Wall St set to open higher as AI boom, rate cuts power bull run in 2024

- Crypto stocks trade higher tracking bitcoin prices

- VeriSign up after Berkshire Hathaway ups stake

- Futures up: Dow 0.17%, S&P 500 0.23%, Nasdaq 0.23%

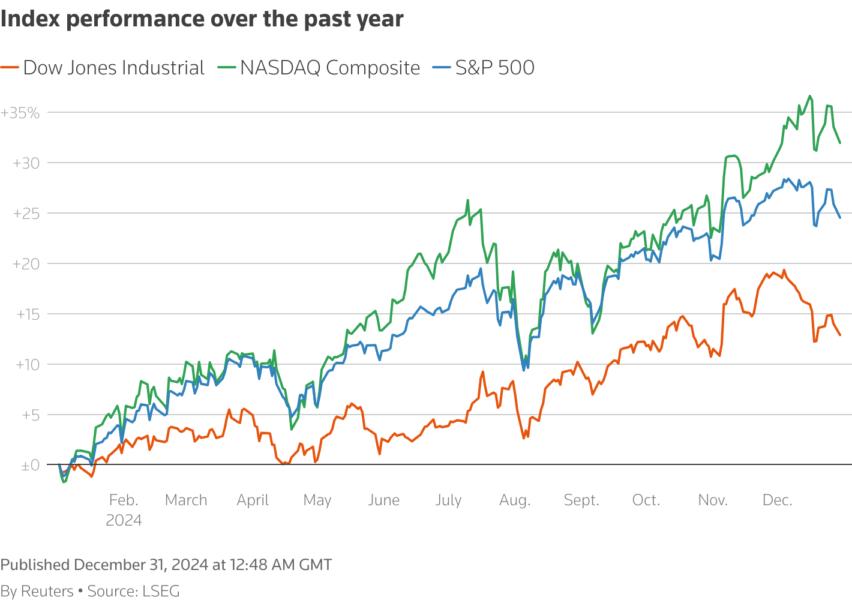

Wall Street's main indexes were set to start the last trading session of 2024 slightly higher, continuing its bull run from more than two years ago on signs of post-pandemic economic resilience, hopes of lower borrowing costs and AI boost.

The S&P 500 SPX, Dow

DJI and Nasdaq

IXIC are near record highs and are set for their second consecutive year of gains.

A nearly 100-basis point cut in interest rates in 2024 by the Federal Reserve and a rally in technology stocks in anticipation of boost to corporate profits from artificial intelligence have catapulted equities to record highs in 2024.

The tech S5INFT, communications services

S5TELS and consumer discretionary stocks

S5COND have advanced more than 30% this year.

Although AI poster-child Nvidia's NVDA nearly 170% surge this year was smaller compared with last year, the rally helped the company notch $3 trillion in market value, while Tesla

TSLA reclaimed $1 trillion level.

At 08:23 a.m. ET, Dow E-minis YM1! were up 71 points, or 0.17%, S&P 500 E-minis

ES1! were up 13.75 points, or 0.23% and Nasdaq 100 E-minis

NQ1! were up 48.25 points, or 0.23%.

Nvidia was up 0.7%, while the Elon Musk-led automaker added 1.2% in premarket trading. Moves are expected to be influenced by thin volumes ahead of New Year's holiday on Wednesday.

Toward the end of the year, risk-taking improved as Donald Trump's presidential win boosted bets that he would deliver on his promises to ease regulations, cut taxes and raise tariffs to help domestic businesses.

His win also powered small-cap stocks. The Russell 2000 RUT clinched a record high and was set for a second straight year of gains with a nearly 10% increase. Bank shares (.SPXBK) are up more than 30% this year.

However, equities hit a rough patch in December, putting the S&P 500 on course for its biggest monthly decline since April, due to higher yields on Treasury notes at a time when equity valuations are stretched and the Fed is cautious.

The yield on benchmark 10-year note US10Y eased to 4.5% as inflationary concerns linked to Trump's policies raises chances of the Fed moderating its rate cuts in 2025.

"Any further gains in equities are unlikely until there is more clarity about what the incoming administration's tax and tariff policies will look like," said Raffi Boyadjian, lead market analyst at brokerage XM.

"How earnings expectations evolve in the coming months will also be crucial for Wall Street, particularly for tech and AI stocks."

Traders expect the first rate cut of 2025 in either March or May. Meanwhile, Trump's win has invigorated crypto stocks, with Bitcoin BTCUSD hitting $100,000.

MicroStrategy MSTR shares have more than tripled in value this year as it continues buying and holding bitcoin. The stock rose 4.5% on Tuesday, while Coinbase

COIN and MARA Holdings

MARA added 2.6% and 2.5%, respectively.

VeriSign VRSN rose 2.1% after Berkshire Hathaway

BRK.A increased its stake in the internet services company.

Other areas of the market, however, have witnessed annual declines, with materials stocks S5MATR down more than 2%, hurt by the economic woes in top metals consumer China.