OPEN-SOURCE SCRIPT

Cumulative Volume Delta (CVD)

█ OVERVIEW

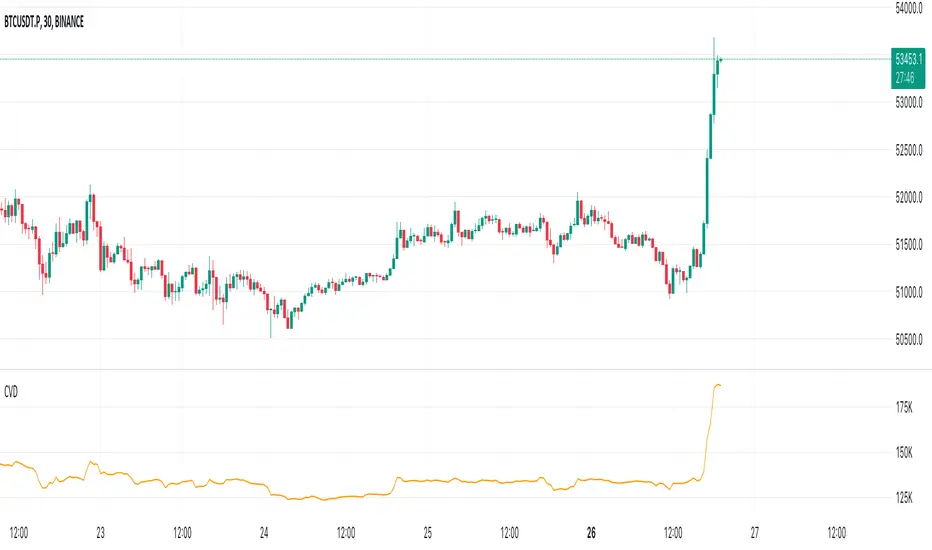

Cumulative Volume Delta (CVD) is a volume-based trading indicator that provides a visual representation of market buying and selling pressure by calculating the difference in traded volumes between the two sides. It uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Volume delta is the net difference between Buy Volume and Sell Volume. Positive volume delta indicates that buy volume is more than sell volume, and opposite. So Cumulative Volume Delta (CVD) is a running total/cumulation of volume delta values, where positive VD gets added to the sum and negative VD gets subtracted from the sum.

I found simple and fast solution how to calculate CVD, so made plain and concise code, here is CVD function :

Pine Script®

where _c, _o, _v are close, open and volume of intrabar much lower timeframe.

Indicator uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Intrabar precision calculation depends on the chart's timeframe:

CVD is good to use together with open interest, volume and price change.

For example if CVD is rising and price makes good move up in short period and volume is rising and open interest makes good move up in short period and before was flat market it is show big chance to pump.

Cumulative Volume Delta (CVD) is a volume-based trading indicator that provides a visual representation of market buying and selling pressure by calculating the difference in traded volumes between the two sides. It uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Volume delta is the net difference between Buy Volume and Sell Volume. Positive volume delta indicates that buy volume is more than sell volume, and opposite. So Cumulative Volume Delta (CVD) is a running total/cumulation of volume delta values, where positive VD gets added to the sum and negative VD gets subtracted from the sum.

I found simple and fast solution how to calculate CVD, so made plain and concise code, here is CVD function :

cvd(_c, _o, _v) =>

var tcvd = 0.0, delta = 0.0

posV = 0.0, negV = 0.0

totUV = 0.0, totDV = 0.0

switch

_c > _o => posV += _v

_c < _o => negV -= _v

_c > nz(_c[1]) => posV += _v

_c < nz(_c[1]) => negV -= _v

nz(posV[1]) > 0 => posV += _v

nz(negV[1]) < 0 => negV -= _v

totUV += posV

totDV += negV

delta := totUV + totDV

cvd = tcvd + delta

tcvd += delta

cvd

where _c, _o, _v are close, open and volume of intrabar much lower timeframe.

Indicator uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Intrabar precision calculation depends on the chart's timeframe:

CVD is good to use together with open interest, volume and price change.

For example if CVD is rising and price makes good move up in short period and volume is rising and open interest makes good move up in short period and before was flat market it is show big chance to pump.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.