Constellation Brands: Cheap Enough for Buffett -- But Is It Cheap Enough for You?

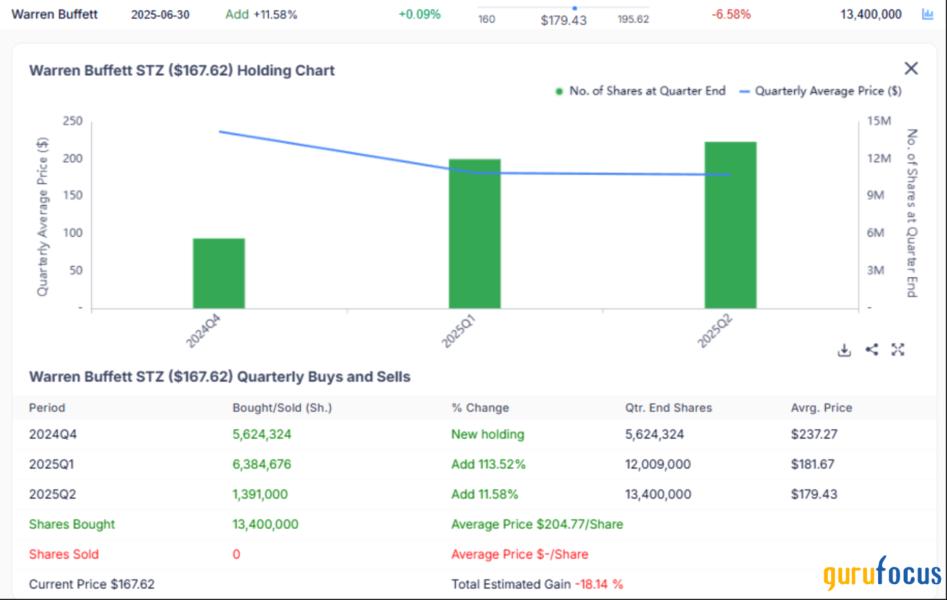

The patron saint of investing has been buying Constellation for three quarters in a row now even though the stock has fallen. Gurufocus estimates the drawdown on his current position is around 18%. So why does he continue buying in the face of a falling stock?

Wny? Because Buffett always plays the long game. He does not worry about short-term volatility.

Here are some of Warren Buffett (Trades, Portfolio)'s most quotes on long term stock investing:

- If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes.

- Our favorite holding period is forever.

- All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies.

- You shouldn't buy stocks unless you expect, in my view, to hold them for a very extended period, and you are prepared financially and psychologically to hold them the same way you would hold a farm and never look at a quoteyou don't need to pay attention to it.

- The stock market is a device to transfer money from the 'impatient' to the 'patient'.

These quotes emphasize Buffett's core philosophy: focus on buying great businesses and holding them patiently over the long term, ignoring short-term market fluctuations.

Warren Buffett (Trades, Portfolio), through Berkshire Hathaway, has significantly increased his investment in Constellation Brands in 2025, now holding approximately 13.6 million shares (7.6% of the shares outstanding) valued at around $2.25 billion. Several reasons explain why Buffett continues to invest in this company:

- Strong Portfolio of Premium Beer Brands: Constellation Brands owns top-performing Mexican beer brands like Corona, Modelo, and Pacifico, which have consistently outperformed the general beer market. Notably, Modelo became the No. 1 beer in the U.S. in 2023, surpassing Bud Light after that brand faced controversy.

Constellation Brands' major portfolio currently focuses on premium beer, luxury wine, and craft spirits. On the beer side, its standout brands include Modelo and Corona, with Modelo now ranked as the most popular beer brand in the United States. For wine, following a recent sell-off of value brands, the company's flagship luxury labels are Robert Mondavi Winery, Schrader, Double Diamond, To Kalon Vineyard Company, Mount Veeder Winery, The Prisoner Wine Company, My Favorite Neighbor, Kim Crawford (noted as the top Sauvignon Blanc in the U.S.), Ruffino Estates and Ruffino Prosecco, Sea Smoke, and Lingua Franca. In spirits, the notable brands are High West whiskey, Nelson's Green Brier whiskey, Mi CAMPO tequila, and Casa Noble tequila. This shift reflects Constellation's strategy to focus on higher-growth, higher-margin segments across beer, wine, and spirits.

In Wines and Spirits, Constellation Brands has sharpened its focus on premiumization by divesting mainstream wine brands and streamlining its portfolio to feature higher-margin, upscale offerings. The company now centers its business on award-winning wines like Robert Mondavi Winery, The Prisoner Wine Company, and Kim Crawford, all priced above $15, alongside notable craft spirits such as High West whiskey and Casa Noble tequila. This strategic shift is a deliberate response to changing consumer preferences, as buyers increasingly value quality and unique experiences over volume, leading the company to invest in brands known for superior craftsmanship and exclusivity.

- Value Investing Opportunity: The stock saw a significant decline (over 20% in 2025, and more than 30% over one year), likely due to short-term concerns like potential tariffs on Mexican beer imports. Buffett appears to be capitalizing on this price weakness, adhering to his strategy of buying quality companies when they are undervalued by the market. Citi analysts have called this move "a perfect example of value investing".

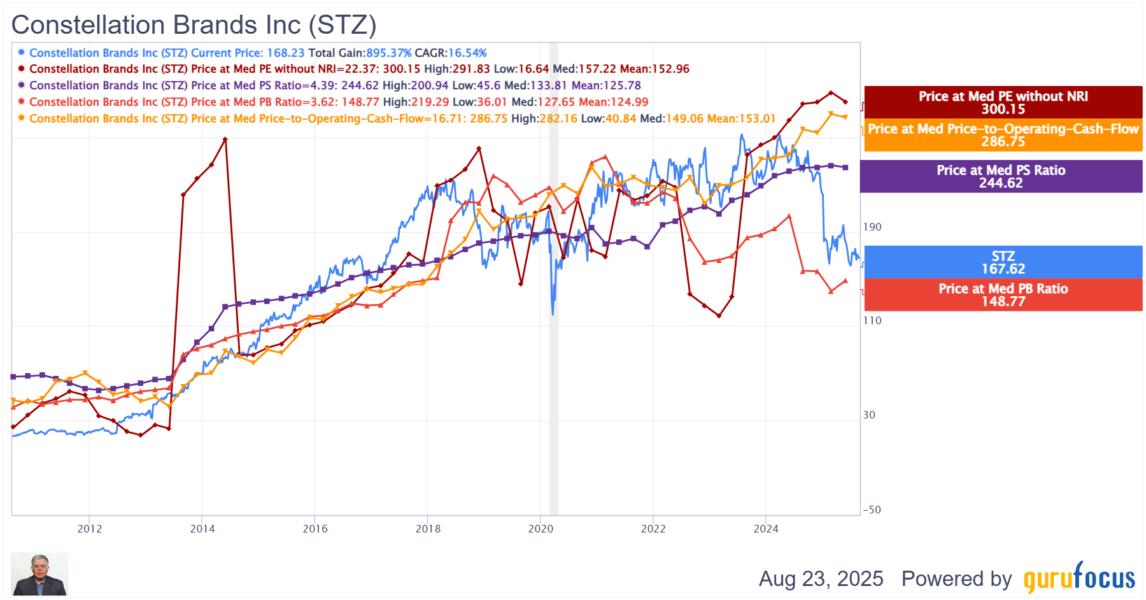

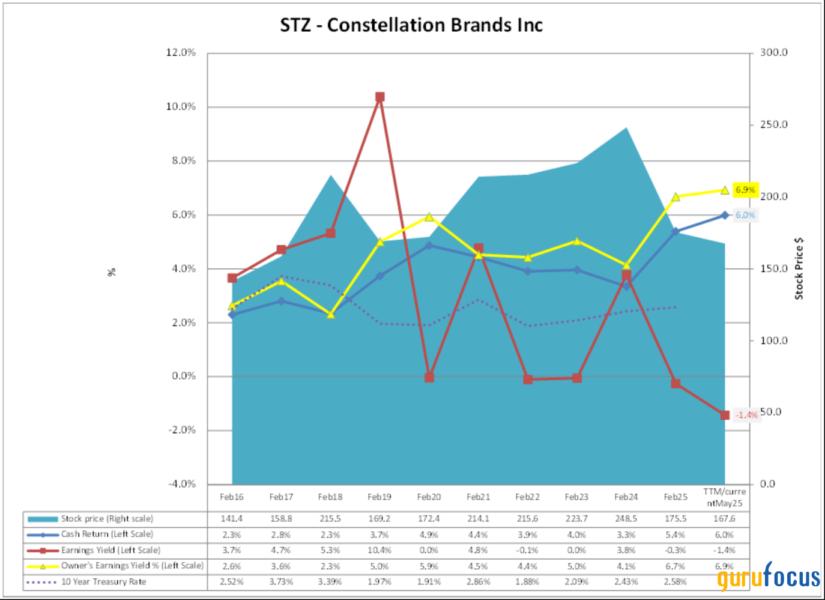

The stock looks undervalued based on historical price multiples plotted over a 15 year period.

STZ Data by GuruFocus

- Favorable Long-term Trends: Despite risks, Constellation is well positioned in the fast-growing U.S. Hispanic market and in categories seeing rising demand. Buffett is betting on the enduring demand and growth potential for their iconic beer brands even during market turbulence.

- Shift in Berkshire's Portfolio: Recently, Berkshire has exited or reduced holdings in financials (like Citigroup and Bank of America) and Technology like Apple, while increasing its presence in consumer defensives and strong brands, signaling a pivot. The stake in Constellation was actually one of the few new large investments Berkshire made during a period of net selling and high cash accumulation.

- Current Undervaluation: Even though the Wine & Spirits segment underperforms and the company faces tariff risk, Buffett likely views the sum of the company's partsespecially the beer businessas worth much more than its current market price, considering long-term fundamentals.

Buffett's continued investment in Constellation Brands reflects his confidence in the company's strong brands, market positioning, distribution network, value opportunity, and ability to weather short-term adversity for long-term growth.

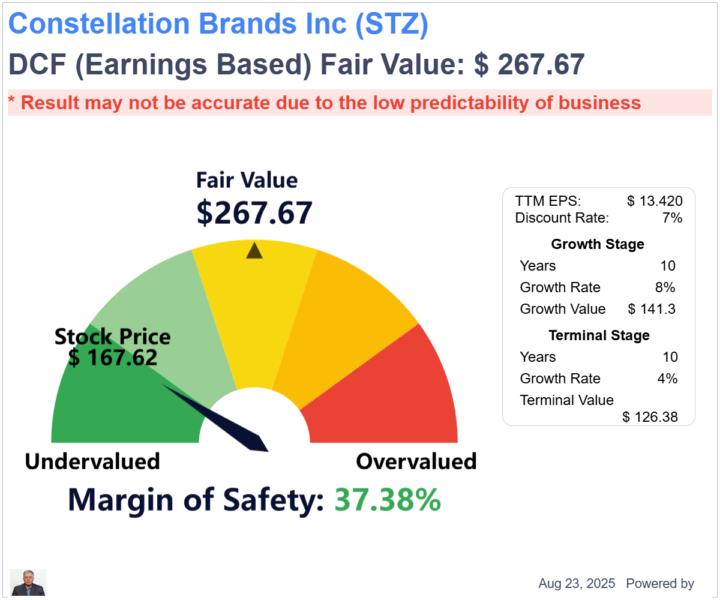

Gurufocus's Discounted Cash Flow calculator using reasonable assumptions also indicates substantial undervaluation.

Constellation boasts leading operating profit margins among its global peers.

| Ticker | Company | Current Price | Operating Margin % | Operating Margin % (10y Median) |

| STZ | Constellation Brands Inc | 167.62 | 31.69 | 30.20 |

| HEINY | Heineken NV | 41.37 | 11.34 | 13.29 |

| TAP | Molson Coors Beverage Co | 52.81 | 15 | 13.69 |

| BUD | Anheuser-Busch InBev SA/NV | 63.86 | 25.94 | 27.64 |

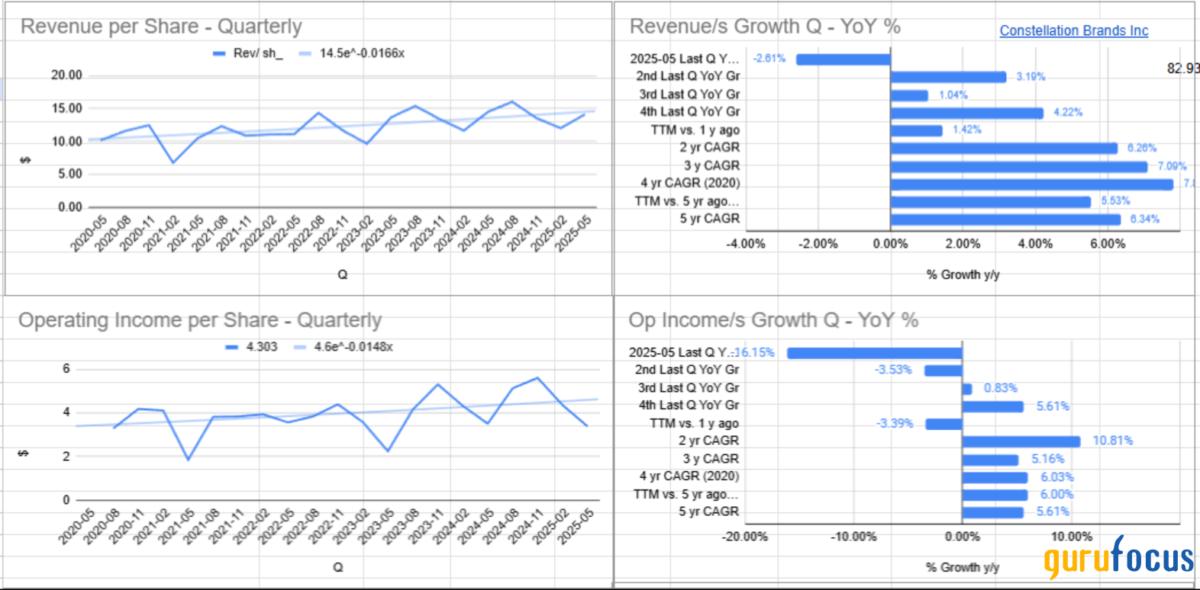

Slowing Revenue and Operating Income Growth Trend

Constellations revenue per share and Operating income per share have come under pressure lately but Buffett being a long term investor likely views this as an opportunity. He likely has confidence that the company will overcome these short term issues and get back to growth in-line with long term metrics.

Constellation Brands achieved beer volume growth of approximately 4% year-over-year for fiscal 2025, with some of its leading Mexican brands like Modelo Especial and Pacifico growing by over 11% and 21%, respectively. In contrast, Global Peers AB InBev, Molson-Coors, and Heineken have experienced more modest or flat growth. For example, AB InBev's global beer volumes declined about 0.6% year-over-year in the first half of 2025, reflecting shifts in consumer preferences and ongoing economic challenges. Molson-Coors reported flat to slightly negative beer volume performance in 2025, with declines in U.S. mainstream brands offset by minor growth in its above-premium segment. Heineken, meanwhile, posted low single-digit global beer volume growth (about 2%) in the first half of 2025 due to strong performance in Europe and Asia, despite headwinds in Latin America.

Owner-Earnings Yield has improved dramatically over the last two years.

Owner Earnings is a cash flow concept introduced by Warren Buffett (Trades, Portfolio) in his 1986 Berkshire Hathaway company letter to shareholders. At this time that companies were not required to produce a cash flow statement nor were stock based compensation such a big concern. Buffet's formulations of owners earnings removes non-cash distortions from earnings to focuses the investors attention on how much cash they are getting as partial owners of the company at the end of the period. Buffet explained Owners Earnings as follows: Owner Earnings = (a) Net Income plus (b) depreciation, depletion, amortization, and other non-cash charges minus (c) average annual maintenance capital expenditures. Owners Earnings is similar to free cash flow, but I think a superior metric because it starts from net earnings, so takes stock-based compensation as well as maintenance capex into account. Unlike Free Cash Flow, owner's earnings includes stock based compensation and maintenance capex which can be a significant expense for some companies. Owner Earning yield as shown in the diagram below (yellow line) is basically price / owner earning expressed as a %.

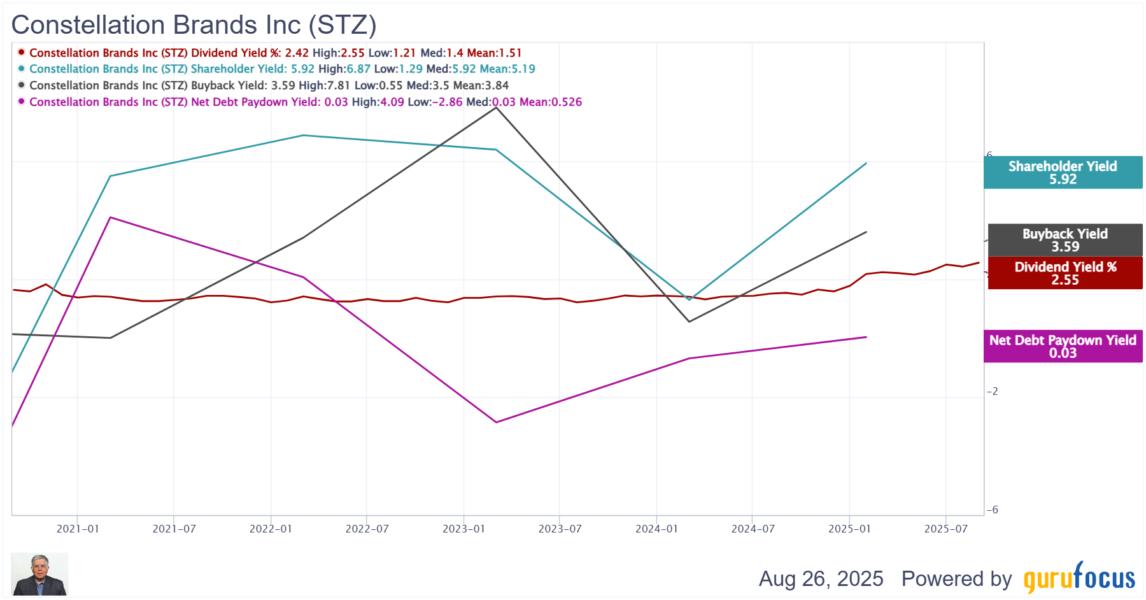

Total Shareholder Return is at a decade high

Shareholder Yield or Shareholder Return is the sum of these three components:

Dividend yield, Buyback yield, and Net Debt paydown yield i.e., Shareholder Yield % = Dividend Yield % + Buyback Yield % + Net Debt Paydown Yield %.

First, Dividend yield is how much a company has paid back in dividends divided by the company's market capitalization. It puts money right back in our pocket but is subject to taxation by the government as it is considered income.

Second Buyback yield is the value of shares the company has bought back in the last twelve months divided by a company's market capitalization. Stock Buybacks are good for existing stockholders in that they reduce the total number of shares outstanding. Simple logic will tell us that, whatever value you place on a company, the fewer shares out there, the more each share is worth.

Finally Debt Paydown Yield is the change in average of four quarters of long term debt over a company's market cap. Debt reduction is also intuitively a good thing. Debt reduction means the company has its act together. It's generating enough cash flow that it can reduce total debt. The less you owe, the lower your interest expenses and more value is left over for equity holders, the owners of the company. Companies that have high debt paydown yields indicate that they are rapidly paying down debt and increasing the equity portion of its capital structure.

As seen in the diagram below, Constellation has been returning a lot of cash to its shareholders directly through dividends and indirectly through stock buybacks and debt paydown,

STZ Data by GuruFocus

Constellation Brands recorded a significant non-cash goodwill impairment charge of up to $2.5 billion last fiscal year, primarily tied to the ongoing struggles within its wine and spirits division. This write-down was prompted by a prolonged period of weak demand in the U.S. market, with consumers cutting back on premium alcohol purchases and retailers reducing their inventories of wine and spirits. As a result, the company downgraded its sales outlook for the segment, forecasting a decline of 4% to 6% after previously expecting flat or slightly positive growth. The impairment reflected the lowered value of acquired assets, as long-term earning power for the division deteriorated amidst shifting consumer preferences and macroeconomic challenges, even as Constellation's beer business continued to perform strongly. Though this development resulted in an accounting loss, the company has continued to generate cash flow growth.

Conclusion

Buffett's investment in Constellation is in line with his investing philosophy. Invest in companies with a strong moat keeping a long term perspective in mind. He is also being opportunistic, swooping in when the company is undervalued compared to its long term trend while ignoring short term issues. Temporary issues like non-cash goodwill impairment has depressed earnings but Buffett looks past that and does not see any impairment in the company's free cash flow and owner earnings.

I think now is a good opportunity to follow the Oracle of Omaha at a discount.