PROTECTED SOURCE SCRIPT

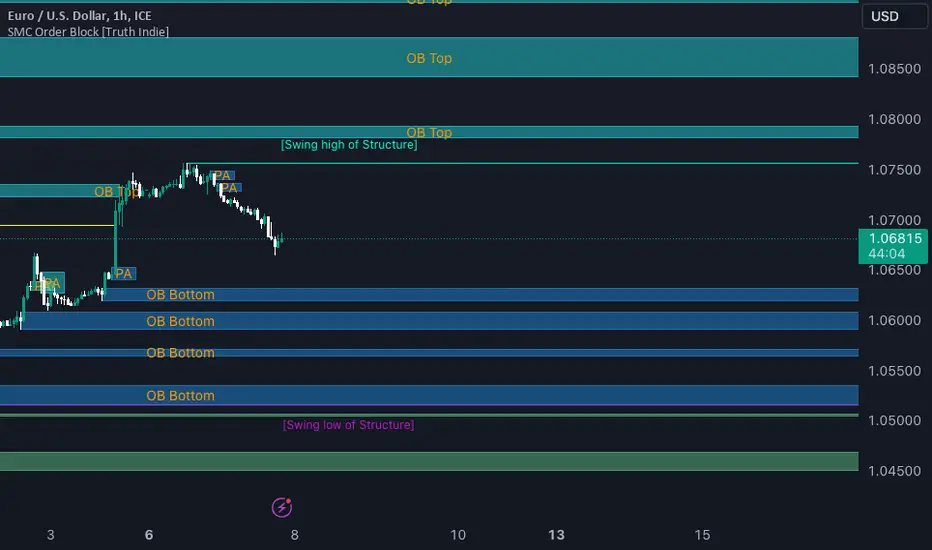

Atualizado SMC Order Block [Truth Indie]

Smart Money Concept (SMC)

For me, SMC is a trading philosophy that stems from those with knowledge and understanding of the structure of the Smart Money group's trading system. It is developed through the observation of price behavior.

SMC is related to the Smart Money group or those entities that can influence the market, such as financial institutions, banks, or funds. Market movements are often driven by market fundamentals or economics. The Smart Money group possesses extensive research data for analyzing the market's fundamentals and has the ability to steer the market in various directions based on market and economic fundamentals at a given time.

The SMC concept is adapted from the ICT concept, and it was developed and shared by The Inner Circle Trader.

I have been studying and trying to understand SMC for some time, and I have many questions I would like to explore. The challenge lies in the fact that different sources of knowledge on this topic often have varying teachings, and my proficiency in the English language is limited. As a result, I haven't had the opportunity to study from the primary source, The Inner Circle Trader.

This indicator was created for the purpose of researching Market Structure and Order Blocks, which are integral parts of the SMC Concept.

The fundamental principle for identifying Order Blocks is as follows:

1.Locate swings that create candlestick imbalances.

2.An imbalance refers to a candlestick that is larger than the preceding one and contains a Fair Value Gap (FVG).

This indicator categorizes Order Blocks into four types, and you are encouraged to customize them to suit your preferences.

OB Type1

1.The closing price of candle [1] has an opposite direction to the candle [2].

2.Candle [1] has a wick longer than its body, by at least 1 times or more (adjustable).

3.Candle [2] has a wick longer than candle [1], by at least 2 times or more (adjustable).

4.There is a Fair Value Gap (FVG) between the wicks of candle [1] and [3].

OB Type1_HTF

-This condition is the same as OB Type1, but it involves analyzing 6 candles instead. This means looking at a larger time frame, twice as big as the original one.

OB Type2

1.The closing price of candle [1] has the opposite direction to candle [2].

2.Candle [1] has a body larger than its wick by at least 1 times or more (adjustable).

3.Candle [2] has a body larger than candle [1] by at least 2 times or more (adjustable).

4.There is a Fair Value Gap (FVG) between the wicks of candle [1] and [3].

OB Type2_HTF means observing a larger time frame, specifically twice as big as the previous one.

OB Type3

1.The closing price of candle [1] has the same direction as candle [2].

2.Candle [1] has a wick longer than its body, by at least 1 times or more (adjustable).

3.Candle [2] has a wick longer than candle [1], by at least 2 times or more (adjustable).

4.There is a Fair Value Gap (FVG) between the wicks of candle [1] and [3].

OB Type3_HTF means observing a larger time frame, specifically twice as big as the previous one.

OB Type4

1.The closing price of candle [1] has the same direction as candle [2].

2.Candle [1] has a body larger than its wick by at least 1 times or more (adjustable).

3.Candle [2] has a body larger than candle [1] by at least 2 times or more (adjustable).

4.There is a Fair Value Gap (FVG) between the wicks of candle [1] and [3].

OB Type4_HTF is an indicator that involves looking at a larger time frame, specifically twice as big as the original one.

Order Block Setting

1.Click to activate the OB search in different Types.

2.Adjust the body of the candle [1].

3.Adjust the strength of the candle [2] or the Imbalance candle.

4.You can change the name of OB.

5.Adjust the font size and color.

6.Adjust the color of the OB BOX and History BOX.

7.Adjust the font of OB HTF.

1.It refers to the value of W for a specific candle.

2.It refers to the value of Im for a specific candle.

3.It refers to the values of W and Im in the HTF.

4.For OB Type1 and Type3, a higher W value will search for candles with a larger wick and a smaller body. When the W value is lower, it will search for candles with a smaller wick and a larger body, moving from low to high.

5.For OB Type2 and Type4, a lower W value will search for candles with a smaller wick and a larger body. When the W value is higher, it will search for candles with a larger wick and a smaller body, moving from high to low.

Market Structure

Comprising the process of breaking the price structure, resulting in BOS (Breakout of Structure) or CHoCH (Change of Character High), and creating new High or Low based on the price structure.

1.When the market forms a price structure with High and Low, when the price moves to disrupt the structure in either direction, it will lead to BOS or CHoCH, resulting in a new High or Low. You can adjust the method of breaking the structure using the close, high, or low.

2.When you break the price structure, a High or Low will be formed on one side, and it will lead to an Inducement Swing. When the price moves and collides, it will create a price range of High and Low. You can adjust the method of breaking the structure using the close, high, or low.

3.There is an option for testing Fibonacci (Fibo). Its function is similar to the Inducement Swing. You can adjust the Fibonacci settings.

Premium & Discount Zone

1.The Premium & Discount Zone will appear based on the current price structure. It helps you see the price zones you are interested in.

2.You can adjust the %Premium & Discount as needed.

3.The OB (Order Block) will be displayed when a price structure of High and Low forms within the Premium & Discount Zone. The OB in this indicator is not a recommendation to buy or sell. You need to research and test various conditions before making trading decisions.

Everyone's trading strategies are different, and it comes down to backtesting and selecting the strategy that suits your individual needs. Hopefully, this indicator will assist the TradingView community of traders in their trading endeavors.

For me, SMC is a trading philosophy that stems from those with knowledge and understanding of the structure of the Smart Money group's trading system. It is developed through the observation of price behavior.

SMC is related to the Smart Money group or those entities that can influence the market, such as financial institutions, banks, or funds. Market movements are often driven by market fundamentals or economics. The Smart Money group possesses extensive research data for analyzing the market's fundamentals and has the ability to steer the market in various directions based on market and economic fundamentals at a given time.

The SMC concept is adapted from the ICT concept, and it was developed and shared by The Inner Circle Trader.

I have been studying and trying to understand SMC for some time, and I have many questions I would like to explore. The challenge lies in the fact that different sources of knowledge on this topic often have varying teachings, and my proficiency in the English language is limited. As a result, I haven't had the opportunity to study from the primary source, The Inner Circle Trader.

This indicator was created for the purpose of researching Market Structure and Order Blocks, which are integral parts of the SMC Concept.

The fundamental principle for identifying Order Blocks is as follows:

1.Locate swings that create candlestick imbalances.

2.An imbalance refers to a candlestick that is larger than the preceding one and contains a Fair Value Gap (FVG).

This indicator categorizes Order Blocks into four types, and you are encouraged to customize them to suit your preferences.

OB Type1

1.The closing price of candle [1] has an opposite direction to the candle [2].

2.Candle [1] has a wick longer than its body, by at least 1 times or more (adjustable).

3.Candle [2] has a wick longer than candle [1], by at least 2 times or more (adjustable).

4.There is a Fair Value Gap (FVG) between the wicks of candle [1] and [3].

OB Type1_HTF

-This condition is the same as OB Type1, but it involves analyzing 6 candles instead. This means looking at a larger time frame, twice as big as the original one.

OB Type2

1.The closing price of candle [1] has the opposite direction to candle [2].

2.Candle [1] has a body larger than its wick by at least 1 times or more (adjustable).

3.Candle [2] has a body larger than candle [1] by at least 2 times or more (adjustable).

4.There is a Fair Value Gap (FVG) between the wicks of candle [1] and [3].

OB Type2_HTF means observing a larger time frame, specifically twice as big as the previous one.

OB Type3

1.The closing price of candle [1] has the same direction as candle [2].

2.Candle [1] has a wick longer than its body, by at least 1 times or more (adjustable).

3.Candle [2] has a wick longer than candle [1], by at least 2 times or more (adjustable).

4.There is a Fair Value Gap (FVG) between the wicks of candle [1] and [3].

OB Type3_HTF means observing a larger time frame, specifically twice as big as the previous one.

OB Type4

1.The closing price of candle [1] has the same direction as candle [2].

2.Candle [1] has a body larger than its wick by at least 1 times or more (adjustable).

3.Candle [2] has a body larger than candle [1] by at least 2 times or more (adjustable).

4.There is a Fair Value Gap (FVG) between the wicks of candle [1] and [3].

OB Type4_HTF is an indicator that involves looking at a larger time frame, specifically twice as big as the original one.

Order Block Setting

1.Click to activate the OB search in different Types.

2.Adjust the body of the candle [1].

3.Adjust the strength of the candle [2] or the Imbalance candle.

4.You can change the name of OB.

5.Adjust the font size and color.

6.Adjust the color of the OB BOX and History BOX.

7.Adjust the font of OB HTF.

1.It refers to the value of W for a specific candle.

2.It refers to the value of Im for a specific candle.

3.It refers to the values of W and Im in the HTF.

4.For OB Type1 and Type3, a higher W value will search for candles with a larger wick and a smaller body. When the W value is lower, it will search for candles with a smaller wick and a larger body, moving from low to high.

5.For OB Type2 and Type4, a lower W value will search for candles with a smaller wick and a larger body. When the W value is higher, it will search for candles with a larger wick and a smaller body, moving from high to low.

Market Structure

Comprising the process of breaking the price structure, resulting in BOS (Breakout of Structure) or CHoCH (Change of Character High), and creating new High or Low based on the price structure.

1.When the market forms a price structure with High and Low, when the price moves to disrupt the structure in either direction, it will lead to BOS or CHoCH, resulting in a new High or Low. You can adjust the method of breaking the structure using the close, high, or low.

2.When you break the price structure, a High or Low will be formed on one side, and it will lead to an Inducement Swing. When the price moves and collides, it will create a price range of High and Low. You can adjust the method of breaking the structure using the close, high, or low.

3.There is an option for testing Fibonacci (Fibo). Its function is similar to the Inducement Swing. You can adjust the Fibonacci settings.

Premium & Discount Zone

1.The Premium & Discount Zone will appear based on the current price structure. It helps you see the price zones you are interested in.

2.You can adjust the %Premium & Discount as needed.

3.The OB (Order Block) will be displayed when a price structure of High and Low forms within the Premium & Discount Zone. The OB in this indicator is not a recommendation to buy or sell. You need to research and test various conditions before making trading decisions.

Everyone's trading strategies are different, and it comes down to backtesting and selecting the strategy that suits your individual needs. Hopefully, this indicator will assist the TradingView community of traders in their trading endeavors.

Notas de Lançamento

Fix bug => the unknown size value: tiny.Notas de Lançamento

Update Details:

1.You can choose to show or hide the OB (Order Block).

2.You can choose to expand the History OB Box to the right.

3.You can change the number of History OBs.

4.You can choose to show or hide the swing of the structure.

5.You can choose to show or hide the Minor Inducement.

6.You can choose to show or hide the Fibo Minor Inducement.

7.Adjust the color of the Fibo Minor Inducement.

8.Adjust the color of the Fibo for break.

Minor Inducement Setting:

A. Adjust the length of the Minor Inducement swing.

- In this section, it functions similarly to Pivot Points High Low, capturing swings based on the specified length.

B. Adjust Fibo Minor Inducement.

- Fibo IDM helps filter Swing IDM.

- When the market is in an uptrend, IDM will be lower than Fibo IDM.

- When the market is in a downtrend, IDM will be higher than Fibo IDM.

An example of a market in a downtrend.

1. Fibo IDM filters out Swing IDM that is above the Fibo line.

2. IDM occurs above the Fibo line in a downtrending market and below the Fibo line in an uptrending market.

3. An example of the Pivot Points High Low indicator with the length set to 3.

Market structure is something quite complex for me. I'm currently studying Trading Hub 3.0. Once I have a deep understanding, I may be able to develop an indicator for it. However, due to its complexity, it might require breaking down only a part of the Market Structure. This indicator may not have the same mechanics as Trading Hub 3.0, but it will have mechanisms that can be adjusted for study and research purposes.

Notas de Lançamento

Fixed the incorrect occurrence of the minor inducement.Notas de Lançamento

Update Details:-Add history of PA. The original value before the update is 0. You can decrease or increase it.

Provide additional explanation about PA.

PA stands for an OB that has not yet been confirmed.

Confirming an OB is detailed as follows.

1.Price break high or low of structure.

2.Price break IDM.

3.Price action (PA) that is in the discount or premium zone will turn into an OB (order block).

Minor IDM

-Fixed occasional repainting of the IDM line.

-Added a 5 candlestick delay before the removal of IDM to allow for code validation.

If you encounter any bugs or repainting issues, please feel free to report them. I will certainly work on fixing them.

Notas de Lançamento

Additionmax_lines_count = 500

max_boxes_count = 500

max_bars_back = 5000

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Get access my indicator : bit.ly/411VJQB

telegram : t.me/Truth_indie

telegram : t.me/Truth_indie

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script protegido

Esse script é publicada como código fechado. No entanto, você pode gerenciar suas escolhas de bate-papo. Por favor, abra suas Configurações do perfil

Get access my indicator : bit.ly/411VJQB

telegram : t.me/Truth_indie

telegram : t.me/Truth_indie

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.