🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

🏆 Swing High / Swing Low

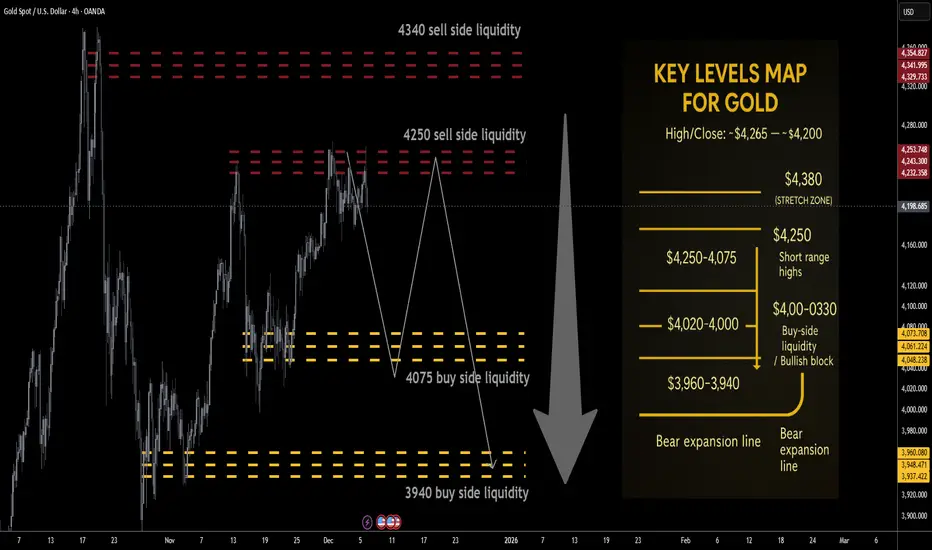

$4,265 → ~$4,164 — clean rejection from the 4,26x breakout zone with a long upper wick, but weekly close still near $4,200, keeping price pinned in the upper part of the broader $4k range.

📈 Trend

Higher-timeframe: Structural bull trend intact while price holds above the $3,940–$4,000 block.

Tactical: Last week’s failed extension above $4,250 and the close back near $4,200 tilt the tape into distributive mode:

Rallies into $4,250 / $4,340 = sell-side liquidity magnets.

Downside liquidity sits lower at $4,075 / $3,940, making upside risk/reward look asymmetric to the downside from current levels.

🛡 Supports – Buy-Side Liquidity / Downside Objectives

$4,130–$4,100:

Short-term intraday pivot where buyers repeatedly stepped in last week; first micro-reaction zone on any flush.

$4,090–$4,075 🟢 Buy-side liquidity #1

First true BSL pocket below the close; ideal TP1 for shorts from above and a spot where responsive dip-buyers are likely to probe.

$4,020–$4,000:

Psychological shelf; loss of 4k would confirm that local distribution is winning and open the deeper BSL run.

$3,960–$3,940 🟢 Buy-side liquidity #2 / structural block

Higher-timeframe demand and key liquidity magnet for a fuller corrective leg. A sustained break/acceptance below $3,940 would signal that the 2025 blow-off is transitioning into broader mean-reversion rather than shallow consolidation.

🚧 Resistances – Sell-Side Liquidity / Short-Side Focus

$4,220–$4,250 🔴 Sell-side liquidity #1

First overhead supply from the prior week’s failed breakout structure and just under recent highs. Clean area for “sell the rip” probes and for late longs to de-risk.

$4,300–$4,340 🔴 Sell-side liquidity #2

Extension / SLI pocket aligned with the upper part of last week’s range and just below the prior $4,38x–$4,40x all-time high band. Ideal for scaling adds if a news-driven squeeze runs stops above 4,250.

Stretch: $4,380–$4,400:

Prior record spike / stop-run area; only expected on a full-on squeeze into the Fed, but a tag here would likely be exhaustion rather than a new sustainable trend leg higher.

🧭 Bias Next Week

Base tactical bias: fade strength / short rallies, not chase upside.

the tape favors a liquidity grab higher → rotation lower scenario:

Look for wicks into $4,220–$4,340 to be sold.

Downside path of least resistance: $4,090–$4,075 → $4,020–$4,000 → $3,960–$3,940.

⚖️ Base Case Scenario

Open/early week:

Price opens near $4,200 and either trades flat or spikes briefly into $4,220–$4,250 on weekend gap/early flow.

Liquidity sweep into resistance:

Rejection from SLI:

Failure to accept above $4,250/4,300 leaves upper wicks on 4H/daily, signaling distribution.

Rotation into BSL:

First objective: $4,090–$4,075 (TP1)

Secondary objective: $4,020–$4,000 (TP2)

Stretch / full flush: $3,960–$3,940 (TP3) into the structural demand block and buy-side liquidity pocket.

🚀 Breakout / Invalidation Trigger

Bearish framework invalidation:

A strong daily/weekly acceptance above $4,380 would imply shorts caught offside and re-open the path toward $4,450+ in line with the higher Street targets for 2026.

In that case, shift from short-the-rip → neutral / buy shallow pullbacks until a new top structure forms.

🔓 Bull / Bear Trigger Lines

Structural bull line:

Above $3,940–$4,000: long-term bull structure remains intact. Even if you’re tactically short, treat deep moves into this area with respect – this is where higher-timeframe players are likely to re-accumulate.

Bear expansion line:

Below $3,940: opens scope for a faster liquidation wave toward $3,880–$3,850 and potentially a broader 2025–26 consolidation phase instead of immediate continuation higher.

🧭 Recommended Strategy – Short at Market Open

⚠️ Illustrative trade plan, not financial advice. Size and risk-manage according to your own rules.

1️⃣ Primary Short – Open + Fade the Rips

Short at/near market open around the $4,195–$4,210 zone if price opens below $4,220 and orderflow confirms rejection of higher bids.

Add / build zones:

Add 1: into $4,220–$4,250 (first SLI band / prior breakout zone).

Add 2 (only if spike): $4,300–$4,340 (second SLI; look for clear blow-off / stop-run behavior before loading the last clip).

Stops / invalidation:

Tactical stop: hard stop above $4,380.

More conservative: soft line at $4,340, hard stop $4,390–$4,400 to allow for intraday wicks.

Targets (aligned with buy-side liquidity):

TP1: $4,090–$4,075 → take partials and reduce risk.

TP2: $4,020–$4,000 → core target for the week if distribution plays out.

TP3: $3,960–$3,940 → full BSL sweep into structural demand; expect responsive buying attempts here.

🏆 Swing High / Swing Low

$4,265 → ~$4,164 — clean rejection from the 4,26x breakout zone with a long upper wick, but weekly close still near $4,200, keeping price pinned in the upper part of the broader $4k range.

📈 Trend

Higher-timeframe: Structural bull trend intact while price holds above the $3,940–$4,000 block.

Tactical: Last week’s failed extension above $4,250 and the close back near $4,200 tilt the tape into distributive mode:

Rallies into $4,250 / $4,340 = sell-side liquidity magnets.

Downside liquidity sits lower at $4,075 / $3,940, making upside risk/reward look asymmetric to the downside from current levels.

🛡 Supports – Buy-Side Liquidity / Downside Objectives

$4,130–$4,100:

Short-term intraday pivot where buyers repeatedly stepped in last week; first micro-reaction zone on any flush.

$4,090–$4,075 🟢 Buy-side liquidity #1

First true BSL pocket below the close; ideal TP1 for shorts from above and a spot where responsive dip-buyers are likely to probe.

$4,020–$4,000:

Psychological shelf; loss of 4k would confirm that local distribution is winning and open the deeper BSL run.

$3,960–$3,940 🟢 Buy-side liquidity #2 / structural block

Higher-timeframe demand and key liquidity magnet for a fuller corrective leg. A sustained break/acceptance below $3,940 would signal that the 2025 blow-off is transitioning into broader mean-reversion rather than shallow consolidation.

🚧 Resistances – Sell-Side Liquidity / Short-Side Focus

$4,220–$4,250 🔴 Sell-side liquidity #1

First overhead supply from the prior week’s failed breakout structure and just under recent highs. Clean area for “sell the rip” probes and for late longs to de-risk.

$4,300–$4,340 🔴 Sell-side liquidity #2

Extension / SLI pocket aligned with the upper part of last week’s range and just below the prior $4,38x–$4,40x all-time high band. Ideal for scaling adds if a news-driven squeeze runs stops above 4,250.

Stretch: $4,380–$4,400:

Prior record spike / stop-run area; only expected on a full-on squeeze into the Fed, but a tag here would likely be exhaustion rather than a new sustainable trend leg higher.

🧭 Bias Next Week

Base tactical bias: fade strength / short rallies, not chase upside.

the tape favors a liquidity grab higher → rotation lower scenario:

Look for wicks into $4,220–$4,340 to be sold.

Downside path of least resistance: $4,090–$4,075 → $4,020–$4,000 → $3,960–$3,940.

⚖️ Base Case Scenario

Open/early week:

Price opens near $4,200 and either trades flat or spikes briefly into $4,220–$4,250 on weekend gap/early flow.

Liquidity sweep into resistance:

Rejection from SLI:

Failure to accept above $4,250/4,300 leaves upper wicks on 4H/daily, signaling distribution.

Rotation into BSL:

First objective: $4,090–$4,075 (TP1)

Secondary objective: $4,020–$4,000 (TP2)

Stretch / full flush: $3,960–$3,940 (TP3) into the structural demand block and buy-side liquidity pocket.

🚀 Breakout / Invalidation Trigger

Bearish framework invalidation:

A strong daily/weekly acceptance above $4,380 would imply shorts caught offside and re-open the path toward $4,450+ in line with the higher Street targets for 2026.

In that case, shift from short-the-rip → neutral / buy shallow pullbacks until a new top structure forms.

🔓 Bull / Bear Trigger Lines

Structural bull line:

Above $3,940–$4,000: long-term bull structure remains intact. Even if you’re tactically short, treat deep moves into this area with respect – this is where higher-timeframe players are likely to re-accumulate.

Bear expansion line:

Below $3,940: opens scope for a faster liquidation wave toward $3,880–$3,850 and potentially a broader 2025–26 consolidation phase instead of immediate continuation higher.

🧭 Recommended Strategy – Short at Market Open

⚠️ Illustrative trade plan, not financial advice. Size and risk-manage according to your own rules.

1️⃣ Primary Short – Open + Fade the Rips

Short at/near market open around the $4,195–$4,210 zone if price opens below $4,220 and orderflow confirms rejection of higher bids.

Add / build zones:

Add 1: into $4,220–$4,250 (first SLI band / prior breakout zone).

Add 2 (only if spike): $4,300–$4,340 (second SLI; look for clear blow-off / stop-run behavior before loading the last clip).

Stops / invalidation:

Tactical stop: hard stop above $4,380.

More conservative: soft line at $4,340, hard stop $4,390–$4,400 to allow for intraday wicks.

Targets (aligned with buy-side liquidity):

TP1: $4,090–$4,075 → take partials and reduce risk.

TP2: $4,020–$4,000 → core target for the week if distribution plays out.

TP3: $3,960–$3,940 → full BSL sweep into structural demand; expect responsive buying attempts here.

Nota

🏅 GOLD WEEKLY SUMMARY — SHORT THE RIPS

🟡 Clean rejection at $4,26x → $4,164, weekly close near $4,200 keeps gold pinned high.

🟡 Trend still bullish HTF, but tactically distributive below $4,250.

🟡 Sell-side liquidity magnets: $4,220–$4,250 → $4,300–$4,340.

🟡 Buy-side targets: $4,090–$4,075 → $4,020–$4,000 → $3,960–$3,940.

🟡 Bias: fade strength; short rips, don’t chase upside.

🟡 Base path: wick into $4,22x–$4,34x → rotation lower into BSL pockets.

🟡 Invalidation: acceptance > $4,380 = squeeze toward $4,450+.

🟡 Bull line: above $3,940–$4,000 structure intact; buyers defend deep dips.

🟡 Bear line: below $3,940 opens liquidation toward $3,88x–$3,85x.

🟡 Strategy: short near open $4,195–$4,210 → add $4,22x/$4,30x → targets $4,075 / $4,000 / $3,940.

Nota

🎁Please hit the like button and🎁Leave a comment to support our team!

Nota

let me know your thoughts on the above in the comments section 🔥🏧🚀taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Publicações relacionadas

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Publicações relacionadas

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.