COMMENT-USD/JPY at key Ichimoku cloud levels, bias down

USD/JPY looks biased lower even though a Bank of Japan interest rate hike in December may be fully discounted now. The focus will be narrowing Japan-U.S. interest rate differentials, with any further shrinkage likely to intensify downward pressure on the currency pair.

The Japan-U.S. two-year rate differential has narrowed from a recent wide of around 385 basis points on Nov 6 to as low as 355 bps Monday; that on 10-year paper has shrunk from a recent peak of 350 bps on Nov 11 to 312 bps Monday. Further tightening will likely result in more USD/JPY downward pressure.

USD/JPY fell out of bed last week, breaking below the 153.28-156.76 EBS range in place between Nov 15-25, finally hitting a 149.47 low in U.S. holiday-thinned trading Friday.

Speculators have recently begun to pare USD/JPY longs taken in conjunction with the so-called Trump trade. IMM CTA data showed yen shorts falling sharply as of Nov 19, and more paring is likely in data due later Monday for the week ended Nov 26.

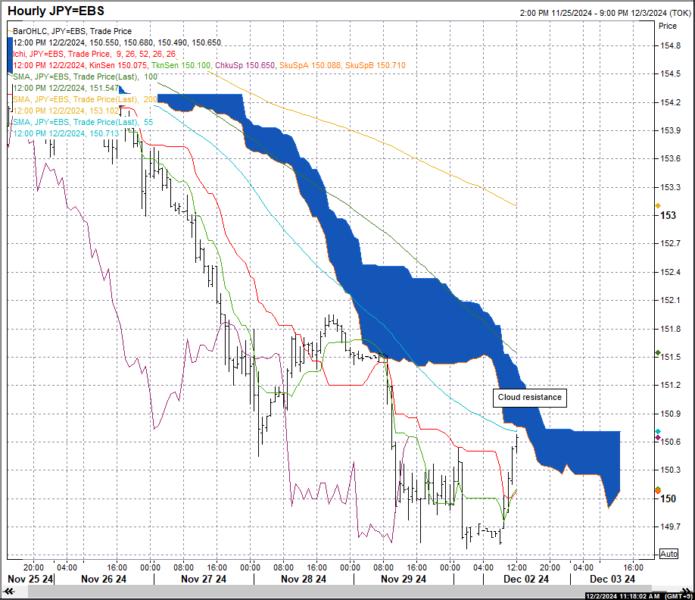

Stops from weak USD longs look to have played a large part in last week's USD/JPY drop. Beginning at 153.00, stops were likely hit at each big figure on the way down with especially large ones at 150.00.

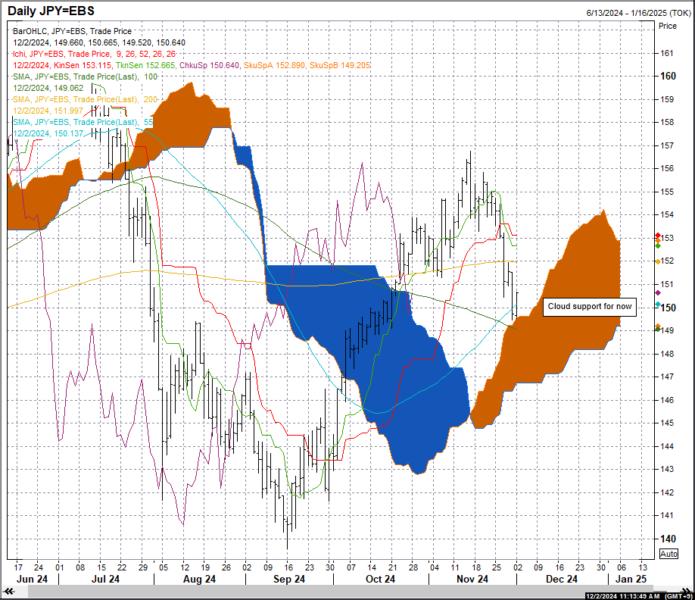

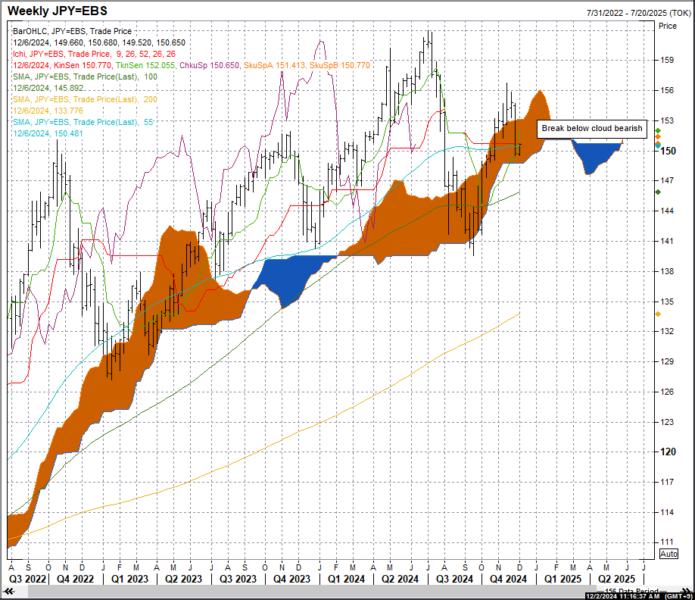

USD/JPY is currently poised at key Ichimoku levels. The ascending daily cloud is between 146.73-149.56 below. Eyes are also on the 148.74-153.15 weekly cloud - a break below would be extremely bearish. The descending hourly cloud at writing is between 150.75-151.40, providing good resistance.

For more click on