Balance Sheet Strength Keeps COP Resilient Amid Price Volatility

ConocoPhillips COP is among the large oil and natural gas exploration and production companies, and therefore is highly vulnerable to fluctuations in commodity prices. Thus, just like any other upstream player, the company’s cash flow generation is volatile, representing an unpredictable business model, unlike the midstream business.

So, does it mean that conservative investors should steer clear of the stock? Certainly not. This is because ConocoPhillips has a strong balance sheet on which it can rely during an unfavorable business environment. COP has a debt-to-capitalization of 26.4%, lower than 49.1% of the composite stocks belonging to the industry. This shows that, compared to its peers, the upstream energy giant has significantly lower debt-capital exposure.

A strong balance sheet will also help ConocoPhillips to get capital on favorable terms for future growth projects or acquisitions. Thus, unlike other small upstream players, the business model of COP is relatively stable as it could lean on its balance sheet strength to support dividend payments and maintain its operations when oil prices turn lower.

EOG & XOM Also Have Strong Balance Sheets

Like COP, EOG Resources Inc. EOG and Exxon Mobil Corporation XOM also have low debt capital exposure. Thus, both EOG & XOM can combat periods of low oil prices while relying on their balance sheet strengths.

While EOG has a debt-to-capitalization of 12.7%, ExxonMobil’s debt-to-capitalization is 12.6%.

COP’s Price Performance, Valuation & Estimates

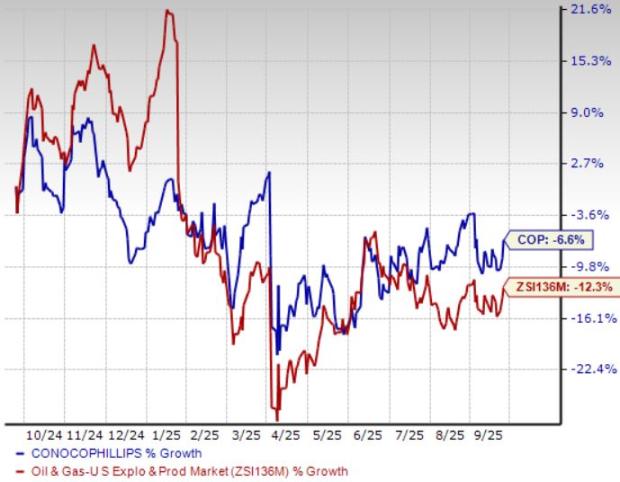

Shares of COP have declined 6.6% over the past year compared with the 12.3% dip of the composite stocks belonging to the industry.

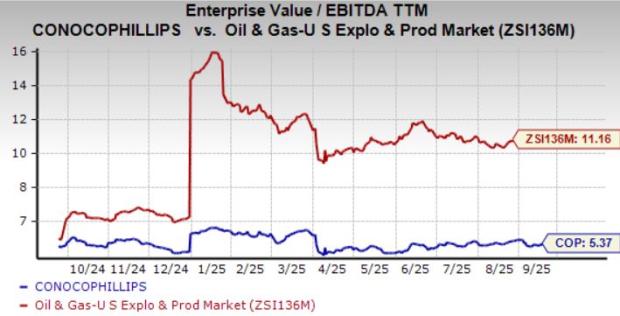

From a valuation standpoint, COP trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 5.37X. This is below the broader industry average of 11.16X.

The Zacks Consensus Estimate for COP’s 2025 earnings has seen downward revisions over the past 30 days.

ConocoPhillips stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research