### 【U.S. May CPI Data All Below Expectations】

Gold10 Data reported on June 11 that the U.S. May unadjusted CPI annual rate came in at 2.4%, lower than the market expectation of 2.5%. The May unadjusted CPI monthly rate was 0.1%, versus the expected 0.2%. The seasonally adjusted core CPI monthly rate in May was 0.1%, below the forecast of 0.3%. The unadjusted core CPI annual rate for May stood at 2.8%, compared to the expected 2.9%.

#### - Enhanced Rate Cut Expectations Drive Gold Prices Higher

Inflation data serves as a key reference for the Federal Reserve's monetary policy decisions. Lower CPI figures indicate easing inflationary pressures in the U.S., strengthening market expectations of Federal Reserve rate cuts. Rate cuts reduce the opportunity cost of holding gold while weakening the U.S. dollar. Since gold is typically priced in dollars, a depreciating dollar enhances gold's attractiveness, prompting investors to buy and driving prices higher. For example, in June 2024, when U.S. May CPI data missed expectations, spot gold briefly surged toward the $2,340 level.

#### - Boosting Gold's Safe-Haven and Hedge Appeal

CPI data below expectations may signal pressures on economic growth, increasing uncertainty. In such scenarios, investors seek safe-haven assets for preservation of value. As a traditional safe haven, gold's hedging and value-preserving attributes gain more attention, attracting capital inflows and supporting prices. Historically, gold prices have risen during economic instability, such as the global financial crisis or escalating geopolitical tensions.

#### - Long-Term Tailwinds for Gold Prices

From a long-term perspective, central banks worldwide are likely to continue accumulating gold. This stems from gold's critical role in the global monetary system and the need for central banks to optimize asset allocation and enhance financial stability amid changing global economic landscapes. Such central bank purchases provide strong support for gold prices, further driving a long-term upward trend.

Strategies Following the Release of U.S. May CPI Data

Hope these strategies are helpful to you:

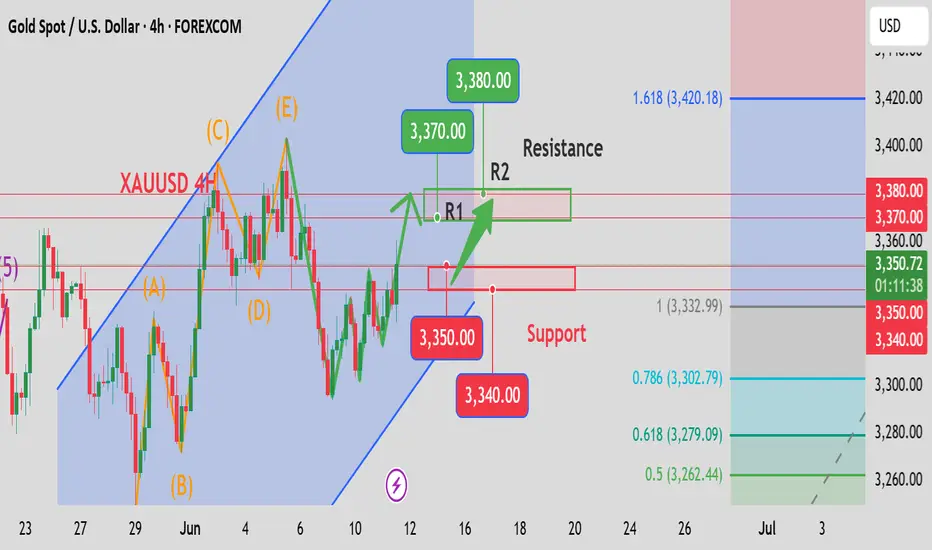

XAUUSD BUY@3340~3050

SL:3330

TP:3370~3380

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.