FedEx: Strong Resilience and Undervalued Opportunity

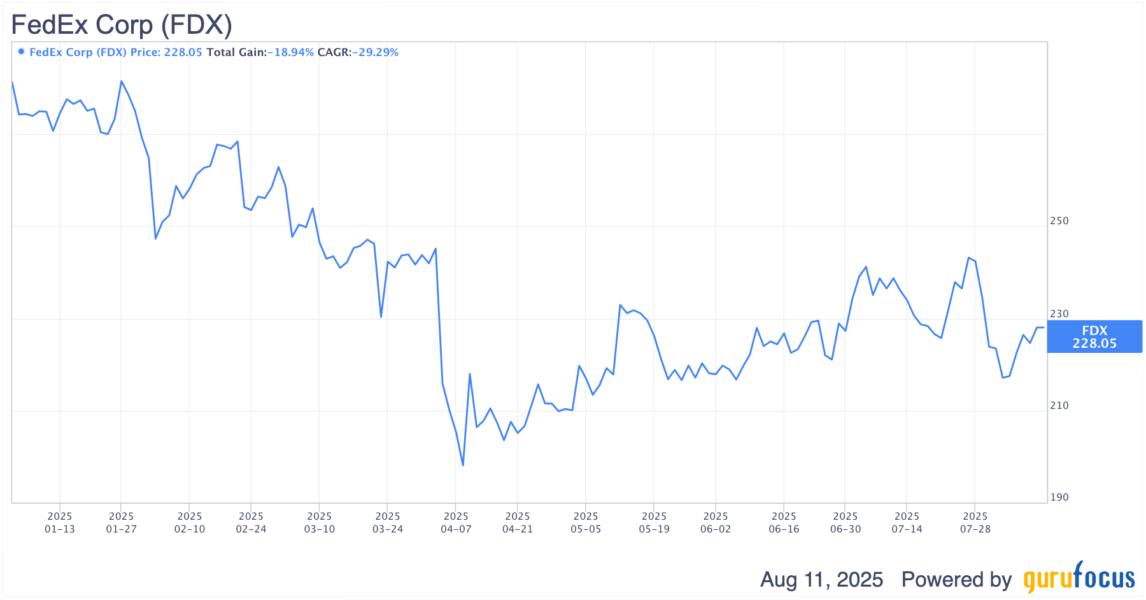

Lately, I've noticed a pretty big gap between the haves and have-nots in this market. The high-flyer tech names keep trading at expensive valuations and barely pay any dividend, while plenty of solid non-tech companies are being ignored. FedEx is one of those stocks I think falls into that overlooked category. Even after bouncing off its early April lows, the stock is still down close to 20% over the past year, while the broader market keeps hitting new highs. Tariffs and a potential global slowdown are obvious risks, even with some recent trade deals in place. But when I look closer, I see a business that's been quietly improving efficiency. Top-line growth hasn't been exciting, but EPS has moved higher thanks to better operations. In my view, that makes the current valuation look like a bargain for long-term investors who care about total return, especially in a market that's this frothy.

FDX Data by GuruFocus

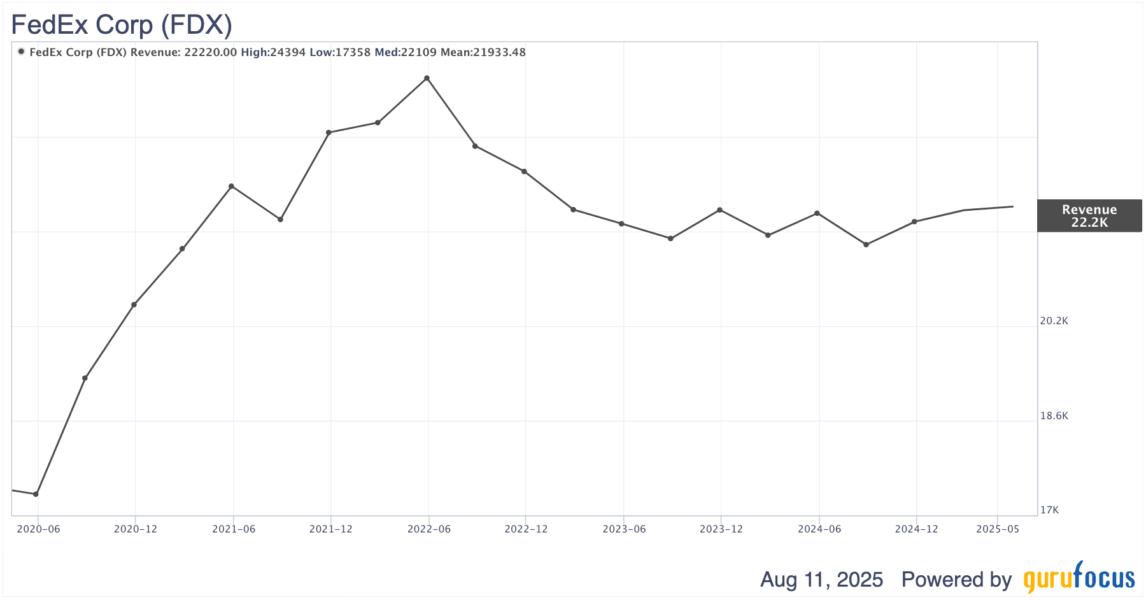

Revenue Trends: Sluggish but Holding Up

For the past five quarters, revenue growth at FedEx has basically been stuck near zero. To me, that says the business is holding steady but not exactly taking off. More recently, results have been hit by a tough demand environment along with a few headwinds, like the loss of a major U.S. Postal Service contract and trade-related disruptions. Even so, I think the company has shown resilience, especially considering the tariffs. Based on the numbers from FY2025, tariffs haven't hurt nearly as much as some feared. Management even said they are uniquely positioned to partner with customers as those customers figure out demand shifts and tariff impacts.

FDX Data by GuruFocus

From what I see, U.S. volumes tell an encouraging story. In April, volumes were up 8% and in May they rose 6%, which doesn't look like tariffs are slowing down the domestic side at all. U.S. consumers still seem to be using FedEx services just fine. The weaker spot is in the Federal Express International Export Package, where growth has slipped for three straight months, with May showing a YoY decline. That tells me overseas demand is softer and that some countries may be pulling back from U.S. trade. On the flip side, the FedEx Ground Package segment remains strong, with May showing 9% growth. I think North America is still a bright spot for now, although the lack of finalized trade deals with Canada and Mexico could be a risk down the road. Looking ahead, management is guiding for just 02% YoY revenue growth in the next year. Still, I believe the long-term growth story is intact thanks to high-margin areas like healthcare, automotive, and international air freight, along with supply chain diversification in Southeast Asia and Latin America.

Big Changes Underway

One of the main reasons I'm bullish here is that FedEx is going through major changes to boost profitability. They've merged their U.S. operations into a single One FedEx setup, which should make them leaner and more efficient. They're also planning to spin off their Freight division, a move that could reshape the company by mid-next year. On top of that, FedEx is going heavy into technology and AI, rolling out tools like the fdx platform to make deliveries smarter and more reliable.

Two big initiatives stand out to me: DRIVE and Network 2.0. DRIVE is all about cutting inefficiencies, while Network 2.0 is focused on optimizing their physical network. This means combining Express and Ground facilities into single hubs, cutting real estate costs, and streamlining pickup and delivery routes. They're also automating more sorting and using predictive analytics to better match aircraft and truck use to demand. These moves helped FedEx save $2.2 billion in structural costs in FY2025 and $4 billion over the past two years. The Express division alone saw a 9% YoY boost in adjusted operating income last quarter, which I think shows how much these cost savings are paying off. By the time Network 2.0 is fully rolled out, management expects about 30% fewer stations and another $1 billion in savings from both programs. Over the next two years, they're targeting $2 billion in annual savings.

EPS Growth, Dividends, and Capital Returns

FedEx's adjusted EPS came in at $6.07 last quarter, up 12.2% YoY, even with revenue basically flat at +0.5%. To me, that's clear proof that internal improvements are driving better bottom-line results. The stock currently yields 2.4% with a payout ratio of 31%, and the dividend has grown at a strong 16.5% CAGR over the past five years. While the yield isn't huge, I see FedEx as more of a total return story because they're also buying back a lot of shares.

A big part of this is a shift in how they allocate capital. FY2025 capex was cut by $1.1 billion to $4.1 billion, which is the lowest in a decade. As a percentage of revenue, it dropped to 4.6%, the lowest in company history. That freed-up cash is being used to reward shareholders. In the past three years, 8.5% of shares have been retired. Buybacks rose from $2.5 billion to $3 billion in annual terms, and the dividend payout increased from $1.259 billion to $1.339 billion. Looking ahead, management expects a 5% dividend hike in FY2026 and plans to return capital roughly in line with adjusted free cash flow. In my view, this shift from spending to distribution is a strong positive. Even though the yield isn't sky-high, management is clearly committed to boosting shareholder returns.

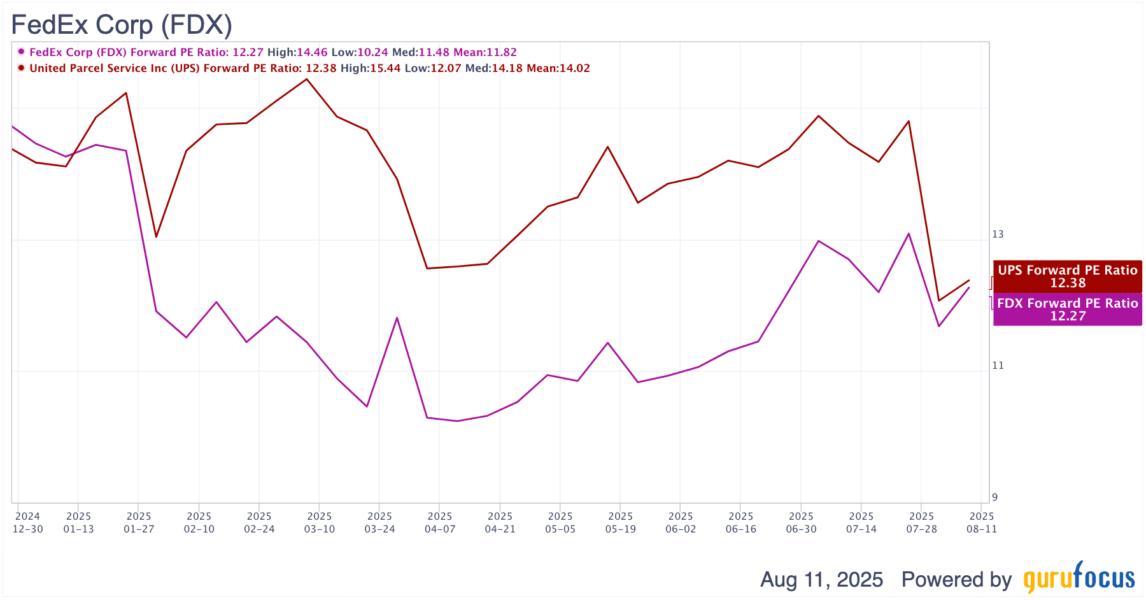

Attractive Valuation vs History

Looking at the chart above, it's pretty clear that FedEx's forward P/E has dropped a lot since the start of the year. Even with the small rebound lately, it's sitting at just 12.27x, which is well under the 16x range I'd consider its normal level over the past few years. It's also slightly cheaper than UPS right now, which trades at a forward P/E of 12.38x. I think that both of these names like they are trading at extremely cheap valuations with the market significantly discounting them.

FDX Data by GuruFocus.

Analysts following the stock don't expect much this year, with EPS growth estimates of only about 2.1%, but they're looking for a decent pickup over the next couple of years, targeting 1014% annual growth. I think that's realistic given the potential for an industrial rebound and the benefits from FedEx's cost-cutting and network upgrades. If that plays out, patient investors could see solid double-digit total returns when you factor in EPS growth, dividends, buybacks, and a possible move back toward its usual valuation. In my view, with FedEx being such a major player in freight and logistics, this valuation gap looks too big and points to a real opportunity for long-term investors.

Guru Investor Activity

Looking at institutional and guru investor positions, FedEx continues to have backing from some of the most respected names in the market. Dodge & Cox and PRIMECAP Management (Trades, Portfolio) remain the largest holders, with stakes of 5.77% and 4.98% of shares outstanding, respectively. Notably, some investors have even increased their exposure; HOTCHKIS & WILEY added over 7%, Parnassus Value Equity Fund (Trades, Portfolio) grew its position by 4%, and George Soros (Trades, Portfolio) made a significant move, increasing his stake by more than 278%. Even Jeremy Grantham (Trades, Portfolio) boosted his holdings by over 800%, albeit from a smaller base, showing that experienced value-focused managers still see upside here.

While a few holders trimmed their stakes, the overall activity reflects continued conviction among top-tier investors in FedEx's long-term potential. With the stock still trading at a steep discount to its historical valuation and offering operational improvement catalysts ahead, I view this high level of guru ownership as another sign the market is underestimating FedEx's recovery potential. In my opinion, when deep-value managers are adding meaningfully to positions, it strengthens the case for patient investors to take a closer look.

Conclusion

All in all, I think FedEx has proven it can weather tough conditions;tariffs, slowing trade, and a sluggish industrial backdrop; without losing its footing. The company's efficiency push through DRIVE and Network 2.0 has already paid off with billions in savings and stronger margins, and I believe there's more upside as those initiatives mature. With management shifting capital toward buybacks and dividends, and the stock trading at a forward P/E well below its historical average, I see this as a classic case of the market being too pessimistic. In my view, patient investors willing to ride out near-term headwinds could be rewarded with strong total returns, making FedEx a buy from where I stand.