Pepsi fizz better added with a stir than a shake

Struggling food producers attract pushy investors like bees to orange soda. PepsiCo PEP now has hedge fund Elliott Management buzzing around after the beverage and snack goliath’s performance and valuation went flat. There are ways to restore some fizz, but too many additives will spoil the financial formula.

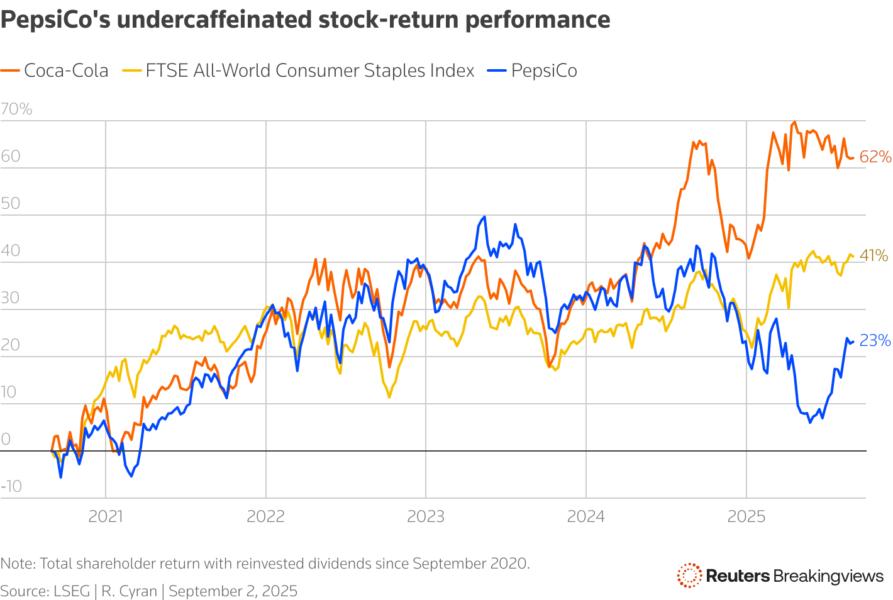

Pepsi’s expansion of its North American snacks business recently stalled while sales volumes of drinks, which include its namesake pop and Gatorade, have been shrinking for years. After peaking in May 2023, the share price tumbled some 25%. Archrival Coca-Cola KO, by contrast, is growing faster, with higher profitability, and better stock performance over the past five years.

Nearly a third of Pepsi’s roughly $90 billion in annual revenue comes from Doritos, Cheetos and other North American nibbles, and a similar proportion from carbonated and other potables sold across the continent. For years, the stale suggestion from frustrated investors has been to separate salty from sweet. A split, however, would undermine the power of marketing and distributing popular brands together, especially internationally.

Instead, Elliott is serving up tastier ideas for Pepsi boss Ramon Laguarta to sample. For example, misfit products such as Quaker Oats and Rice-A-Roni are best jettisoned. Moreover, costs can be slashed in snacks, where the adjusted operating profit margin has slumped 5 percentage points since 2019. Company-wide capital expenditure also swelled to $5 billion annually, despite slowing growth, providing more room to cut. Pepsi could stand to refocus on its best drinks, too, with a bigger collection of them generating less revenue than Coca-Cola.

Redesigning the bottling business would be a less fruitful tonic, however. It’s true that manufacturing is more capital intensive and having semi-independent distributors might offer a helpful check on acquisitions; Pepsi recently wrote down $1.8 billion from buying Rockstar energy drinks.

Even so, the capital advantages can be illusory. Soda makers want to keep partners viable, meaning there may be implicit guarantees in the debt. Separate bottlers also take away some strategic maneuvering room. Pepsi already has spun them out before and then bought them back, as have peers, further suggesting an element of faddish financial engineering.

The best case for backing the $200 billion company is that it’s cheap. It trades at 18 times estimated earnings over the next 12 months, according to LSEG, a roughly 20% discount to its own 10-year average and Coca-Cola’s multiple. It will only take a stir, not a shake, to add plenty of sparkle to Pepsi.

Follow Robert Cyran on Bluesky.

CONTEXT NEWS

Hedge fund Elliott Investment Management said on September 2 that it had accumulated a $4 billion stake in PepsiCo and urged the soda and snacks maker to consider refranchising its bottling operations, cutting costs in its North American snack unit and divesting non-core brands such as Quaker Oats and Rice-A-Roni.

Pepsi’s stock price closed at $150.28 on September 2 compared to $148.65 on August 29, the last day of trading before Elliott unveiled its investment. Elliott said a reinvigorated Pepsi would lead to at least 50% upside for the shares.