OPEN-SOURCE SCRIPT

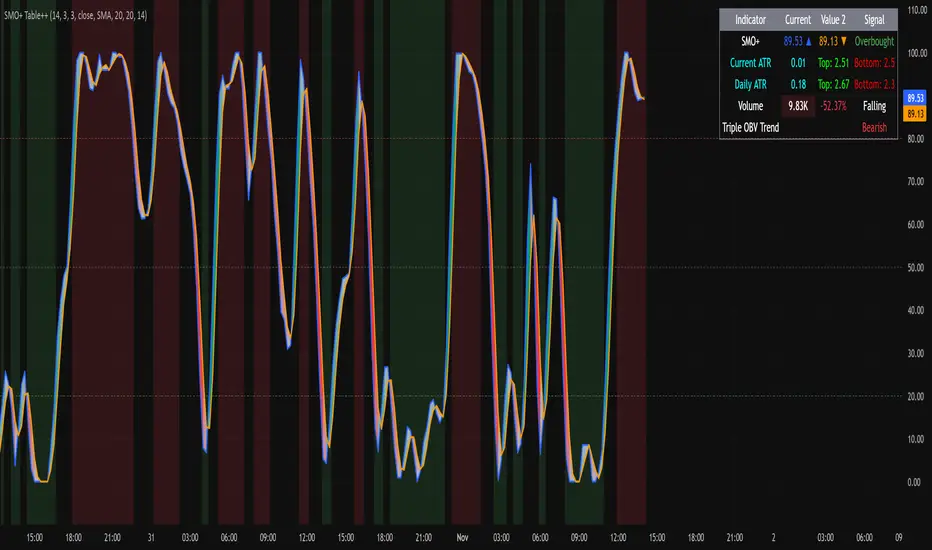

Atualizado Enhanced stochastic Momentum Oscillator with signals

Overall Benefits of This Enhanced SMO Script

Fully Customizable Inputs – period, smoothing type, source, and colors.

Gradient Momentum Ribbon – visually communicates strength and direction.

Overbought/Oversold Highlights – both lines and background for clarity.

Alert System Built-In – monitors crossovers and zone entries/exits.

Error-Resistant Calculations – prevents division by zero, avoids Pine v5 multi-line ternary issues.

Highly Visual – suitable for quick decision-making, not just raw numbers.

Flexible for Any Timeframe – can be used on multi-timeframe analysis.

Table that shows current condition (neutral, overbought and oversold)

Try with my other indicator highlighted in picture-

Fully Customizable Inputs – period, smoothing type, source, and colors.

Gradient Momentum Ribbon – visually communicates strength and direction.

Overbought/Oversold Highlights – both lines and background for clarity.

Alert System Built-In – monitors crossovers and zone entries/exits.

Error-Resistant Calculations – prevents division by zero, avoids Pine v5 multi-line ternary issues.

Highly Visual – suitable for quick decision-making, not just raw numbers.

Flexible for Any Timeframe – can be used on multi-timeframe analysis.

Table that shows current condition (neutral, overbought and oversold)

Try with my other indicator highlighted in picture-

Notas de Lançamento

Update 2.0Updated to Version 6

Added volume information for direction confirmation and strength;

Volume row with spike highlighting

OBV row with % change

Triple OBV row showing Bullish/Bearish/Neutral under Status

How to implement the strategy

Identify the pattern: Look for a triple top, where an asset's price reaches approximately the same high level three times, with a low point between each peak.

Analyze volume during the peaks: Observe the On-Balance Volume (OBV) indicator during these peaks.

Bearish divergence: If the price makes a new high on the third peak, but the OBV makes a lower high, this is a bearish divergence. This indicates that even though the price is rising, the volume behind the move is decreasing, suggesting that buying pressure is weakening.

Strong trend confirmation: If the price makes a new high on the third peak and the OBV also makes a new high, it confirms the strength of the uptrend and the strategy might not be appropriate at that time.

Confirm the reversal:

If you see the bearish divergence (higher price, lower OBV on the third peak), wait for confirmation. A common confirmation is for the price to break below a support level that formed between the peaks.

The OBV line itself may also break a previous support level during this period.

Enter a short position: Once the price breaks the support level, consider entering a short position, as the triple top pattern combined with the OBV divergence suggests a reversal is likely.

Notas de Lançamento

Update 3.0 Added a “Sentiment” row that evaluates market bias based on:

SMO+: Overbought / Oversold

Volume: Rising / Falling / Spike

Triple OBV: Bullish / Bearish / Neutral

Simple scoring system:

Bullish sentiment if:

SMO+ is oversold (k < 20) or near midline rising

Volume is rising

Triple OBV is bullish

Bearish sentiment if:

SMO+ is overbought (k > 80) or midline falling

Volume is falling

Triple OBV is bearish

Otherwise: Neutral

Notas de Lançamento

Update 4.0Simplified text box to combine K and D overbought and oversold signals

Current ATR (based on chart timeframe)

Daily ATR (from 1D timeframe)

Current ATR Top / Bottom levels

Daily ATR Top / Bottom levels

Integrated into a clean expanded table layout

Notas de Lançamento

Minor tweaks Notas de Lançamento

bug fixesScript de código aberto

No verdadeiro espirito do TradingView, o autor desse script o publicou como código aberto, para que os traders possam entendê-lo e verificá-lo. Parabéns ao autor Você pode usá-lo gratuitamente, mas a reutilização desse código em publicações e regida pelas Regras da Casa.

Want to join a safe community full of like-minded individuals that work together, not against each other? Join Xtrader! Link for more amazing indicators and support.

discord.gg/NHjztdYv6U

discord.gg/NHjztdYv6U

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Script de código aberto

No verdadeiro espirito do TradingView, o autor desse script o publicou como código aberto, para que os traders possam entendê-lo e verificá-lo. Parabéns ao autor Você pode usá-lo gratuitamente, mas a reutilização desse código em publicações e regida pelas Regras da Casa.

Want to join a safe community full of like-minded individuals that work together, not against each other? Join Xtrader! Link for more amazing indicators and support.

discord.gg/NHjztdYv6U

discord.gg/NHjztdYv6U

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.