence (potential sell signal).

How It Works

Inputs:

* The user specifies the lookback period (lookback) for calculating the standard deviation and detecting divergences.

Calculation:

* Each bar’s returns are computed and used to calculate the standard deviation over the specified lookback period.

* The indicator evaluates price highs/lows and compares these with the highest and lowest values of the standard deviation within the same lookback period.

Highlight of Divergences:

When divergences are detected:

Bullish Divergence: The background of the chart is shaded green.

Bearish Divergence: The background of the chart is shaded red.

Trading Application

Bullish Divergence:

* Occurs when the market is oversold, or downward momentum is weakening.

* Suggests a potential reversal to an uptrend, signaling a buying opportunity.

Bearish Divergence:

* Occurs when the market is overbought, or upward momentum is weakening.

* Suggests a potential reversal to a downtrend, signaling a selling opportunity.

Contextual Use:

* Use this indicator in conjunction with other technical tools like RSI, MACD, or moving averages to confirm signals.

* Effective in volatile or ranging markets to help anticipate shifts in momentum.

Summary

The "Standard Deviation of Returns: Divergence" indicator is a robust tool for spotting divergences that can signal weakening market trends. It combines statistical volatility with price action analysis to highlight key areas of potential reversals. By integrating this tool into your trading strategy, you can gain additional confirmation for entries or exits while keeping a close watch on momentum shifts.

Disclaimer: This is not a financial advise; please consult your financial advisor for personalized advice.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.