Core Drivers

Bullish for Gold

Expectations of a Fed Rate Cut: Weak US economic data (narrowing trade deficit, stagnant services sector) strengthens the probability of a September rate cut, putting pressure on the US dollar and boosting gold.

Risk aversion: The escalation of Trump's tariff policy and the uncertainty of the Federal Reserve's personnel changes have increased market volatility, and gold is favored as a safe-haven asset.

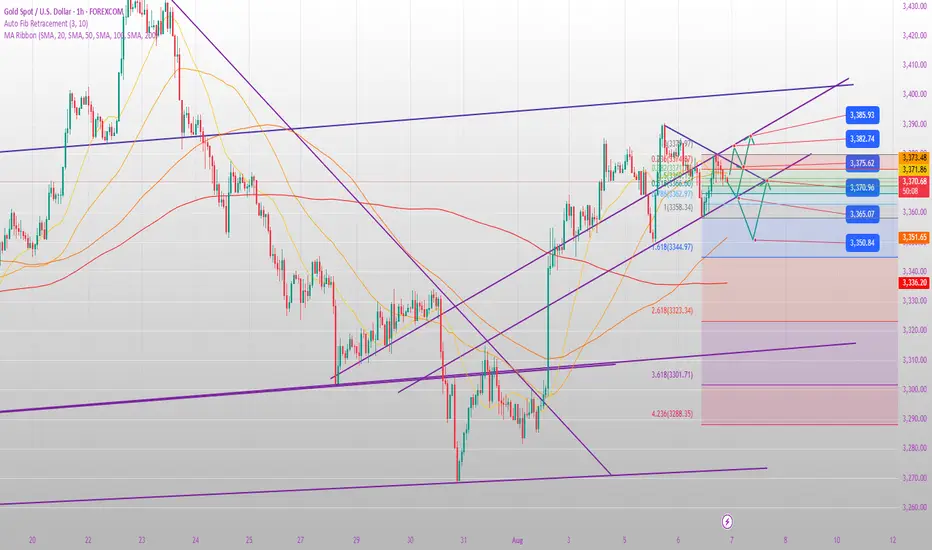

The technical side is strong: the daily line has four consecutive positive lines, and after the big positive K at the bottom, it oscillates to digest the short momentum, and the lower track support of the convergence triangle is effective (3350-3355).

Potential Bearish Factors

Inflation Data Risk: May weaken expectations of a rate cut, triggering a gold price correction.

Russia-Ukraine ceasefire agreement: If reached, it will weaken safe-haven demand and dampen gold's upward momentum.

Technical Pullback Risk: The previous two rounds of gains have both experienced five-wave pullbacks. Be wary of downside risks after a break of 3350.

Key Technical Levels

Support:

3355-3360 (lower band of the daily convergence triangle + 5-day moving average + middle band of the 4-hour moving average).

3350 (bull-bear watershed). If it breaks, the market will fluctuate and shift to a bearish bias, with a target of 3320-3300.

Resistance:

3375 (hourly middle line; a break above this level could lead to short-term strength).

3390 (previous high; a break above this opens up upside potential to the upper triangle line at 3406).

Today's Trading Strategy

1. Long Scenario (60% probability)

Entry Condition: Gold price holds support at 3355-3360 and closes above 3375 on the hourly chart.

Target: 3390 → 3406 (upper band of the converging triangle).

Stop Loss: Below 3350 (confirmation of a breakout).

2. Short Scenario (40% probability)

Entry Condition: Gold price falls below 3350 and closes below it on the hourly chart.

Target: 3320 (previous support low) → 3300 (psychological barrier). Stop loss: above 3360 (false breakout and covering).

Trading Recommendations

Conservative: Wait until the US market opens, confirming a breakout above 3350 or 3390 before entering the market.

Aggressive:

Take a light position to buy near 3365, with a stop-loss at 3350 and a target of 3375 → 3390.

If 3375 fails to break through before the US market opens, reverse into a short position targeting 3355.

Risk Warning

Event Risk: Speech by Federal Reserve officials or sudden changes in geopolitical dynamics could trigger sharp short-term fluctuations.

Position management: Currently at the end of the triangle, it is advisable to operate with a light position before breaking through to avoid two-way losses.

Conclusion: Gold is likely to fluctuate upward in the short term, but be wary of the risk of a pullback after a breakout of 3350. The recommended range is 3350-3390.

Trade ativo

In-depth Analysis of Gold Trends and Precise Trading Strategies:

Current Market Core Logic

The bullish trend remains unchanged, but the risk of stagflation at high levels is increasing.

The daily stochastic indicators (KD/RSI) have formed a golden cross, and the MACD momentum is mild, indicating that bulls still have the upper hand. However, the price is approaching the upper Bollinger band (3415), so be wary of a technical pullback.

Key Watersheds:

A break above 3390 → confirms the continuation of the bullish trend, opening up potential for 3415 or even higher.

A break below 3350 → may trigger profit-taking by bulls, leading to a deeper correction (target 3320-3300).

The H4 cycle is consolidating, with a breakout imminent.

The Bollinger Bands are closing (3390-3350), and the K-line is fluctuating with broken bullish and bearish candlestick patterns, indicating that the market is awaiting a directional decision.

The Asian and European sessions are likely to experience range-bound fluctuations, while the US session may see a breakout driven by data or news.

Today's Practical Trading Strategy:

Scenario 1: Range-bound (3350-3390)

Long at Lows: Buy lightly at 3365-3370, stop loss below 3355, target 3385-3390.

Short at Highs: Sell lightly at 3390-3395, stop loss above 3400, target 3365-3355.

(Note: Buy low and sell high within the range and enter and exit quickly to avoid losses after a breakout.)

Scenario 2: Upward Breakout of 3390

Buy: Follow up long orders on a pullback to 3380-3385, with a stop loss at 3370 and a target of 3415.

Ultimate resistance at 3415: If it is reached, try a short position (stop loss at 3425), anticipating a daily peak and decline.

Scenario 3: Downward movement below 3350

Short selling: Short on a rebound to 3355-3360, stop loss at 3370, target at 3330-3320.

Trend reversal confirmation: If the daily chart closes below 3350, the medium-term outlook will shift to bearish.

Trade fechado: objetivo atingido

August 8th Gold Trend Analysis and Strategy:

Core Drivers

Expectations of Easing Support Gold Prices

The market anticipates a 25 basis point rate cut by the Federal Reserve in September with a probability exceeding 90%, potentially leading to two rate cuts this year. This lowers the cost of holding gold, an interest-free asset, and strengthens the medium- to long-term bullish outlook.

A modest rebound in the US dollar index (stabilizing after a one-week low) and rising US stocks will limit gold's gains in the short term, but risk aversion (due to trade uncertainty) provides hedging support.

Key Technical Signals

Daily Chart:

The market is nearing the end of a converging triangle, with upper support moving down to 3406 and lower support moving up to 3360.

Thursday's close firmly above the 5-day moving average, with the MACD trend showing a mild bullish bias. A break above 3400 would open up upside potential.

4-Hour Chart:

Middle support at 3371-3372 resonates with the daily 5-day moving average. A breakout above the downward trend line in the Asian session and a pullback confirm this, indicating a short-term bullish bias. The 4-hour MACD top divergence needs to be repaired. If the price retraces but does not break below 3370, the bullish outlook remains.

Day Trading Strategy

1. Long Opportunity

Entry Zone: 3370-3373 (618 retracement of overnight rally + 4-hour middle band support).

Target:

First target: 3397-3400 (Asian session high + psychological barrier).

After a breakout, target 3406 (upper band of the triangle), with further breakouts targeting 3420.

Stop Loss: Below 3365 (a break below would destroy the short-term upward trend).

2. Be cautious when shorting.

Conditions: If the gold price surges to around 3406 and then experiences pressure and a rapid decline, a small position can be considered for a short position.

Target: 3380-3375.

Stop Loss: Above 3412.

Key Risk Warning: US Dollar Trend: A sharp rebound in the US Dollar Index (e.g., above 104.5) could suppress gold prices. Fed Commentary: If Fed officials send hawkish signals (e.g., downplaying interest rate cuts), gold prices could pull back.

Triangle Breakout: A break below 3360 could trigger a potential drop to support levels of 3340-3330; a break above 3406 would confirm a new uptrend.

Trading Recommendations

Main Strategy: Invest primarily in low-level long positions, relying on support at 3370-3372, with a stop-loss at 3365 and a target of 3400-3406.

Alternative plan: short-term short selling under pressure at 3406, enter and exit quickly.

Breakthrough follow-up: If it stabilizes at 3400 after the European session, you can chase it to 3420; otherwise, if it falls below 3360, wait and see.

Publicações relacionadas

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Publicações relacionadas

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.